For churches seeking to provide donors with clear and professional receipts, using a donation receipt template simplifies the process. The template should include key details such as the church’s name, donation date, amount, and donor information. This ensures both transparency and accuracy in record-keeping for tax purposes.

Make sure to include the following details:

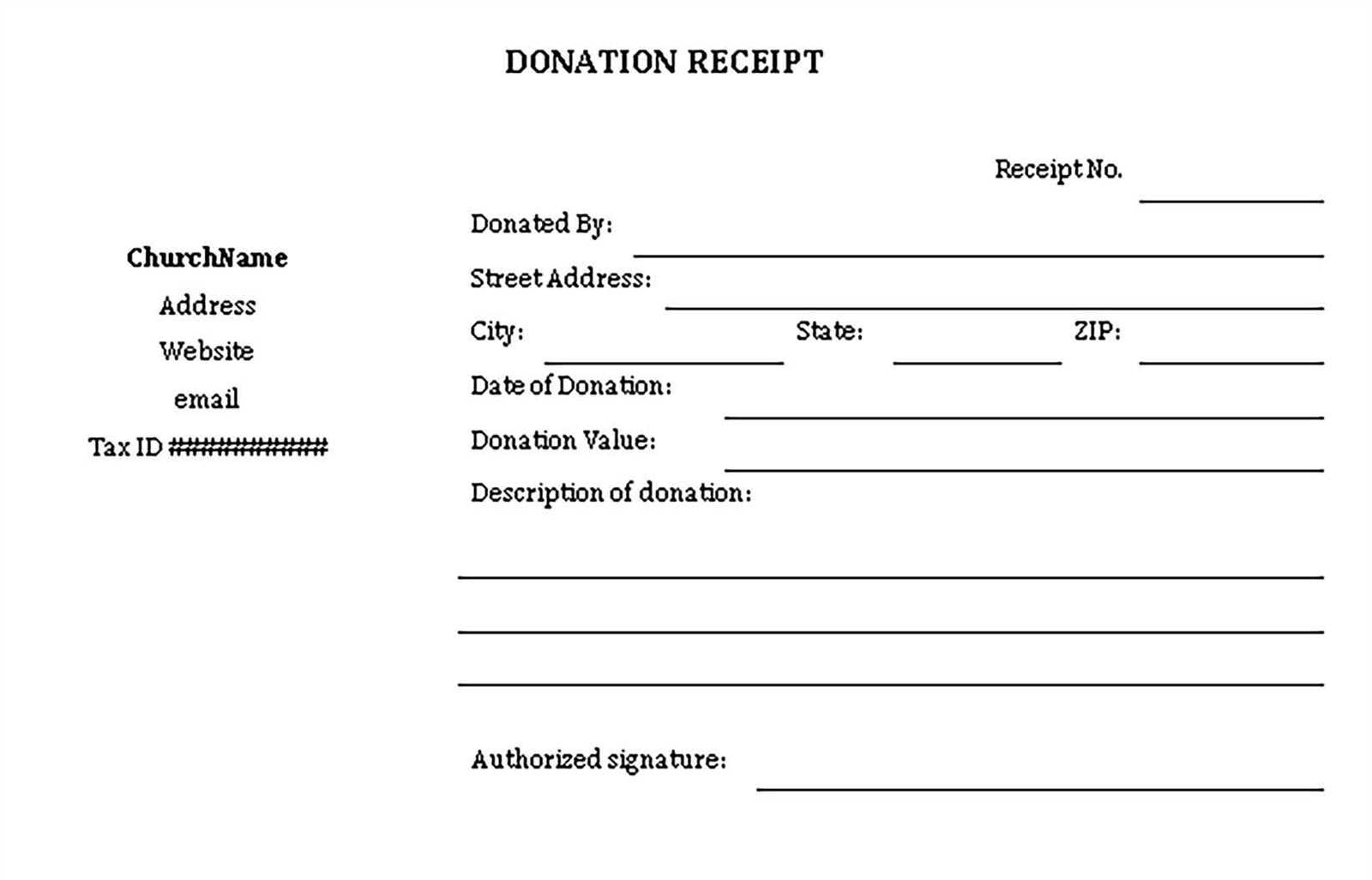

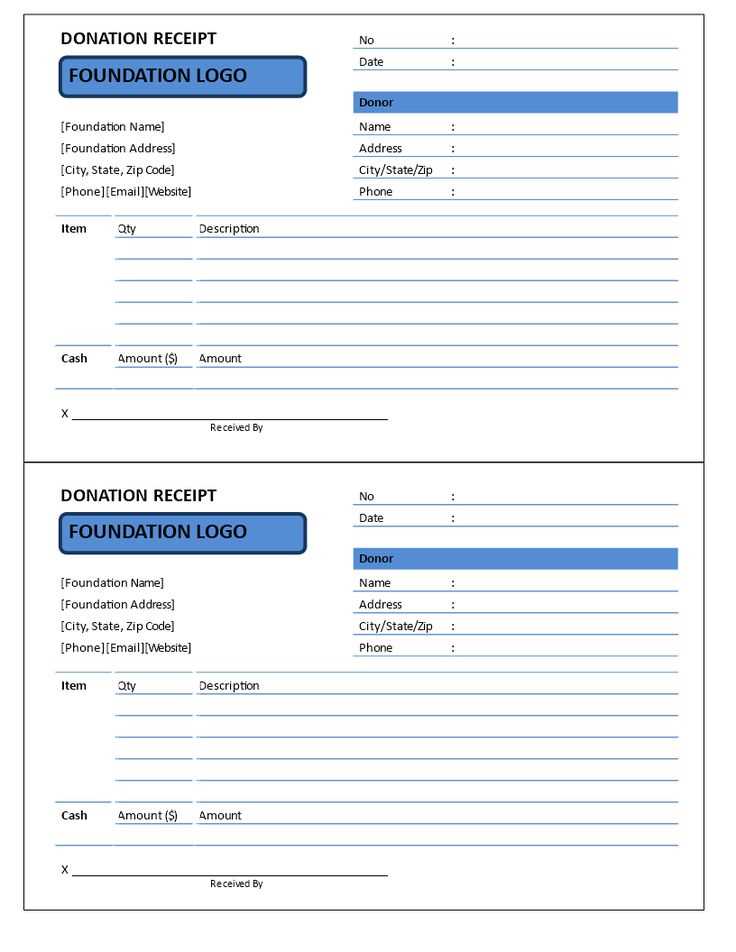

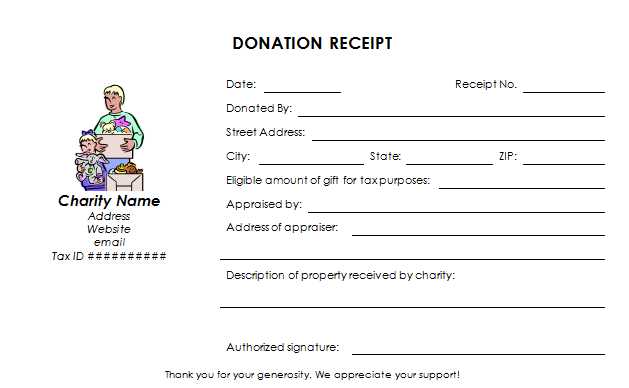

1. Church Name and Contact Information: Start by clearly listing the church’s name, address, phone number, and email for easy identification.

2. Donor Information: Include the donor’s name and contact details, if applicable, to ensure accurate records for both the church and the donor.

3. Donation Amount: Clearly specify the exact amount of the donation. If applicable, note whether the donation was in cash, check, or in-kind contributions.

4. Date of Donation: Document the exact date when the donation was received. This ensures the receipt is valid for the year in which it was given.

Incorporating these details into your receipt template not only helps maintain accurate records but also ensures that donors can easily use these receipts for tax deductions.

