To claim rental payments as part of your income tax deductions in Canada, a proper rent receipt is necessary. A rent receipt should include specific details that confirm the transaction, ensuring that both the tenant and landlord have accurate records. Without this documentation, you may face difficulties when filing your taxes.

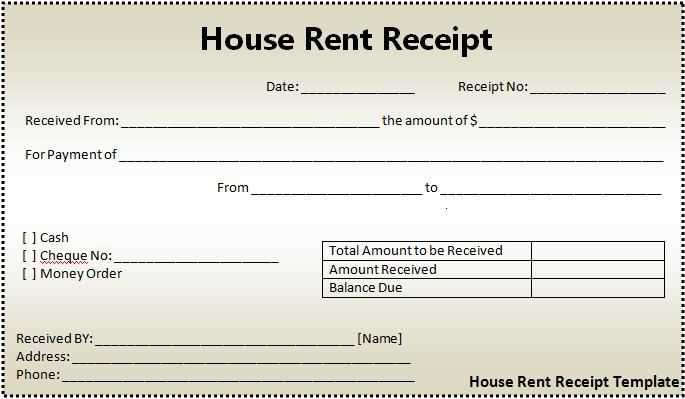

Ensure the receipt includes the tenant’s name, the landlord’s name, the rental property address, and the amount paid. Also, specify the rental period (month or range of months) and indicate the payment method. The receipt must also include the date of payment to avoid any confusion with future claims. Always provide a clear breakdown of what is covered by the payment, especially if it includes utilities or other additional costs.

If you are the landlord, it’s important to keep copies of all receipts issued. This ensures both parties maintain accurate records for their tax purposes. You can find a simple template online or create one using a word processor or spreadsheet program. Using a standardized template will make the process easier for both parties and will ensure you don’t miss any crucial details.

Lastly, keep in mind that a rent receipt is not only helpful for tax purposes but also serves as proof of payment for tenants who may need it for other purposes, such as applying for loans or benefits. Proper documentation benefits everyone involved and helps avoid potential disputes later on.

Here’s the revised version, where repetitive words are limited to 2-3 occurrences:

