To create a clear and professional tip receipt, focus on including specific details that both you and the recipient will find useful. A well-structured tip receipt should show the date, the service provided, the amount tipped, and the total charge. This ensures transparency and helps maintain proper records.

Start by including the business name and contact information at the top. This allows the recipient to easily identify the source of the tip receipt. Then, list the items or services for which the tip was given. If applicable, show any additional taxes or fees that were added to the total amount.

For the tip amount, break it down separately, showing the percentage of the total bill or the fixed amount given. This helps both parties understand how the tip was calculated. Lastly, make sure the final total is clearly displayed, so there’s no confusion about the amount paid after the tip has been added.

Tip receipts serve as a useful record for both personal and tax purposes. Keep it simple and straightforward to make the information easy to follow. Whether you are a business owner or a customer, having a consistent template for receipts can save time and avoid misunderstandings.

Here is the corrected version:

Make sure your tip receipt template includes clear, legible information. Start by listing the business name and contact details at the top. This provides quick reference for both the customer and the business.

Include a Breakdown of Charges

Detail the total amount of the service or purchase, followed by the tip amount. Make it easy for customers to understand how their tip was calculated, whether it’s a percentage of the total or a fixed amount.

Provide a Date and Receipt Number

Each receipt should have a date and a unique number. This helps with record-keeping and can be useful for both tax purposes and resolving any future disputes. Include a thank you note at the bottom to enhance customer experience.

Ensure the layout is clean and uncluttered. This makes the receipt more user-friendly, and the customer will appreciate the clarity and professionalism.

- Tip Receipt Template: A Practical Guide

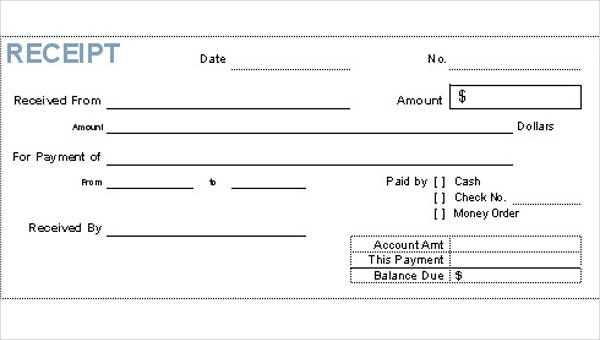

To create a tip receipt that is clear and accurate, start by including essential details like the date, amount of the tip, and the name of the recipient. Keep the format simple and easy to read. Use clear labels for each section of the receipt, such as “Tip Amount,” “Total Amount,” and “Service Provided.” Make sure that the totals are calculated correctly and are easy to understand for both parties.

Key Elements of a Tip Receipt

A solid tip receipt template should include the following elements:

- Date: Always include the date of the transaction.

- Service Provider Name: Include the name of the person who received the tip.

- Tip Amount: Clearly state the tip amount given.

- Total Amount: Include the total amount, which is the sum of the service charge and the tip.

- Payment Method: Specify whether the tip was given in cash, via card, or another method.

- Additional Notes: If necessary, include any notes or special instructions relevant to the tip.

Formatting the Template

Use a simple, clean format for easy reading. Avoid cluttering the template with unnecessary details. A basic structure could look like this:

- Date: [Insert Date]

- Service Provider: [Insert Name]

- Tip Amount: [Insert Tip]

- Total Amount: [Insert Total]

- Payment Method: [Insert Method]

- Additional Notes: [Optional]

Once the template is structured, it can be customized for different needs, such as for restaurants, personal services, or delivery tips. Ensure consistency in design and layout to maintain a professional appearance.