Here are the corrected lines:

Start by specifying the donor’s name and the amount of the contribution in the receipt. Be clear with the date and purpose of the donation. For example:

Example Template:

Donor Name: John Doe

Donation Amount: $100

Date: February 5, 2025

Purpose: General Fund

Ensure you include your organization’s tax ID number and any other identifying information required for tax purposes. This helps both the donor and the church stay compliant.

Tax Information:

Tax ID Number: 123-45-6789

Conclude the receipt with a thank-you message, reinforcing the value of the donor’s contribution to the church’s work.

Thank you for your generous donation!

- Church Donation Receipt Template

Creating a Church Donation Receipt Template ensures both transparency and proper documentation for your donors. A well-crafted receipt helps confirm donations for tax purposes and strengthens trust in your church community.

Key Elements of a Donation Receipt

- Church Name and Contact Information: Include the official name, address, phone number, and email address of the church.

- Donation Date: Specify the date the donation was received to establish a clear timeline.

- Donor Information: List the donor’s name and address. If possible, include their phone number or email for easy follow-up.

- Amount of Donation: Clearly mention the amount donated. If the donation is non-monetary, describe the item(s) donated and their fair market value.

- Tax-Exempt Status Notice: Include a statement confirming that your church is a tax-exempt organization, such as “Your donation is tax-deductible under section 501(c)(3) of the Internal Revenue Code.” This reassures the donor that the contribution is eligible for tax deductions.

- Thank You Message: Add a simple note expressing gratitude for the donation, acknowledging the donor’s support.

How to Use the Template

- Personalize the template by filling in the specific details for each donation.

- Ensure the total amount donated is accurately reflected and clearly visible.

- Make the receipt available promptly, whether it’s through email or physical mail.

- Keep a copy of all receipts for your church’s records and for future reference during tax season.

Begin by including the church’s name and contact details at the top of the receipt. Make sure to include the full address, phone number, and email to ensure the donor can reach you if needed.

Next, specify the donor’s name and contact information. This ensures that the donation is properly attributed. If the donation is anonymous, state that clearly.

List the donation amount and the date it was received. If the donation is in the form of goods or services, include a brief description of the items or services and their estimated value.

For tax purposes, include a statement confirming whether the donation is tax-deductible, such as: “No goods or services were provided in exchange for this donation.” This adds clarity for both parties.

Lastly, include a unique receipt number to help track donations. This helps maintain accurate records for the church and simplifies future reference if needed.

To ensure a donation receipt is clear and meets legal requirements, include the following key details:

- Donor’s Name and Address: List the full name and address of the donor. This ensures the receipt is tied to the correct individual or organization.

- Church’s Name and Contact Information: Include the full name, address, and contact details of the church, so it’s clear who issued the receipt.

- Date of Donation: Specify the exact date when the donation was made to provide a clear record for tax purposes.

- Donation Amount: Clearly state the monetary value of the donation or describe the donated items in detail (for in-kind gifts).

- Description of Donation: If the donation is non-monetary (such as items or services), provide a detailed description to avoid ambiguity.

- Statement of No Goods or Services Provided (for tax purposes): Include a statement confirming that no goods or services were exchanged for the donation, if applicable. This is required for tax deductions under IRS guidelines.

- Tax-Exempt Status: Reference the church’s tax-exempt status with the IRS, typically including the 501(c)(3) designation.

- Signature of Authorized Representative: Ensure the receipt is signed by a church representative authorized to issue donation receipts.

Ensure your donation receipt is easy to read and understand by following these key formatting guidelines:

1. Use a Clear and Legible Font

Choose a simple, professional font such as Arial or Times New Roman. Keep the font size large enough for readability–typically 12-14pt. Avoid using overly stylized fonts that could make the receipt hard to decipher.

2. Organize Information with Sections

Divide the receipt into clear sections with headings. Start with the donor’s information, followed by the church’s details, donation amount, and the date. Use headings such as “Donor Information,” “Donation Details,” and “Acknowledgement” to guide the reader through the document.

Use bullet points or numbered lists to present multiple items in an organized way. This helps recipients quickly locate relevant information and improves clarity.

3. Include Adequate White Space

Maintain sufficient spacing between sections and around text. Avoid cramming too much information into a small space. White space makes the document less cluttered and easier to scan quickly.