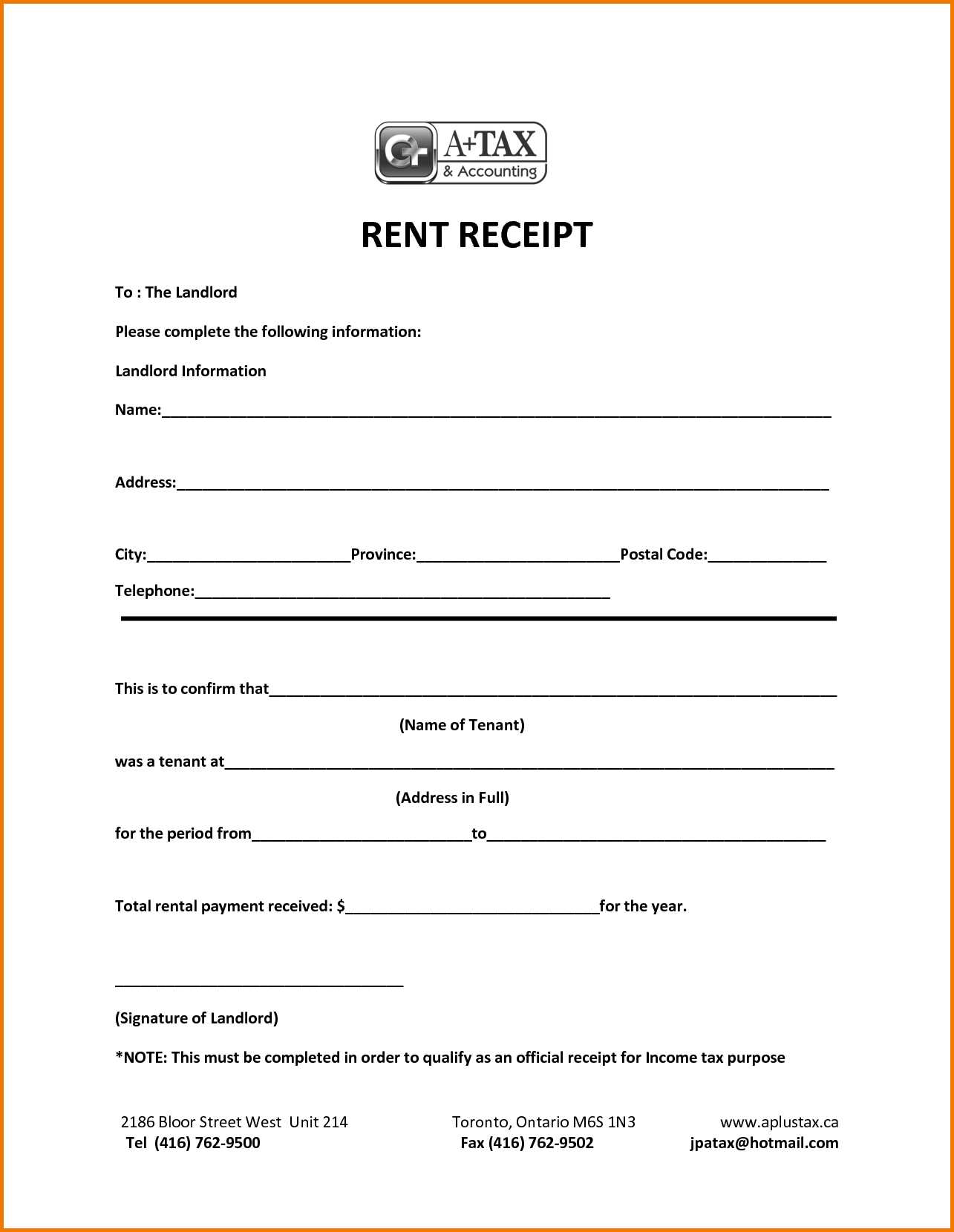

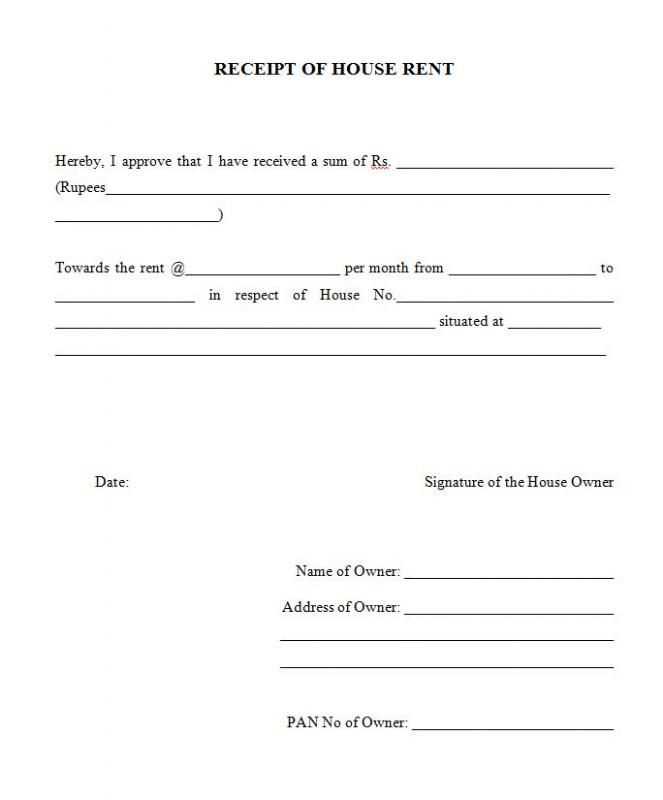

When preparing a rent receipt for income tax purposes in Canada, it’s crucial to ensure the details are clear and compliant with the Canada Revenue Agency’s (CRA) guidelines. The template should include specific information such as the landlord’s name, tenant’s name, rental period, and total amount paid. Keep the format simple and direct, avoiding unnecessary terms or phrases. Accuracy matters, and your rent receipts should reflect the actual transaction details.

