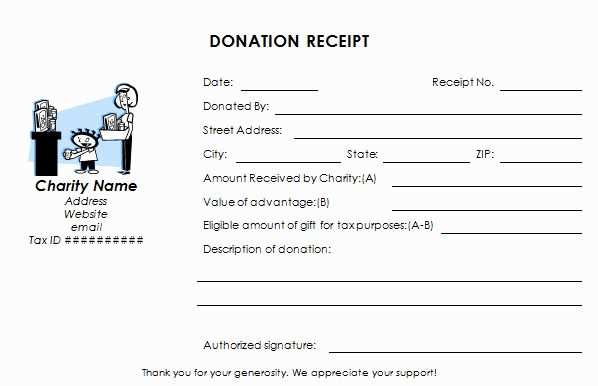

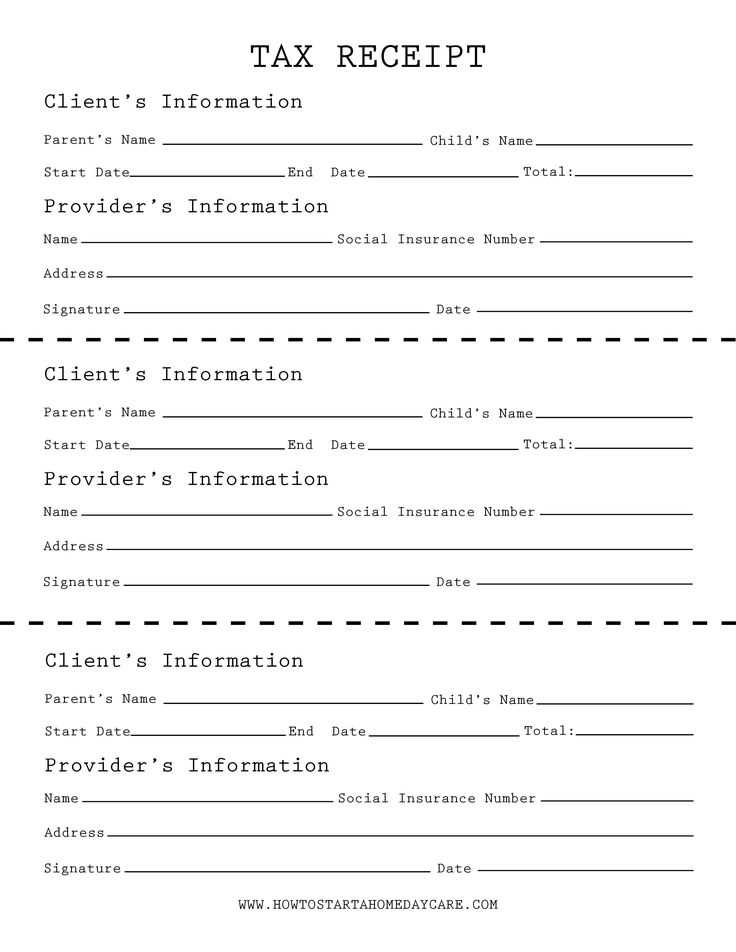

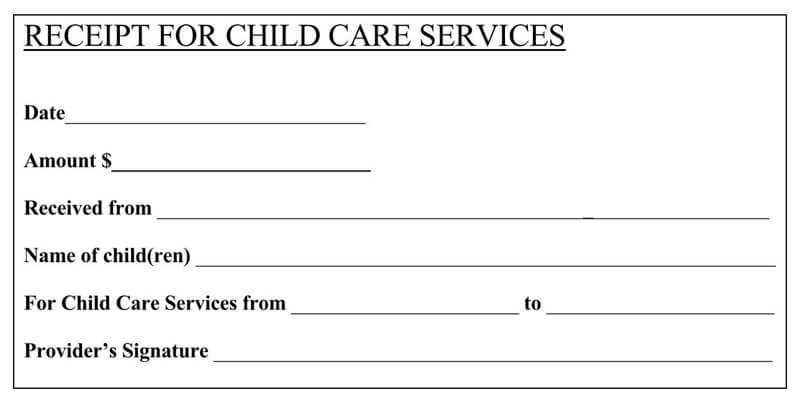

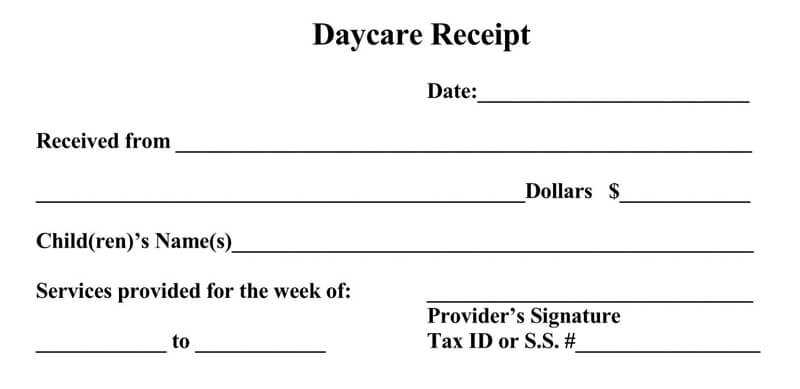

To streamline your tax filing process, a well-organized receipt template is crucial for documenting dependent daycare expenses. Use this template to track payments made for child or dependent care services, ensuring you meet IRS requirements for tax deductions.

