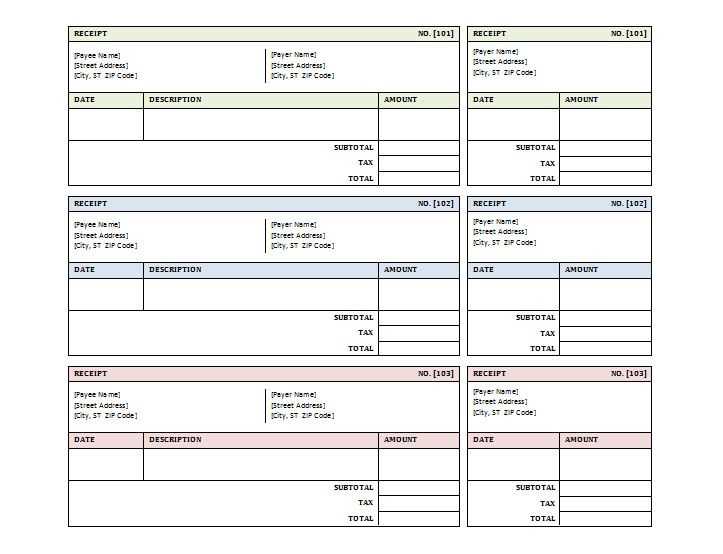

Use an online receipt template to create professional, consistent documents with minimal effort. By selecting the right template, you can generate a receipt in seconds, saving time and ensuring accuracy in your transactions.

Many online platforms offer customizable receipt templates that cater to various business needs. Choose one that fits your business model, whether you’re dealing with retail sales, services, or freelance work. With a few simple edits, you can personalize the receipt by adding your logo, contact details, and any other relevant information.

One key benefit of using a receipt template is the ability to streamline your invoicing process. You won’t need to manually format each receipt, reducing the chances of errors and increasing your workflow efficiency. Additionally, online templates can help ensure that all necessary legal details are included, providing clarity and transparency for both you and your clients.

Here’s the updated version:

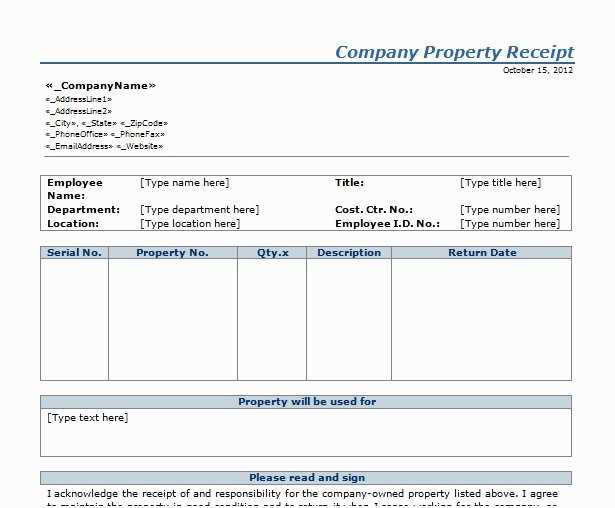

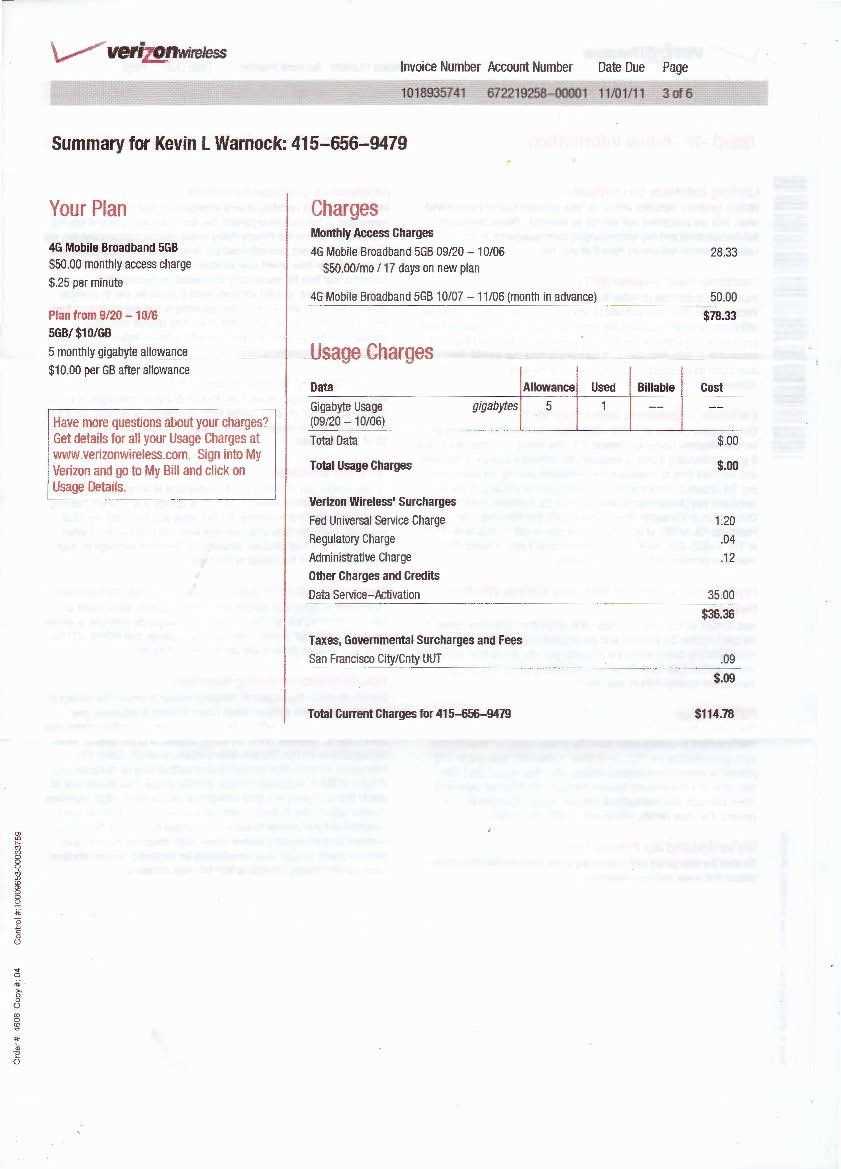

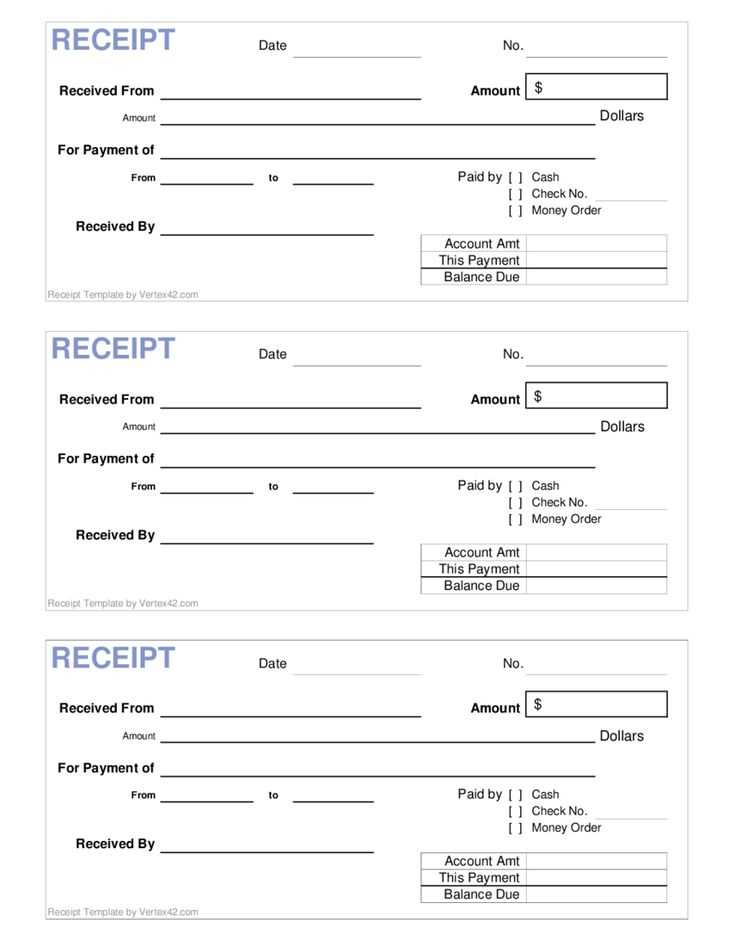

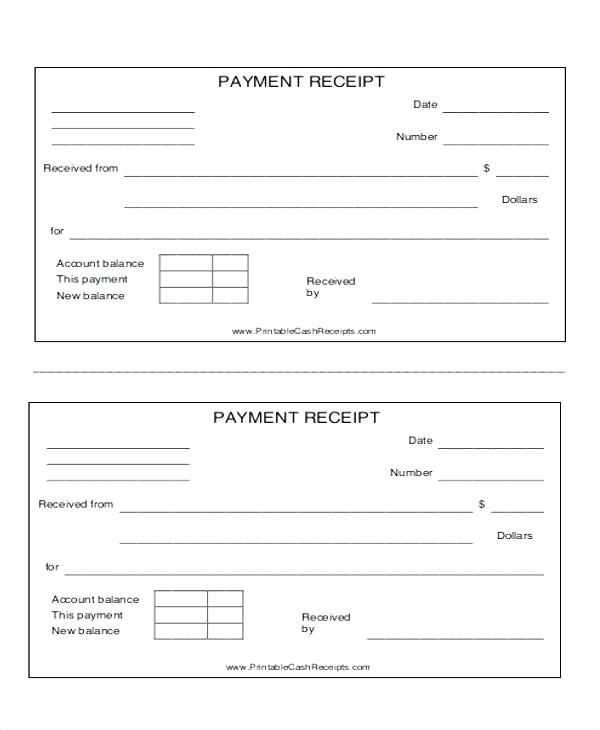

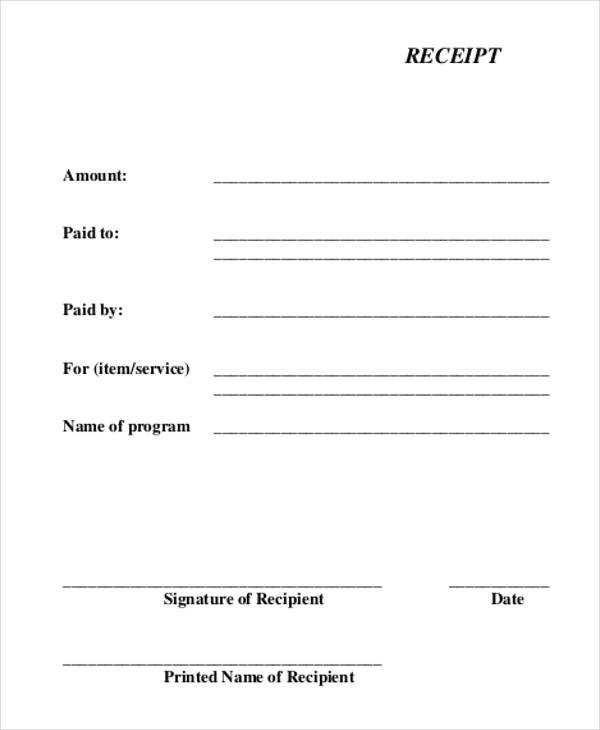

Make sure the receipt template includes all relevant information: business name, address, contact details, and tax identification number. Ensure that each line item is clearly labeled with descriptions, quantities, unit prices, and total amounts. Avoid clutter by only adding the necessary details, and make sure the layout is easy to read with enough spacing between sections.

