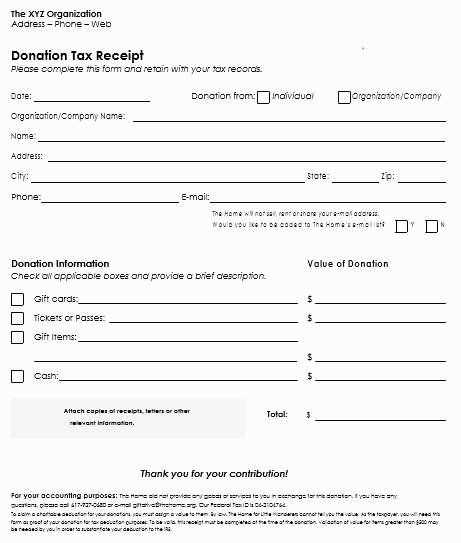

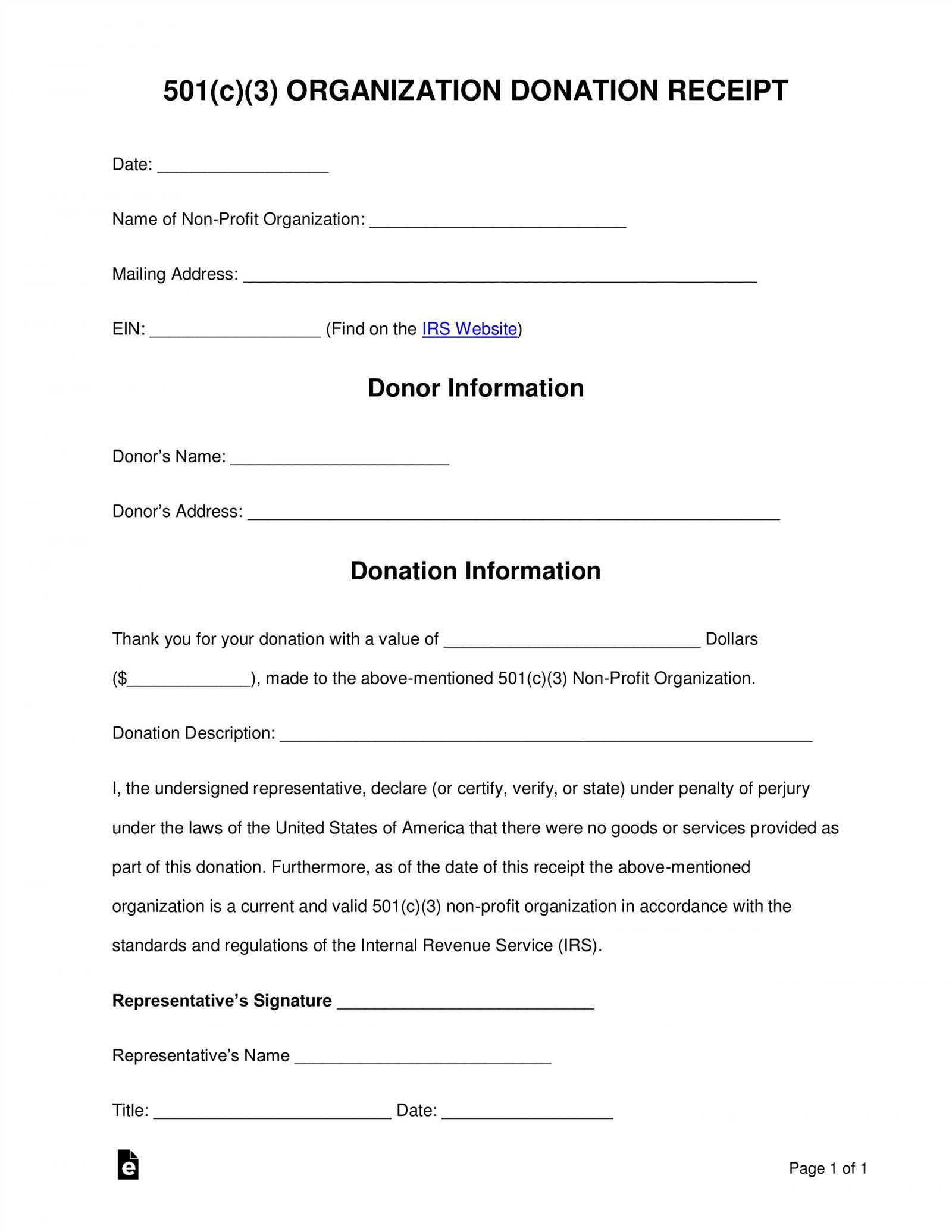

To create a valid charity receipt in Canada, ensure the document contains all required elements for tax purposes. Include the charity’s official name, registration number, and the donor’s details. Specify the amount donated and clearly describe any goods or services exchanged in return, if applicable.

