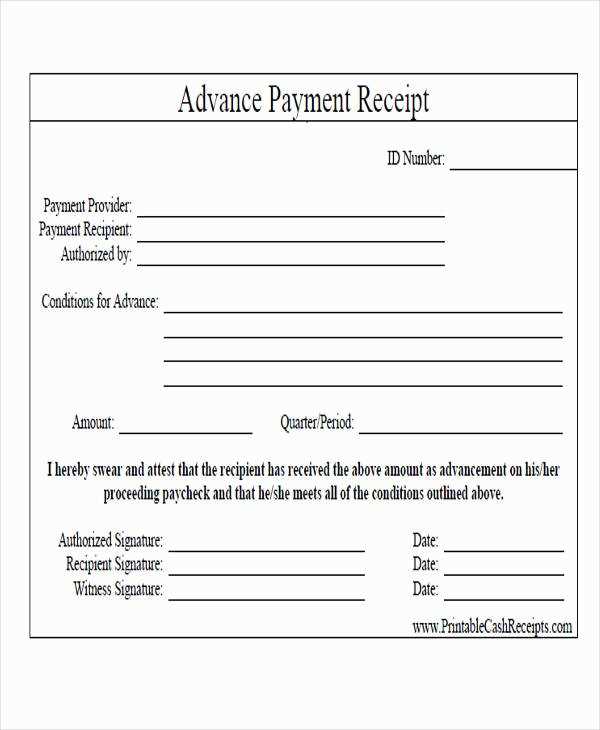

To make the process of receiving an advance on your paycheck smoother, a well-organized template is key. This template serves as an official record of the amount borrowed, repayment schedule, and the date of disbursement. Clear details ensure both the employee and employer are on the same page regarding terms and expectations.

Ensure clarity by including the advance amount, payment deductions, and any relevant terms directly on the receipt. Both parties should verify and sign the document for confirmation. Providing this receipt makes tracking advances easier and helps avoid potential misunderstandings about wages.

Include a section for the repayment timeline and interest, if applicable. This way, employees can see exactly when payments will be deducted and how much will be taken out each pay period. Clear repayment terms also help manage financial expectations for the worker and employer.

Don’t forget to add a note specifying whether the advance will be paid back in full or deducted incrementally from future paychecks. This will avoid any confusion down the road.

Here’s the corrected version:

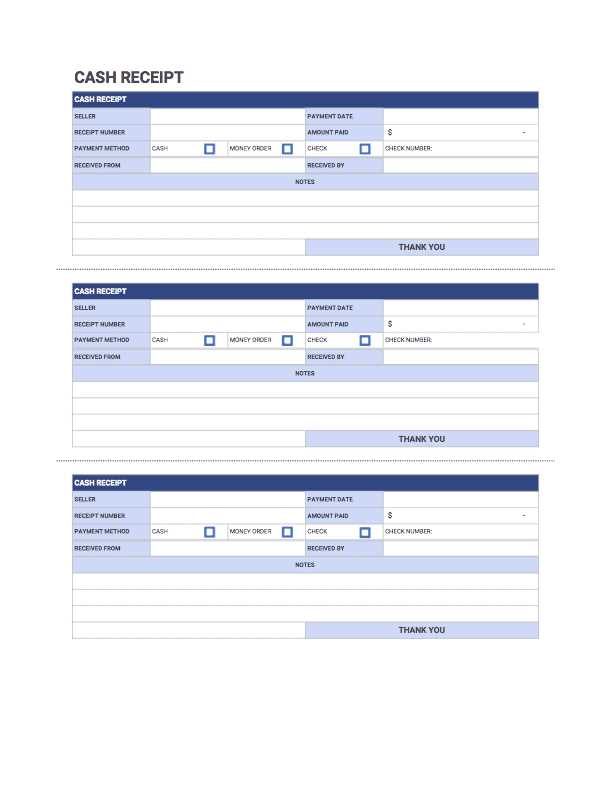

Ensure that the paycheck receipt template includes fields for the employee’s name, job title, and pay period. It’s important to clearly list the number of hours worked, the hourly wage or salary rate, and any bonuses or deductions. Additionally, include a breakdown of taxes withheld and any benefits or retirement contributions. Make sure to provide space for the total gross pay, any deductions, and the net pay. The template should also include the date of payment and the method of payment (e.g., direct deposit or check). This clarity helps employees easily understand their earnings and deductions. Lastly, ensure that the template complies with local labor laws and includes any necessary legal disclaimers.

