Use a free cash receipt template in Google Docs to keep a clear record of all transactions. This tool helps streamline the process of documenting payments, ensuring accuracy and consistency for personal or business use. With Google Docs, you can easily access and modify your templates from any device, making it a convenient option for managing cash receipts on the go.

To get started, search for a customizable cash receipt template on Google Docs or create one from scratch. You can modify fields such as the payer’s name, amount received, payment method, and date of transaction. This ensures that every receipt contains the necessary information for record-keeping and future reference.

By using a template, you save time on creating receipts and maintain a professional appearance. Google Docs offers built-in sharing and collaboration features, so you can quickly send receipts or update them with team members. The integration with Google Drive also provides secure storage for easy access to all receipts whenever you need them.

Here is the updated version with fewer repetitions:

To streamline your receipt process, start by eliminating redundant entries. By organizing information logically, you can ensure each receipt serves its purpose clearly without unnecessary repetition. Consider the following approach:

Key Adjustments

- Use concise headers to categorize receipt details like payment method, date, and amount.

- Avoid repeating the same phrases in multiple fields; instead, reference the relevant sections clearly.

- Include only essential data–skip information that doesn’t directly contribute to the receipt’s main purpose.

Template Example

- Receipt ID: [unique identifier]

- Date: [payment date]

- Amount: [amount paid]

- Payment Method: [method used]

- Description: [service/product name]

By adjusting your template with these changes, you can minimize unnecessary repetition and keep the document focused on key information. The result will be a clearer, more functional receipt every time.