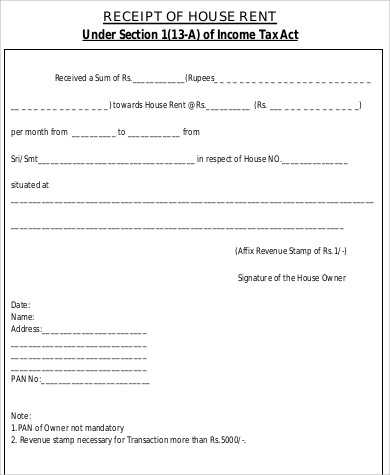

Required Information

Include the following in the receipt: the full address of the rental property, the amount of rent paid, the period for which the rent was paid, and a signature or statement from the landlord confirming the details. If the rent is paid in installments, specify each payment and date it was made. Avoid unnecessary phrases, and keep the details straightforward.

Additional Considerations

Double-check that the amounts match your lease agreement or previous receipts. If there were any adjustments, such as rent discounts or late fees, list them separately to maintain transparency. Keep a copy for your own records in case the CRA requests verification during tax filing.

- Rent Receipt for Income Tax Purposes Template in Canada

A rent receipt for income tax purposes in Canada must include key details to be valid for the Canada Revenue Agency (CRA). These details allow tenants to use the receipt for tax claims, such as claiming rental property expenses or the GST/HST rebate.

Required Information for the Rent Receipt

Ensure the receipt includes the following elements:

- Tenant’s Name: Full legal name of the tenant who made the payment.

- Landlord’s Information: Include the landlord’s name, address, and contact information.

- Rental Property Address: Provide the complete address of the rental property.

- Amount Paid: Clearly state the total rent payment made.

- Payment Date: Indicate the exact date the payment was made.

- Rental Period: Specify the time frame covered by the rent payment (e.g., January 1 to January 31, 2025).

- Payment Method: Note how the rent was paid (e.g., cash, cheque, or electronic transfer).

Important Notes for Landlords

Landlords should sign the receipt and provide a copy to the tenant. This will help ensure that both parties have proof of the payment. Keeping organized records of all rent receipts can be crucial in case the CRA requests documentation for tax audits or rental deductions.

Ensure the receipt includes the following key details for tax filing purposes:

- Landlord Information: Clearly list the name, address, and contact details of the landlord.

- Tenant Information: Include the tenant’s full name and contact details.

- Rental Property Address: Specify the address of the rental property being leased.

- Payment Amount: Indicate the amount paid, and ensure this matches the rental agreement or monthly payment.

- Payment Date: Mention the specific date the payment was made.

- Rental Period: Clearly state the time period covered by the payment (e.g., from January 1, 2025 to January 31, 2025).

- Receipt Number: Assign a unique receipt number for tracking purposes.

- Signature: The landlord’s signature or electronic verification confirms the receipt’s authenticity.

This format provides clarity and meets Canada Revenue Agency requirements for rental income verification during tax filing. Ensure all entries are legible and accurate to avoid discrepancies during tax assessment.

Ensure your receipt includes specific details to comply with income tax requirements. The tenant’s full name and address should be clearly stated. Include the landlord’s full name, address, and contact details for transparency.

Rental Period

Clearly specify the rental period covered by the receipt. Include both the start and end dates of the rental period, avoiding ambiguity. This helps the tenant confirm the exact duration of the payment.

Payment Amount

Clearly indicate the total rent amount paid, broken down if necessary (e.g., base rent and additional fees). Make sure to include the currency used and specify whether the amount covers full or partial payment.

Make sure to add payment method details such as cheque, cash, or electronic transfer, if relevant. This allows for transparency and provides a traceable record of the transaction.

Don’t forget to add the date the payment was received and a unique receipt number for easy reference in future inquiries or for tax reporting purposes.

