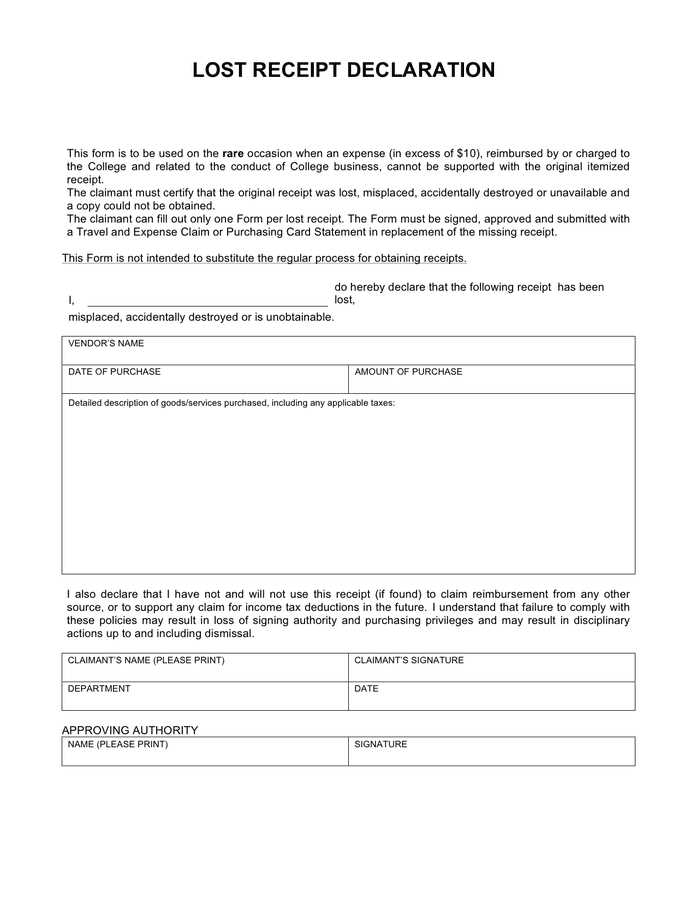

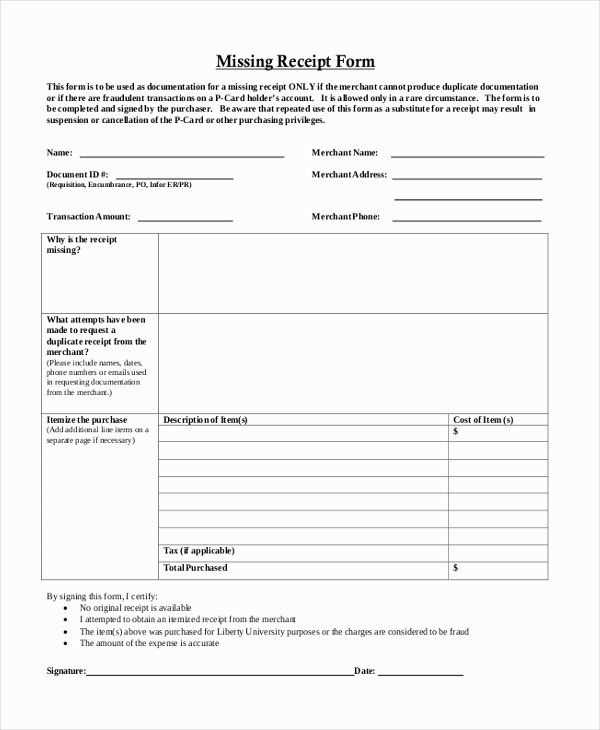

If you need to declare a lost receipt for reimbursement or tax purposes, using the right form is key. A Lost Receipt Declaration Form simplifies the process, ensuring all the required details are provided. It’s a straightforward document that allows you to officially declare a missing receipt and provide alternative evidence of your transaction, such as bank statements or purchase orders.

Ensure your form includes specific information: the date of the transaction, the merchant’s name, the amount spent, and a brief explanation of why the receipt is lost. You should also provide any supporting documents that may help validate the expense. Depending on your organization or tax regulations, the form may require additional details, so double-check your requirements before submission.

A clear and accurate Lost Receipt Declaration Form can expedite the approval process, preventing unnecessary delays. Save time by having all the necessary information ready, and make sure to follow any submission guidelines set by your organization or tax authorities. By doing so, you avoid unnecessary complications and help streamline the reimbursement or audit process.

Here are the corrected lines based on your requirements:

To make the lost receipt declaration process clearer and more straightforward, it’s crucial to ensure all necessary details are provided in the correct format. Below are the revised sections with improved structure:

Section 1: Personal Information

-

Include your full name and contact details in the top section.

