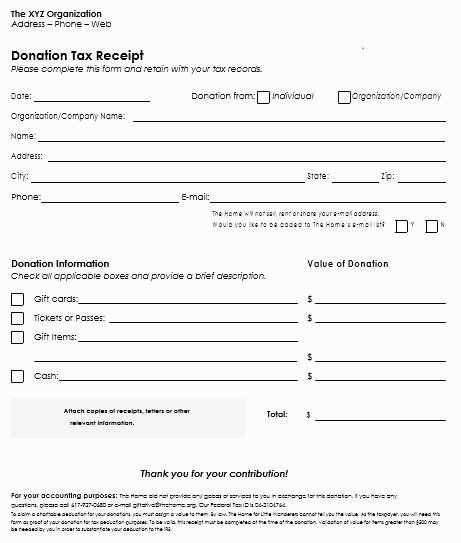

If you’re responsible for issuing donation receipts for a church, creating a well-structured template can save you time and ensure compliance with tax regulations. A good template should clearly state the name of the church, the donor’s details, the donation amount, and the date of the donation. It’s also a good practice to include the church’s tax-exempt status and a statement confirming that no goods or services were exchanged for the donation, as required by tax laws.

Be sure to include a unique receipt number for tracking purposes and make it easy for both the church and the donor to refer back to. If the donation was in kind (goods or services), list the items or services donated along with their estimated value. It’s also helpful to mention the method of payment, whether cash, check, or electronic transfer.

To keep things transparent, you can add a note about how the donation will be used, whether it’s for a specific fund or general church expenses. This builds trust with donors and helps them understand the impact of their contributions.

By using a clear, standardized template, the church can stay organized while making sure donors have all the information they need for tax purposes. The receipt should be professional, easy to read, and follow any local guidelines for charitable contributions. A good receipt template not only simplifies your record-keeping but also strengthens relationships with donors by demonstrating transparency and gratitude.

Here are the corrected lines:

Make sure to include the correct legal name of the church and its tax-exempt status. This is key for the recipient to verify the validity of the donation.

Donation Amount: Specify the exact amount donated in clear terms (either in words or numerically), ensuring accuracy in the receipt.

Date of Donation: Always state the date on which the donation was received. This helps both the church and donor track donations for tax purposes.

For monetary donations, a brief statement such as “No goods or services were provided in exchange for this donation” should be added. This assures the donor that their contribution is fully tax-deductible.

Be sure to list the donor’s full name and address. This is necessary for tax reporting and ensures the donation is associated with the correct individual.

Church Contact Information: Provide the church’s address, phone number, and email. This allows the donor to contact the church if needed.

For non-cash donations, include a description of the items received. This is especially important for in-kind donations and may require a fair market value estimation.

Signature: A signature or an authorized representative’s name on the receipt makes it more official and ensures legitimacy.

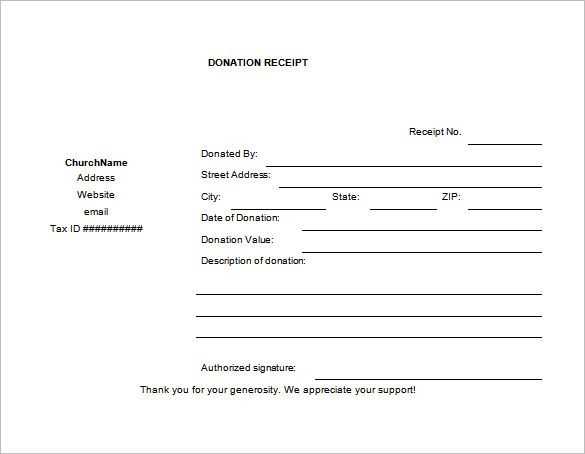

- Church Tax Donation Receipt Template

To create a proper church tax donation receipt, include the donor’s name, address, and the date of the donation. Specify the donation amount and describe the items donated, if applicable. Make sure to note whether the donation was monetary or in-kind.

Key Components of a Donation Receipt

Each receipt should contain the following details:

- Church Name and Address – Include the official name and contact information of the church.