- Free Cash Receipt Template in Google Docs

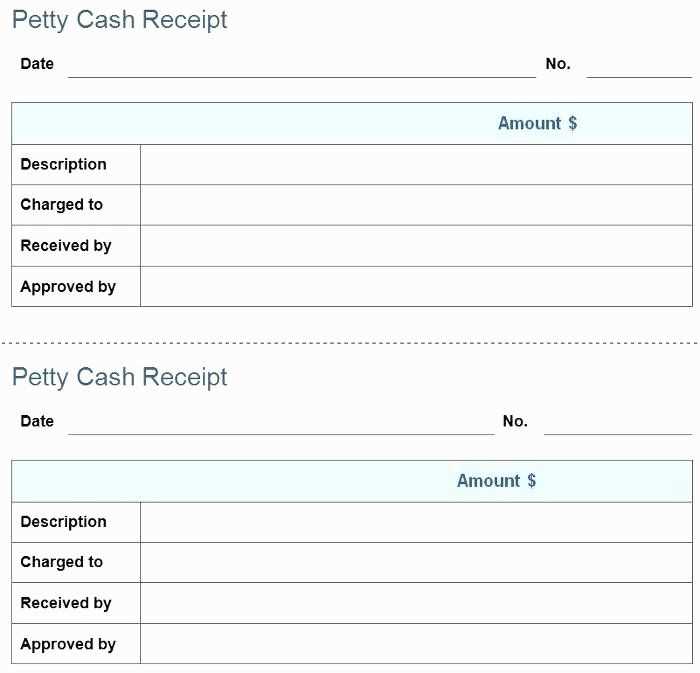

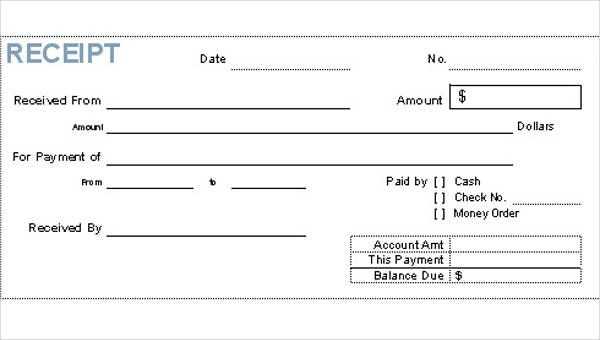

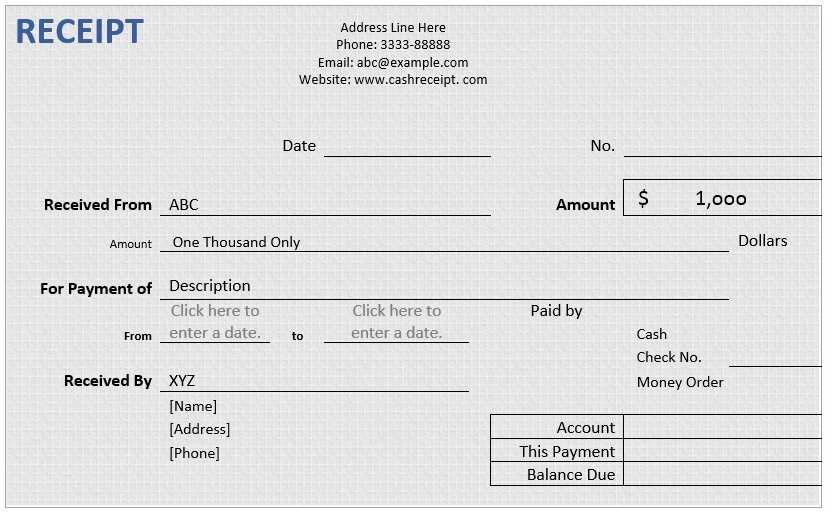

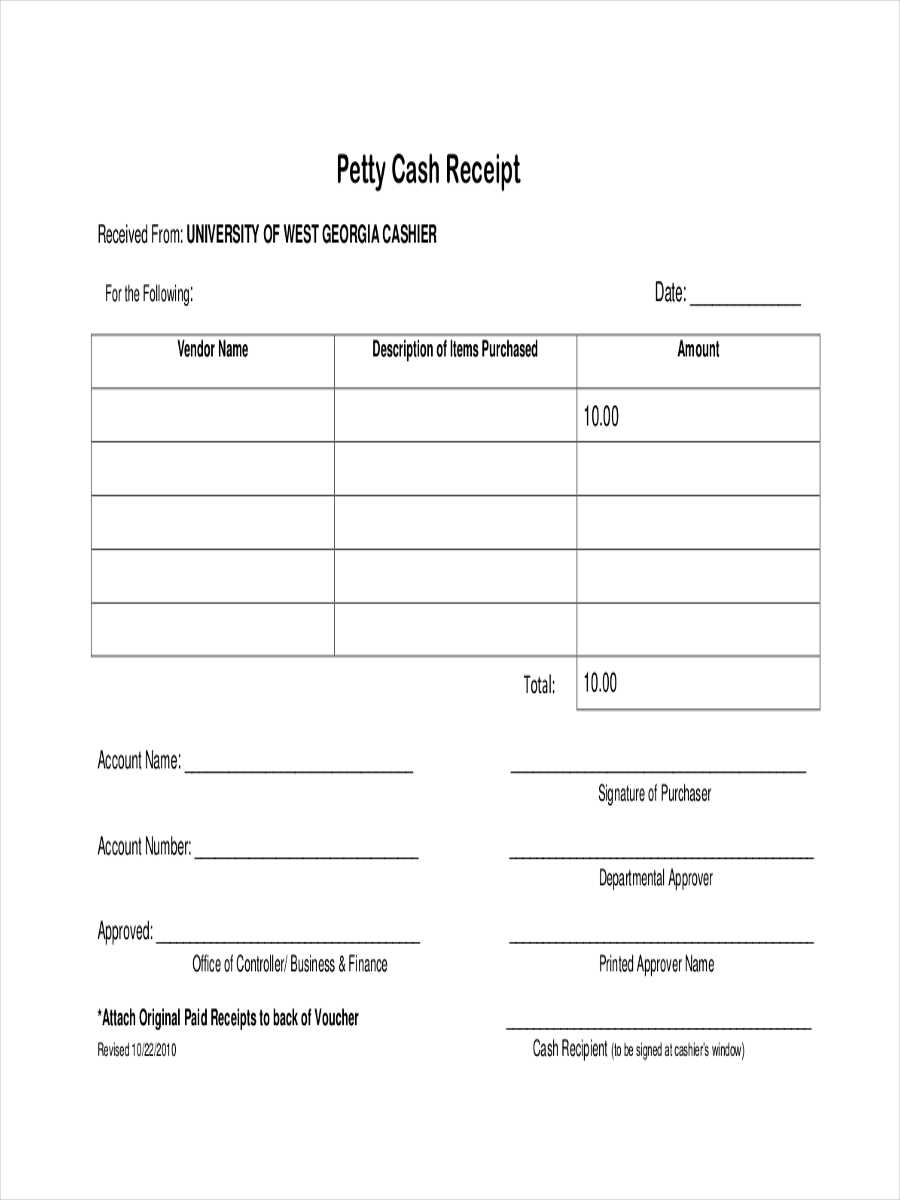

Creating a free cash receipt template in Google Docs is straightforward and can be customized to fit your needs. Start by opening a new Google Docs document and select a table format for clarity. Use a three-column table: one for the item description, another for the amount received, and a third for the payment method. This structure helps in keeping records organized.

Make sure to include the necessary details like the date, payer’s name, and a reference number for each receipt. Use bold for headings to distinguish the sections clearly. Include a signature line at the bottom to authenticate the receipt, which adds a professional touch. For a more streamlined look, choose a simple, clean font like Arial or Times New Roman, and ensure the font size is easy to read, typically between 10-12 pt.

Once your template is set up, you can save it and reuse it every time you need to issue a receipt. Adjust the design or layout as required, but keep the essential information consistent to maintain uniformity across all receipts. This method ensures that your cash receipts are clear, organized, and easily understandable.

Open Google Docs and create a new document. Set the page layout to “Portrait” for a standard receipt format. Use a clear font, such as Arial or Times New Roman, with a readable size like 12 pt.

Start by adding the title “Cash Receipt” at the top. Make it bold and center-align it. Below the title, add the date of the transaction and a unique receipt number. This helps for tracking purposes.

Next, include sections for the payer’s name, address, and contact information. This makes the receipt more formal and detailed. Beneath that, create a table or bullet points for listing the amount paid, payment method, and a brief description of the goods or services provided.