-

Specify the date and reason for your claim clearly.

-

Ensure the address matches the one on file for accuracy.

Section 2: Transaction Details

-

Provide the transaction date, amount, and vendor information.

-

If available, reference the transaction ID or any alternative identifying information.

-

Clearly mention why the receipt is missing and any supporting evidence, if applicable.

Double-check that all fields are filled out completely and accurately to avoid delays in processing.

- Lost Receipt Declaration Template

If you’ve misplaced a receipt and need to provide documentation for an expense, a lost receipt declaration form can help. Use the template below to declare the missing receipt and ensure the process runs smoothly.

The form should include the following details:

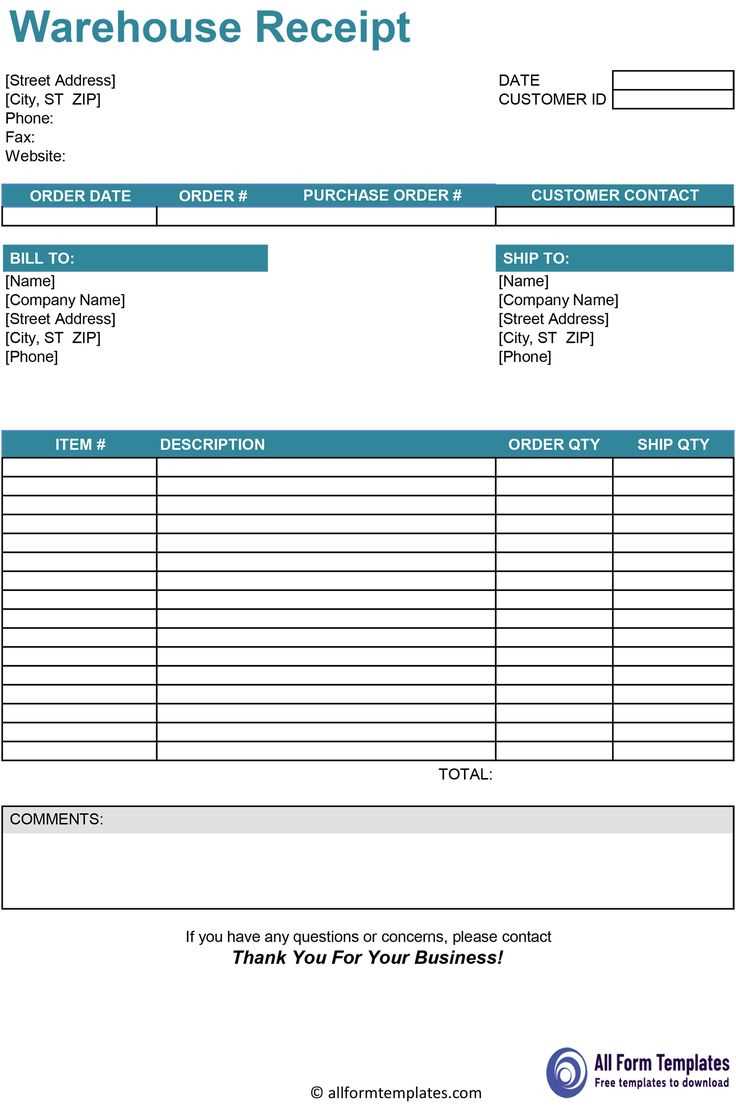

| Field | Description |

|---|---|

| Date of Purchase | Indicate the exact date when the transaction took place. |

| Amount | State the total amount spent, including any taxes and fees. |

| Vendor Name | Provide the name of the business or service provider. |

| Reason for Lost Receipt | Explain the reason the receipt cannot be found (e.g., lost, damaged, or missing). |

| Confirmation | Include a statement verifying that the information provided is accurate and truthful. |

Once completed, submit the form to the relevant department or entity for review. Make sure to include any supplementary documents that may help validate the claim, such as bank statements or credit card records.

In case of frequent lost receipts, consider keeping digital copies of all receipts for easier tracking in the future.