- Advance on Paycheck Receipt Template

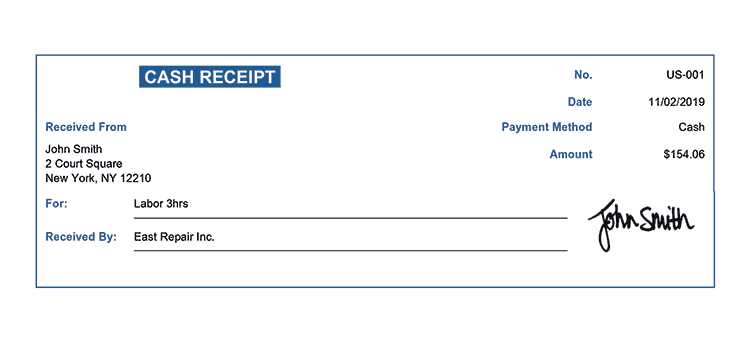

Use this simple and clear template to document an advance on an employee’s paycheck. It ensures transparency and provides both the employer and employee with a clear record of the transaction. The template should include key details like the date of the transaction, the amount advanced, and the repayment terms. These elements help to avoid confusion or disputes down the line.

Key Components

- Employee Name – Clearly state the name of the employee receiving the advance.

- Advance Amount – Include the specific amount being advanced.

- Repayment Terms – Specify how and when the employee will repay the advance, whether through deductions from future paychecks or another arrangement.

- Date of Transaction – Include the date the advance was issued.

- Signature – Both the employee and employer should sign the document to acknowledge the transaction.

Best Practices

Ensure that the repayment terms are clear and agreed upon by both parties. This will avoid misunderstandings and keep the process smooth. Consider providing a copy of the receipt to the employee for their records. This simple approach helps maintain proper documentation and accountability.

Begin with the date the advance was issued. This sets the timeline and ensures that both parties can track the transaction accurately. Follow up with a clear description of the amount advanced and specify whether it’s a loan or an advance payment. This distinction is crucial for future reference and proper accounting.

Detailed Information on Payment Terms

Clarify the repayment terms, including the due date, installment amounts, and any interest rates if applicable. Specify whether the amount will be deducted from future paychecks or repaid in a lump sum. If there are any penalties for late repayment, include them as well.

Signatures and Acknowledgement

End with both the employee’s and employer’s signatures, ensuring mutual agreement on the terms. This confirms the receipt of the advance and ensures both parties are aware of their obligations. Keep a copy for both the employer and employee for record-keeping.

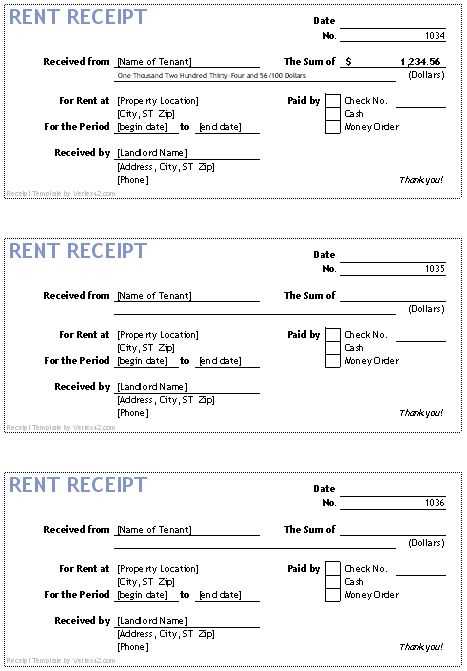

Start by formatting the date in a consistent and readable manner. Use the “DD/MM/YYYY” format or “MM/DD/YYYY,” depending on regional preferences. Keep the date at the top of the document for easy reference, ensuring that it stands out clearly.

For payment details, include the following information:

- Payment Amount: Specify the exact amount in both numbers and words to prevent misunderstandings.