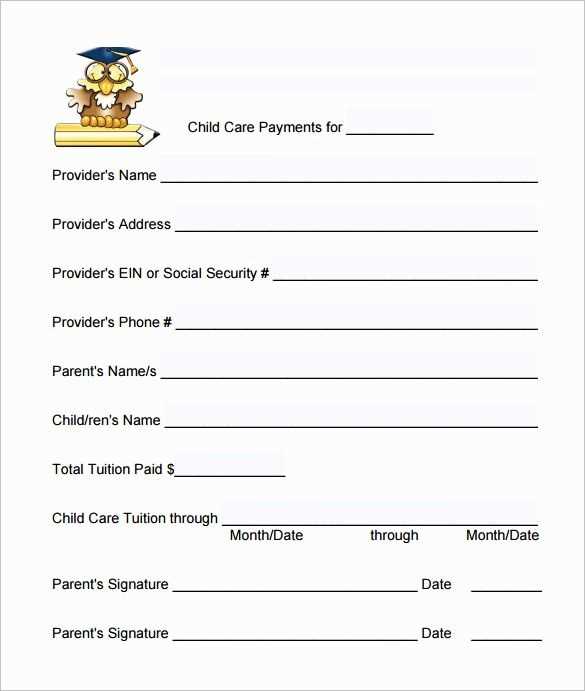

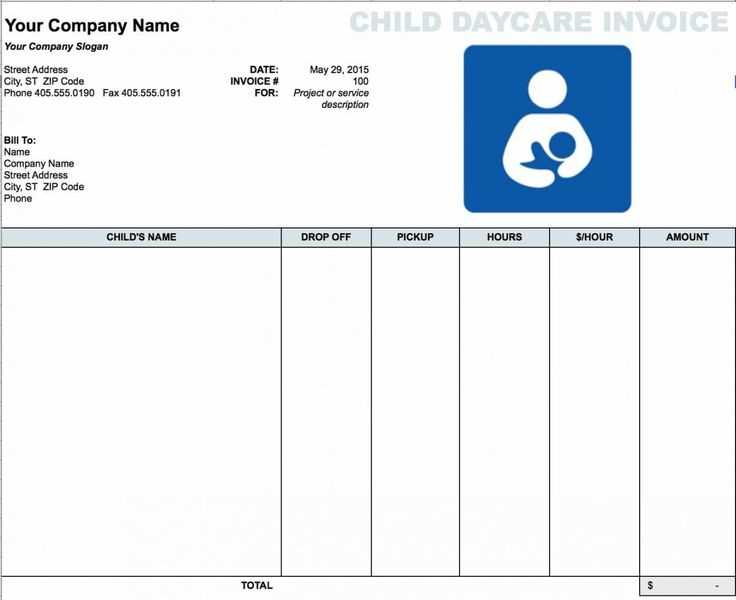

The template should include fields for the provider’s name, address, and taxpayer identification number (TIN), alongside the dates of service and the total amount paid. This information allows you to accurately report the care costs on your tax return.