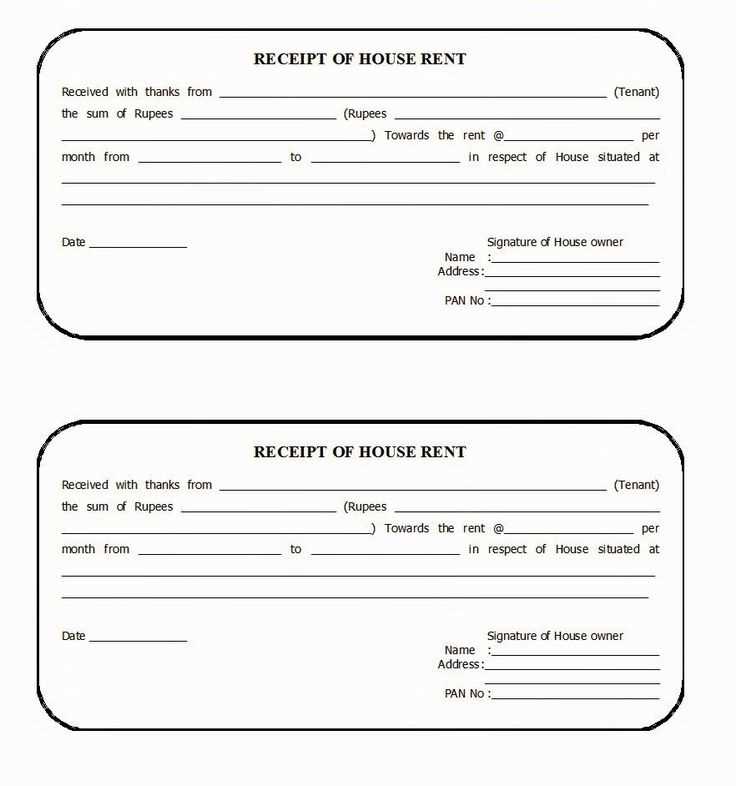

Design a tip receipt template by focusing on key elements. Start by adding your business name and contact information at the top. This makes it easy for customers to know where the tip is coming from. Make sure to use a clean, readable font so the text stands out clearly.

Step 1: Include Basic Details

- Business name

- Contact information (phone number, email, or website)

- Date and time of the transaction

- Transaction number or ID (if applicable)

Step 2: Clearly Display the Tip Information

- Break down the total amount, indicating the tip separately.

- Include a space for customers to write the tip amount, or pre-fill the most common amounts.

- Optionally, leave space for a personalized message from the business or employee.

Use simple formatting, like bold text for the most important details, to guide the customer’s eye. The template should be easy to modify for each transaction, so avoid over-complicating the layout.

Ensure your receipts contain all key information for tax purposes. Accurate and clear data on receipts helps businesses stay compliant with tax regulations and simplifies reporting. Below are specific elements that should be included on receipts to support tax filings.

Required Information

- Date and time of the transaction – This helps to verify the timing of the purchase and calculate any relevant tax periods.

- Business name, address, and contact details – Required for identification and correspondence, ensuring authorities can easily reach the business if needed.

- Itemized list of goods or services – Each item or service sold should be listed separately, showing quantities and prices to reflect the taxable amount.

- Tax rate and amount – Clearly state the tax rate applied to the transaction and the corresponding tax amount. This makes tax calculations transparent.

- Total amount due – The total cost, including taxes, should be clearly highlighted to show the final amount paid.

Additional Considerations

- Discounts or refunds – If applicable, show any discounts, credits, or refunds applied to the transaction, as these can affect the tax reporting.

- Payment method – Document whether the payment was made by cash, credit, or another method, as this may be relevant for financial tracking and auditing purposes.

- Transaction number – Assigning a unique reference number to each receipt can simplify tracking and auditing.

By including these details, businesses can streamline their tax reporting process and ensure all necessary information is available in case of an audit.

Choosing the right format for digital receipts depends on the needs of the business and the preferences of customers. Below are common formats with their benefits and drawbacks.

1. PDF Receipts

- Pros: PDF receipts are widely accepted and can be viewed on any device with a PDF reader. They maintain formatting, ensuring that receipts look the same across all platforms.

- Cons: Larger file size compared to other formats, which can be cumbersome for customers to download or store. It may also be difficult to edit or extract data directly from a PDF.

2. HTML Receipts

- Pros: HTML receipts are lightweight and easy to integrate into websites and email templates. They are easily customizable and can be styled to match a company’s branding.

- Cons: If not properly designed, HTML receipts can appear cluttered or have inconsistent formatting across different devices or browsers.

3. Plain Text Receipts

- Pros: Plain text is simple and compatible with virtually all devices. It’s fast to generate and doesn’t require special software or large file storage.

- Cons: Lack of visual appeal or any branding elements. Limited functionality in terms of adding images or complex formatting.

4. JSON Receipts

- Pros: Great for businesses needing to process data or integrate with other systems. JSON is lightweight and easy to parse programmatically.

- Cons: Not user-friendly for customers, as it lacks a readable format. Best suited for backend processing rather than direct communication with consumers.

For most businesses, choosing the right format requires balancing user experience with technical needs. For straightforward receipts, PDF or HTML formats are most common, while JSON suits backend integration well. Plain text can be a simple choice for basic needs but offers the least branding potential. Adjust your choice according to the specific context in which your receipts are used.

To ensure your receipts comply with local legal standards, include all mandatory elements specified by the authorities. These typically involve the business name, address, and tax identification number, along with details of the transaction such as date, itemized list of goods/services, total amount, and applicable taxes. Always verify the specific requirements for your location, as they can vary by jurisdiction.

