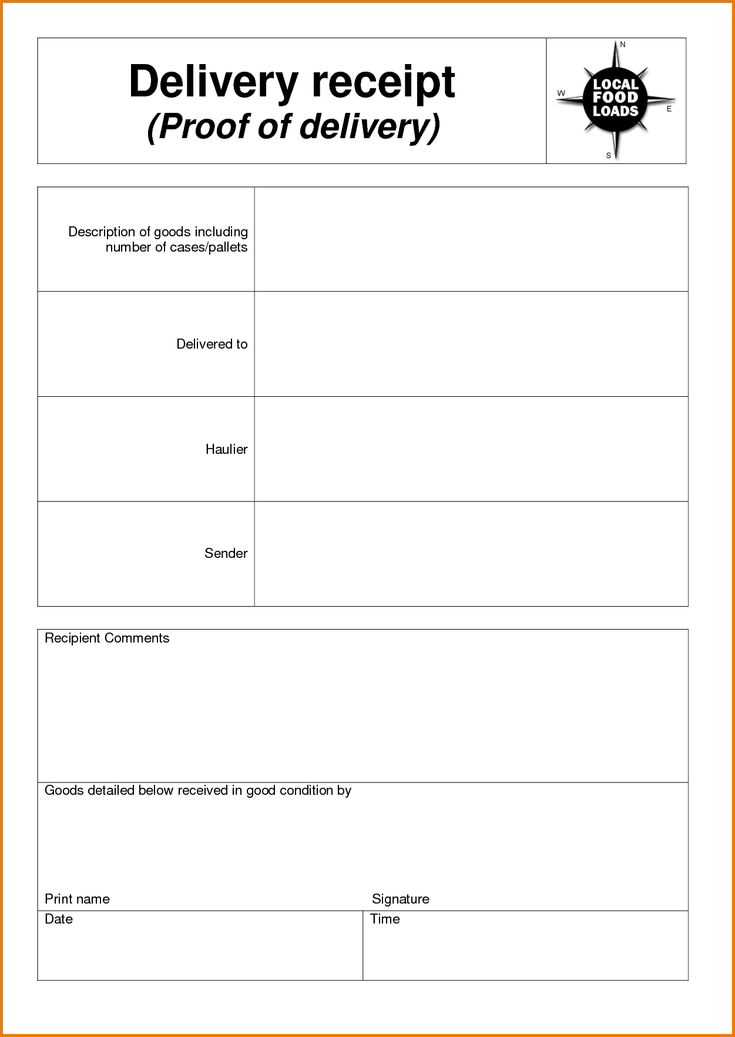

To streamline documentation processes, creating a proof of receipt template is an excellent way to ensure accurate record-keeping. This template should include the key elements: recipient’s name, the date of receipt, description of the received item, and the signature of the person receiving it. A clear format reduces confusion and provides a solid reference for both the sender and receiver.

Start by listing the date and time when the item was received. Make sure to specify the item details concisely–whether it’s a document, package, or payment. Ensure the receiver acknowledges the transaction with their signature or initials. Including the sender’s contact information also adds clarity and makes it easy to follow up if needed.

It’s a good idea to add a note field for any additional remarks or conditions. This helps in tracking specific circumstances or issues that might arise later. If applicable, consider including a tracking number or any identification code that links the receipt to a specific transaction or shipment.

With a well-structured proof of receipt template, both parties can be confident in the details of the exchange, reducing the chances of disputes and improving transparency in record management.

Here’s the version with minimized repetitions:

To streamline the process of proof of receipt, reduce unnecessary wording while retaining clarity. Stick to clear, concise phrasing to ensure the message is easily understood. Eliminate redundancies and avoid restating the same information multiple times.

Key Points to Include:

- Confirmation of receipt with the exact date and time.

- Clear identification of the item or service being acknowledged.

- A statement confirming the recipient’s full understanding of what was received.

- Any necessary follow-up actions or next steps, if applicable.

Example Template:

- Subject: Proof of Receipt – [Item/Service Name]

- Dear [Name],

- We hereby confirm receipt of [Item/Service] on [Date].

- The item is in good condition, and we acknowledge the contents as outlined in the accompanying documents.

- If any follow-up actions are required, they will be completed by [Date].

- Thank you for your attention to this matter.

