Ensure your payment receipts are clear and professionally structured. Use this template to document transactions with clients, providing transparency and accountability. A well-crafted receipt offers peace of mind for both parties.

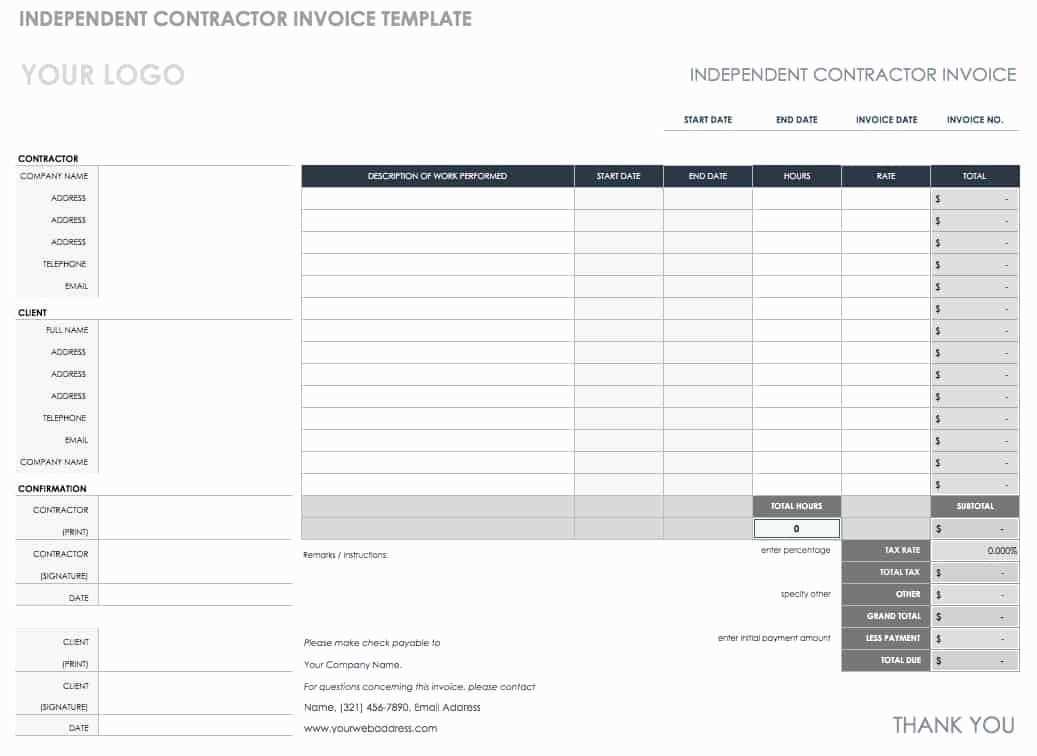

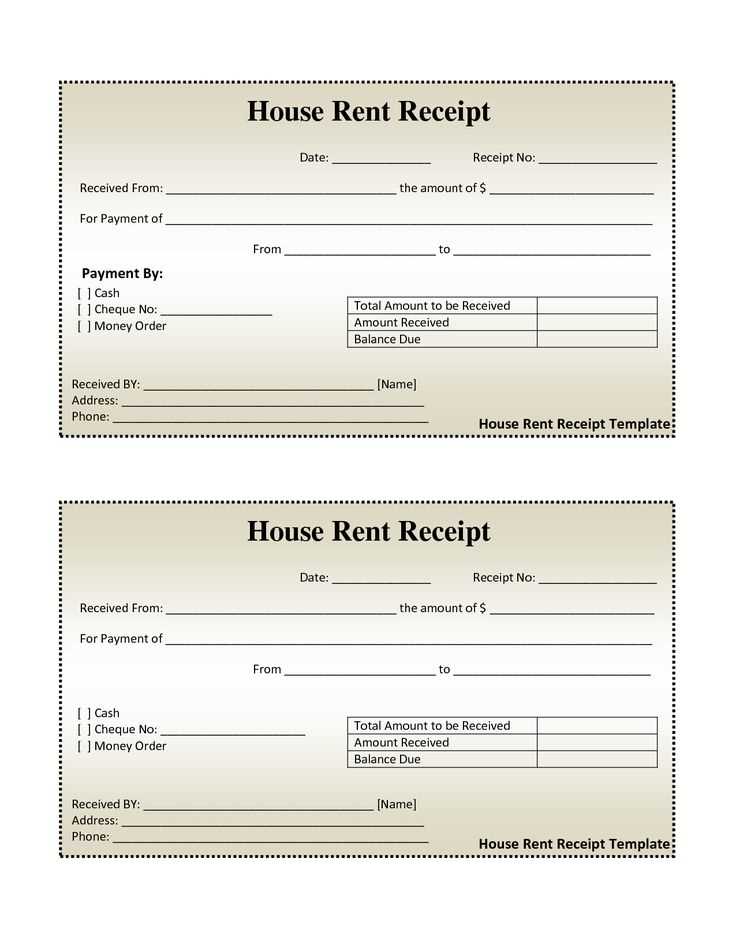

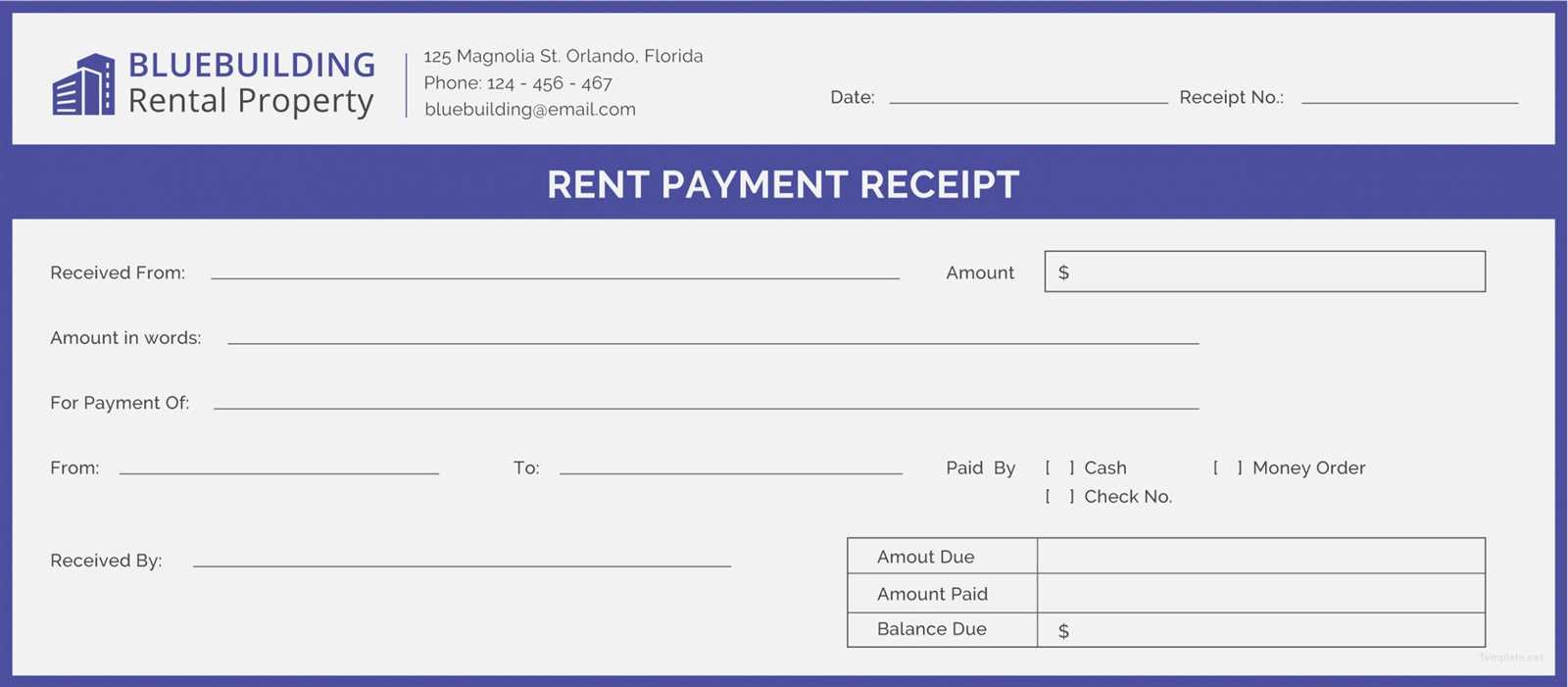

The receipt should include the contractor’s details, such as name, business address, and contact information. Add client information next, followed by the service provided and the agreed-upon payment amount. Clearly state the payment method–whether it’s a bank transfer, cheque, or cash. Include any applicable taxes, fees, or additional costs to avoid confusion.

