Creating a clear and concise title commitment receipt template can streamline the process of closing real estate transactions. This document serves as a vital tool in ensuring that all parties involved understand the terms and conditions outlined in the title commitment. It provides a straightforward way to confirm that the title insurance company has received the necessary documents and fees to proceed with the title insurance process.

A well-structured title commitment receipt template should include key elements such as the property address, the date of receipt, the amount of the fee paid, and a list of documents submitted. The clarity of this document is crucial for both the buyer and the seller, as it sets expectations for the next steps in the transaction. Avoid unnecessary jargon and focus on including only the necessary details to prevent confusion or miscommunication.

Incorporating fields like the name of the title company, transaction reference number, and signatures from both parties can further solidify the document’s authenticity. A well-organized template ensures smooth communication and minimizes delays during the closing process. By paying attention to these details, you can create a document that offers transparency and builds trust throughout the transaction.

Here’s a version with corrected repetitions, where each word appears no more than 2-3 times:

When crafting a title commitment receipt template, focus on clarity and conciseness. Ensure each word contributes meaningfully to the document without unnecessary repetition. Limit the usage of technical jargon and use clear language for easy understanding. The key is to maintain a professional tone while ensuring the terms are familiar to the reader. Each section should address specific details relevant to the title commitment, avoiding redundant phrases that do not add new information.

Be sure to organize the content logically, starting with the essential details. Outline the terms of the title commitment, including the parties involved and specific conditions. It is important to avoid overloading the recipient with excessive information, as this could obscure the key details. The template should remain straightforward, focusing on the necessary legal and procedural elements for the title commitment process.

Also, make sure to limit the number of terms that are repeated. If a word must appear more than once, try to vary its usage or use synonyms where appropriate. This ensures a smoother reading experience and prevents the template from becoming redundant or cumbersome. Keep the flow natural while still addressing the key points required by the title commitment process.

Title Commitment Receipt Template

Understanding the Purpose of a Commitment Receipt

Key Components of a Title Commitment Receipt Template

How to Customize a Receipt for Different Transactions

Legal Requirements and Standards for Title Commitment Templates

Common Mistakes to Avoid When Creating a Commitment Receipt

Steps to Finalize and Distribute the Receipt Template

The title commitment receipt confirms the parties involved in a real estate transaction have reviewed and agreed to the title commitment details. It’s vital for establishing the legal and procedural framework that follows during property transactions. A well-structured receipt template ensures that all parties have the necessary information regarding ownership and title insurance coverage.

