Access a free business receipt template that simplifies your transaction tracking. With this template, you can easily document sales, services, or any business exchange while maintaining a professional appearance. It provides space for essential details like the buyer’s information, date, and itemized list of products or services, ensuring clear communication between you and your customers.

Incorporating this template into your routine offers a practical way to streamline your invoicing process without the need for complicated software. Customize it to fit your specific needs and save time while keeping all transaction records organized and accessible.

Ensure your receipts include all the necessary components–such as total amount, taxes, and payment method–to avoid misunderstandings. This simple yet effective solution will help you maintain accurate financial documentation, perfect for future reference or accounting purposes.

Here is the revised version with repetitions minimized:

Design a simple and clear receipt template to ensure your business transactions are well-documented. Focus on including only the necessary information, such as the buyer’s name, items purchased, total price, and payment method. Avoid adding excessive details that might clutter the document.

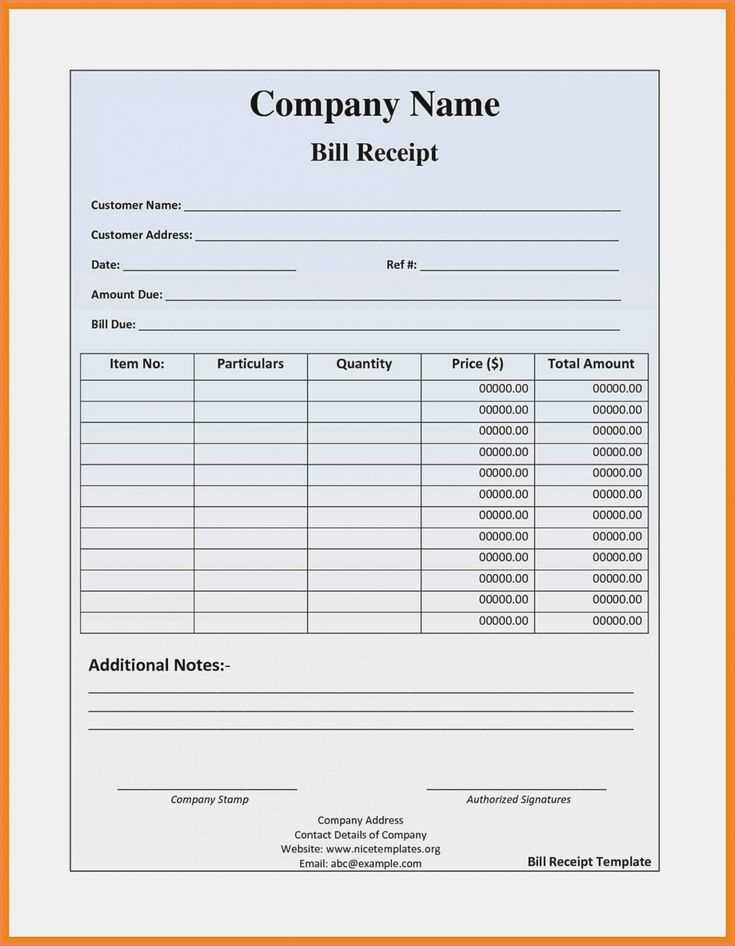

Customize the template to reflect your brand, including your business name, logo, and contact information. Keep the layout organized by using clear headings and separating sections with sufficient spacing. Make sure to use legible fonts and a readable font size.

Include a unique receipt number for each transaction, making it easier to track and reference past purchases. This number should be sequential to maintain consistency. Also, add a field for the date of the transaction to keep your records accurate and up-to-date.

Using a free online template service or a simple word processor is a great way to start. Templates are available in various formats, including PDF and Word, and can be easily modified to suit your specific needs.

- Business Receipt Template Free

Start by downloading a free business receipt template that suits your needs. Choose a format that is simple yet clear, with sections for the company name, address, customer information, purchase details, and the total amount due. Many templates are available in Word, Excel, or PDF formats, ensuring compatibility across various platforms.

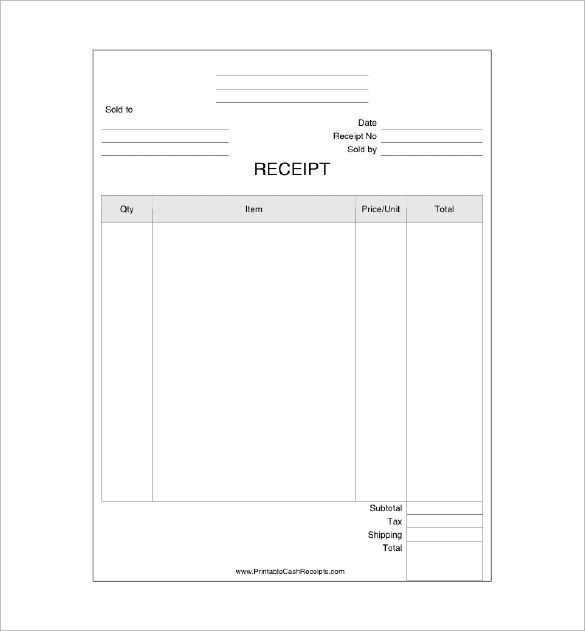

Here’s an example of a basic structure you might include:

| Item | Description | Amount |

|---|---|---|

| Product/Service Name | Short description | $ Amount |

| Subtotal | $ Amount | |

| Tax (if applicable) | $ Amount | |

| Total | $ Total Amount |

Ensure that the receipt includes a unique number for tracking purposes, the date of the transaction, and payment method (e.g., cash, credit card, etc.). If your business is VAT registered, make sure to add the VAT number and apply the correct tax rates.

Don’t forget to include space for a signature or stamp if needed. Adjust the design and layout to reflect your branding, and save the template for future use. This will streamline your invoicing process and maintain consistency in your records.

Follow these steps to download a free business receipt template that fits your needs:

- Search online for trusted sources offering free templates. Websites like Microsoft Office Templates or Template.net often provide reliable options.

- Choose a template that aligns with your business type. Look for templates designed for the specific industry or transaction type you’re handling.

- Review the template’s format and features. Ensure it includes fields such as the receipt number, date, business details, and itemized list of goods or services provided.

- Download the template by clicking the provided link, usually in formats such as .docx, .xls, or .pdf. Most sites will offer a direct download button.

- Save the downloaded file to your computer or cloud storage for easy access whenever you need to create a new receipt.

Customization Tips

- Edit the template to match your business branding. Customize the logo, business name, and contact information to maintain consistency.

- Ensure the fields for item descriptions, pricing, and payment details are clear and appropriately formatted for quick input.

Adjust your business receipt template to match your brand identity and make transactions smoother. Begin with your business logo at the top, ensuring it’s clear and well-positioned. Include the name of your business and contact details so customers can easily reach you if needed.

Incorporating Necessary Fields

Add specific fields such as the date of the transaction, unique receipt number, and a breakdown of items or services purchased. This provides clarity for both the customer and your accounting records.

Choosing the Right Layout

Design your template with easy-to-read sections. Use a clear, legible font and make sure the prices and totals stand out. Group information logically, for example, listing the item description, quantity, unit price, and total price next to each other for simplicity.

| Item | Quantity | Unit Price | Total |

|---|---|---|---|

| Product A | 2 | $10 | $20 |

| Product B | 1 | $15 | $15 |

| Total | $35 | ||

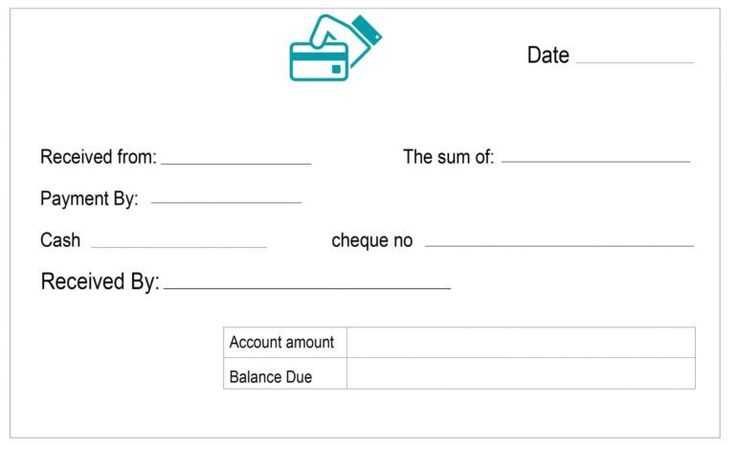

Consider adding a section for payment methods, including cash, credit cards, or digital payments, so customers know exactly how their transaction was processed. This can help build trust in your business practices.

A business receipt should contain clear, concise information to make it easy to understand and validate transactions. Here are the key components to include:

- Business Information: Include the business name, address, and contact details. This ensures customers can reach you if they need to address any concerns.

- Receipt Number: Assign a unique identifier to each receipt. This makes tracking and referencing easier for both your business and the customer.

- Date of Transaction: Indicate the exact date when the purchase occurred. This helps clarify when the goods or services were provided.

- Description of Products or Services: List each item purchased or service provided with a brief description. This prevents any confusion about what was bought.

- Price Breakdown: Show the price of each item or service along with any taxes or discounts applied. Transparency in pricing avoids future misunderstandings.

- Total Amount: Display the final amount due, including all applicable charges and taxes. This is the most important part for the customer’s record.