Be sure to note the date of the donation and the total amount contributed. For non-cash donations, provide a detailed description of the donated items and an estimated value. Donors can claim tax deductions based on the value of their contributions, so accuracy in listing these details is vital.

For donations of goods: Ensure that the valuation method is fair and well-supported by records. If the donor receives any benefit, such as event tickets or merchandise, deduct the fair market value of those benefits from the receipt total.

Lastly, confirm that the receipt is signed by an authorized representative of the charity, and issue the document promptly after receiving the donation. This will help your donors maximize their tax benefits and maintain trust with the charity.

Here’s a detailed plan for the article “Charity Receipt Template Canada” in HTML format, featuring six practical and specific headers, as per your request:

Creating a charity receipt template in Canada requires specific details to ensure compliance with the Canada Revenue Agency (CRA) guidelines. This ensures that donors can claim charitable tax credits. Below are key aspects to consider when building the template:

1. Mandatory Information for Tax Receipts

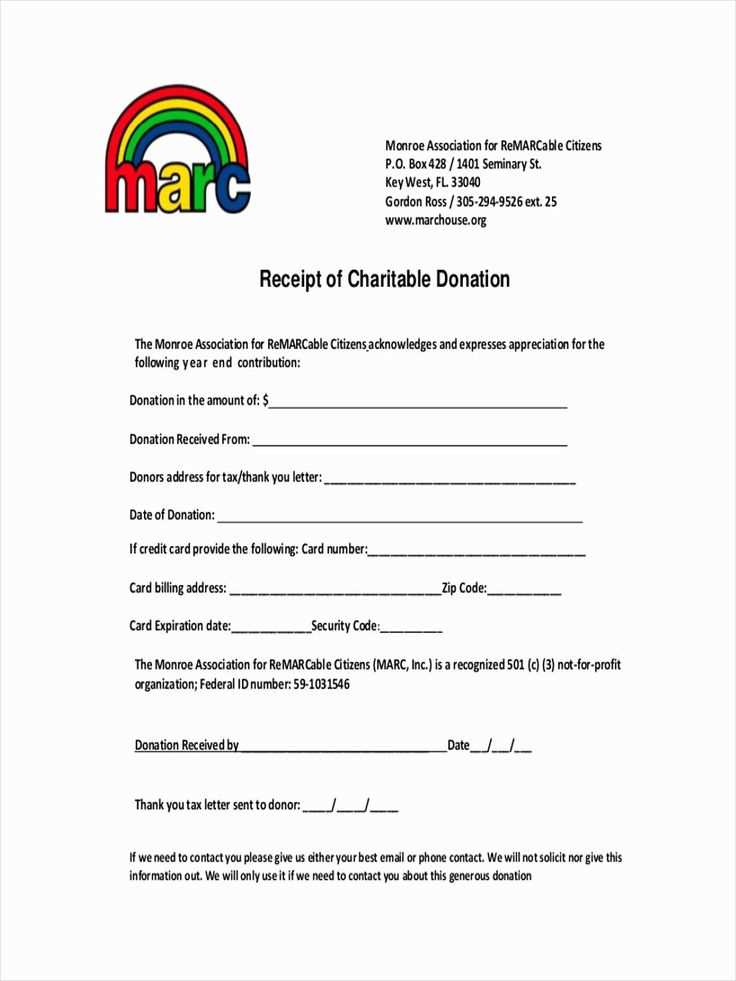

Include the official name of the charity, its registration number, the date of the donation, and a description of the donated item or cash amount. These details are critical for donors to verify the legitimacy of the receipt for tax purposes.

