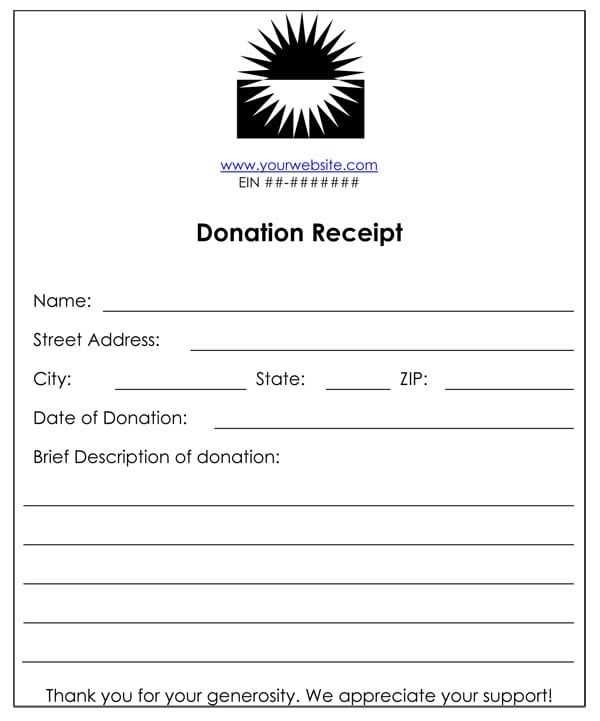

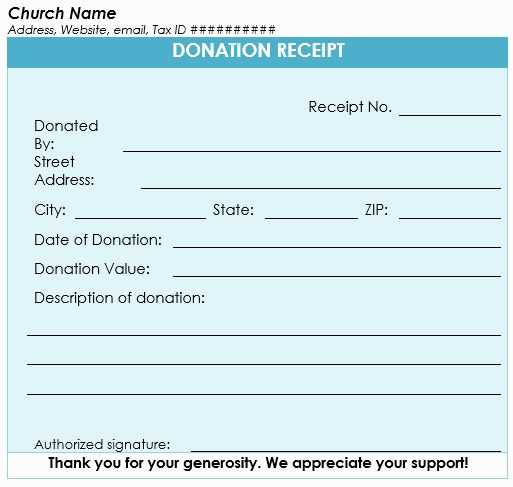

Creating a Simple and Clear Template

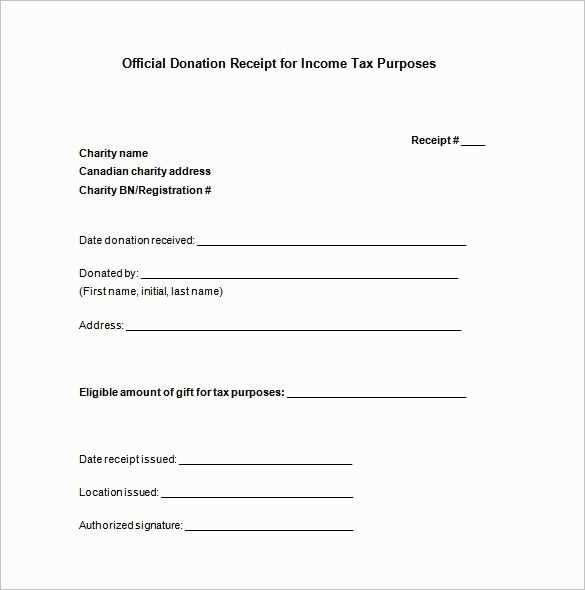

Design a food donation receipt template with clear fields for essential details. Include the name of the organization receiving the donation, the donor’s name, and the date of the donation. A brief description of the food donated, including the quantity or weight, ensures transparency. Add the donor’s contact information for future references.

Key Fields to Include

- Organization Name: The name of the entity receiving the donation.

- Donor Name: The name of the person or group making the donation.

