If you need a clear and reliable way to document payment for services, using a receipt template is a practical solution. This document serves as proof of payment, helping both parties keep accurate records. Be sure to include key details such as the name of the payer and payee, the amount paid, the date of the transaction, and a brief description of the service provided. You can personalize it further by adding any terms or conditions agreed upon.

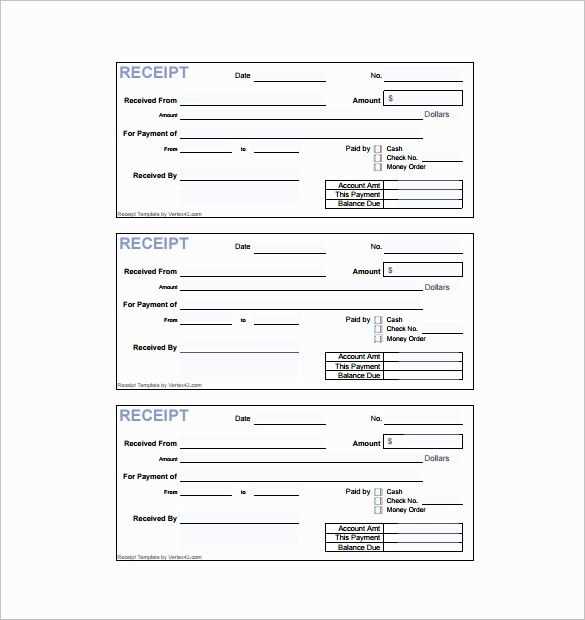

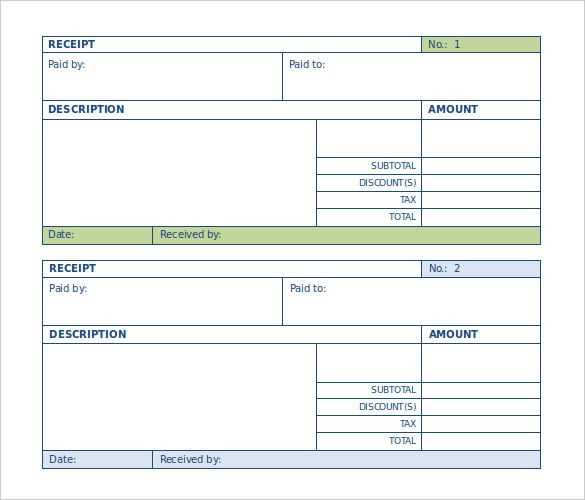

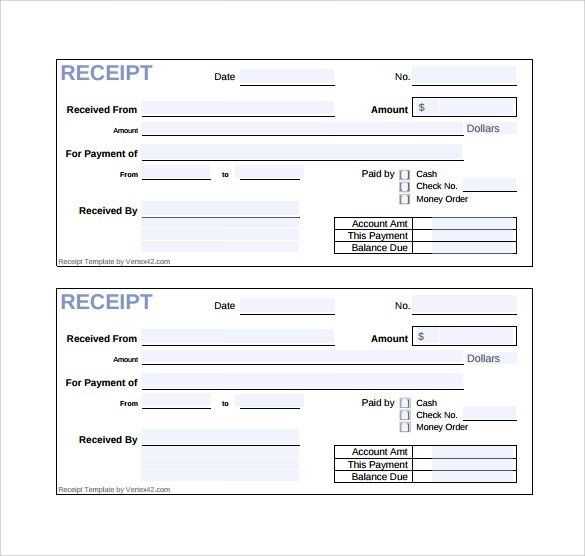

When creating or selecting a template for paid work, ensure it is easy to fill out and professional in appearance. A simple layout with clearly defined sections for payment details, service description, and contact information will make the receipt effective and straightforward. You may also want to include a unique receipt number for better tracking.

Always double-check that the date and payment amount match your records before issuing the receipt. Keep a copy for your own records, and consider providing the payer with a printed or electronic version as appropriate. This will help in case of any disputes or future reference needs.

Here are the corrected lines where words do not repeat more than two or three times:

To ensure clarity and avoid redundancy, focus on keeping sentences concise. In formal documents like a payment receipt, simplicity matters. For example, consider reducing repetitive terms in descriptions and breaking up overly long sentences. Use specific terms instead of general ones to convey information directly. Each line should serve a distinct purpose without unnecessary elaboration.

