Creating a lien payment receipt ensures clear documentation of any financial transaction related to liens. This template helps both parties involved keep track of payments, showing proof of a debt’s partial or full satisfaction. A receipt, well-crafted and detailed, eliminates any ambiguity in the payment process.

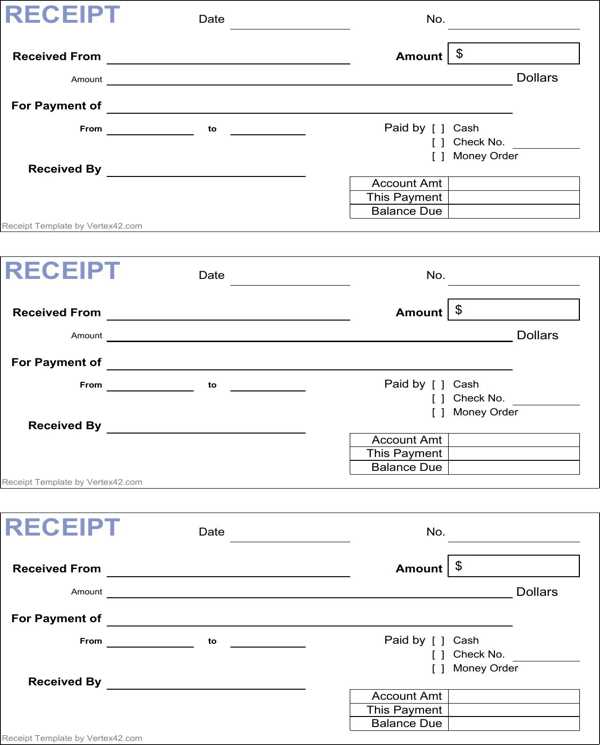

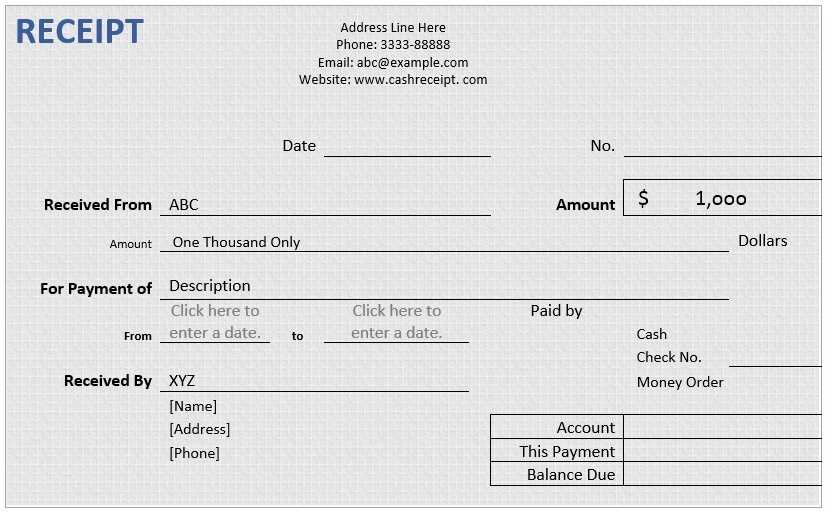

Include the payee’s and payer’s names, the payment amount, and the date of the transaction. Also, be sure to list the outstanding balance if applicable. Having these details ensures that the payment can be tracked with accuracy in case of any future disputes.

Make sure the receipt is signed by both the payer and payee for legal validation. A brief description of the lien or debt being settled further clarifies the context. With all these elements in place, the template serves as a solid reference for both parties moving forward.

Lien Payment Receipt Template Guide

To create a lien payment receipt, begin with including the payer’s details such as their full name, address, and contact information. These should be placed at the top of the document, clearly identifying the individual making the payment.

Next, provide a unique receipt number for record-keeping purposes. This helps both parties track the transaction easily. Follow this by the date of payment, which should reflect the exact day the payment was received.

The receipt should then outline the amount received, using both numerical and written forms to eliminate any confusion. Be clear about whether the payment is partial or full. If applicable, mention the remaining balance if it’s a partial payment.

Indicate the method of payment (e.g., cash, check, bank transfer) and include any relevant transaction numbers or check details. This ensures there is a clear record of how the payment was made.

For clarity, add a section detailing what the payment is for, such as specific liens or obligations being settled. This provides transparency for both the payer and the lienholder, confirming that the payment is being applied appropriately.

Finally, include a signature line for both the lienholder and the payer. This will serve as proof that both parties agree to the terms outlined in the receipt.

Understanding the Purpose of a Lien Payment Receipt

A lien payment receipt confirms the satisfaction of a lien debt and serves as a formal record of payment. It signifies that the debtor has fulfilled their obligation, releasing any claims the creditor had on the property. This document provides a clear and verifiable trail of the transaction, which can be essential for both parties involved.

What the Receipt Represents

This receipt is a legal acknowledgment that the lienholder has accepted payment and no longer has a financial claim over the property. For the debtor, it provides proof that the lien has been settled, protecting them from future disputes. For the creditor, it serves as an official record that their debt has been cleared, ensuring their right to pursue further action is no longer in effect.

Why a Receipt Matters

Without a payment receipt, a debtor may face difficulty proving that a lien has been resolved, potentially leading to future legal issues. The receipt also helps maintain transparency in any future property transactions, as it proves that no further liens exist against the property. Both parties benefit from this clarity and reassurance in their dealings.

Key Elements to Include in a Receipt

Clearly display the name of the payee or business at the top. This should include a physical or email address and contact information to ensure easy communication if needed. Include the date the payment was made, as this serves as a reference point for both parties.