- Sincerely,

- [Your Name]

- Proof of Receipt Template Guide

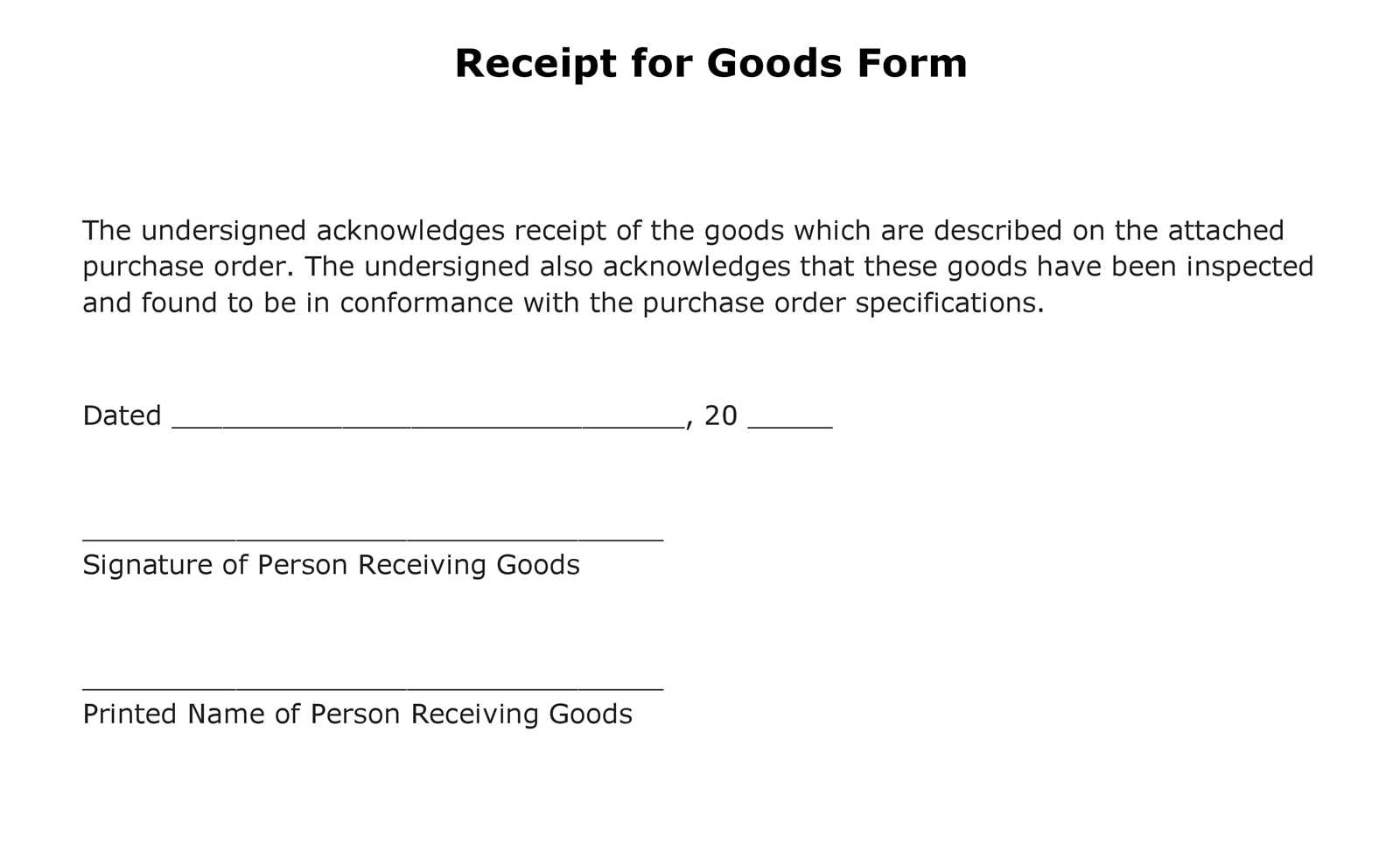

A Proof of Receipt Template is a simple but important tool to confirm that a party has received a document or item. This document is commonly used in various transactions, whether for goods, services, or legal paperwork. Make sure your template includes all necessary information for clarity and accuracy.

Key Elements of a Proof of Receipt Template

The essential components to include are:

- Date – Specify the exact date of receipt.

