Creating a receipt template that fits your business needs is straightforward. First, ensure it includes the key components: business name, address, and contact information at the top. This provides the customer with all the necessary details about your company in case they need to reach you later.

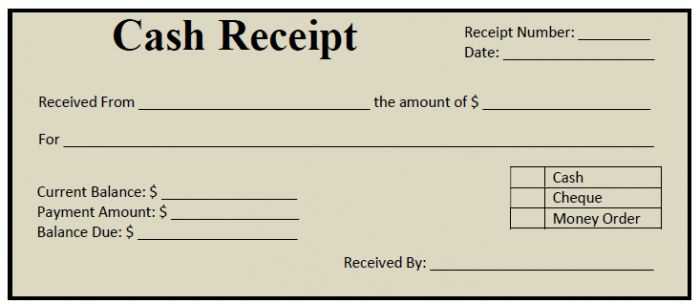

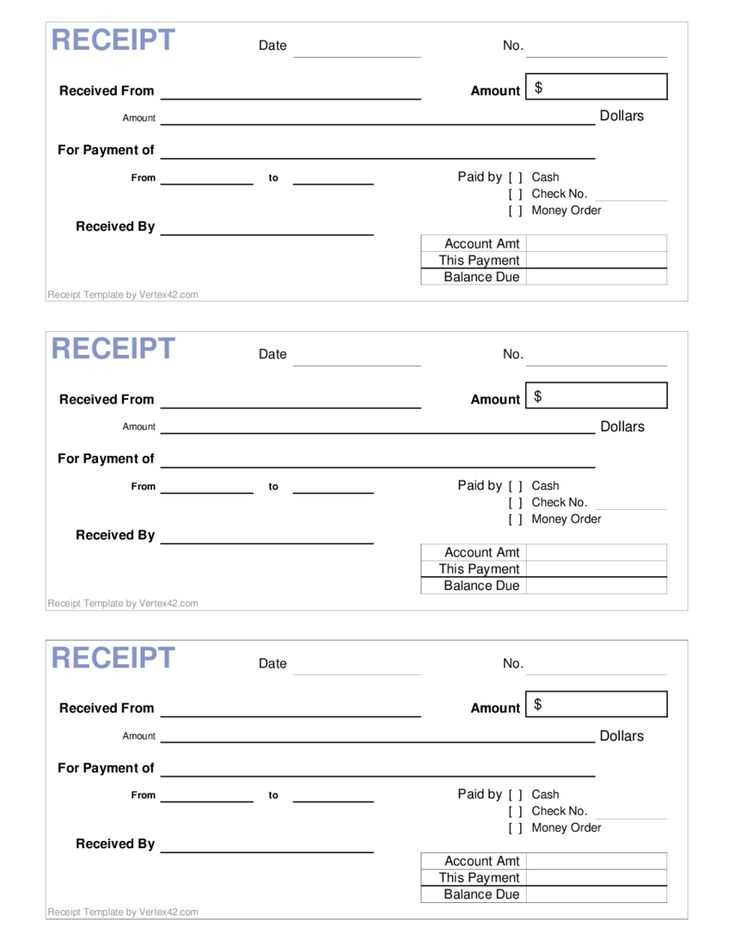

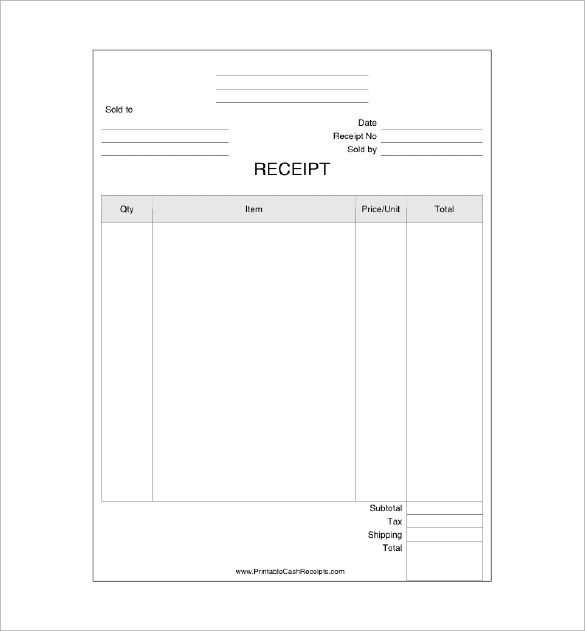

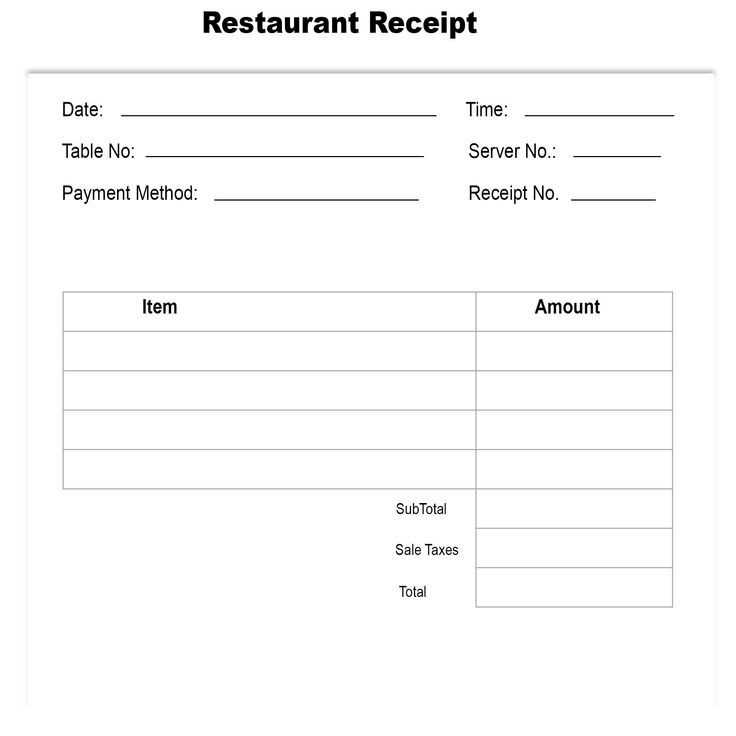

List the transaction details clearly. Include the items or services purchased, their prices, any applicable taxes, and the total amount. Be sure to format this in an easy-to-read table to avoid confusion. A receipt should also have space for the payment method, whether it’s credit, debit, or cash, to provide transparency for both parties.

For the best clarity, add a unique receipt number for tracking purposes. This will help you manage your transactions and refer back to any issues if they arise. Also, remember to include the date and time of the purchase–this is crucial for both legal and organizational purposes.

Finally, leave a small section for customer notes or a thank-you message. This adds a personal touch to your receipt and encourages repeat business. A well-structured receipt template not only keeps things professional but also builds trust with your customers.

Here’s the improved version:

For a clean and user-friendly receipt template, start by clearly labeling the business name and contact details at the top. Keep the font simple, using a legible size for quick reading. Include the transaction date, receipt number, and payment method to ensure clear identification.

Transaction Breakdown

List the purchased items with their descriptions, quantities, and prices. This keeps things transparent for both the customer and the business. Apply taxes or discounts in separate lines to avoid confusion.

Footer Information

Wrap up with a brief thank-you message and any return or warranty policies. Make sure the footer also includes the total amount, including taxes, to give a complete financial summary.

- Receipt Template Guide

For a clear and functional receipt template, start by including the basics: the date of purchase, transaction number, business name, and customer details. These are crucial for organizing transactions. Make sure to list the purchased items along with their quantities and prices. This helps ensure transparency and minimizes errors during future reference.

Key Elements to Include

Besides the standard details, include a breakdown of taxes and any discounts applied. It’s also helpful to provide payment methods (e.g., cash, card, or online) to track how the transaction was completed. This adds an extra layer of clarity for both parties.

Formatting Tips

Ensure the font size is readable and that there is enough space between sections for easy reference. A clean layout with bold headings will enhance the readability of the receipt. You can also offer a digital version of the receipt for convenience, providing a copy via email or through a QR code for access on mobile devices.

