If you need a quick way to generate a Foot Locker receipt template, a simple solution is to use customizable templates available online. These templates allow you to tailor the document to your specific needs, whether for a return, warranty claim, or tax purposes. A template ensures that you have all the necessary details such as the store name, address, transaction number, itemized list of purchases, and total amount.

Make sure to include transaction date, item descriptions, and purchase price in your template. This will make it easy for you to track your purchases or resolve any disputes with the store. If you regularly shop at Foot Locker, having a template on hand can save you time and effort in the future.

Adjust the layout and information in the template to suit your requirements. For example, if you’re using it for returns, leave space for return instructions and refund methods. With a properly set-up receipt template, you can quickly fill out relevant details without worrying about formatting or missing information.

Here’s the modified version of your lines, removing repetitions while keeping the meaning intact:

Remove redundant phrases to make the receipt clear and easy to understand. Focus on the key details without over-explaining the purpose of each section.

1. Simplify Item Descriptions

- Shorten product names where possible without losing clarity.

- Include only the necessary details, such as size, color, and quantity.

- Avoid repeating words or phrases across multiple lines (e.g., “Item purchased” can be omitted after the first instance).

2. Streamline Price Information

- Clearly list the cost without adding extra commentary.

- Group all similar information together to avoid repetition (e.g., taxes and discounts).

- Use bullet points or columns to separate the price, taxes, and total for better readability.

- Foot Locker Receipt Template Guide

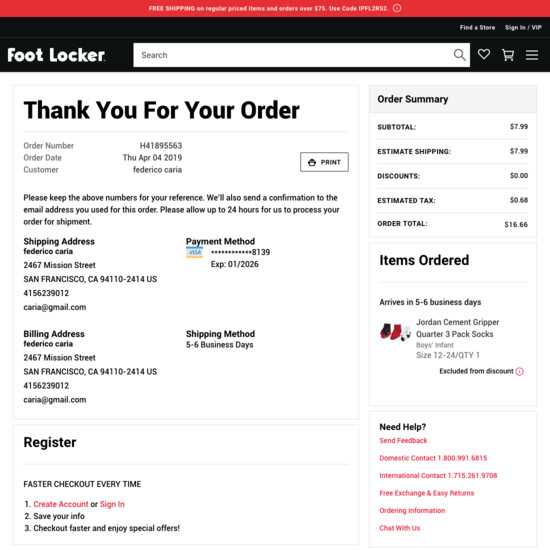

When creating a Foot Locker receipt template, focus on including key details such as transaction date, store location, item descriptions, prices, taxes, and total amount. Ensure the layout is clear and concise to avoid confusion. The store name and logo should be prominently placed at the top, with a breakdown of items below.

Key Elements to Include

Each item on the receipt should have its own line, showing the name, size (if applicable), quantity, and price. Include taxes as a separate line item to clarify the total amount due. Provide space for the total sum at the bottom, along with any discount applied, if relevant.

Formatting Tips

Use clear fonts for easy readability. Consider adding a footer with customer service contact information, return policy, and store hours. Ensure the date and time are easily visible, as well as any transaction ID or order number for tracking purposes.

Open a blank document in Microsoft Word. Set the document’s layout to a simple, clean design by adjusting margins and font styles. Use a standard font like Arial or Times New Roman in size 12 for readability.

Step 1: Create a header with the store name, address, and contact information. This helps establish the receipt’s authenticity. Use bold or a slightly larger font size to make the header stand out.

Step 2: Add the receipt title. Use the text “Receipt” or “Transaction Receipt” centered beneath the header. Ensure it’s distinguishable with bold formatting.

Step 3: Include transaction details. Below the title, add the following sections: the date and time of purchase, the cashier’s name, and the transaction number. Use bullet points or simple line breaks to keep each detail clear.

Step 4: List the purchased items. Add each item’s name, quantity, and price. You can use a table to keep the data organized and easy to read.

Step 5: Add totals. Sum the cost of all items and include a tax section if necessary. Use bold formatting for the total amount and tax to make it stand out.

Step 6: Include payment method and footer information. Below the totals, specify the payment method (credit card, cash, etc.). Add a thank-you note or store policy in the footer, keeping the tone professional.

Save the document and print as needed. Adjust the layout for neatness and ensure all information is aligned properly. This process creates a professional and easy-to-read receipt that can be customized for each transaction.

Adjust your Foot Locker receipt template to match the type of transaction by incorporating specific fields. For purchases, add item descriptions, quantities, and prices. If the transaction involves returns or exchanges, include fields for the original purchase details and refund amounts. For gift cards or promotional discounts, integrate relevant sections showing the balance or discount applied.

| Transaction Type | Custom Fields |

|---|---|

| Purchase | Item Description, Quantity, Price, Total |

| Return/Exchange | Original Purchase Info, Refund Amount |

| Gift Card | Gift Card Number, Balance |

| Discount | Discount Code, Discount Amount |

To ensure accuracy, clearly label each section with transaction-specific information. Include additional notes for special conditions like expired coupons or membership discounts.