- Sender’s Information – Name, address, and contact details of the sender.

- Recipient’s Information – Name, address, and contact details of the person or organization receiving the item.

- Details of the Item or Document – Provide a brief description of the item or document, including any relevant serial numbers or references.

- Signature – Space for both the sender and recipient’s signatures, confirming the transaction.

- Additional Notes – Include a section for any comments or special instructions related to the receipt.

How to Use the Template

Once the template is complete, both parties should review and sign it. The signed document serves as proof that the recipient has received the item or document as outlined. Keep a copy for your records and provide the original to the recipient. This step helps avoid disputes or confusion later on.

By following these simple steps, you can create a reliable Proof of Receipt template that keeps transactions clear and documented.

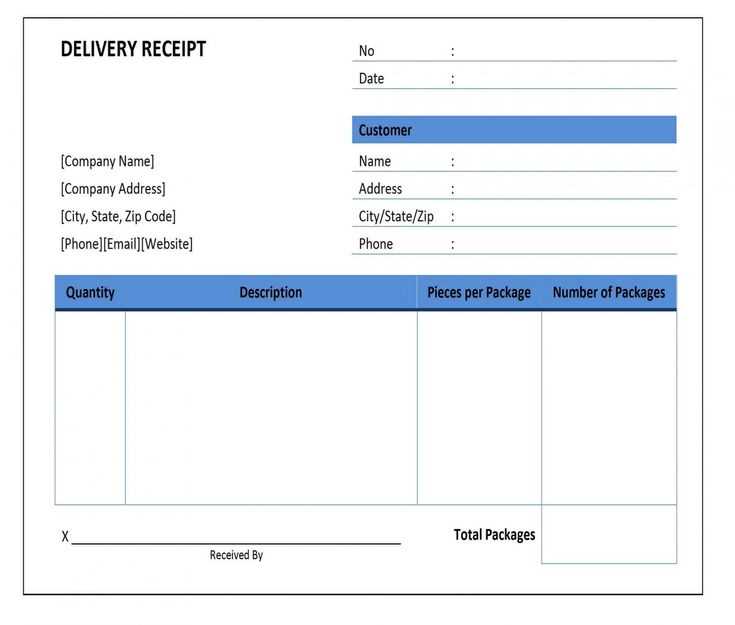

To create a basic receipt template, focus on clear structure and essential details. Begin with the business name and contact information at the top. This includes the company name, address, phone number, and email address. Place this information in the header section for easy identification.

Next, include a receipt number. This helps in tracking the transaction. Position it under the business details and label it as “Receipt No.” or simply “Invoice Number.”

Provide the date of the transaction. It’s helpful to place the date near the receipt number, formatted clearly as “Date” or “Transaction Date.”

List the items or services purchased. For each item, provide a description, quantity, price, and total. Use a table format to keep the information aligned for readability. Label the columns as “Item Description,” “Quantity,” “Unit Price,” and “Total.”

Include the subtotal of the transaction. This value represents the sum of all item totals before taxes or discounts. Label it as “Subtotal.”

If applicable, add tax information. Include the tax rate and amount separately, with a clear label like “Sales Tax” or “VAT.” Position it below the subtotal and above the total amount.

Finally, provide the total amount due, clearly marked as “Total.” This is the final amount the customer must pay. You may also want to include payment methods or transaction ID at the bottom for reference.

With these sections in place, your receipt template will be simple yet functional, providing all the necessary information for both parties to keep track of the transaction.

Key Elements to Include in a Receipt

A receipt should clearly communicate the transaction details. Focus on the following key elements:

1. Transaction Date and Time

Always include the exact date and time of the transaction. This helps track purchases, returns, and exchanges. It is especially important for warranties and tax purposes.

2. Merchant Information

Include the merchant’s name, address, and contact details. If applicable, a website URL and business registration number should also be listed. This allows customers to reach out if needed.

3. Itemized List of Products/Services

Each product or service should be listed separately along with the price. Provide quantities, unit prices, and any discounts applied. This transparency helps clarify the cost breakdown.

4. Total Amount Paid

State the total amount the customer paid, including taxes, shipping, or any additional charges. Ensure this total is easily visible to avoid confusion.

5. Payment Method

Specify how the payment was made, such as credit card, cash, or other methods. This verifies the transaction for both parties and assists in tracking payments.

