For parents looking to claim daycare expenses in Canada, using a standardized receipt template can simplify the process. These templates are tailored to meet the requirements set by the Canada Revenue Agency (CRA) for tax deductions. Make sure to include the daycare provider’s business name, address, and contact information clearly on the receipt.

Each receipt should also list the child’s name, the period of care, and a breakdown of the total amount paid. Don’t forget to include the provider’s tax number or registration number. This ensures that the receipt is valid and can be used for tax reporting. A simple template, either digital or printed, can help streamline this process.

To avoid delays, ensure that all required information is filled out correctly and legibly. Using a daycare receipt template designed for Canadian tax purposes can save time and reduce the chance of errors when submitting your expenses for reimbursement or tax filing.

Sure! Here is a version with reduced repetition of words:

For creating a daycare receipt template in Canada, include the following key elements:

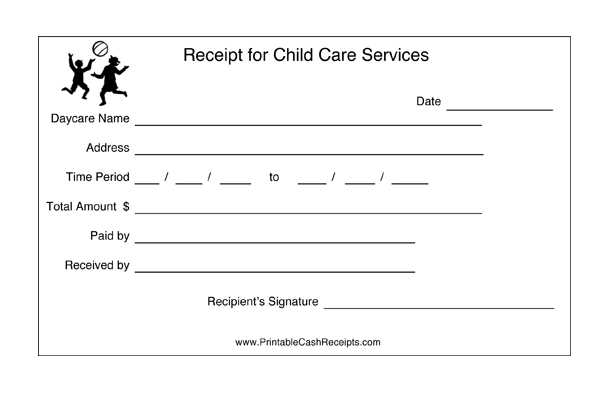

- Business Details: Include the daycare name, address, and contact information at the top.

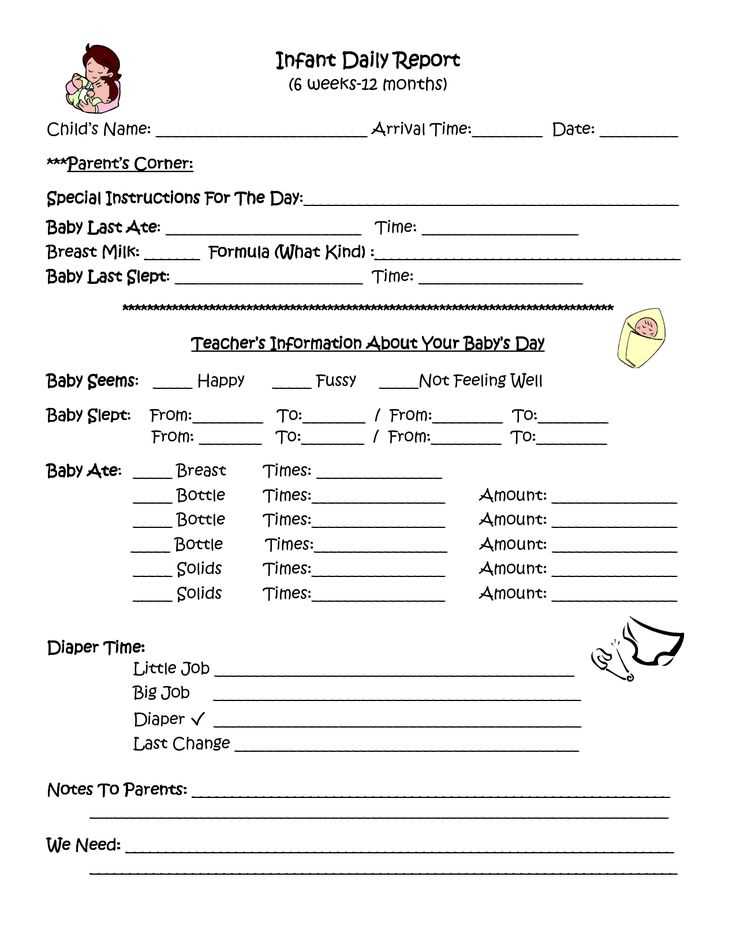

- Date and Time: Clearly mention the date of service and the duration of care provided (e.g., hours per day or week).

- Child’s Information: Include the child’s name and age for reference.

- Fee Breakdown: List the charges, such as daily or hourly rates, and any additional fees (e.g., late fees or special services).

- Payment Method: Specify how the payment was made (e.g., credit card, cheque, cash, or e-transfer).

- Amount Paid: Indicate the total amount paid for the service.

- Tax Information: Ensure GST/HST is included if applicable, along with the tax rate.

- Signature: A space for the daycare provider’s signature for confirmation of receipt.

Using these sections ensures the receipt is clear, accurate, and complies with Canadian tax requirements.

- Daycare Receipt Template for Canada

Creating a daycare receipt template for Canada is simple but must include specific details. Begin by including the daycare provider’s full name, address, and contact information. This ensures clarity for both parents and authorities if needed. The child’s full name, as well as the dates of service, must be listed. Additionally, the receipt should clearly state the total amount paid and any breakdown of charges if applicable.