4. Align Information Consistently

Ensure that all text is aligned properly, such as aligning dates to the right and names to the left. Consistent alignment makes the document look professional and easy to follow.

5. Add a Footer with Contact Information

Include the church’s contact details at the bottom of the receipt. This provides the donor with a reference point if they need to reach out regarding their donation.

When issuing receipts for in-kind donations, be specific and clear about the donated items. Acknowledge the description, condition, and fair market value of the items. Avoid estimating their value–this is the donor’s responsibility, but you can provide a general description to guide them in their evaluation.

What to Include in the Receipt

The receipt should list the item(s) donated along with a brief description, such as “used furniture” or “box of clothing.” Avoid vague terms like “goods” or “items.” Make sure the receipt includes a statement that the donor did not receive any goods or services in exchange for the donation, confirming the donation was purely charitable.

Fair Market Value Clarification

If the donor provides an estimated fair market value for the in-kind gift, record it on the receipt. In some cases, it may be appropriate to suggest that donors consult a professional appraiser for a more accurate valuation. Always emphasize that the value is the donor’s responsibility to determine, not the charity’s.

Churches must follow specific guidelines when issuing donation receipts. To comply with tax regulations, ensure receipts contain the necessary information outlined below.

| Information Required | Description |

|---|---|

| Church’s Name and Address | Clearly list the church’s full name, physical address, and contact details. This helps identify the entity receiving the donation. |

| Donor’s Name | The name of the individual or organization making the donation should be included for verification purposes. |

| Donation Amount | State the exact amount donated. If the donation is non-cash, describe the item(s) or property donated. |

| Date of Donation | Indicate the date when the donation was made, to verify the donation’s timing within the tax year. |

| Statement of Goods or Services | If goods or services were provided in exchange for the donation, state their fair value. A donation receipt must indicate if no goods or services were given in return. |

| Tax-Exempt Status | Confirm that the church is a tax-exempt organization by including the church’s federal tax identification number (EIN) or its tax-exempt status details. |

Ensure the receipt is clear and accurate to protect both the donor’s and the church’s tax positions. In some cases, receipts must be issued within a specific timeframe, so make sure to stay up to date with any changes to the regulations.

Tailor your donation receipts to reflect the specific information donors need for year-end reports. Include a detailed breakdown of all donations made throughout the year. This can be done by listing individual contributions with dates and amounts, as well as the total donated amount for the year. Providing these specifics ensures donors have everything they need for tax deductions and financial planning.

Incorporate the organization’s financial year in the receipt to make it easier for donors to match their giving records. Clearly state if donations were tax-deductible, as well as any applicable limits or regulations they should be aware of. Including a brief reminder about the charitable status of the organization can also be helpful.

Make sure to include the organization’s logo and contact information for verification. Adding a thank-you note at the end of the receipt, while keeping it concise, strengthens donor relations. This can be a simple sentence expressing appreciation for their ongoing support, reinforcing the importance of their contribution.

Finally, ensure that all receipts are sent in a timely manner, so donors have the documentation they need for filing taxes. Using an automated system to generate and send receipts will help streamline the process and avoid delays during the busy end-of-year period.

Donation Receipt Guidelines

Ensure the donation receipt includes the donor’s name, donation amount, and the date the donation was made. This ensures transparency and clarity for both the church and the donor.

Key Elements of the Donation Receipt

When drafting the receipt, make sure it clearly states whether the donation was in cash, check, or goods. For in-kind donations, include a description and estimated value, but note that the IRS doesn’t require the church to assess the value of the donation.

Accurate Date and Amount

Be sure the date listed is the actual date the donation was received. The amount should match what the donor gave, ensuring there is no ambiguity.

| Item | Description |

|---|---|

| Donor’s Name | Full name of the individual or entity making the donation |

| Donation Amount | Exact monetary value or estimated value for goods donated |

| Date of Donation | Specific date the donation was received |

Always double-check that all details are accurate before issuing the receipt. A well-documented receipt simplifies record-keeping for both the donor and the church.