6. Receipt Number

Assign a unique receipt number for each transaction. This serves as a reference for both the customer and merchant, aiding in future inquiries or disputes.

7. Tax Information

Break down the taxes applied (e.g., sales tax, VAT) and provide the applicable tax rate. This is particularly important for business accounting and reporting.

8. Return and Exchange Policy

If relevant, include your store’s return and exchange policy. This ensures that customers know their rights regarding refunds or exchanges.

| Element | Example |

|---|---|

| Transaction Date and Time | Feb 5, 2025, 2:30 PM |

| Merchant Information | Store Name, 123 Main St, Contact: (555) 123-4567 |

| Itemized List | Product A – $10.00, Product B – $15.00 |

| Total Amount | $25.00 |

| Payment Method | Credit Card (Visa) |

| Receipt Number | 00012345 |

| Tax Information | Sales Tax: 5% ($1.25) |

| Return Policy | Returns accepted within 30 days with receipt. |

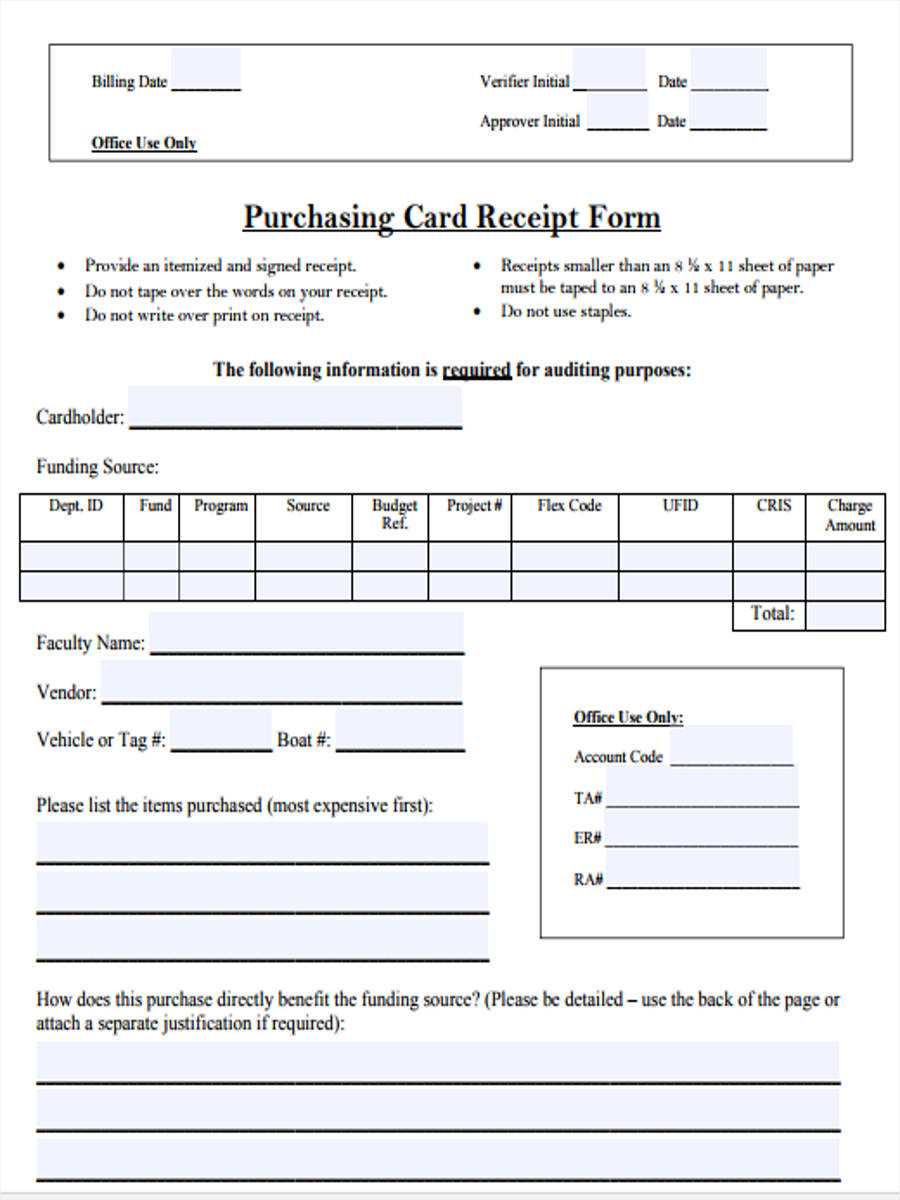

To tailor a proof of receipt for specific transactions, begin by incorporating details that reflect the nature of the transaction. For example, when dealing with product deliveries, include the item description, quantity, and delivery address. For service transactions, ensure to note the service rendered, date, and any relevant timelines.