Taxpayers in Canada can reduce their taxable income by claiming specific deductions. To qualify for these deductions, individuals must meet certain requirements outlined by the Canada Revenue Agency (CRA).

Eligible Deductions for Rent Payments

If you pay rent for your residence, you may be eligible to claim a deduction for a portion of the rent under certain circumstances. Generally, deductions related to rent are applicable if you’re using the rented space for business purposes or meet specific criteria related to provincial or territorial benefits.

Determining Deduction Eligibility

To claim a rent deduction, ensure you have:

- A valid lease or rental agreement.

- Proof of payment (receipts, bank statements, or other supporting documents).

- Documented use of the rented space for income-generating purposes (if applicable).

Check with CRA to ensure eligibility criteria for your province or territory align with your claim.

Always include the correct tenant information. Missing the tenant’s full name or address can lead to confusion and disputes. Double-check the details before issuing the receipt.

Do not omit the rental period. Clearly specify the start and end dates of the rental period for which the payment is being made. This helps avoid misunderstandings, especially during tax reporting.

Ensure the payment amount is correct. Verify the rent amount matches the agreed-upon terms. A common mistake is entering the wrong figure, which can cause issues with recordkeeping.

Avoid using vague descriptions. Be specific about the type of payment, whether it is for rent, utilities, or other charges. Ambiguity can complicate tax filing for both landlords and tenants.

Do not forget to sign the receipt. The signature serves as proof that the receipt was issued by the landlord. Without it, the document may be considered incomplete or invalid.

Be careful with the date format. Use a consistent and clear format for dates, such as “MM/DD/YYYY.” Misdated receipts can lead to confusion or complications when presenting them for tax purposes.

| Mistake | Consequence |

|---|---|

| Missing tenant details | Leads to confusion or disputes |

| Omitting rental period | Causes misunderstandings during tax reporting |

| Incorrect payment amount | Results in inaccurate financial records |

| Vague payment descriptions | Complicates tax filing |

| Unsigned receipt | Invalid receipt, lacks proof of issue |

| Incorrect date format | Leads to confusion or errors in documentation |

Issue a receipt immediately after receiving rent payments. Make sure the receipt includes the date, amount paid, tenant’s name, rental period, and the property address. This will help the tenant keep accurate records for tax purposes. If the payment is made via cheque or electronic transfer, include those details too. Provide the receipt in person or via email, depending on the tenant’s preference.

For tenants who pay in cash, it is especially important to provide a receipt as a formal acknowledgment of payment. If a tenant requests a receipt after the payment, issue it without delay to avoid confusion or disputes later on.

In cases where multiple tenants share the same rental space, ensure each tenant receives their individual receipt, reflecting their specific payment contribution. This practice helps avoid potential issues if tenants need to provide proof of payment for tax or legal matters.