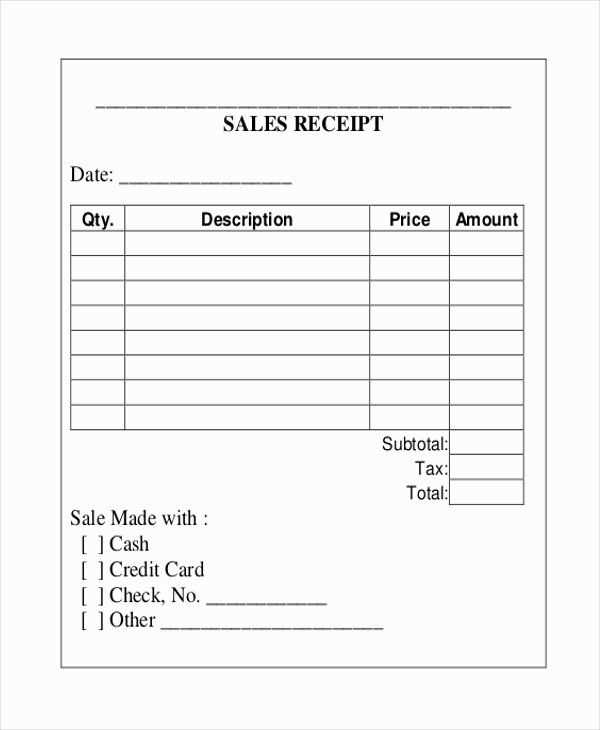

If you’ve lost a receipt, submitting a declaration form can help you recover it. Start by contacting the vendor or service provider where the purchase was made. Request a copy of the receipt and inform them that you’ve misplaced it. Many companies allow you to submit a declaration form to confirm the transaction details. The form typically asks for information such as the date of purchase, the total amount, the payment method, and any other relevant details.

Once you have the declaration form, carefully fill it out with accurate information. Provide any additional supporting documents that might be helpful, such as bank statements or credit card records showing the transaction. After submitting the form, follow up with the vendor to ensure they have received it and are processing your request. In most cases, businesses can issue a duplicate receipt after reviewing the form.

The declaration form must clearly state the transaction details, including the purchase date, store name, and the items bought. Include the total amount paid, the method of payment, and any order number if applicable. Ensure you add personal details such as your full name, contact information, and address. If the transaction was made online, include the order confirmation number or email. Finally, provide a brief explanation of how the receipt was lost, whether it was misplaced, damaged, or never received. This information ensures a smooth review of your claim.

Follow these steps to ensure a smooth process when filling out a Lost Receipt Declaration Form:

- Gather Required Information: Before you start, make sure you have all relevant transaction details such as the date of purchase, merchant information, and the amount spent. This will help you complete the form accurately.

- Identify the Reason for Loss: Be clear on why the receipt is lost. Was it misplaced, damaged, or never received? Providing an accurate reason helps clarify the situation for whoever processes the form.

- Provide Personal and Payment Information: Include your full name, contact details, and any payment method used (e.g., credit card, cash, bank transfer). This allows the organization to trace the transaction effectively.

- State the Transaction Details: Fill in the specifics of the transaction, including the total amount, items or services purchased, and any reference number if available. Double-check for accuracy.

- Sign and Date the Form: Ensure you sign and date the form to confirm that the information you’ve provided is correct and complete. This is often a required step for validation.

- Submit the Form: Submit the completed form to the appropriate department or organization. Make sure to follow their specific submission process, whether online or via mail.

Double-check your entries before submission to avoid any delays. Following these steps carefully will help the process move forward without issues.

Common Errors to Avoid When Submitting a Lost Receipt Form

Ensure that all required fields are filled out correctly. Incomplete or missing information can delay the processing of your claim. Double-check that the receipt details, such as the amount, date, and vendor, are accurately stated.

1. Providing Incorrect or Inconsistent Information

When filling out the lost receipt form, make sure the details match your records. Incorrect information, such as wrong dates, amounts, or vendor names, can lead to rejection. If you’re uncertain, review your purchase history to avoid discrepancies.

2. Forgetting to Attach Supporting Documents

Always include any supporting documents that can help verify the transaction. This might include bank statements, credit card transactions, or purchase confirmations. Skipping this step can cause delays or even result in your form being returned for additional information.

3. Not Following the Submission Guidelines

Each form may have specific instructions regarding how to submit it, such as the preferred file format or submission method. Make sure you adhere to these details to avoid your submission being rejected. Check if there’s a deadline for submission, and avoid submitting late.

4. Submitting Multiple Forms for the Same Receipt

If you’ve already submitted a form for a particular lost receipt, avoid resubmitting the same claim unless requested by the processing team. This could cause confusion and delays in reviewing your case.

5. Missing Signature or Date

Some forms require your signature and the date of submission. Forgetting these simple details is a common mistake that can lead to the rejection of your form. Ensure everything is properly signed before submission.

By avoiding these mistakes, you’ll streamline the process and increase the chances of your lost receipt claim being processed smoothly and quickly.

Ensure that your lost receipt declaration form is fully completed, with all necessary details filled out accurately. Double-check the information, including dates, transaction details, and any additional notes required by the vendor or organization. This will prevent delays or complications during processing.