Key Information to Include on Receipts

| Required Information | Description |

|---|---|

| Business Name and Address | Ensure the full legal name and physical location are listed. |

| Tax Identification Number (TIN) | Include the relevant tax number or registration code. |

| Date and Time of Transaction | The exact moment of the sale should be recorded. |

| Itemized List | Clearly describe each item or service purchased, with corresponding prices. |

| Total Amount and Taxes | Include the total price and applicable taxes (e.g., VAT or sales tax). |

Compliance with Local Tax Laws

Tax laws dictate specific details about how taxes should appear on receipts. Some regions may require distinct breakdowns for different tax rates applied to items. Always review local regulations or consult with a tax expert to avoid penalties. Additionally, some jurisdictions may demand receipts to be issued within a specific timeframe, such as immediately after payment or within a certain number of days. Adhere to these timelines to ensure compliance.

Use automated tools and software to simplify receipt generation and reduce manual effort. These solutions enable businesses to generate receipts instantly and accurately, cutting down on errors and saving time.

1. Receipt Generator Software

Receipt generator tools, such as “Invoice Simple” or “Zoho Invoice”, let you create customizable receipt templates. These platforms offer straightforward interfaces, allowing users to enter transaction details and generate a receipt with a click. Some platforms even integrate with accounting software to sync payment records automatically.

2. Point-of-Sale (POS) Systems

POS systems like Square and Shopify streamline the transaction process and automatically generate receipts for every sale. They connect directly to payment terminals, so receipts are generated and emailed to customers instantly, offering a smooth and professional transaction experience.

By integrating these tools with other business systems, you can maintain accurate records and reduce administrative tasks. Look for features that allow easy customization, cloud-based storage, and seamless syncing with other financial tools.

Receipts play a significant role in enhancing customer experience and building trust. A well-designed receipt not only provides proof of transaction but also communicates vital information that can improve transparency. By offering clear, detailed, and easy-to-understand receipts, businesses help customers feel more confident in their purchases.

Designing User-Friendly Receipts

The layout of a receipt should prioritize simplicity and clarity. Include the following key details:

| Item | Description | Price |

|---|---|---|

| Product Name | Clear description of the item | Price |

| Quantity | Number of items purchased | Total Price |

| Discount | Applicable discounts | Discounted Price |

| Tax | Tax breakdown | Tax Amount |

| Total | Final amount paid | Total Cost |

Providing itemized receipts that show all relevant costs, discounts, and taxes adds clarity and eliminates confusion. It also reduces the chances of any misunderstanding between the business and the customer regarding pricing.

Leveraging Receipts for Customer Engagement

Incorporating customer engagement elements into the receipt can further enhance the experience. Adding thank-you messages or loyalty program reminders creates a personalized touch that shows appreciation. A well-crafted message makes customers feel valued and encourages return visits. For instance, including an invitation to follow the company on social media or offering a discount on future purchases helps strengthen the business relationship.

These simple strategies can transform a transaction from a mere exchange to a part of a larger customer experience strategy, driving satisfaction and repeat business.

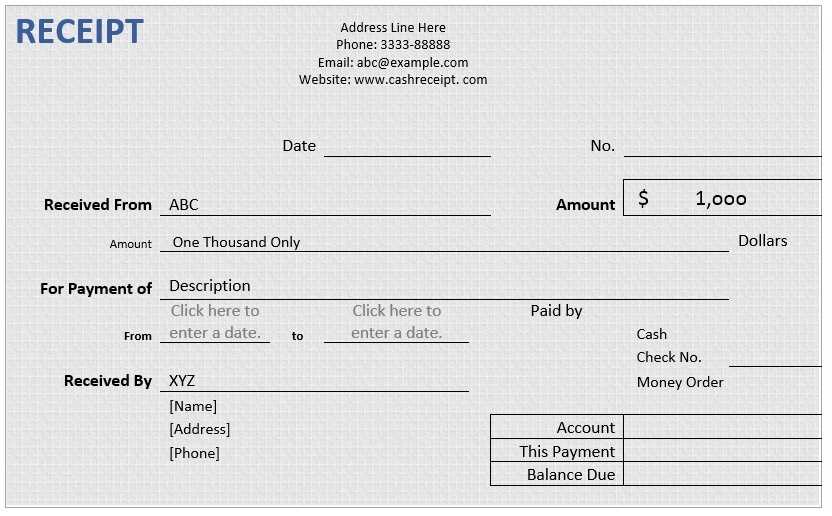

Use a clear layout to make the tip receipt template easy to understand and use. Begin with a concise heading that states the purpose of the receipt. For example, “Tip Receipt” works well and sets the tone. Follow with sections for the tip amount, date, service description, and total cost.

Tip Amount

Clearly display the tip amount in a separate line. This helps distinguish it from the total and other costs. You can format it with a bold font to ensure it stands out for quick recognition.

Additional Information

If necessary, include any additional information like the service provider’s name or an optional note about the service. This makes it easy for both the person giving the tip and the recipient to track the transaction in the future.

Always include a clear total that combines both the tip and the original amount. This ensures there are no misunderstandings about the payment details. A simple formula like “Total = Original Amount + Tip” works effectively.