Design your custom receipt template by focusing on your brand’s identity and the specific information you need to include. First, choose a layout that suits your business’s style, keeping the document clean and easy to read. For instance, place your business logo at the top for brand visibility and select a color scheme that reflects your branding.

Step 1: Include Necessary Information

Ensure your receipt template contains all the required fields such as the date, itemized list of purchased products or services, prices, taxes, and total amount due. Don’t forget to include contact details like your business address, phone number, and website, as well as any relevant terms and conditions.

Step 2: Personalize the Template

Customize the template by adding your business’s unique touch. You can incorporate custom fonts or include promotional messages or discounts to make your receipts more engaging. Ensure the font is readable and the layout is well-organized for easy scanning by customers and accounting systems.

Tip: If your business offers multiple services or products, consider categorizing items for clarity. This helps both customers and staff to navigate the receipt with ease.

Lastly, test the template across different devices and printers to ensure consistency in its appearance. Make adjustments as necessary to guarantee a professional presentation every time.

Focus on including details that provide clarity and avoid overwhelming the recipient. Each receipt should include the following core elements:

- Vendor Name and Contact Information: Include the full name, address, and contact details (phone number or email) of the business. This ensures the recipient knows where the transaction originated.

- Transaction Date: Clearly state the date and time of the transaction. This helps track purchases and provides a reference for returns or warranties.

- Receipt Number: Assign a unique identifier to every receipt for easier tracking and reference in case of disputes or inquiries.

- Itemized List of Purchases: List each item or service with its description and individual price. This ensures transparency and helps the customer understand what they are being charged for.

- Total Amount: Show the total amount paid, including any taxes or additional charges. This avoids confusion and provides a clear breakdown of the cost.

- Payment Method: Specify how the payment was made, whether by cash, credit card, or digital payment method. This provides proof of transaction method.

Examine your business’s needs and select any additional details relevant to your transactions, such as refund policies or loyalty program information. Keep it straightforward, focusing only on necessary information for accuracy and convenience.

Choose a Clear Font: Use simple, legible fonts like Arial or Helvetica. Avoid overly decorative fonts that can make reading difficult. Ensure font size is large enough for easy readability, especially for older customers.

Maintain a Consistent Layout: Align text in a way that guides the reader’s eyes naturally. Group similar information together, such as contact details and payment methods. Consistency makes the document intuitive.

Use Ample White Space: Avoid overcrowding the template with too much information in one place. White space helps separate sections and makes the receipt less overwhelming to read. Aim for balance between content and empty space.

Highlight Key Information: Bold important sections like totals, payment methods, and dates. This helps users quickly locate crucial details without having to scan the entire receipt.

Organize with Clear Headings: Use clear headings and subheadings to divide sections. For instance, group taxes, discounts, and item descriptions under specific titles. This structure improves readability.

Be Mindful of Color Contrast: Choose colors that provide good contrast between text and background. Dark text on a light background is most readable. Avoid using too many colors that can distract the reader.

Incorporate a Logical Flow: Ensure the receipt flows in a logical order–from item details, to pricing, to the total. This approach minimizes confusion and guides the reader’s eye smoothly across the template.

Provide Clear Totals: Make sure the total amount stands out on the receipt. Use a larger font size, bold text, or a different color to highlight this crucial piece of information.

How to Add Tax Calculations and Discounts to Your Receipt

To include tax calculations and discounts on your receipt, follow these simple steps:

Tax Calculation

First, determine the tax rate for the transaction. Multiply the total price by the applicable tax percentage. For example, if the total amount is $100 and the tax rate is 8%, the tax amount will be $8.

- Tax Amount = Total Price × Tax Rate

- Tax Amount = $100 × 0.08 = $8

Display the tax amount separately under a “Tax” label to ensure clarity. You can also show the pre-tax total to highlight the tax contribution to the final amount.

Applying Discounts

To apply a discount, first calculate the discount amount based on the total or specific items. For example, a 10% discount on a $100 total would be $10. Subtract the discount from the total before calculating the tax, if applicable.

- Discount Amount = Total Price × Discount Percentage

- Discount Amount = $100 × 0.10 = $10

Subtract the discount from the subtotal before applying the tax. In this case, the new subtotal after the discount would be $90, and the tax would then be calculated on the reduced amount.

