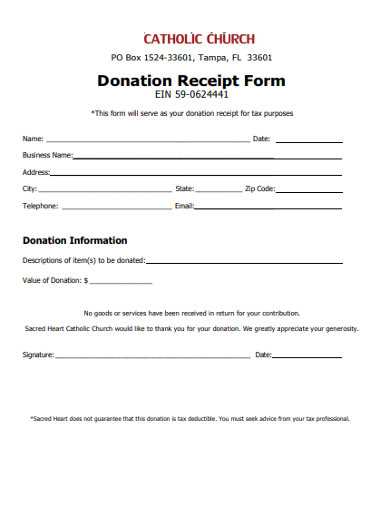

Provide your donors with a clear, professional acknowledgment of their contributions by using a donation receipt template. This template helps churches maintain accurate records while ensuring transparency with their supporters.

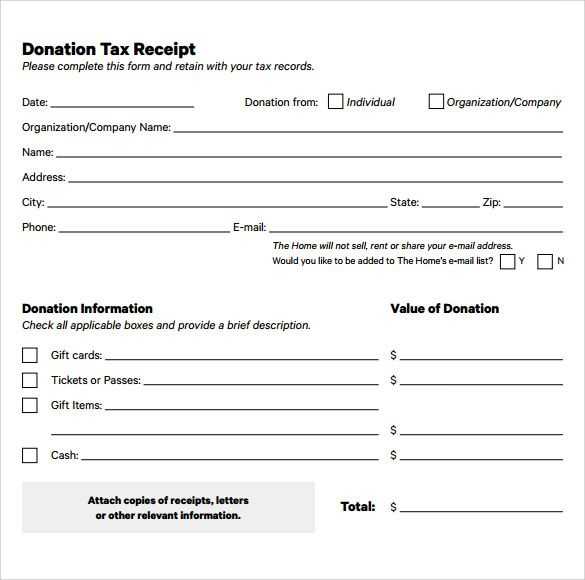

Use a standard format to make sure the receipt includes all necessary information: the donor’s name, donation amount, date, and a description of the donation. A well-structured receipt shows respect for your donors’ generosity and supports tax deductions for them.

Make it easy to fill out by using a PDF template. With the right format, you can quickly input donation details, saving time and ensuring consistency. This approach also makes it easier to store records digitally for easy access in the future.

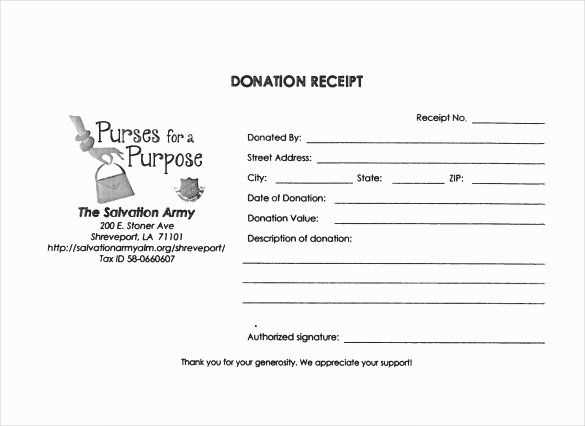

Don’t forget to add a personal touch, such as a thank-you message or a specific note about the impact of the donation. This can strengthen the relationship between the church and its supporters while reinforcing their ongoing commitment to your mission.

Here’s the corrected version:

Ensure the donor’s name and contact details are clearly stated at the top of the receipt. Include the donation amount in both figures and words for clarity. Specify the date of the donation and the method used (cash, check, online transfer, etc.). If applicable, note if the donation is for a specific purpose or event. Remember to include your church’s tax-exempt status or EIN number, making it easier for the donor to claim deductions. Conclude with a statement affirming that no goods or services were exchanged for the donation, if true.

- Church Donation Receipt Template PDF

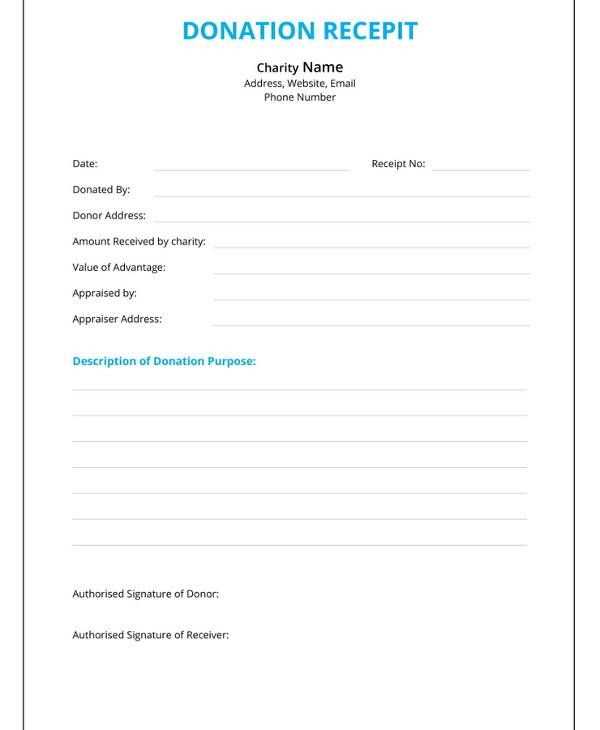

A church donation receipt template is a straightforward tool that helps both the donor and the church maintain accurate records. It serves as proof of a donation, ensuring transparency and smooth financial tracking. Here’s how to make the most of it:

- Clear Details: Include the donor’s name, address, and the amount donated. Specify whether the donation is monetary or in-kind, and provide a description of any items if applicable.