- Date of Donation: Specify the date the donation is made.

- List of Donated Items: Include the food items with details like quantity, weight, or volume.

- Value of Donation: If possible, assign a fair market value to the donation. This may be helpful for tax purposes.

- Organization Signature: A space for the receiving organization to sign, acknowledging the donation.

Formatting and Accessibility

Keep the design straightforward. Use a clean font and clear layout to ensure readability. The receipt should be easy to fill out and print. A PDF format works well for providing both a physical copy and a digital version. Make sure it’s downloadable, enabling both donors and organizations to store a copy for record-keeping.

Why Use a Template?

A standardized template streamlines the donation process, making it easier to track donations and issue receipts consistently. This helps both the donor and the organization keep accurate records. When donors need receipts for tax deductions, the template ensures they have all the required details.

Food Donation Receipt Template PDF: A Comprehensive Guide

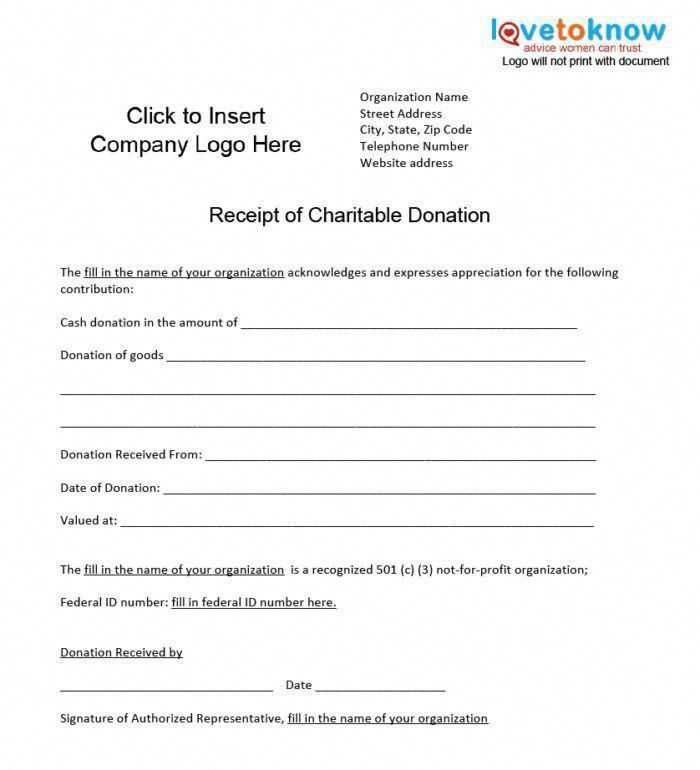

Creating a donation receipt template in PDF format simplifies record-keeping and ensures that all necessary details are included. The receipt should be clear, concise, and legally compliant. Below are key steps and elements for developing an effective donation receipt template.