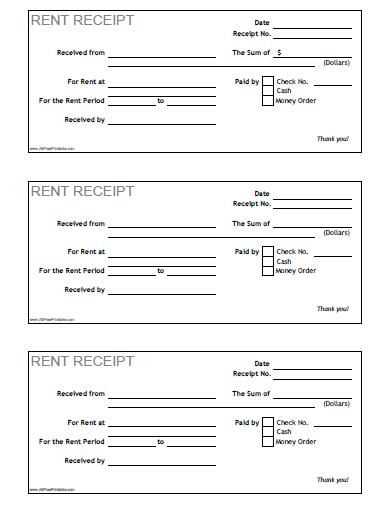

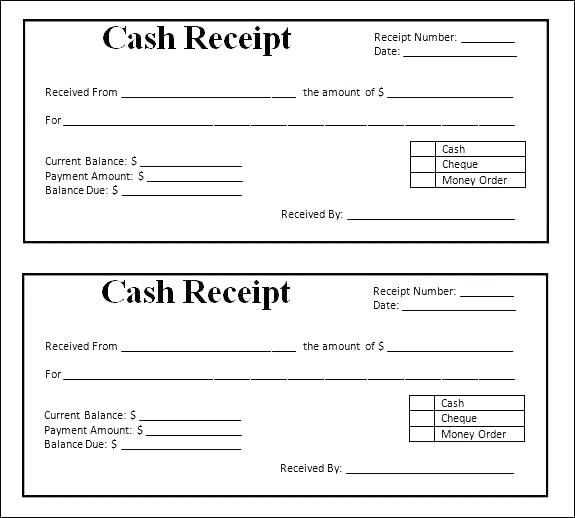

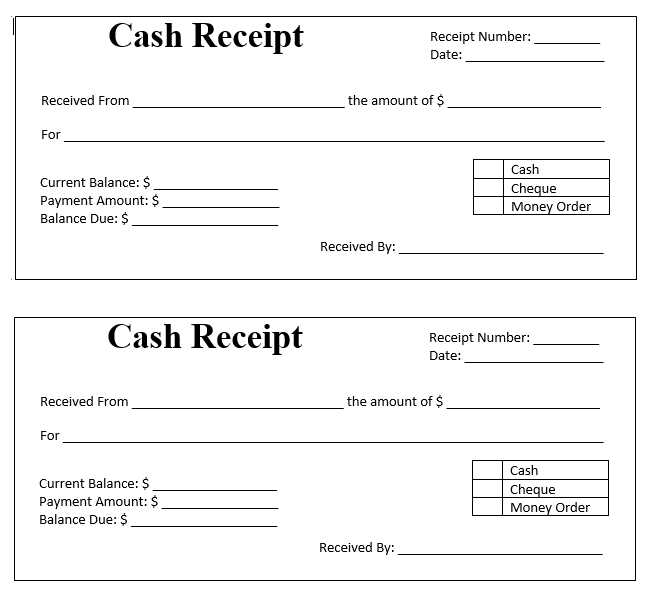

Include Payment Methods

Clearly state the method of payment, whether it’s cash, card, or another form. This can help both parties track the transaction accurately.

Offer a Simple Refund Policy

Provide a concise refund or return policy on the receipt. This should include any conditions that apply, ensuring transparency in case of disputes.

Receipt Template Online

How to Choose the Right Template for Your Business

Customizing Templates for Different Payment Methods

How to Add Important Business Details to a Template

Ensuring Legal Compliance in Online Receipts

Best Practices for Organizing and Storing Digital Records

Integrating Templates with Accounting Software

Start by choosing a receipt template that aligns with your business type. A retail store might need a simpler design, while a service-based business may benefit from detailed templates that include hours worked or services rendered. Look for templates that allow for flexibility in both design and functionality to match your brand identity and business needs.

Customizing for payment methods helps provide clarity to your customers. If you accept multiple payment options like credit cards, cash, or digital wallets, make sure the template includes fields for payment types. You might need separate lines for transaction IDs or authorization codes for credit card payments, while a “paid by cash” field can simplify cash payments.

Always include key business details on your receipts. Include your business name, address, phone number, and tax identification number. This builds trust and ensures transparency. If you’re a VAT-registered business, ensure the template has a space for VAT amounts. Also, if applicable, add your website URL for customer reference.

Legal compliance varies by location, so check your local regulations. Some jurisdictions may require specific information on receipts, like sales tax breakdowns or refunds policies. Always stay updated with your country’s tax rules and consumer protection laws to avoid legal issues.

For organizing and storing digital records, ensure that all receipts are stored in an easily accessible but secure digital format. Cloud storage is a practical solution, offering flexibility in access while keeping your documents safe. Regular backups can prevent data loss, and organizing receipts by date or transaction type will save time when retrieving them later.

Integrating receipt templates with accounting software can save time and reduce errors. Many software programs allow you to directly import digital receipts or link them with transactions, making accounting and tax filing much easier. Ensure that your chosen receipt template is compatible with your software to maintain a streamlined process.