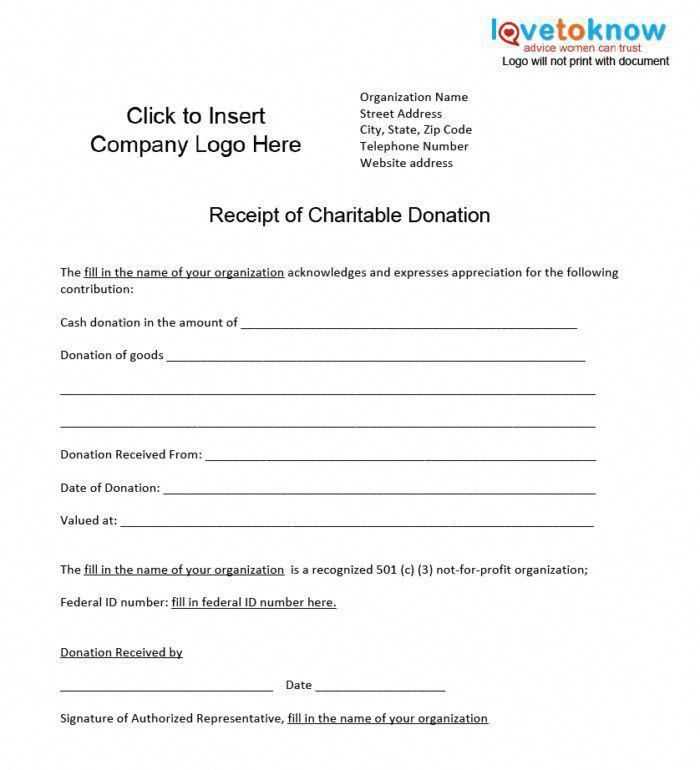

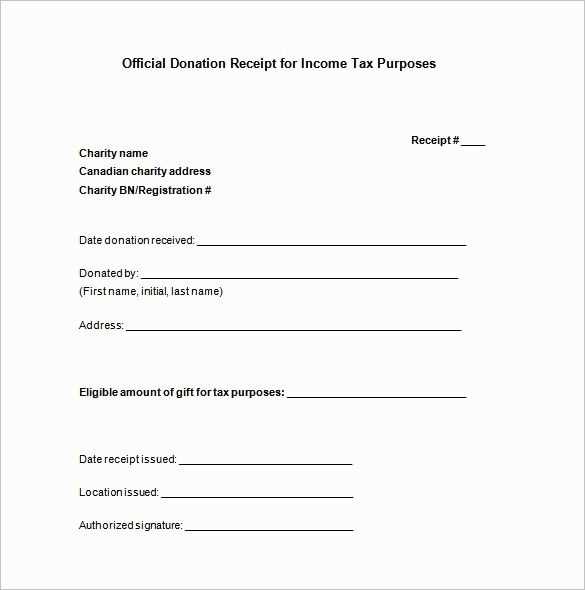

If you’re looking for a simple, clear template to acknowledge donations, this free donation receipt letter template is exactly what you need. A donation receipt is vital for both the donor and the receiving organization, as it serves as proof of the transaction for tax purposes. Keep it straightforward, professional, and concise, while ensuring all necessary details are included.