Once the form is ready, save it in the preferred format (usually PDF or Word). Some organizations may also request a scanned copy or a digital image of the signed form. Confirm the format guidelines before submitting.

Submission Methods

Submit the declaration through the method specified by the vendor or organization. Most commonly, this will be via email, through an online portal, or by physical mail. If submitting via email, attach the completed form and use the correct subject line as instructed by the recipient.

Follow-Up

After submission, keep track of the process. If no acknowledgment is received within the expected timeframe, send a polite follow-up to confirm receipt and check on the status of your declaration. Always keep a copy of all correspondence for reference.

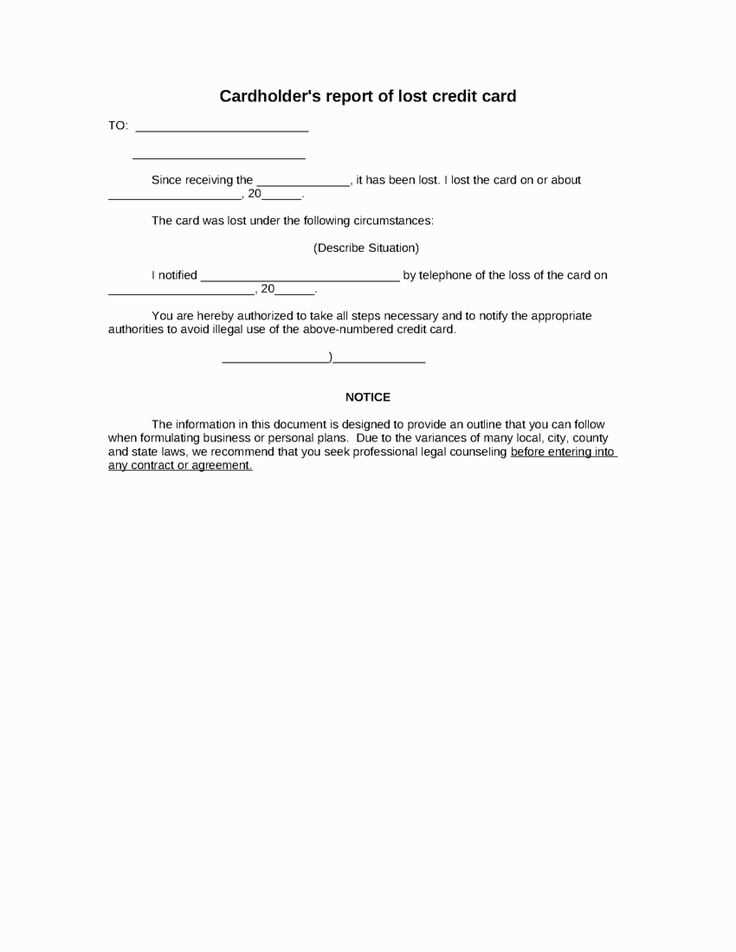

If your lost receipt form is rejected, take the following steps to address the issue effectively.

1. Review the Rejection Reason

Check the rejection notice for any specific reasons. It may be due to missing information, improper documentation, or errors in the form. Addressing these issues directly can help you resubmit a correct and complete application.

2. Correct the Issues and Resubmit

If the rejection is due to missing details, provide the requested information as accurately as possible. Attach any supplementary documents, such as bank statements or alternative proof of purchase, to support your claim.

3. Contact the Issuing Authority

If the reason for rejection is unclear or you believe there has been a mistake, contact the organization or company handling the receipt form. Request clarification on what specifically needs to be fixed and ask for guidance on how to improve your submission.

4. Keep Track of Deadlines

Make sure to resubmit your corrected form within the specified deadline. Missing deadlines can lead to further delays or the rejection of your claim altogether.

If you’ve lost your receipt, filling out a Lost Receipt Declaration form can help. Start by gathering any relevant information about your purchase, such as the transaction date, amount, and merchant name. This will support your claim. Be clear and accurate when entering details into the form to avoid delays.

Steps to Complete the Form

1. Provide personal information, including your name, address, and contact details.

2. Include transaction details, such as the date of purchase, total amount, and the merchant’s name.

3. State the reason why the receipt is unavailable.

4. Sign and date the declaration to confirm that all information is accurate.

After Submission

Once submitted, the form will be reviewed by the merchant or relevant authority. Make sure to keep a copy for your records. In some cases, you may need to provide additional documentation, like bank statements or order confirmations, to verify the purchase.

Remember to fill the form accurately and follow any additional instructions from the merchant or authority to ensure your claim is processed quickly.