Examples of Optimized Lines

| Before | After |

|---|---|

| “The payment for the work performed was paid on the date provided in the agreement.” | “Payment was made on the agreed date.” |

| “The receipt for the payment made reflects the amount paid and the service rendered.” | “This receipt shows the payment amount and service provided.” |

| “The payment is for the work done according to the terms mentioned in the receipt.” | “Payment corresponds to the work as per the receipt’s terms.” |

These changes eliminate unnecessary word repetition while maintaining the original meaning. This makes the text clearer and more professional.

- Receipt for Paid Work Template

For a clear and organized record of completed work and payments, include these elements in the receipt:

Work Details

Describe the nature of the work completed. Include the start and end dates of the project, along with any specific tasks or services provided. This will help both parties track the scope of work.

Payment Information

State the amount paid for the work. If applicable, break the payment down into categories, such as labor, materials, or other charges. Provide clarity on the total amount due and received.

Payment Method

Note the method of payment, whether it was by cash, cheque, bank transfer, or other means. This step confirms the payment transaction was completed successfully.

Receipt Date

Include the exact date the payment was received. This is an important detail for record-keeping and verification.

Signatures

Both parties should sign the receipt. This serves as mutual acknowledgment that the payment was made for the work performed.

These details ensure the receipt is thorough and serves as an accurate reflection of the transaction between the worker and employer.

Begin by clearly stating the receipt’s title, such as “Receipt for Paid Work” or “Work Payment Receipt,” at the top of the document. This sets the purpose right away.

- Date of Transaction: Include the exact date the payment was made to ensure clarity regarding the timing of the transaction.

- Work Description: Provide a brief but precise description of the work performed. This section should cover the task completed and the relevant hours worked, if applicable.

- Amount Paid: Clearly state the total payment received. It’s helpful to break down the amount if there are multiple services or tasks.

- Payment Method: Mention how the payment was made, whether via cash, bank transfer, or another method. This adds transparency to the transaction.

- Receiver’s Information: Include the name, contact details, and any other identifying information of the person receiving payment.

- Issuer’s Information: List the name and contact details of the person or company issuing the receipt. This ensures both parties can be reached if necessary.

- Signature: Add space for signatures from both the worker and the person making the payment. This formalizes the receipt.

Ensure the receipt is easy to read and organized. A structured layout helps both parties understand the terms and amounts quickly.

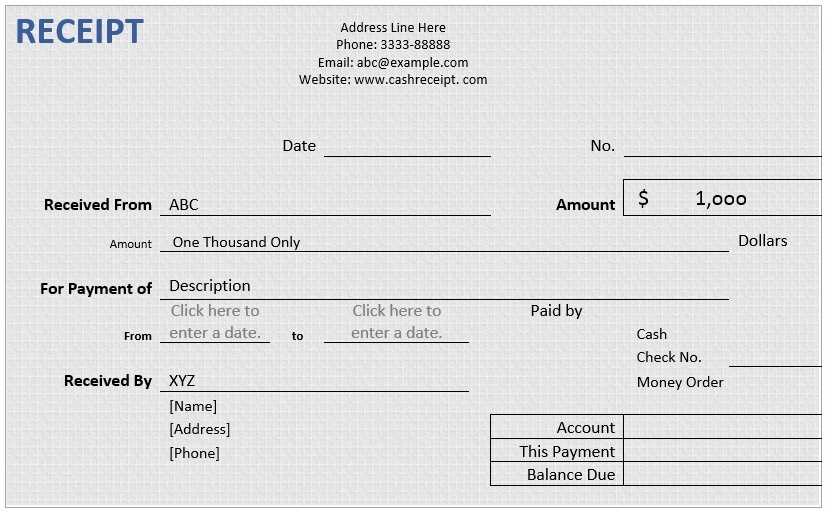

Begin with the date of payment and the name of the person or company making the payment. This ensures clarity about the transaction’s timing. Next, include the total amount paid along with a breakdown, if applicable, of any taxes, fees, or deductions that were applied. This transparency helps avoid confusion in the future.

Provide a clear description of the work completed, specifying the type of services provided. If the payment is for a specific project or task, detail what was delivered to ensure both parties are on the same page.