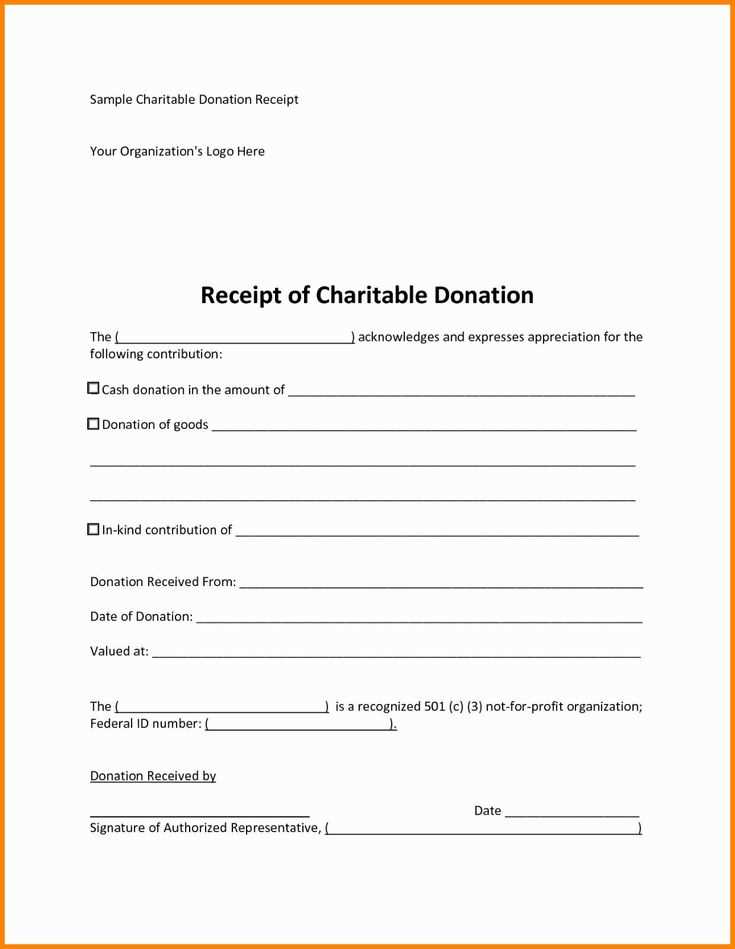

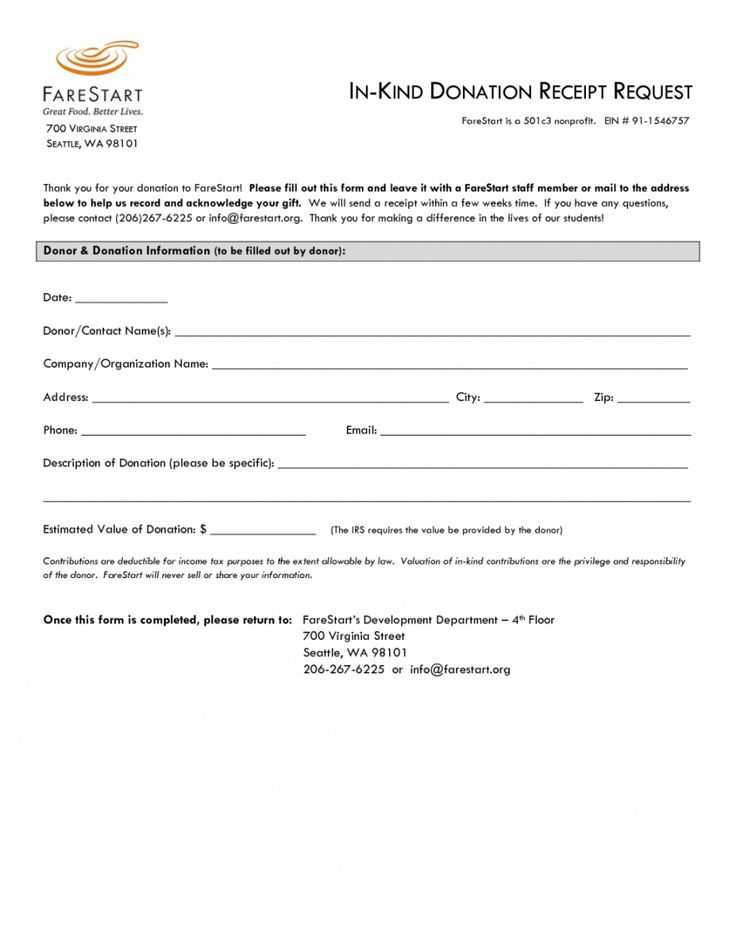

The template should include the name of the donor, the amount or value of the donation, and a description of the items donated. Be sure to specify the date the donation was made and whether the contribution was monetary or non-monetary. If applicable, also mention whether any goods or services were provided in exchange for the donation, as this affects the donor’s tax deductions.

Using this template saves time, while providing a polished and legal receipt for your donors. It’s simple to customize and ensures you stay compliant with the requirements for tax documentation. Personalize it with your organization’s name and contact information for a professional touch.

Here’s the revised version, minimizing repetition while keeping the original meaning:

When drafting a donation receipt letter, make sure to include key details: the donor’s name, the donation amount or description of items, and the date. This helps ensure clarity and legitimacy. Specify that the donation is tax-deductible if applicable, and include the charity’s name and contact information for reference.

Clearly state whether the donation was a one-time gift or recurring, and provide any necessary IRS information for donors who may require it for tax filing. Avoid unnecessary wording to keep the letter concise while addressing all essential points.