- Payment Method: Clearly state how the payment was made (e.g., bank transfer, check, or cash).

- Payment Date: Include the date the payment was processed to ensure accurate tracking.

- Employee Information: Ensure the employee’s full name, ID, and position are included for proper identification.

By maintaining clarity and accuracy in these sections, you eliminate confusion and ensure proper record-keeping.

The advance sum is the amount you receive ahead of your regular paycheck. It’s typically deducted from your next salary, which means your remaining balance will be the difference between the total earned for the pay period and the advance given. For example, if you receive an advance of $500 and your total earnings for the period amount to $2,000, the remaining balance will be $1,500 after the deduction.

To avoid any confusion, always verify the advance amount against your pay stub or salary statement. If the amount appears incorrect, contact your payroll department for clarification. Keep in mind that some employers may apply interest or fees to advances, so make sure to review your pay statement carefully to account for any additional deductions.

Ensure that signatures are clear, legible, and consistent to avoid any misunderstandings. Both employee and employer should sign in the designated areas, with each signature corresponding to the proper section of the document.

- Use full names for clarity, avoiding initials or abbreviations.

- Have both parties date the document to confirm when the agreement was made.

- Ensure the employee’s signature is witnessed or acknowledged if required by company policy.

- Provide clear instructions for electronic signatures if using digital platforms. Ensure they comply with legal standards in your jurisdiction.

- Keep a copy of the signed document for record-keeping, ensuring that both parties have access to a copy.

- Review all fields on the document before signing to ensure accuracy, particularly when handling payroll or sensitive financial data.

When receiving an advance on your paycheck, it’s critical to account for the tax implications that may arise. Advances are generally considered taxable income and should be reported on your tax return. The amount you receive upfront will be subject to payroll taxes like Social Security, Medicare, and federal or state income tax withholdings. Depending on how your employer handles the advance, these taxes may be deducted immediately or at a later time.

Tax Withholding on Advances

The withholding tax rate for an advance can vary. Some employers apply the standard withholding rate, while others might treat the advance as a bonus, applying a higher percentage. It’s essential to review your pay stub to ensure the withholding aligns with your expectations and actual tax liability.

Recordkeeping for Tax Purposes

Accurate recordkeeping is necessary when receiving an advance. Employers should provide you with a clear breakdown of how the advance is applied to your regular earnings and any tax withholdings associated with it. You’ll need this documentation for tax filing to ensure everything is reported correctly.

| Tax Type | Rate | Notes |

|---|---|---|

| Federal Income Tax | Varies by income level | Typically withheld on advances, check pay stub for rate |

| Social Security Tax | 6.2% | Withheld on all wages up to the annual limit |

| Medicare Tax | 1.45% | Applied to all wages, no annual limit |

| State Income Tax | Varies by state | Subject to the state’s tax laws and payroll practices |

Avoid omitting critical fields that can cause confusion. Include all necessary sections, such as employee details, pay period, gross income, deductions, and net pay. Missing even one of these sections can lead to errors in calculations and delay payments.

Do not use inconsistent formatting. Ensure that dates, amounts, and terms are clear and easy to read. Inconsistent fonts or spacing may make the template look unprofessional and difficult to understand.

- Keep the language simple and clear. Avoid using complex terminology or jargon that might confuse employees.

- Ensure the calculations are correct by double-checking formulas. Mistakes in calculating deductions or bonuses can cause serious issues with payroll.

Another mistake is ignoring local tax laws or company policies. Make sure the template complies with all applicable laws and includes all necessary deductions based on your region and business rules.

- Leave room for adjustments, such as overtime or tax changes. This flexibility helps to keep the template useful in different situations.

Ensure that each paycheck receipt includes a detailed breakdown of the advance amount. This makes it clear to both the employee and employer how the advance affects the current paycheck.

Here’s a simple template structure for calculating and displaying the advance on a paycheck receipt:

| Category | Amount |

|---|---|

| Gross Pay | $3,500 |

| Advance Deduction | $500 |

| Net Pay | $3,000 |

Make sure to clearly label the advance deduction to avoid confusion. A well-structured template helps streamline payroll processes and maintains transparency.