2. Formatting the Receipt Correctly

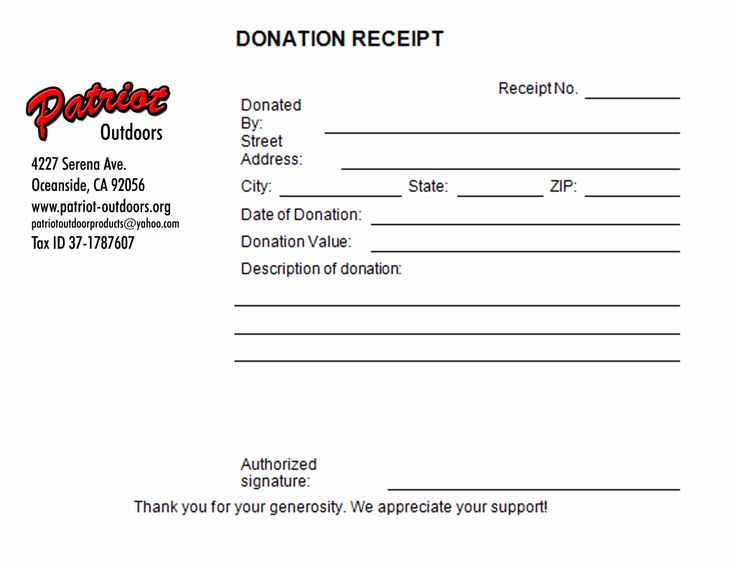

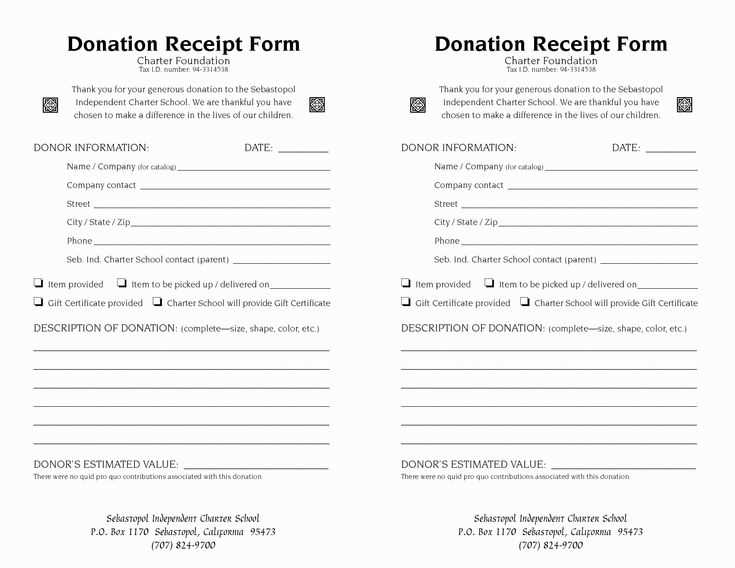

Use a professional format that is easy to read. The receipt should clearly state the charity’s name, and the receipt’s unique serial number. Make sure the donor’s full name and address are also included to prevent any confusion.

To further ensure compliance, indicate whether the donation was cash or non-cash, including fair market value for non-cash donations. This information helps ensure donors are properly credited.

By following these steps, you ensure a receipt that adheres to CRA regulations and is useful for both the charity and donor.

- How to Customize a Charity Receipt for Canadian Donations

To ensure your charity receipt meets Canadian requirements, include specific elements. First, ensure your charity’s legal name and registration number are clearly visible on the receipt. This is essential for donors who plan to claim tax deductions.

Include the Donation Details

Provide the date of the donation and the exact amount received. If the donation is non-cash (e.g., goods or services), describe the item and its fair market value. For monetary donations, list the amount given in both numbers and words.

Provide the Donor’s Information

Include the donor’s full name and address. This is necessary for both acknowledging the gift and ensuring the tax deduction can be processed correctly. If a business made the donation, include the name of the business and its contact details.

| Element | Description |

|---|---|

| Charity Name & Registration Number | Legal charity name and registered charity number issued by the CRA |

| Donation Amount | Exact amount donated, both numerically and in words |

| Non-Cash Donations | Description and fair market value of donated goods |

| Donor’s Information | Full name, address, and any business details if applicable |

| Date of Donation | When the donation was made |

Make sure the receipt clearly states whether the donation is eligible for a tax receipt, especially if it includes non-monetary contributions or if the donor has received anything in return. Finally, remember to issue the receipt promptly after receiving the donation. This shows professionalism and helps maintain trust with your donors.

Receipts in Canada must include specific information to be valid for tax purposes. Start by listing the name of the organization issuing the receipt. It’s crucial to provide the official address and contact details to ensure traceability. The date of the donation or transaction is mandatory, as is a description of the donated goods or services, including their approximate value.