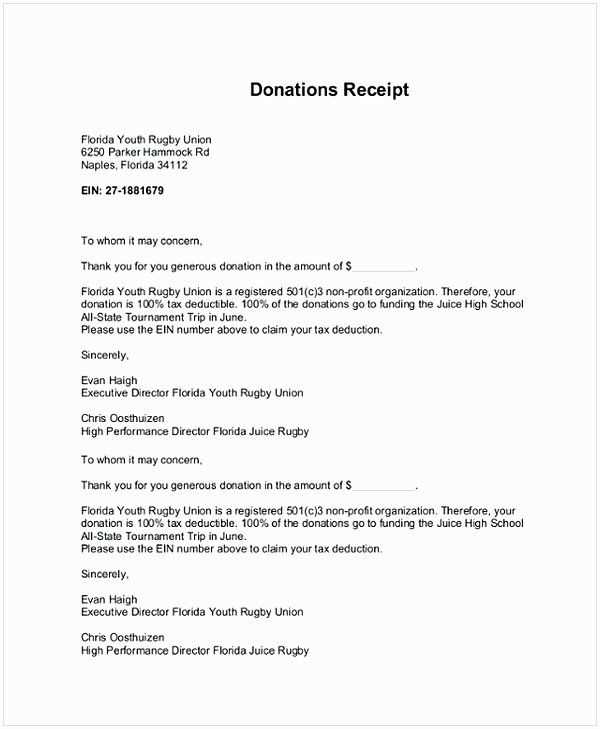

Finally, express gratitude for the donor’s support. A simple “thank you” goes a long way in maintaining a strong relationship for future donations.

- Free Donation Receipt Letter Template

Creating a donation receipt letter is simple and straightforward. Use this template to provide a clear acknowledgment of the donation for tax purposes. Make sure to include the donor’s name, date of donation, the donation amount, and any goods or services received in exchange for the donation.

Here’s a basic structure for your donation receipt letter:

[Your Organization Name] [Your Organization Address] [City, State, ZIP Code] [Phone Number] [Email Address] [Date] Dear [Donor’s Name], Thank you for your generous contribution to [Your Organization Name]. This letter serves as a receipt for your donation. Donation Details: - Date of Donation: [Date of Donation] - Donation Amount: [Dollar Amount] - Description of Goods/Services (if any received): [Details] No goods or services were provided in exchange for your donation, making it fully deductible. If you have any questions, feel free to contact us at [Phone Number] or [Email Address]. Thank you for your support! Sincerely, [Your Name] [Your Title] [Your Organization Name]

Make sure to adjust the template with the specific details of each donation. It’s best to send receipts promptly after receiving donations to help donors with their record-keeping. The IRS requires donations over $250 to be substantiated with a written acknowledgment like this one.

To ensure your donation receipt qualifies for tax deductions, include the following details in a clear and concise format:

- Organization’s Name and Address: Clearly state the name of the charity or nonprofit, including its full mailing address. This confirms that the receipt comes from a recognized organization.

- Donor’s Information: Include the donor’s name and address. If the donation is anonymous, the receipt can omit this, but be sure to keep it on file.

- Date of Donation: Specify the exact date the donation was made. This helps determine the tax year for which the deduction can be applied.

- Description of Donation: Provide a detailed description of the donated items or amount. If it’s a cash donation, note the amount. For non-cash donations, include the type of item, its condition, and if possible, an estimated value.

- Statement of No Goods or Services Provided: If the charity did not offer anything in exchange for the donation, include a statement to that effect. This is required for tax deduction eligibility.

- Signature of Authorized Representative: The receipt must be signed by a representative of the charity to verify authenticity.

Cash Donations

- If a donor gives cash or a check, record the exact amount. It’s crucial to specify that the donation was purely a monetary gift without any goods or services in return.

Non-Cash Donations

- For items like clothes, electronics, or furniture, list each donated item and its fair market value. An appraisal may be necessary for higher-value donations to ensure accurate reporting.

Key Elements to Include in a Donation Letter Template

A donation letter should contain specific details to ensure clarity and proper documentation. Start with these key elements:

- Donor’s Information: Clearly state the donor’s full name, address, and contact details. This ensures the donation is attributed correctly for tax purposes.

- Nonprofit’s Information: Include the name, address, and tax-exempt status of the organization receiving the donation. This confirms the legitimacy of the entity and ensures compliance with tax laws.

- Donation Amount: Specify the exact amount donated, whether it’s monetary or an in-kind gift. For non-monetary donations, provide a brief description of the donated item(s) and their value, if applicable.

- Purpose of the Donation: Mention how the donation will be used. Donors appreciate knowing their contribution makes an impact.

- Date of Donation: Include the date the donation was made to serve as a clear record for tax reporting.