A receipt also serves as a record for future reference. In case of disputes, this document can help resolve issues by showing the exact terms of payment. Make sure to include the date the payment was received, and always keep a copy for your records.

Be precise when listing the services rendered. For example, instead of vague descriptions like “work done,” break down each task with specific details, such as “painting of living room walls” or “plumbing repairs in the kitchen.” This clarity protects both parties and ensures mutual understanding.

Finally, once the payment receipt is prepared, share it promptly with the client. A formal, well-documented transaction builds trust and ensures that all terms are clear and agreed upon.

Key Elements to Include in a Receipt

Include the contractor’s full name or company name and contact details. Clearly state the date of payment and reference number to avoid confusion. List the service or product provided, along with a detailed description, quantity, and price for each item.

Show the total amount paid and specify the payment method, such as cash, check, or bank transfer. If applicable, mention any taxes or additional fees, and break them down separately. Include a space for both the payer’s and contractor’s signatures to confirm the transaction.

Lastly, add a clear statement indicating that the payment has been received in full. This confirms that both parties are aligned on the completed transaction.

How to Format the Receipt for Clarity

Ensure the receipt layout is simple and logical. Begin with the contractor’s name and contact details at the top, followed by the recipient’s information. This ensures both parties can be easily identified in case of any follow-up.

Next, clearly state the invoice number and date of payment. This helps in tracking and organizing receipts for future reference. Align the itemized list of services or products in a table format to provide a clear breakdown of each charge. Each entry should include the description, quantity, unit price, and total cost, with the grand total at the bottom.

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Service 1 | 2 | $50 | $100 |

| Service 2 | 1 | $75 | $75 |

| Total | $175 |

Include payment terms, such as the payment method used and the due date for any outstanding balance. Be clear about any discounts, taxes, or additional fees applied to avoid confusion.

Lastly, add a thank-you note at the bottom to convey appreciation for the business transaction. This ensures the receipt feels professional while maintaining a positive relationship with the client.

Common Payment Methods and Their Documentation

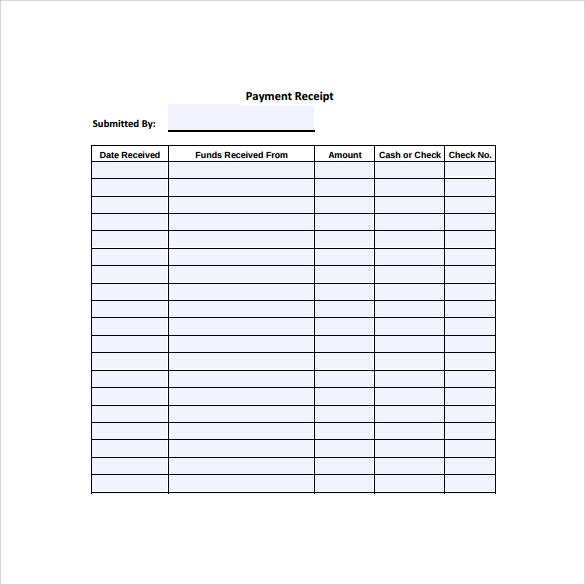

For smooth payment processing, contractors must clearly document each transaction. Below are the most common payment methods along with their required documentation.

Bank Transfer

Bank transfers require a payment receipt showing the amount, transfer date, sender’s bank details, and recipient’s information. The bank’s transaction reference number should be included as proof of payment. Ensure that both parties have copies of the transfer confirmation for record-keeping.

Checks

Checks must be documented with a copy of the check, including the payee’s name, the check number, and the date. A bank deposit slip confirming the check’s clearance should accompany the check copy. It’s advisable to track the check number and the amount deposited for future reference.