Include the payment method, whether it was by check, bank transfer, cash, or other means. If a payment reference or transaction ID exists, make sure it’s included for tracking purposes.

Lastly, include contact information for both parties, ensuring that any follow-up or queries can be addressed without delay. This provides a point of contact in case further clarification is needed.

Opt for a clean, straightforward layout for your payment receipt. Include key details such as the payer’s name, payment amount, date, and method. A simple, structured format enhances readability and ensures all necessary information is captured. Avoid cluttering the receipt with unnecessary elements that don’t directly relate to the transaction.

If you’re creating a receipt for digital or online payments, ensure compatibility with various devices and platforms. A PDF format works well, offering clear presentation and easy sharing. If a physical receipt is required, consider providing both a printed version and a digital backup for convenience.

Always ensure the receipt is easily retrievable and editable for future reference, particularly when dealing with recurring payments or large transactions. Keeping the format consistent helps both parties stay organized and prevents confusion in case of follow-up questions.

Provide a payment acknowledgment immediately after receiving payment for services rendered. This helps establish clear documentation of the transaction and ensures transparency between both parties. A prompt acknowledgment confirms that the work is complete and the agreed amount has been received, preventing any future disputes.

Before Delivering Final Products

If the payment is made prior to final delivery (e.g., after project completion), issue the acknowledgment right after receiving funds, especially if the payment was made in advance or in stages. This confirms your receipt and signals that the project is progressing as agreed.

For Partial Payments

In cases where clients make partial payments throughout a project, send an acknowledgment after each installment. This ensures that both you and the client are on the same page regarding the financial status of the work. Clear records of payments made can prevent confusion later on.

When paying for services, it’s crucial to understand the payment methods and how to document them accurately. Below are the most common payment methods and tips for proper documentation:

Cash Payments

For cash transactions, provide a written receipt stating the amount received, date, and the payer’s details. The recipient should sign the receipt to confirm the transaction. Keep a copy for your records, ensuring both parties have proof of the exchange.

Bank Transfers

Bank transfers require detailed documentation, including the transfer reference number, date, and bank account information. A digital or printed receipt from the bank should be provided, confirming the payment. Ensure that both the sender’s and receiver’s details are accurately recorded.

Cheque Payments

For cheque payments, issue a receipt that includes the cheque number, date, and payment amount. The receipt should also indicate whether the cheque has cleared, particularly if there is a delay in processing. Keep a copy of the cheque and transaction details for your records.

Online Payment Methods

Online payments, such as those made through PayPal or other platforms, require receipts provided by the payment system. These receipts typically include transaction IDs, payer details, and payment confirmation. Print or save these receipts for accurate documentation.

When issuing payment receipts, businesses must comply with local regulations, which vary across regions. The receipt should clearly state the nature of the work, the amount paid, and both parties’ identifying details, including the employer’s or payer’s tax identification number if required. Ensure the payment date is listed accurately, as some jurisdictions mandate receipts to reflect specific timeframes for record-keeping and tax purposes.

North America

In the United States, the IRS requires businesses to provide clear documentation of transactions for tax filing. While not always mandatory for small transactions, providing a receipt is recommended for businesses. Canada follows similar guidelines, with additional rules in provinces like Quebec, where receipts must include GST/HST numbers if applicable.

Europe

European Union member states require payment receipts for tax purposes, with each country having its own rules about information included. In countries like Germany, a receipt must include both the gross and net amount, VAT rate, and the payer’s details. In the UK, a receipt must be issued for all business transactions over a certain value for VAT reporting purposes.

To create a well-organized receipt for paid work, focus on including key information that ensures clarity and accuracy. Follow these steps:

- Receiver’s Information: Include the name and contact details of the person or company receiving payment.

- Payer’s Details: Provide the name and contact information of the person or company making the payment.

- Service Description: Clearly list the work done, including any relevant details such as hours worked or tasks completed.

- Payment Amount: Specify the exact amount paid, along with the payment method (e.g., cash, bank transfer, check).

- Date of Transaction: Include the date the payment was made.

- Receipt Number: Add a unique identifier for the transaction for future reference.

- Signature: Leave space for both parties to sign, confirming the transaction.

By following this format, both parties have a clear record of the transaction that can be referred to if needed.