- Donor’s Information – Name, address, and any other relevant details of the donor.

- Donation Date – Clearly state the date the donation was received.

- Donation Description – A brief description of the items donated or the amount of money given.

- Value of In-Kind Donations – For non-monetary donations, include an estimated value (if possible). This can help the donor for tax purposes.

- Statement of Non-Compensation – Include a statement confirming that the donor received no goods or services in exchange for the donation (if true).

Formatting Tips

Ensure the receipt is clear and professional. The format should be easy to read and include a section for the church’s tax identification number (TIN) if required. Provide a copy for the donor and keep a record for the church’s tax filings. The receipt should also be signed by a church official for added authenticity.

Include the church’s name and address at the top of the receipt. This helps establish the authenticity of the document and ensures donors know exactly where their contributions are going. Follow with a statement confirming that the donation is tax-deductible under IRS rules. It’s important to specify that no goods or services were provided in exchange for the contribution if this is the case.

Next, list the donor’s name and address. Include the donation amount or description of the item donated, and the date of the donation. If the donation is non-monetary, describe the item(s) and estimate their fair market value.

For monetary donations, include a clear statement of the total amount donated. If the donation was cash, state “Cash donation.” If checks were involved, note the check number and amount. A signature from a church representative adds credibility and confirms the donation.

Ensure the receipt is concise but includes all required information. This can be done in a simple table format or bullet points for clarity. Always provide the donor with a copy of the receipt and keep a record for church records.

Ensure the receipt contains the following elements for clarity and transparency:

- Church Name and Address: Clearly list the church’s full name and physical address for identification and verification.

- Donor’s Name: Include the full name of the donor, ensuring it matches the record in your system.

- Donation Amount: Specify the exact amount donated. If the donation is in kind, describe the items or services provided and their estimated value.

- Donation Date: Provide the date of the donation, ensuring it aligns with the donor’s tax records.

- Receipt Number: Assign a unique receipt number for easy tracking and future reference.

- Tax-Exempt Status: Mention the church’s tax-exempt status (e.g., 501(c)(3) for U.S. organizations), confirming that the donation qualifies for tax deductions.

- Statement of No Goods or Services Provided: If applicable, include a statement that no goods or services were exchanged for the donation. If goods or services were provided, state their estimated value.

- Signature of Authorized Person: An authorized representative’s signature adds credibility to the receipt.

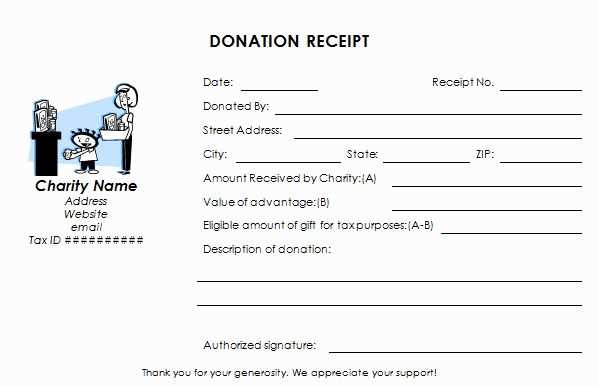

Donation receipts must include specific details to meet legal standards. These details help donors claim tax deductions and ensure organizations comply with regulations. Here’s what is required:

- The name of the organization receiving the donation.

- The date the donation was made.

- The amount of cash donated or a description of the donated property if it’s not money.

- For non-cash donations, a description of the items donated and an estimate of their value.

- A statement that the organization did not provide any goods or services in exchange for the donation, or a description of what was provided in exchange.

- If the donor received goods or services, the receipt must list their value, helping the donor to deduct only the portion of the donation that exceeds the fair market value of the goods or services received.

Make sure receipts are provided for donations over a certain amount, which varies depending on your jurisdiction. It’s crucial that donations are documented in this way to maintain transparency and avoid legal complications for both the donor and the organization.

Begin by including the date of donation and the name of the donor. Clearly state the amount donated and whether it was a monetary contribution or an in-kind donation. For in-kind gifts, describe the items donated, along with their estimated value. Make sure to specify the charity’s name and tax-exempt status number for verification purposes.