Adjust the structure based on the type of transaction. For instance, a proof for a financial transaction should emphasize transaction amounts, payment methods, and reference numbers. In contrast, proof for contractual agreements should include specific terms agreed upon, such as the duration or scope of work.

- For product-related transactions, provide fields for product SKU, quantity, price per unit, and total cost.

- For service agreements, outline service dates, location, and specific deliverables or milestones.

- For financial receipts, include payment methods (credit card, bank transfer), transaction ID, and any applicable taxes.

When customizing, ensure all key transaction-specific elements are easily identifiable, especially for situations requiring legal or financial verification. A concise summary of the transaction with precise timestamps and signatures can help enhance clarity and reliability in proof of receipt.

Lastly, consider including customizable sections for additional notes. This can be particularly useful in transactions where terms might vary or for clarifications. Keeping flexibility within the proof template allows for adjustments based on unique transaction details without overcrowding the document.

Before using any template for proof of receipt, ensure you have the proper authorization for its use. Templates often contain proprietary elements, and using them without consent could lead to legal disputes. Always check whether the template you plan to use is copyrighted or subject to any licensing agreements. This is particularly important if the template is from a third-party provider.

Intellectual Property Rights

Intellectual property laws protect templates in many cases, especially if they are customized or designed for specific purposes. Using a template without securing the right to do so can infringe on copyrights. It’s important to read the terms of service or licensing agreements before using any template, even those available for free. If in doubt, seek legal advice to clarify any potential intellectual property concerns.

Customization and Liability

Templates often need customization to fit your specific needs. While customization is generally permitted, ensure the modifications do not violate any laws or create unintended liabilities. For example, altering a template to misrepresent information could expose you to legal action, especially if the document is used in a business or legal context. Always ensure the final version of the template accurately reflects the information intended and complies with applicable regulations.

Double-check the recipient’s information before finalizing the document. Cross-reference the name, address, and any contact details to avoid discrepancies. Use templates with pre-filled fields to minimize errors.

Review and Cross-verify Information

Ensure all details in the document match the original source. Verify figures, dates, and other key elements, comparing them against the supporting documents. Any inconsistencies can lead to confusion or misinterpretation.

Maintain Clear Formatting

Use consistent formatting throughout the document. Ensure headings, bullet points, and other structure elements are uniformly applied. This makes the document easy to follow and prevents errors due to misinterpretation of layout or sections.

Distribute receipts in a format that suits your audience’s preferences–email is often the most convenient for digital records, while paper is still necessary for certain situations. For digital receipts, ensure the file is in a commonly used format like PDF, making it easily accessible and viewable across devices.

Always include relevant transaction details such as the date, amount, vendor, and a brief description of the purchase. This makes receipts easier to store and retrieve for future reference.

For paper receipts, consider scanning them and storing digital copies. This helps reduce clutter and minimizes the risk of losing important information over time. Organize digital receipts into clearly labeled folders, and back them up regularly to a cloud service for extra security.

If you use a receipt management system, make sure it integrates well with other tools you use for tracking expenses or inventory. This streamlines the process and improves accessibility when needed.

When storing receipts, both paper and digital, ensure they are organized by category or date. This simple method allows for quick retrieval, especially when tax season arrives or when you need to reference past purchases.

Always close the unordered list with the tag to ensure proper HTML structure. Without it, browsers may not interpret your list correctly, leading to potential display issues. This tag signifies the end of your list, allowing for the correct formatting of your items and the rest of the page’s layout.

If you’re using nested lists, make sure each sublist also ends with its own tag. This ensures that each list is properly closed, preventing confusion or errors in rendering. Consistent use of closing tags contributes to cleaner, more maintainable code.

It’s easy to overlook small syntax details like this, but it’s worth checking before finalizing your page. Missing closing tags can cause unexpected results, especially when combined with other elements on the page.