Each receipt must clearly indicate the dates of care provided and the exact amount paid. It’s also helpful to keep a copy of the payment method (e.g., check, credit card) in case of an audit or verification request.

Regularly updating the receipt for each daycare service will simplify tax reporting and ensure you’re prepared when it’s time to submit documentation to the IRS. Keep detailed records, and double-check that all information is accurate before submission.

Here’s the revised version without excessive repetition of words:

Keep the language clear and direct. Avoid using the same words repeatedly throughout the document. For example, instead of using “important” several times, try incorporating synonyms like “necessary” or “crucial” where appropriate. This small change helps the text feel fresher and more engaging.

When writing, break down long sentences into shorter, clearer ones. This improves readability and ensures that each point is communicated effectively. A concise statement is often more powerful than a verbose one.

Make sure to structure your content logically. Use headings and subheadings to guide the reader through the sections. This not only makes the text more organized but also easier to navigate.

If you need to refer to the same concept more than once, avoid redundancy by rephrasing. For instance, instead of repeating “receipt” or “document” constantly, alternate between terms like “form,” “voucher,” or “record” as long as they match the context.

Incorporate bullet points or numbered lists where applicable to present key details. This visually breaks up the text and makes it simpler to scan for essential information.

- Understanding Key Elements of a Receipt

Focus on these core components when reviewing a daycare receipt:

- Provider Information: This includes the daycare’s name, address, contact details, and any registration numbers. It verifies the legitimacy of the service provider.

- Payment Date: The exact date when the payment was processed is crucial for accurate records and tax purposes.

- Amount Paid: Ensure the total is clearly stated, along with any breakdowns for multiple services, such as hourly rates or package costs.

- Service Period: Look for the start and end dates for the daycare services rendered. This helps match the receipt with your calendar.

- Child’s Name: Confirm that the name of the child receiving care is listed correctly, ensuring no confusion or errors.

- Payment Method: The receipt should specify whether the payment was made by cash, check, credit card, or another method. This ensures transparency in financial transactions.

- Tax Information: If applicable, check for the inclusion of taxes or any tax-exempt status. This is particularly important for end-of-year tax filing.

By paying attention to these details, you can keep track of payments and ensure all necessary information is documented correctly for future reference.

When documenting daycare services, ensure that dates are consistently formatted. Use the standard date format, such as “MM/DD/YYYY” or “DD/MM/YYYY,” depending on your region. This avoids confusion, especially for tax or reimbursement purposes. Always write out the full date, avoiding shorthand like “1/5/23,” to prevent ambiguity.

For service periods, list the exact start and end dates. Specify the range clearly, such as “January 1, 2023 – January 31, 2023,” rather than just “January 2023.” This level of detail helps avoid misunderstandings about the billing period and ensures accuracy when calculating costs or verifying services rendered.

Additionally, include the specific times when services were provided, especially if daycare operates on a part-time or hourly basis. For example, “8:00 AM – 5:00 PM” clarifies the exact service window for that date.

Consistency across all entries in the receipt makes reviewing and processing simpler for both parties involved. A uniform approach to date and service period formatting ensures clarity and transparency.

Ensure the provider’s full legal name is listed correctly. Double-check for any abbreviations or misspellings that may cause discrepancies. Include the provider’s business name (if applicable), address, and contact details such as a phone number or email address. These are necessary for communication and verification purposes.

Tax Identification Number

Include the provider’s Tax Identification Number (TIN) or Employer Identification Number (EIN). This is crucial for tax reporting and ensures the daycare service is properly recognized by the authorities.