In the final section, leave space for both the receiver’s signature and the payer’s signature, confirming the transaction. These add authenticity and are a standard practice in cash receipts.

Review the document for accuracy. Once satisfied, you can download or share the receipt directly from Google Docs.

Adjust your receipt template by adding custom fields for detailed information. For example, include unique identifiers like transaction IDs or order numbers to make tracking easier. You can also modify the layout to emphasize key details such as payment method or discounts applied. Use tables or grids to separate items clearly, improving readability.

Consider adjusting fonts and colors to match your business branding. Customizing the header with your logo and contact details makes the receipt more personalized and professional. Include your company’s return policy or other relevant terms in the footer to keep everything in one place.

If you’re dealing with different currencies or tax rates, make sure to add specific sections for those values. You can create formulas that auto-calculate tax based on the total amount or configure fields to display multiple payment options, like credit card, cash, or digital payment methods.

Lastly, ensure that your receipt is easy to print or save as a PDF. Maintain a clean and uncluttered layout that looks professional in both digital and physical formats.

Start by including the necessary details that will make your receipt clear and organized. These key elements help maintain transparency and make the receipt more useful for both the payer and the payee.

- Receipt Number: Add a unique number for each receipt to easily track and reference it.

- Date of Transaction: Clearly specify the date the transaction occurred to avoid any confusion later on.

- Payment Method: Mention how the payment was made–whether it was via cash, credit card, or another method.

- Amount Paid: Ensure the amount is clearly written and includes any applicable taxes or additional fees.

- Sender and Recipient Information: Include the full name and contact details of both parties involved in the transaction.

Additional Optional Details

- Reference Number: If applicable, include a reference number for the transaction to help identify it quickly.

- Itemized List: For detailed receipts, break down each item or service provided with the corresponding amount.

By organizing these key details efficiently, your cash receipt template will be easy to understand and provide all the necessary information for any future reference or record-keeping.

To share your template with others, click the “Share” button in the top right corner of the Google Docs window. Choose the sharing settings based on who you want to access the document. You can select between ‘Viewer’, ‘Commenter’, and ‘Editor’ roles for your collaborators.

If you want collaborators to be able to make changes, grant them ‘Editor’ access. For limited interaction, choose ‘Commenter’, allowing feedback without altering the content. Use the ‘Viewer’ option to allow others to only view the document.

For more control, you can limit access by adding specific email addresses or generating a shareable link. Be mindful of privacy settings and whether you want the template to be accessible to anyone with the link or only to a select group.

Collaborators can directly edit or comment on the template, which is visible in real-time. All changes are tracked, and you can review the document’s version history by going to “File” > “Version History”. This feature ensures transparency, so you can see what has been modified and by whom.

To maintain seamless communication, encourage users to leave comments or suggestions where necessary. You can also reply to their comments, which fosters direct interaction without altering the document.

Use built-in formulas to ensure your data is processed correctly in Google Sheets. For example, applying SUM to add up values in a range or AVERAGE to find the mean helps maintain precision without manual entry errors.

Leverage Cell References

Instead of hardcoding numbers, use cell references. This allows for dynamic updating of calculations when data changes. For instance, =A1+B1 updates automatically when the values in A1 or B1 are modified.

Use Built-In Functions for Complex Calculations

Google Sheets offers a variety of functions to automate more complex calculations. The IF function allows conditional calculations, while VLOOKUP and INDEX-MATCH enable advanced data lookups across ranges.

Organize your templates in clearly labeled folders for easy access. Create a folder hierarchy that groups templates by categories such as invoice, receipt, and contract. This minimizes the time spent searching and ensures you can quickly find the right template when needed.

Cloud Storage Solutions

Cloud storage services like Google Drive or Dropbox are ideal for storing templates. They allow you to access templates from anywhere and keep them securely backed up. Ensure you use clear and consistent naming conventions for your files to avoid confusion later.

Version Control

Track the versions of your templates to prevent confusion over outdated formats. Google Docs automatically saves versions, but consider adding version numbers to filenames for easier identification.

| Storage Method | Benefits | Drawbacks |

|---|---|---|

| Google Drive | Easy access, automatic backups, and collaboration | Limited free storage |

| Dropbox | Reliable, fast syncing, good for teams | Storage limits for free accounts |

| Local Hard Drive | Complete control over files, no internet required | Risk of data loss without backup |

Use consistent and meaningful file names, such as “Receipt_Template_2025_v1”. Avoid vague names like “Template1” to ensure easy retrieval.

Use a simple template for cash receipts to streamline your financial records. Start by creating a clean and easy-to-follow format with basic fields like the date, amount, and payment method. Include a space for the payer’s details, such as name and contact information, to ensure accuracy.

Design Tips

Keep the layout uncluttered with clear sections for each piece of information. Use bullet points or tables to organize the data, making it easy to read. Avoid adding unnecessary information, as the goal is to have a quick reference sheet for financial transactions.

Key Information to Include

Ensure the template includes a receipt number for tracking purposes. Add a section for the description of the goods or services provided, along with the total amount paid. This helps maintain transparency and clarity in all financial dealings.