Key Elements of a Daycare Receipt

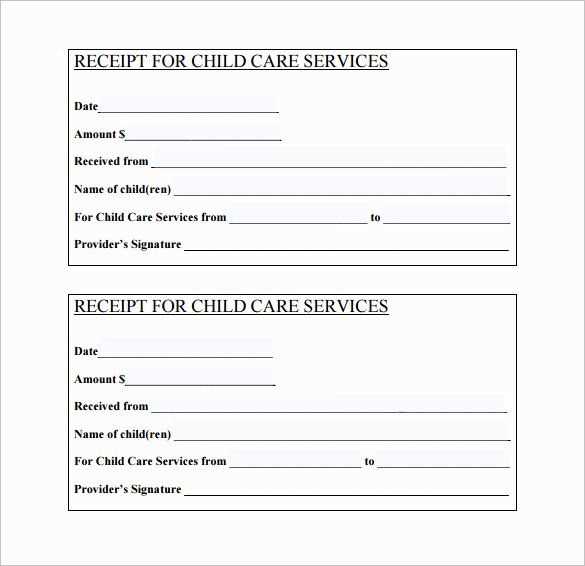

A well-structured daycare receipt should include the following mandatory information:

- Daycare provider’s name and address

- Parent or guardian’s name

- Child’s name

- Dates of service (start and end dates)

- Total amount paid

- Payment method (cash, cheque, credit card)

- Signature of the daycare provider

Example Template

Here’s a simple layout to use for a daycare receipt template:

Daycare Provider Name: [Provider Name] Provider Address: [Street, City, Postal Code] Phone: [Phone Number] Receipt Number: [Receipt ID] Date of Issue: [Date] Received from: [Parent Name] Child’s Name: [Child Name] Dates of Service: [Start Date] to [End Date] Total Paid: $[Amount] Payment Method: [Cash/Credit Card] Signature of Provider: ___________________

This template can be customized according to specific needs. Be sure to keep a copy for your records in case of tax-related inquiries or for reimbursement purposes.

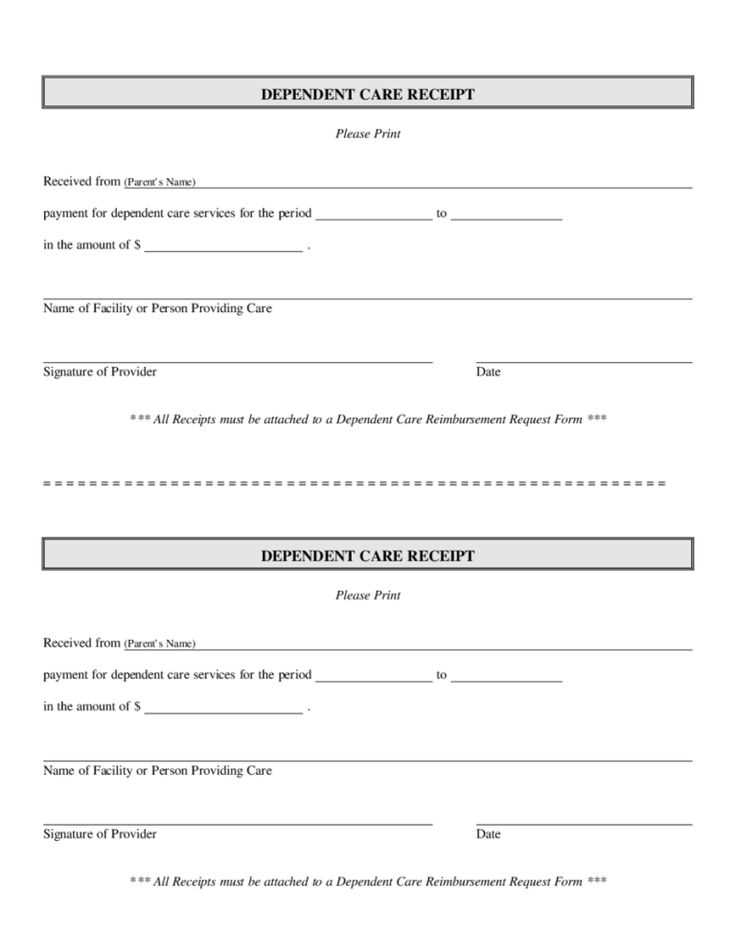

To create a simple receipt for tax purposes in daycare, ensure the following details are included:

- Business Information: Include the daycare’s legal name, address, and contact details.

- Parent/Guardian Details: List the parent or guardian’s name and address to identify the recipient of the services.

- Service Description: Clearly state the service provided, such as childcare, after-school care, or any additional services offered.

- Dates of Service: Specify the start and end dates for the period the payment covers. This helps track expenses for each year’s tax filing.

- Amount Charged: Provide the total amount paid for the services, breaking it down if necessary (e.g., weekly rate, daily rate, or special fees).

- Payment Method: Note the payment method used (e.g., cash, cheque, credit card, or e-transfer) for clarity.