License Information

Specify the provider’s license number, if applicable. This proves that the daycare meets local or state regulations. Include the issuing authority and expiration date to confirm the provider’s status remains valid.

| Information Type | Required Detail |

|---|---|

| Provider’s Legal Name | Full legal name with no abbreviations |

| Tax Identification Number | Tax ID or EIN |

| License Number | License number with expiration date and issuing authority |

| Contact Information | Phone number and email |

| Business Name (if applicable) | Business name if different from the provider’s personal name |

First, gather all your daycare receipts and contracts. Carefully check the billing statement for any extra fees like late pick-up charges, enrollment fees, or early drop-off charges. These can significantly affect your total cost.

Next, calculate the total hours your child attends daycare each week. Multiply this by the hourly rate provided by the daycare. If they offer a flat weekly or monthly rate, make sure you understand how many hours are covered by the standard rate and if there are any additional hours that will incur extra charges.

Don’t forget to account for any discounts that may apply. Some daycares offer discounts for siblings, long-term commitments, or off-season periods. Be sure to confirm these before making your final calculations.

Review your payment schedule. Some centers may charge you upfront for the month, while others may charge per session. Track your payments to ensure that they match the costs outlined in your agreement.

Keep a record of all payments made to avoid confusion when filing taxes or if you need to dispute any charges. Having a clear history of payments will help you ensure that your calculations are correct.

Collect all relevant receipts and records to support your daycare tax deductions. Ensure each receipt includes the provider’s name, address, and tax identification number, along with the dates and amounts paid for services. Accurate documentation can help avoid delays or issues when filing taxes.

Keep Records of Payment Methods

Track how payments were made, whether by credit card, check, or direct deposit. This adds an extra layer of clarity when verifying your expenses. If payments are made in cash, make sure to request a signed receipt from the daycare provider.

Document Service Dates and Hours

Record the exact days and hours your child attended daycare. This helps confirm that your claims for the tax credit match the actual services rendered. It’s advisable to keep a log or calendar with attendance details, supported by receipts from the daycare provider.

Adjust the template based on the particular requirements of your daycare program. Tailor the sections to reflect the specific services offered, such as different age groups, hours of operation, or special programs. For example, add or remove fields related to meal options or extracurricular activities that are unique to your center.

Make sure the payment section clearly outlines any adjustments for part-time or full-time care, with rates that match the needs of each family. If necessary, include custom payment terms or discounts for multiple children attending.

Consider adding a space for specific caregiver notes or instructions. This helps personalize the experience for each child and ensures parents’ requests are easily integrated into daily care routines.

Finally, update the footer to include any legally required information relevant to your area, such as licensing details or tax information, ensuring compliance with local regulations.

Keep the headers clear and specific. They should directly communicate what the reader can expect from the section. Avoid vague language; instead, be direct and to the point. This ensures the content is easily understood and actionable.

Examples of Effective Headers:

- “How to Complete a Dependent Daycare Receipt” – directly addresses the task at hand.

- “Step-by-Step Instructions for Submitting Your Daycare Claim” – provides a clear guide.

- “Understanding the Required Documentation for Daycare Receipts” – helps readers know exactly what they need.

Each header should guide the reader through a simple, logical flow, creating an intuitive structure. The goal is to eliminate any guesswork and ensure the instructions are clear. When the headers are actionable, the rest of the content falls into place, providing readers with the most useful and efficient information.

Let me know if you’d like any further changes!

If you’d like any modifications to the daycare receipt template, feel free to reach out. I’m happy to adjust the formatting, add more details, or simplify specific sections based on your needs. Whether it’s adding the child’s name, adjusting the date range, or including additional payment breakdowns, let me know what works best for you. If there’s a specific part you’d like more clarity on or something you’d like to remove, don’t hesitate to ask!

I’m here to make sure the template fits your specific requirements. Just drop me a message with any requests, and I’ll make the necessary adjustments to ensure it meets your expectations.