Always show the discount clearly, with a label such as “Discount” and the discount value, so the customer understands the breakdown of their total.

For a more personalized receipt, tailor the template to reflect the specific payment method used. For credit card payments, include the card type (e.g., Visa, MasterCard) and the last four digits of the card number. For cash transactions, note the total amount received and any change given. This helps customers quickly identify the method and verify the payment details.

When handling digital payments, like PayPal or bank transfers, display the transaction reference number and date of the transfer. This ensures transparency and provides an easy way for customers to track payments. For mobile payments, include the payment provider (e.g., Apple Pay, Google Pay) to keep things clear.

If the payment method involves installments or subscriptions, include the payment schedule and due dates. This is especially useful for long-term services or products, ensuring customers are aware of the next payment cycle.

Lastly, adapt the layout to reflect the payment method. For instance, credit card receipts often include a payment authorization code, while cash payments may simply display the total amount in a large, prominent font. These small customizations help maintain clarity and improve the customer experience.

For creating and managing receipt templates, several software tools stand out for their user-friendly interfaces and robust features. Here are some of the best options available:

1. Microsoft Word

Microsoft Word offers pre-designed templates for various documents, including receipts. You can easily customize the layout and design by adjusting the styles and formatting options. Word’s broad compatibility with different file formats makes it a great choice for creating professional-looking templates.

2. Google Docs

Google Docs provides a free, cloud-based platform that allows you to create and edit templates anywhere. The receipt template feature can be customized to your specific needs, and since it’s cloud-based, you can easily share it with others for collaboration or feedback.

3. Canva

Canva is a web-based tool that simplifies graphic design. It offers various templates, including receipt templates, which can be easily modified with drag-and-drop functionality. Its versatility in design and easy-to-use interface makes it an excellent option for creating visually appealing receipt templates.

4. Adobe InDesign

If you require more complex and professional templates, Adobe InDesign provides advanced layout and design features. It allows for precise control over typography, colors, and structure, making it ideal for businesses needing high-quality receipt templates.

5. Template.net

Template.net offers an extensive library of pre-made templates, including receipt templates. You can access templates for different industries, customize them online, and download the final version in various formats. It’s a straightforward tool for quickly generating professional documents.

6. Zoho Invoice

Zoho Invoice is specifically designed for invoicing but also offers customizable receipt templates. It allows you to create and manage receipts easily, with the added benefit of integrating them into your invoicing system for streamlined operations.

7. QuickBooks

QuickBooks is popular for accounting and invoicing, and it includes customizable receipt templates. It ensures that all receipts are compliant with financial regulations and can be easily tracked and managed within the system.

| Tool | Key Features | Best For |

|---|---|---|

| Microsoft Word | Pre-designed templates, custom formatting options | General use, easy customization |

| Google Docs | Cloud-based, collaboration options | Collaborative work, remote access |

| Canva | Graphic design features, drag-and-drop interface | Visually appealing templates |

| Adobe InDesign | Advanced design tools, precise control | High-quality professional templates |

| Template.net | Pre-made templates, easy online editing | Quick creation of documents |

| Zoho Invoice | Customizable receipt templates, invoicing integration | Business use, invoicing and receipts |

| QuickBooks | Financial tracking, customizable receipt templates | Business and accounting |

These tools cater to a range of needs, from simple receipt creation to full business invoicing and financial management. Choose the one that fits your specific requirements to streamline your template creation process.

Ensure your receipt template is easy to read and organized. Begin with a clear header, containing your business name, logo, and contact details. Then, list the transaction date and receipt number for better reference. It’s crucial to include an itemized list with descriptions, quantities, and individual prices. This will help the customer understand the breakdown of their purchase.

Clear Layout

Use a simple font and layout. This makes the receipt more accessible and ensures key details stand out. Avoid clutter and unnecessary elements that could distract from the main information, like total amount due or payment method.

Tax and Discounts

Clearly show any taxes, discounts, or promotions applied. This transparency builds trust and ensures your customers can easily verify charges. Include the tax rate and total amount, as well as any discounts with descriptions.