Payment Details

Specify the amount paid, along with the currency. Include a breakdown of the payment, such as the total amount, any taxes, or fees if applicable. It’s also helpful to add a unique transaction number or invoice reference for easier tracking.

Payment Method

Indicate the payment method used, whether it’s credit card, bank transfer, check, or another form. This provides clarity and confirms how the transaction was processed.

Step-by-Step Process to Create a Template

To create an accurate lien payment receipt template, follow these steps:

1. Start with the Title: Label the document clearly. Use a simple title like “Lien Payment Receipt” at the top of the template to indicate its purpose.

2. Add Contact Information: Include sections for both the payer and payee’s names, addresses, and contact details. This ensures clarity in case of disputes or verification needs.

3. Specify the Date: Clearly state the date of payment. Include a field for the exact date the payment is made or processed.

4. Payment Details: List the amount paid and any reference numbers tied to the payment, such as invoice or account numbers. This section should also have a brief description of the payment, including the lien it relates to.

5. Payment Method: Provide a dropdown or field for specifying the payment method (e.g., check, bank transfer, cash). This adds transparency to the transaction.

6. Signature Area: Add space for signatures from both parties. Include lines for the payer’s and payee’s signatures, with dates if necessary. A digital signature option can be included if needed.

7. Legal Language: Include a brief disclaimer or statement to affirm that the payment fully satisfies the lien or that it’s a partial payment towards a larger lien, depending on the situation.

8. Layout and Design: Ensure the template is organized and easy to fill out. Use a clean layout with clear sections separated by lines or borders for clarity.

Here’s a sample template structure in table format:

| Section | Details |

|---|---|

| Title | Lien Payment Receipt |

| Payer Information | Name, Address, Contact Information |

| Payee Information | Name, Address, Contact Information |

| Date | Payment Date |

| Payment Amount | Amount Paid |

| Reference Number | Invoice/Account Number |

| Payment Method | Cash, Check, Bank Transfer, etc. |

| Signature | Payer’s and Payee’s Signatures |

Common Mistakes to Avoid When Issuing Receipts

Always ensure that the receipt includes all necessary details, such as the correct date, transaction amount, and clear item descriptions. Missing or incorrect information can lead to confusion or disputes later.

1. Incorrect or Missing Date

Failing to include the correct date or leaving it out entirely can cause problems, especially in legal matters or when tracking payments. Double-check the date and time of the transaction before issuing the receipt.

2. Lack of a Unique Receipt Number

Receipts should have a unique number for easy tracking. Not using a sequential or reference number can make it harder to locate a transaction if you need to verify or follow up on it.

- Always use a numbering system to organize receipts.

- Ensure the numbers are sequential to avoid confusion.

3. Vague Item Descriptions

Be specific when listing the items or services provided. Vague descriptions like “miscellaneous” or “various goods” can lead to misunderstandings about what was purchased. Provide clear, detailed descriptions for each item.

4. Failing to Include Payment Method

Not specifying the payment method–whether it’s cash, credit card, or bank transfer–can lead to ambiguity. Always include this detail for both your records and the customer’s reference.

- Note whether the payment was made in full or partially.

- Provide any transaction ID numbers for credit card or online payments.

5. Overlooking Tax Information

Including the correct tax rate and amount is necessary to comply with tax regulations. Failing to do so can cause legal complications and dissatisfaction from customers. Always ensure tax amounts are clearly displayed.

6. Inaccurate Contact Information

Incorrect or incomplete contact details can make it difficult for customers to follow up if they need clarification or issue a refund request. Always check your business contact information before printing or sending a receipt.

7. Issuing Receipts After Payment Has Been Refunded

If a refund is processed, issue a new receipt indicating the refunded amount and any adjustments made. Issuing a receipt for a transaction that was later refunded without updating the details could lead to confusion in financial records.

8. Using Unclear Formatting

Receipts should be easy to read. Avoid using excessive fonts or layouts that make the document hard to understand. Stick to a clean, straightforward format with clearly separated sections for payment details, items, and totals.

Legal Requirements for Lien Payment Receipts

Make sure the lien payment receipt includes key details to avoid future disputes. Include the full name and address of the lienholder and the debtor. Clearly state the amount paid, the date of payment, and the method used. Specify the lien or claim being settled, including any reference numbers or legal descriptions related to the property or agreement.

Ensure the receipt indicates the full satisfaction of the lien, meaning no further claims are being made on the debt. If applicable, include any release of lien or discharge language, confirming the removal of the lien from public records. The receipt should be signed by the lienholder or their authorized representative to validate the transaction.

Depending on jurisdiction, some areas require the payment receipt to be notarized. Check local regulations to confirm if notarization is necessary. Also, provide the debtor with a copy of the receipt for their records and file it properly in case future verification is needed.

How to Customize the Template for Different Situations

Tailor your lien payment receipt template by adjusting the details based on the nature of the transaction. For example, if the payment is partial, clearly note the amount paid and the remaining balance. Ensure that both amounts are highlighted for clarity.

- For different payment methods, include specific fields for details like check number, transaction ID, or payment platform used.

- If the payment is for a specific lien type, modify the header to specify whether it’s for a tax lien, mortgage lien, or other type.

- In cases where additional documentation is provided, leave space for attachments or references to supporting documents.

Adjust the template’s date format and currency symbol to match local standards. If your receipt needs to be sent in multiple languages, create a version with customizable language options.

- For legal purposes, include a section that mentions any applicable laws or terms related to the lien.

- If the receipt needs to be signed, add a signature line or digital signature option for a more formal process.

Finally, regularly update the template to reflect any changes in local regulations or organizational standards. Make sure to review all legal requirements before finalizing the document.