Credit/Debit Cards

Card payments require a transaction receipt from the payment processor. The receipt should show the transaction amount, the cardholder’s name, and the authorization number. Contractors should maintain a digital or paper record of the payment confirmation provided by the payment gateway.

Online Payment Platforms

Payments via platforms like PayPal, Venmo, or similar should be supported by an electronic receipt from the service provider. This receipt typically includes the payment amount, the payer’s name, the transaction ID, and the date of the transaction. It’s crucial to save a screenshot or export a PDF of the transaction details from the platform for verification.

Cash Payments

Cash payments should be accompanied by a signed receipt that includes the amount paid, date, and the payer’s name. Both parties should sign the document to confirm the transaction. A copy of the signed receipt should be stored for future reference.

Having clear documentation for each payment method provides transparency and protects both parties in case of disputes or audits. Ensure records are kept securely and are easily accessible for future use.

Customizing Templates for Different Contract Types

Tailoring a payment receipt template to fit the specifics of each contract type improves both clarity and professionalism. Here are key points to consider for different contracts:

- Fixed-Price Contracts: Include payment milestones with clear due dates. Highlight total payment, and consider adding a breakdown of tasks or deliverables completed. Ensure that any penalties or bonuses related to deadlines are visible.

- Hourly or Time and Materials Contracts: Specify the hourly rate and the total hours worked. Add a section for any materials used, with itemized costs. Make sure to include space for tracking time worked and client sign-offs on hours billed.

- Retainer Agreements: Clarify payment terms for ongoing work. Include the retainer amount, frequency of payments (weekly, monthly), and any services or deliverables included in the retainer. This structure helps avoid confusion and ensures both parties are aligned.

- Milestone-Based Contracts: Customize templates to clearly reflect each project phase and its corresponding payment. Each milestone should have its own line item, specifying the amount due upon completion, with room for any adjustments.

- Progressive Billing Contracts: Adjust the template to account for partial payments. Include percentage completed, invoice dates, and amounts due at each stage. This helps manage cash flow and keeps both parties aware of payment progress.

For any contract type, the template should always include a clear statement of payment due, payment methods, and any late fee policies. Customizing receipts based on contract terms reduces errors and ensures a smooth transaction process.

Legal Considerations When Issuing a Payment Receipt

Ensure that the payment receipt includes all required details to be legally binding. This includes the full names of both the payer and the payee, the amount paid, the date of transaction, and a brief description of the service or goods provided. Lack of these key elements could lead to disputes or confusion over the terms of the payment.

- Clearly state the payment method (e.g., cash, check, credit card).

- Indicate whether the payment is partial or in full.

- Include any applicable tax information if required by law.

Be aware of the legal obligations regarding tax reporting. In some jurisdictions, you may be required to report certain payments to tax authorities, even if a receipt has already been issued. Consult a tax professional to ensure compliance with local laws.

Also, maintain proper records of all receipts issued. This could be important in case of audits or legal disputes. Keep digital or physical copies of receipts for at least the legally required duration, which may vary depending on local legislation.

- Check local laws for retention periods for payment receipts.

- Make sure records are accessible and organized for easy retrieval if necessary.

Finally, always issue a receipt upon request. Even if it is not legally mandatory to provide one automatically, offering a receipt upon the payer’s request is considered a best practice and can help avoid future misunderstandings.

How to Handle Discrepancies in Payment Records

First, review the payment records thoroughly, ensuring all amounts align with the contract terms. Verify the payment date and method, and check if the correct invoice number or reference is noted. Compare the contractor’s receipts with bank statements or transaction histories to identify any mismatches. If there’s a discrepancy in the amount, check if any deductions or adjustments were made that were not initially agreed upon.

If you notice any issues, contact the payer directly to clarify the payment details. Be clear about the discrepancy, providing all supporting documentation, including receipts and bank statements. Keep the tone professional and objective throughout the discussion. Avoid assumptions and seek explanations for any inconsistencies that appear in the records.

In some cases, discrepancies can arise from technical errors or misunderstandings. Ensure that both parties have a clear understanding of the payment terms to avoid further confusion. After resolving any issues, update your payment records and confirm that everything is accurate going forward. Consider implementing an organized tracking system to make monitoring easier in the future and prevent similar issues from happening again.