Provide a summary of the donation: Include a short statement confirming that no goods or services were provided in exchange for the donation, if that’s the case. This is particularly important for tax purposes. If something was given in return, such as a gift or event ticket, ensure the value of that item is clearly mentioned.

Customize the layout: Make your receipt easy to read. Use a simple, clean design with clear headings. Group related information, such as donor details and donation information, under separate sections. Provide enough space between each section to avoid clutter.

Lastly, include a thank-you note. A personalized message expressing gratitude for the donor’s support can go a long way in fostering positive relationships. Keep the tone sincere and heartfelt.

Ensure the donor’s name and address are spelled correctly. Any mistake can cause confusion during tax filing. Double-check these details before issuing the receipt.

Clearly state the donation amount, specifying whether it’s in cash, check, or other forms of payment. Not mentioning this can cause issues during tax deductions.

Include the date of the donation. Missing or incorrect dates can lead to complications during audit or when verifying the donation for tax purposes.

Make sure to provide the church’s official name and tax identification number (TIN). Without this, donors might struggle to claim their tax deduction. This is non-negotiable for valid receipts.

Don’t combine multiple donations into one receipt. Each donation should be listed separately to ensure accurate records and proper tax reporting.

Always include a clear description of the donation. If it’s an item, list the specific goods donated, including their estimated value. Lack of detail can result in the donor losing out on possible deductions.

Avoid vague language. Use precise wording like “Cash donation” or “Clothing donation,” and specify the value if applicable. This will help maintain transparency and clarity.

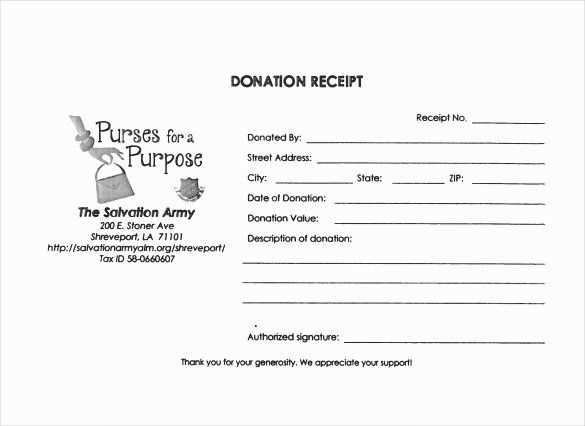

Send receipts via email as the quickest and most eco-friendly option. Ensure the email subject clearly identifies the receipt, such as “Your Donation Receipt from [Church Name].” Include a PDF attachment of the receipt for easy printing and record-keeping. Make sure the PDF is formatted for clarity, with all the necessary details such as donor name, donation amount, and church tax ID number.

If email isn’t suitable, provide printed receipts. Organize a distribution event at the church where donors can pick up their receipts, or mail them directly. Include a return address and clear instructions in case the donor has any questions or needs corrections.

Automating the process can save time, especially if your church uses a donor management system. Set it up to generate and email receipts immediately after a donation is made. Be sure the system includes a follow-up reminder for donors who haven’t received their receipts.

For regular givers, consider sending annual summary statements instead of individual receipts. This allows them to have an overview of their total contributions for tax purposes.

To create a donation receipt for church tax purposes, include specific details to meet tax regulations. The receipt should list the donor’s name, donation amount, and the date of the donation. For transparency, also note whether the donation was made in cash, check, or another form of payment.

Key Information for the Template

Include these key details in the receipt template:

| Field | Description |

|---|---|

| Donor Name | The full name of the individual or entity making the donation. |

| Donation Amount | The exact value of the donation (in dollars or other relevant currency). |

| Date of Donation | The date the donation was made. |

| Type of Donation | Cash, check, credit card, or other payment method. |

| Tax-Exempt Status | Statement confirming the church’s tax-exempt status (usually under IRS 501(c)(3)). |

| Non-Refundable Clause | A note stating that donations are non-refundable. |

Formatting Tips

Ensure the receipt is easy to read. Use a simple font and avoid cluttering the document with too much text. Also, include your church’s logo and contact information at the top for professionalism.