- Date of Donation: Accurately record the date of the donation. This is important for tax purposes and for confirming the timing of contributions.

- Tax Identification Number (TIN): Make sure the church’s TIN is visible. This number is needed for tax deduction claims by the donor.

- Thank You Message: Include a note of gratitude for the donor’s support. A simple message adds a personal touch and strengthens the relationship.

- Church Information: Clearly list the church’s name, address, and contact details. This helps verify the authenticity of the receipt.

Using a downloadable PDF template allows for easy customization and printing. It can be generated automatically through various church management software or manually filled in when required.

Design your template by including key components such as the donor’s name, the date of the donation, and the amount donated. Make sure to leave space for the donor’s contact information, as well as a brief description of the purpose of the donation.

Layout and Structure

- Use a simple and clean layout that is easy to read.

- Ensure the template has a clear heading indicating it is a “Donation Receipt” to avoid confusion.

- Provide a section for the organization’s details, including the name, address, and tax identification number if needed.

Legal and Tax Information

- Include a statement about the tax-deductible nature of the donation, if applicable.

- Ensure the template complies with local laws and regulations regarding donations.

By following these steps, you will create a professional and functional donation receipt template.

Ensure donation receipts comply with IRS regulations to provide donors with valid proof of their contributions. Charitable organizations must include specific details in the receipt, including the donor’s name, donation date, amount, and whether any goods or services were exchanged for the donation. For donations over $250, a written acknowledgment is required.

Required Information

Receipts must contain the donor’s name, the organization’s name, the donation amount, and a description of any goods or services provided. If no goods or services are exchanged, a statement to that effect should be included.

Special Considerations for Non-Cash Donations

For non-cash donations, a detailed description of the item and its estimated value should be included. If the donation exceeds $500, donors are required to submit Form 8283 along with their tax return.

Tailor your donation receipts by considering the specific preferences and needs of different donor groups. For example, for recurring donors, include details about their previous donations to help them track their giving. For large donors, provide a personalized message of thanks and any additional recognition they may appreciate.

Include customized fields such as donation method, fund allocation, or a specific event related to the donation. This can make the receipt feel more personalized and relevant to the donor’s contribution. Adjust the tone of the message for individual or corporate donors to reflect the nature of their giving.

For tax-deductible contributions, clearly outline the amount that qualifies for tax exemption. If necessary, add a disclaimer or a reminder about the benefits of the donation for tax purposes. Ensure these details are easy to spot and understand.

PDF format ensures that donation receipts are easily shareable across various platforms without compromising formatting. This file type preserves the layout, ensuring that the document appears as intended regardless of the device or operating system.

Benefits of PDF Format for Sharing

- Consistency: The PDF retains the exact design, fonts, and layout, preventing any alterations when opened on different devices.

- Accessibility: PDFs can be opened on almost any device, including smartphones, tablets, and computers, making sharing straightforward.

- Security: Password protection or encryption can be applied to PDFs, providing an extra layer of security for sensitive donation information.

How to Share PDF Donation Receipts

- Attach the file to an email for a quick, direct delivery.

- Upload to cloud storage services, sharing a secure link for easy access.

- Share via messaging apps that support PDF files for instant delivery to donors.

Use a clear and organized template to record each donation, ensuring you capture the donor’s name, donation amount, date, and method of payment. This practice helps keep all information in one place, simplifying tracking for future reference.

Choose a template that allows easy categorization, whether by donor type (individual, business) or donation frequency (one-time, recurring). This makes it easier to access specific data when needed, especially during tax season or for reporting purposes.

Ensure templates are stored in a secure location, either digitally or physically. For digital storage, cloud-based platforms provide backup options and easy access. Regularly update your donation records to keep them current and prevent errors.

Implement version control if using digital templates. This keeps a history of updates and ensures you have access to the most recent records at all times. This also allows you to trace any changes or mistakes efficiently.

Update the church donation receipt template by ensuring all contact information is accurate. Replace outdated church details such as the address or phone number with the most current data. Double-check the donation amount and donor’s name fields to ensure they are formatted correctly for ease of use.

Review the tax-exempt status section and modify it if there are any updates to the church’s exemption. Make sure the language used complies with current tax guidelines and that the template reflects any recent legal requirements.

Make the template adaptable by ensuring placeholder text is clear. Modify the date field to allow quick updates for each new donation period. Ensure that the receipt’s formatting is consistent and works on both digital and printed versions.

Lastly, maintain a record of changes made. Documenting updates helps keep track of revisions over time. Use the following table for version control:

| Version | Date | Changes |

|---|---|---|

| 1.0 | January 2023 | Initial template creation. |

| 1.1 | June 2023 | Updated church contact details. |

| 1.2 | December 2023 | Modified tax-exempt statement. |

Keep the template flexible to adapt to future needs. Regular updates ensure its continued accuracy and usability.

To create a clear and professional donation receipt for a church, ensure that the format adheres to key details. Start by including the church’s name and contact information at the top. This ensures the receipt is easily traceable back to your organization.

Key Information to Include

- Donor’s full name

- Donation amount and description

- Date of donation

- Tax-exempt status of the church, if applicable

Ensure the receipt includes a statement clarifying the non-refundable nature of the donation and the church’s charitable status. This can help during tax preparation for the donor. Also, provide a thank-you note that shows appreciation for the support received.

Donation Receipt Template Example

| Item | Details |

|---|---|

| Church Name | St. John’s Church |

| Donor Name | Jane Doe |

| Donation Amount | $100.00 |

| Date | February 5, 2025 |

| Tax-Exempt Status | Tax-exempt 501(c)(3) organization |

Finally, always provide an option for the donor to request a duplicate receipt for their records. This fosters transparency and keeps your church’s financial documentation in order.