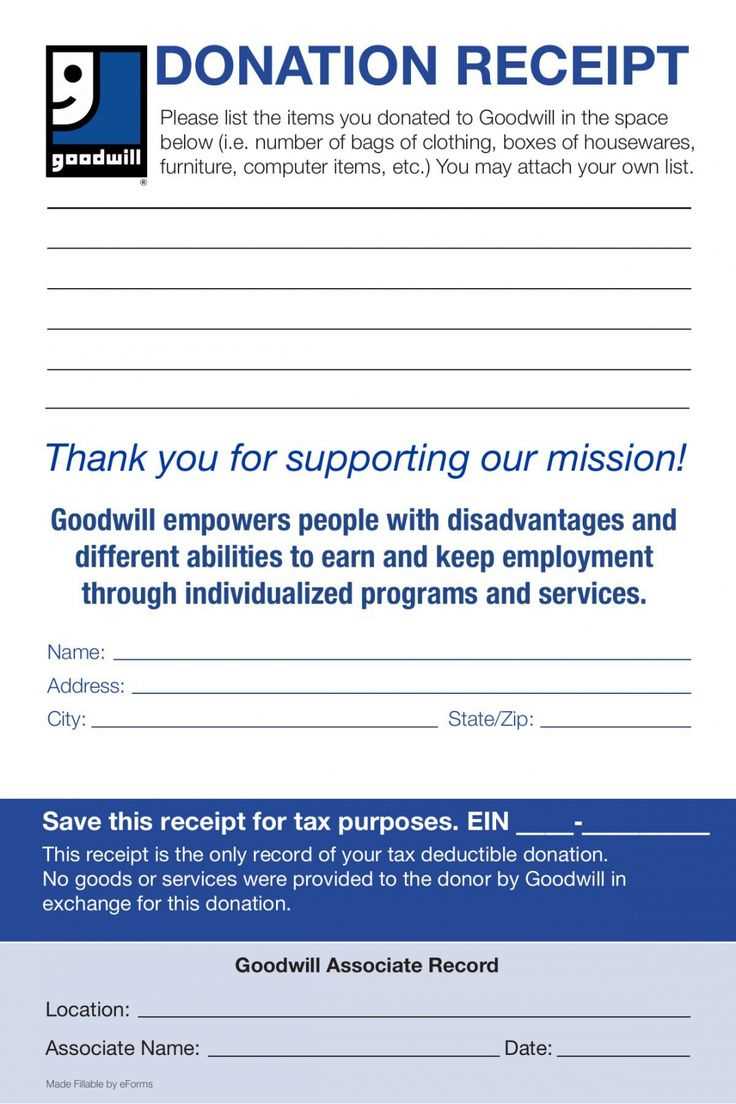

Understanding the Purpose of a Donation Receipt

A donation receipt serves as proof of donation for the giver, allowing them to claim tax deductions. It also provides the recipient organization with a record of contributions. Make sure the template includes details that validate the donation, including the donor’s information, the value of the donation, and the purpose for which the donation was made.

Key Elements to Include in a Donation Receipt

- Donor’s Information: Include the donor’s name and address.

- Organization’s Details: Provide the name, address, and tax-exempt status of the organization.

- Date of Donation: Specify the exact date the donation was received.

- Description of Donated Items: List the items donated. If it’s food, detail the type and quantity.

- Estimated Value: Include an estimate of the donation’s value. For non-cash donations, a qualified appraiser may be necessary.

- Statement of Non-Exchange: Clearly state that no goods or services were provided in exchange for the donation.

- Signature: Sign the receipt to confirm authenticity.

How to Create a Template for a Donation Receipt in PDF

To create a donation receipt template, use PDF software or online tools that allow customization. Start with a standard layout that includes all the necessary fields. Make sure to leave space for the donor’s information and donation details. Include a clean, professional design to enhance readability.

Once the template is complete, save it as a PDF to ensure that the format remains consistent for all users. This makes the template easy to distribute and print for both the donor and the receiving organization.

Legal Considerations When Issuing a Donation Receipt

Ensure that the receipt includes accurate information, as incorrect details could lead to issues with tax deductions. Depending on the donation type, some countries may require specific information or language to meet tax reporting requirements. Always stay informed about local tax laws and regulations that apply to donations.

Best Practices for Storing and Managing Receipts

- Organize Records: Keep a well-organized database of receipts for easy retrieval.

- Secure Digital Storage: Store PDF receipts in a secure, encrypted system to prevent unauthorized access.

- Backup Copies: Regularly back up records to avoid data loss.

Common Mistakes to Avoid When Using a Donation Receipt Template

- Incomplete Information: Failing to include all necessary details, such as the donor’s information or the value of the donation, can invalidate the receipt.

- Incorrect Valuations: Incorrectly estimating the value of non-cash donations can lead to tax issues.

- Failure to Update Templates: Make sure the template is regularly updated to reflect any changes in tax laws or organizational details.