- Receipt Number: Assign a unique receipt number to help with organizing and referencing past transactions.

- Tax Information: If applicable, include any relevant tax details such as GST/HST numbers, especially if the daycare provider is registered for tax purposes.

Formatting and Organization

- Ensure the receipt is easy to read and properly formatted. List items in a clear, organized manner.

- Consider using a template to save time and maintain consistency in all receipts.

Additional Considerations

- Provide receipts for each payment to avoid confusion when filing taxes.

- Store all receipts in an accessible manner for easy retrieval during tax filing or audits.

Provide the full name of the daycare provider, including the business name and address. This ensures clarity and authenticity of the receipt. Add the provider’s contact details such as phone number and email address for any follow-up inquiries.

Receipt Date and Period of Care

List the exact date the payment was made. It’s also helpful to specify the care period the payment covers (e.g., from January 1 to January 31). This keeps the record precise and linked to specific services.

Child’s Name and Age

Include the child’s full name and age to match the payment with the correct child in the daycare’s records. This helps prevent confusion and ensures the receipt reflects the accurate service rendered.

Payment Amount and Details

Clearly state the amount paid. Break down the payment if applicable (e.g., daily rate, extra activities, or supplies) to avoid ambiguity. Use a clear format like “$XXX for X days of care” to detail the financial transaction.

Payment Method

Indicate how the payment was made (cash, cheque, or credit card) for record-keeping purposes. This is useful for both the daycare provider and the parent for tracking financial transactions.

Signature and Confirmation

Include a line for the daycare provider’s signature and date to confirm that the payment was received. This adds authenticity to the receipt.

| Item | Details |

|---|---|

| Provider’s Name | Daycare Provider Name |

| Child’s Name | Child’s Full Name |

| Payment Amount | $XXX |

| Payment Method | Credit Card |

| Payment Date | January 15, 2025 |

In Canada, receipts are not just a good practice but a legal necessity for various transactions, especially when it comes to daycare services. These receipts must contain specific information to ensure they are valid for tax purposes and other official matters.

Required Information on Daycare Receipts

Daycare receipts must clearly include the name of the daycare provider, their business address, and a contact number. The receipt should also state the date of the transaction and a description of the services provided. The total amount paid must be itemized, including taxes. Importantly, receipts for daycare services need to identify the provider’s business number (BN) or registration number with the Canada Revenue Agency (CRA). This helps verify that the provider is operating legally and that the receipt can be used for potential tax claims.

Tax Considerations

Parents can use daycare receipts to claim child care expenses when filing taxes, as long as the receipts meet CRA guidelines. The receipts should also specify the name of the child receiving care. If you are claiming expenses under the child care tax credit, ensure that the daycare receipts include all required details and are kept for at least six years in case of a CRA audit.

To accommodate different payment methods, tailor your daycare receipt to reflect the type of transaction. If a payment is made through cash, specify the exact amount received. For credit or debit card payments, include the last four digits of the card number, and ensure you indicate the transaction method. If an e-transfer is used, provide the transaction reference number for verification.

For multiple payment types within a single transaction, break down the receipt to show each method used separately. This will help clients understand the breakdown of their payment. For example, if a portion of the payment was made by card and the rest by e-transfer, list these separately with corresponding amounts. This clarity supports transparency and record-keeping.

Ensure that all receipts include the date, total amount paid, and the services rendered regardless of the payment method. This will prevent confusion and make it easier for clients to claim any eligible deductions on their taxes.

To issue receipts for multiple children, clearly separate each child’s expenses on the receipt. This ensures parents or guardians can easily track payments for each child. Include the child’s name, the service period, and the total amount paid for each child individually. If a parent has multiple children enrolled in your daycare, list the details for each child separately to avoid confusion.

Use a template that allows you to input multiple child names and their corresponding charges. This will help you manage receipts without needing to create new ones each time. Organize receipts by date to streamline record-keeping. Additionally, keep a log or database of issued receipts for future reference or tax purposes. This can be easily done through accounting software or a simple spreadsheet.

It’s also helpful to include a unique reference number for each receipt. This will make tracking payments more organized and prevent errors. Parents can use this number to refer to their payment, making communication clearer in case of disputes or queries.

Group receipts by categories such as daycare, groceries, or transportation. Create dedicated folders or binders to keep everything neat and easy to find. Label each section clearly for quick access when needed.

Digital Receipts for Easy Access

Scan physical receipts or take pictures with your phone to keep digital copies. Store them in a cloud storage service or on a dedicated hard drive. Make sure to organize them by date or category for better retrieval.

Set a Routine for Regular Organization

Establish a habit of sorting receipts weekly or monthly. Set aside time to file new receipts into your designated system. This prevents a backlog and keeps everything organized without stress.

Include all necessary details on your daycare receipt to ensure it’s accepted by tax authorities. Make sure to add the name of your daycare provider, the address, and the business number. Clearly state the dates when the services were provided, along with the total amount charged for each period. List the child’s name and any other relevant information that may be required, such as the number of days attended or specific activities charged separately. Always maintain a copy for your records.