- Thank You Message: Express gratitude to the donor for their support. A simple and sincere thank-you shows appreciation and strengthens donor relations.

- Tax Deduction Disclaimer: If applicable, include a statement explaining that the donation is tax-deductible and remind the donor to consult a tax advisor for further details.

Including these elements in your donation letter template ensures that both the donor and recipient have a clear understanding of the donation’s details and can easily refer to the information for tax and record-keeping purposes.

Begin by adjusting the receipt to reflect the type of donation made. For monetary donations, include the exact amount, the payment method (credit card, bank transfer, etc.), and the transaction date. If it’s an in-kind donation, provide a detailed description of the item(s) donated, including quantity, condition, and approximate value. Ensure you note whether a professional appraisal is required for higher-value items.

For recurring donations, clearly mention the frequency and the amount of each installment. Specify the start and end dates if applicable. This helps in tracking long-term contributions and ensures clarity for both the donor and your organization.

If the donor is eligible for tax deductions, include a statement about the non-profit status and a reminder that no goods or services were exchanged in return for the gift. This is critical for legal compliance. For donations involving special events, list the event details, ticket price, and the portion of the payment that is deductible if applicable.

Ensure that all receipts are personalized with the donor’s name, address, and contact information. This not only shows appreciation but also ensures accurate records for future communications or tax purposes. Keep receipts concise, but include all required details specific to the type of donation received.

Donation receipts must meet specific legal criteria to ensure validity for tax purposes. First, include the name of the organization receiving the donation, the donor’s name, and the amount or description of the donation. If the donation is non-cash, provide a description of the item without specifying its value. The IRS requires that the donor receives acknowledgment in writing, especially for donations over $250. This acknowledgment should state whether any goods or services were exchanged for the donation and provide a good-faith estimate of their value.

For non-profit organizations, it’s important to offer a clear and accurate statement on the receipt that confirms the donation is tax-deductible. If you receive more than one donation from the same donor, issue a single receipt for all contributions made in the year. Always ensure that the receipt complies with both federal and state regulations to avoid legal issues during audits.

To issue a receipt for international donors, ensure you comply with both local and international standards. Start by including the donor’s name, donation amount, and the date of the contribution. Clearly state the currency used in the transaction, as international donors may transfer funds in different currencies. If the donation was made online, include the transaction reference number or receipt ID to confirm the payment.

Currency and Conversion

For donations made in foreign currencies, provide a conversion rate or the equivalent amount in the donor’s currency at the time of the donation. This helps clarify the value of the contribution both for the donor’s personal records and for any potential tax filings in their home country. Make sure the conversion is accurate and clearly mentioned on the receipt.

Tax and Legal Considerations

Different countries have varying tax laws regarding donations. Be sure to inform international donors whether their donation qualifies for tax deductions in your country. Include a disclaimer stating that the receipt is for donation purposes only and does not guarantee tax deductibility unless otherwise specified by their local tax authority.

Ensure that donation receipts are sent as soon as possible after the donation is made. A quick response helps the donor track their contributions for tax purposes and strengthens their connection to the organization. Use clear language and include the necessary details such as the amount donated, the date, and the organization’s tax identification number.

Format and Clarity

Make sure the receipt is easy to read and professionally formatted. Include a clear breakdown of the donation amount, whether it was a monetary gift or an in-kind contribution. Avoid any jargon or overly technical terms. A donor should be able to look at the receipt and immediately know how much they contributed, and for which cause or campaign.

Storage and Recordkeeping

Store receipts securely in both physical and digital formats. For physical records, ensure they are kept in a locked, organized filing system. For digital copies, utilize cloud storage or encrypted systems to prevent unauthorized access. Keep these records for several years, in accordance with local tax regulations. This ensures you can respond to any inquiries and provides a reference in case the donor needs a copy later on.

I aimed to keep the phrases concise and logical. What do you think?

When creating a donation receipt letter, clarity is key. Make sure the letter includes the donor’s name, donation amount, and date of the donation. It’s crucial to specify whether the donation is in cash, goods, or services. This transparency helps both the donor and the organization stay on the same page.

Key Details to Include

| Item | Details |

|---|---|

| Donor Name | Full legal name of the donor |

| Donation Amount | Specify the exact amount or describe donated goods/services |

| Donation Date | The specific date the donation was made |

| Organization Details | Include the legal name of your nonprofit, address, and tax ID number |

It’s also helpful to include a statement that the donation was tax-deductible, which provides clarity for the donor when they file taxes. Be sure the letter is signed by someone in charge to make it more official.