- Payment Method: Mention whether the payment was made by cash, card, or other methods. This adds clarity to how the transaction was completed.

- Return/Refund Policy: If applicable, briefly mention your business’s return or refund policy. This provides customers with the necessary information if they wish to return goods or request a refund.

Incorporating these components into your receipts ensures a clear, professional transaction record for both you and your customers.

Ensure that your receipts meet local tax requirements. In many regions, receipts must include specific information such as business name, address, contact details, date of transaction, description of goods or services, and the total amount paid. This helps to ensure proper accounting and compliance with tax laws.

Verify that the receipt complies with consumer protection laws. Some jurisdictions may require additional information such as refund policies, terms of sale, and warranty details. Not providing this information may lead to legal disputes or complaints from customers.

Be aware of the retention period for receipts. In many areas, businesses must retain receipts for a certain number of years for tax and legal purposes. Ensure that you store receipts in a secure manner to avoid accidental loss or damage.

Include necessary disclaimers where applicable. For example, if your business operates in a specific industry that requires a disclaimer or warning (such as the sale of certain products), ensure that it is clearly visible on the receipt to protect against legal liability.

Consider electronic receipts. If you offer digital receipts, ensure they comply with privacy and data protection laws. Securely store customer information and provide clear consent options for receiving receipts electronically.

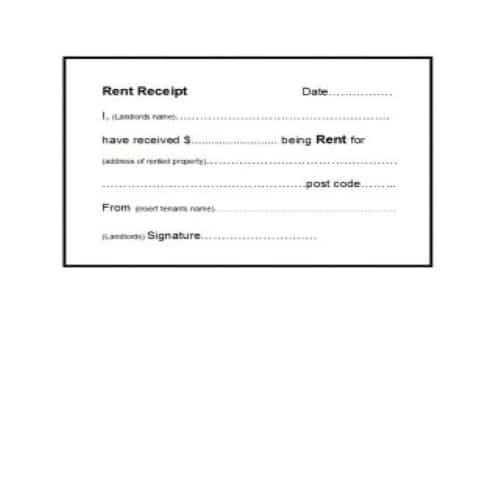

Customize your receipt template for specific transactions by filling in key details relevant to each type. For sales transactions, include the product or service name, price, quantity, and total amount. For rental agreements, add rental period, payment terms, and security deposit if applicable. Adjust the tax rates according to the region where the transaction occurs.

For Services

In service-related transactions, clearly outline the services rendered, duration, and any applicable service fees. Include any discounts or packages applied to make the transaction clearer for both parties. This helps in avoiding confusion and ensures that clients understand the charges fully.

For Product Sales

For product sales, ensure your template contains the item name, quantity sold, price per unit, and applicable taxes. If offering discounts, indicate them clearly and adjust the total accordingly. Including shipping details, if relevant, adds value to the receipt and enhances transparency.

Use receipt templates to streamline your workflow and eliminate the need for repetitive data entry. Automating the receipt process saves time and ensures consistency in the details captured. With templates, you only need to input the specific transaction data, and everything else, from format to required fields, is ready to go.

Choose a template that matches your business needs. Simple templates might include basic fields like date, item description, and amount, while more advanced versions can also handle taxes, discounts, and payment methods. Select one that suits your type of business.

Set up an automated system where templates integrate directly with your accounting or sales software. This will reduce manual data input, minimize errors, and streamline your process significantly. Make sure the template allows for quick updates to reflect changes like tax rates or invoice numbering.

Customization is key. Adjust your templates to include company branding, return policies, and other relevant details that give the receipt a professional appearance. This can be done easily in most receipt-generation software or through simple document editing tools.

Save your templates. Once you have a format that works for your business, save it and use it repeatedly. This ensures uniformity and prevents wasting time creating new receipts from scratch each time.

To create a business receipt template, ensure it contains all necessary details in a clear format. The following list covers the key elements for an effective template:

- Business Information: Include your business name, address, and contact details at the top of the receipt.

- Customer Information: List the customer’s name, address, and contact information if applicable.

- Receipt Number: Assign a unique receipt number for tracking purposes.

- Transaction Date: Specify the date of the transaction for accurate record-keeping.

- Itemized List: Clearly list the products or services purchased, along with their prices and quantities.

- Taxes and Discounts: Show applicable taxes and any discounts applied to the total amount.

- Total Amount: Include the total amount due, including taxes and any additional fees.

- Payment Method: Indicate the method of payment (e.g., cash, card, online payment).

- Terms and Conditions: Add any relevant terms, such as return policies or warranties, if necessary.

By structuring the receipt with these components, your template will be both practical and professional. Adjust the layout based on your brand’s preferences, but ensure consistency in information for easy tracking and reference.