Key Components of a Title Commitment Receipt Template

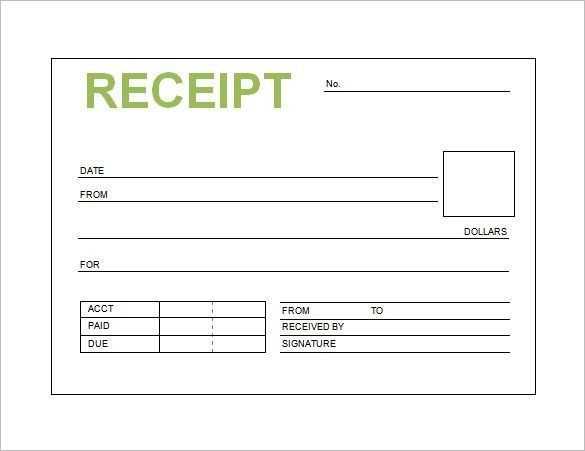

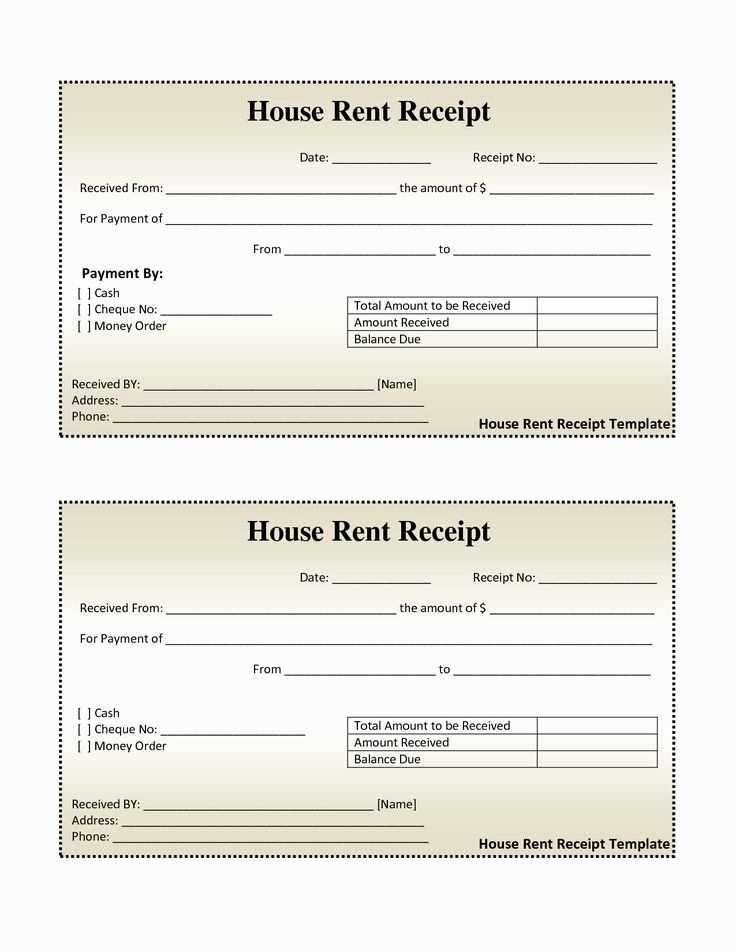

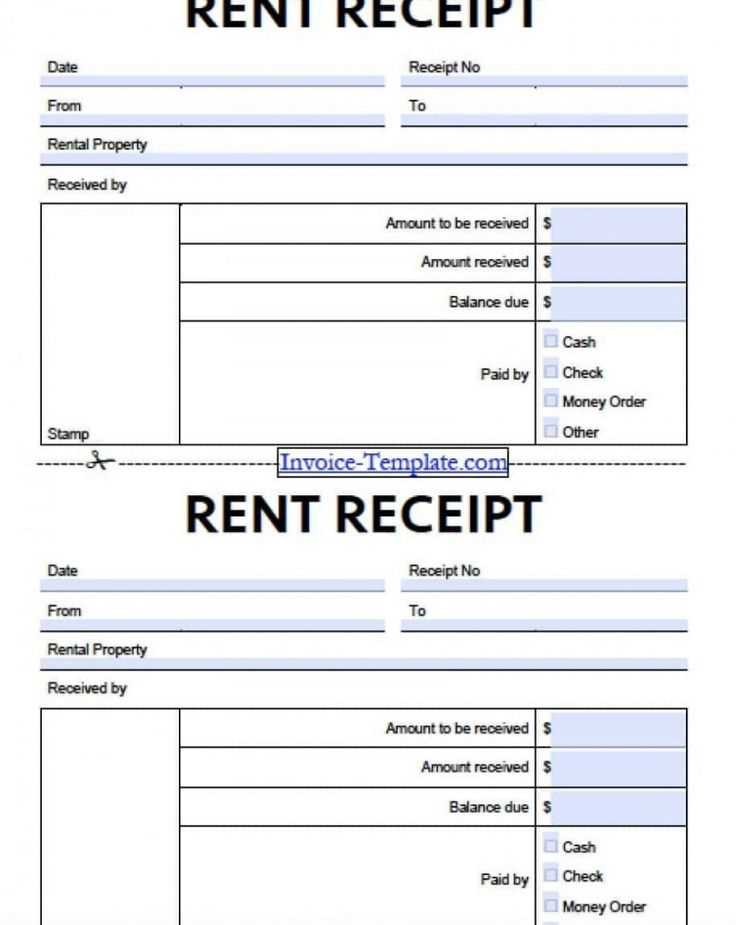

A typical title commitment receipt template includes several essential elements:

- Transaction Details: Identifies the property, buyer, seller, and lender involved.

- Commitment Number: Unique identifier assigned to the title commitment.

- Effective Date: The date when the commitment was issued.

- Exclusions and Conditions: Lists any conditions or exclusions that may impact the title insurance policy.

- Signatures: Signature lines for all parties acknowledging receipt of the commitment details.

How to Customize a Receipt for Different Transactions

Customizing the receipt template is crucial to address the specific needs of different types of transactions. For residential properties, you may need to provide additional details like property survey results or zoning laws. Commercial transactions often require more extensive disclosure about liens, easements, or environmental conditions. Tailor your template to reflect the transaction’s complexity and the parties’ requirements.

Include fields for special conditions or additional clauses based on transaction specifics. This ensures that all necessary information is captured and acknowledged by the involved parties.

To prevent common mistakes, avoid leaving out critical details or overloading the receipt with irrelevant information. Make sure to use clear, concise language to enhance readability.

Legal Requirements and Standards for Title Commitment Templates

Each jurisdiction may have specific legal requirements for title commitment receipts. It’s essential to consult local laws or regulatory bodies to ensure compliance. Standard practices usually involve including clear references to title insurance policies, underwriting provisions, and applicable exclusions.

Consult with legal counsel to ensure the template reflects state or national standards, which can vary based on the nature of the transaction. Ensuring legal accuracy prevents disputes and protects all parties involved.

Once the template is customized, finalize the receipt by carefully reviewing it for completeness. Distribute it promptly to all parties for acknowledgment. This step ensures transparency and avoids potential delays in the transaction process.