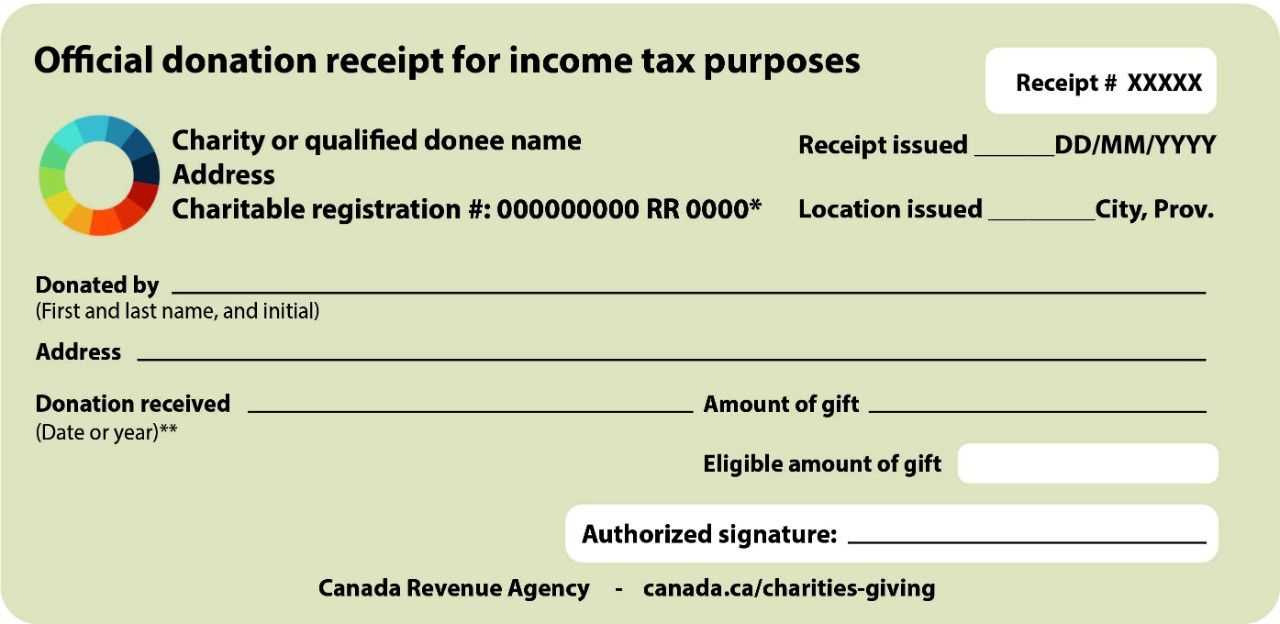

Both digital and paper receipts are accepted by the CRA for income tax purposes. The key factor is that the receipts must be clear, legible, and contain all required information, such as the date, amount, and details of the transaction. You can submit a digital copy of the receipt as long as it meets these requirements.

For digital receipts, ensure that the file is intact and has not been altered. Scanned or photographed versions are acceptable, as long as they are of good quality and show all necessary details. The CRA allows for submissions via email or through online platforms, which is a convenient option for keeping records organized.

Paper receipts must be kept in their original form unless you have scanned or photographed them. In that case, the digital copy will serve as the official record, but it is recommended to retain the paper receipt in case it is needed for verification or auditing purposes.

In short, both formats are valid as long as they meet the CRA’s criteria for accuracy and legibility. Choose the method that works best for your record-keeping system, but ensure you can easily access your receipts if requested by the CRA.

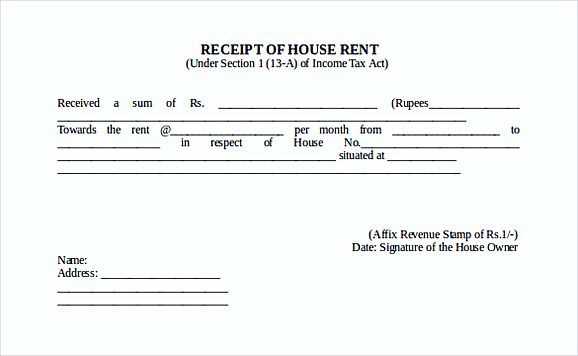

Rent Receipt for Income Tax Purposes

A rent receipt for tax purposes must include specific information to meet the Canada Revenue Agency (CRA) requirements. Make sure the document contains the following key details:

1. Landlord and Tenant Information

Include the landlord’s full name and address, as well as the tenant’s name. Clearly state the rental property address, ensuring it’s accurate.

2. Payment Details

List the rental payment amounts, including the period covered by the payment (e.g., monthly, quarterly). It’s important to mention the total amount paid and the specific date(s) for which the rent was paid.

3. Signature of the Landlord

The rent receipt must be signed by the landlord or authorized agent, confirming that the payment has been received. This adds a layer of authenticity to the document.

4. Additional Information

If applicable, include information about the type of rental (e.g., residential or commercial) and any special conditions or agreements. For tax purposes, clarity is key.

5. Format and Delivery

It’s recommended to provide a printed version of the receipt. While digital formats may be accepted, ensure the document is legible and includes all required information.