To display discounts and taxes on your receipt template, include clear sections for each, ensuring customers understand the breakdown of their purchase. Start with a “Discount” line that shows the amount or percentage off the original price. Below that, list the tax applied, indicating the rate and the calculated amount. This transparency helps customers verify the final price and avoid confusion.

How to Add a Discount

When adding a discount, clearly indicate whether it’s a percentage or a fixed amount. For example, use the label “Discount” followed by the discount value (e.g., “10% off” or “$5 discount”). Make sure this is placed before taxes are calculated, so customers can see the original price reduction before the tax is added.

How to Add Tax Information

For tax information, display the applicable tax rate (e.g., “Sales Tax: 7.5%”) along with the calculated amount. If multiple taxes apply, list each one separately. The tax section should be placed after the discount but before the final total. This ensures the final amount accurately reflects all adjustments to the price.

Include payment methods clearly in your receipt template to ensure smooth transactions. Start by choosing a section dedicated to payment details. This could be labeled “Payment Information” or something similar. Ensure this part is easily identifiable.

1. List Accepted Payment Methods

Indicate all the payment methods you accept, such as credit cards, PayPal, or bank transfers. Be specific with the payment options, including card types (e.g., Visa, MasterCard). If you accept multiple payment gateways, include them by name.

2. Add Payment Amount and Breakdown

Show the total payment amount along with any taxes, discounts, or additional fees. Use clear formatting, such as bullet points or a table, for better clarity. This provides transparency and allows customers to verify their transaction details easily.

3. Include Transaction Reference Number

Add a unique reference or transaction number to help both you and your customer track the payment. Place this in the payment section for easy access.

4. Indicate Payment Status

Clearly state whether the payment has been completed or is pending. If there are any issues, provide instructions or a contact point for resolving the problem.

Finalize the section by double-checking that all information is accurate and easy to understand. This improves the user experience and helps prevent confusion.

Ensure your Foot Locker receipt template includes all necessary legal information. Start with the accurate inclusion of your business name, address, and tax identification number (TIN). These elements help establish the legitimacy of the transaction and satisfy local tax laws.

Include Specific Legal Language

In some regions, receipts must feature particular disclaimers regarding returns or refunds. Verify your template reflects your store’s policies clearly, such as return windows, eligibility for refunds, and any restocking fees. Include terms in a way that is easy to read, without excess jargon.

Check for Sales Tax Compliance

Your template should reflect the correct sales tax rates applicable to your region. Display the tax amount separately from the total to comply with tax reporting regulations. This ensures transparency and avoids potential legal issues.

Lastly, ensure the template accommodates any legal changes in your jurisdiction, such as new consumer protection laws or updated tax rules. Regular updates will help keep your receipts compliant and legally sound.

Use high-quality paper that can withstand wear and tear, ensuring that printed receipts remain legible for a long time. Avoid overly thin paper, as it may tear easily, leading to potential issues when receipts are needed later.

Use Clear, Readable Fonts

Choose a font that is simple and easy to read. Avoid decorative fonts, as they can make essential information hard to decipher. Stick to standard fonts such as Arial or Times New Roman, and ensure the text is large enough for clear visibility.

Ensure All Key Information is Included

Each receipt should contain the date, store name, transaction number, itemized list of purchased items, payment method, and total amount paid. Make sure that the font size and spacing allow each of these elements to stand out for easy identification.

Distribute receipts promptly. If distributing in person, hand over the printed receipt directly to the customer. For digital receipts, ensure they are sent immediately via email or text with a clear subject line and in a format that is easy to open, like PDF or JPEG.

Store receipts electronically to reduce paper waste and allow quick access for both customers and employees. An organized electronic receipt system makes it easier to track sales and address any customer inquiries effectively.

Lastly, train staff on the importance of accurate receipt distribution and handling. Proper procedures ensure a smoother customer experience and a well-managed transaction process.

Foot Locker Receipt Template

To create a Foot Locker receipt template, focus on including all the necessary details for clarity and accuracy.

- Store Information: Include the store’s name, address, and contact details for easy reference.

- Transaction Date and Time: Ensure the template captures the exact date and time of purchase.

- Receipt Number: Add a unique receipt number for tracking purposes.

- Itemized List: List all purchased items, including the name, size, quantity, and price of each item.

- Subtotal: Clearly display the subtotal before taxes.

- Tax Information: Specify applicable taxes, including the tax rate.

- Total Amount: Show the final amount after taxes and discounts.

- Payment Method: Indicate the method of payment, such as cash, card, or gift card.

- Return Policy: Briefly mention the store’s return policy for customer convenience.