Donors must see the amount contributed clearly listed. If it’s a charitable donation, the receipt must include the charity’s registration number issued by the Canada Revenue Agency (CRA). Without this, donors cannot claim the tax deduction. The receipt should also outline whether any goods or services were provided in exchange for the donation, and if so, their fair market value.

Lastly, the receipt must be signed by an authorized person, confirming the details are accurate. This ensures the donation is properly accounted for by the recipient organization, and the donor can rely on it for claiming tax benefits.

For each donation, you must provide a receipt that meets Canada Revenue Agency (CRA) guidelines. Below are the key steps for issuing receipts for different types of donations:

- Cash Donations: Ensure the receipt includes the donor’s name, donation amount, and the date of the gift. If the donation exceeds $20, include your organization’s name and registration number.

- Property Donations: If a donor contributes property, such as goods or services, you need to state the fair market value (FMV) of the item on the receipt. Include a description of the item and the donor’s information.

- Non-Cash Gifts with Appraisal: For high-value items, provide a receipt that reflects the FMV based on an independent appraisal. This is required when the donated property is over $1,000.

- Volunteer Contributions: If a volunteer receives reimbursement for expenses (such as travel costs) while donating time, a receipt is not typically issued unless the reimbursement is a gift or donation itself.

- Online Donations: Use an automated system that generates receipts for online donations, ensuring they comply with CRA requirements. The receipt should show the transaction amount, the date, and any applicable fees or taxes deducted.

Always confirm that your receipts include a clear statement confirming your charity’s registered status, and make sure to keep detailed records for verification by the CRA.

First, check if the charity is registered with the Canada Revenue Agency (CRA). You can easily confirm this by searching the CRA’s official list of registered charities online.

Next, review the charity’s documentation. A valid charity tax receipt should contain specific information, such as the charity’s registration number, the donor’s name, the date of the donation, and the amount donated. The receipt must also include a statement confirming that no goods or services were provided in exchange for the donation.

If you’re still unsure, contact the charity directly. Ask them to provide their official registration number and verify that they are allowed to issue tax receipts. A legitimate charity will readily offer this information.

Lastly, look for an official charity website or a third-party verification service that confirms the charity’s tax-exempt status. Some platforms specialize in listing charities that meet all necessary regulatory standards for tax receipts.

To manage multiple donors in a single receipt, ensure you include clear breakdowns for each contribution. It’s important to separate each donor’s name, donation amount, and date of contribution for proper documentation and transparency.

Breakdown of Donors

- List each donor’s full name.

- Include their full address, especially if required for tax purposes.

- Clearly state the amount donated by each person.

- Ensure the receipt reflects the correct date for each contribution.

Group Donations Together

- If donors contribute together, note their combined total while still highlighting individual contributions for clarity.

- If applicable, specify if the donation was in cash, cheque, or online transfer, for each donor separately.

By providing a clear summary for each donor, you ensure accurate reporting for both your organization and your supporters. This method also allows donors to keep track of their individual contributions for tax purposes.

Ensure all receipts contain the correct legal information. Failing to include the charity’s registration number or the full name of the organization can render the receipt invalid. Double-check that the information on the receipt matches what’s registered with the Canada Revenue Agency (CRA).

1. Incorrect Donor Information

Always verify the donor’s details. Mistakes in the donor’s name or address can cause issues when they attempt to claim their tax credit. Ensure that spelling is accurate and that the address corresponds to the one on file.

2. Missing or Incorrect Donation Amount

Clearly state the exact amount of the donation. Ensure that donations in-kind are valued correctly. If the value of a donated item is not reasonable or is not supported by proper documentation, the receipt may not be valid.

Lastly, never issue receipts for non-deductible items, such as memberships or purchases that aren’t purely charitable donations. The receipt should reflect only the donation portion of any transaction.

When creating a charity receipt template in Canada, it’s important to include specific details that meet the legal requirements. A clear structure will ensure your receipt is valid for tax purposes and helps donors maintain proper records.

Include Required Information

Make sure the receipt contains the charity’s name, address, and charitable registration number. These details confirm that your organization is authorized to issue tax receipts. Clearly state the donation amount and date, as well as a description of the donation, including whether it was a monetary or in-kind gift.

Format for the Receipt

The format should be simple yet informative. A donor’s name should appear on the receipt along with the total contribution amount. If applicable, include a thank-you message. Providing a detailed receipt for each donation will enhance donor trust and streamline the donation process.