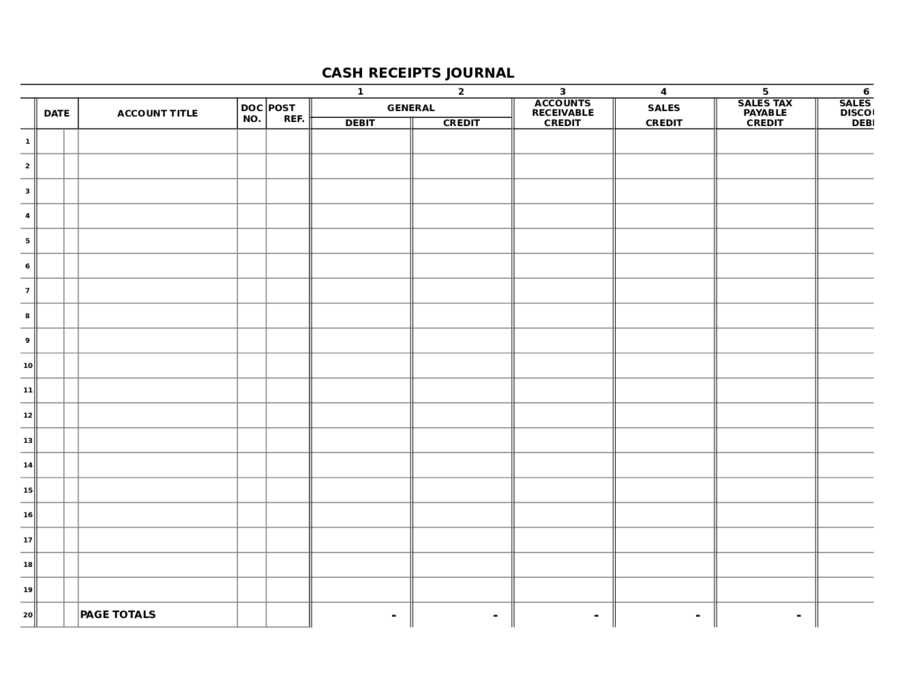

A well-organized cash receipt journal can simplify your accounting process, ensuring you stay on top of your income. By using a monthly template, you can record every cash transaction in a consistent manner. This will help you track receipts efficiently, monitor cash flow, and avoid any discrepancies in your financial records.

The template typically includes columns for the date, description, account reference, and the total amount received. It also allows you to specify payment methods and categorize income sources, which makes it easier to generate financial reports later on. With a clear and structured format, it’s easier to spot trends and assess your monthly financial performance.

Make it a habit to enter your receipts daily to avoid backlogs. You can further enhance the template by adding a column for notes, where you can clarify any unique transactions or agreements. This will give you a better overview and help when preparing for tax season or audits.

Here’s the corrected version:

To ensure accuracy and clarity in your monthly cash receipt journal, follow these key guidelines:

Structure and Organization

The journal should be divided into clear sections, including the date of receipt, payer’s name, payment method, and amount received. Each entry must be recorded sequentially for easy reference.

Essential Data Fields

- Date: The exact date the cash was received.

- Payer’s Information: Name or business of the person making the payment.

- Payment Method: Specify whether it’s cash, check, or electronic transfer.

- Amount: Ensure the exact amount is recorded in both numeric and written forms.

- Invoice Number/Reference: Link the payment to any relevant invoices or contracts.

Maintaining these sections ensures transparency and prevents discrepancies when reviewing financial records.

Tips for Maintaining Accuracy

- Always double-check amounts before recording to avoid errors.

- Update the journal regularly to avoid backlogs.

- Cross-reference with bank statements at the end of each month to verify receipts.

By following this format, you’ll streamline your monthly cash receipt process and minimize the chances of errors.

- Monthly Cash Receipt Journal Template

A monthly cash receipt journal helps track all incoming payments for your business in a simple, organized format. Use the following template to record each payment transaction accurately. This method ensures you never miss a detail when reconciling your cash flow at the end of the month.

| Date | Receipt Number | Customer Name | Description | Amount | Account Debited |

|---|---|---|---|---|---|

| 01/05/2025 | 001 | John Doe | Payment for Invoice #1234 | $500.00 | Cash Account |

| 01/10/2025 | 002 | Jane Smith | Payment for Invoice #1235 | $300.00 | Cash Account |

| 01/15/2025 | 003 | ABC Corp | Payment for Service Contract | $1,000.00 | Cash Account |

This journal format is ideal for small businesses that receive frequent cash payments. Ensure that every entry is recorded clearly and consistently to prevent errors during financial reviews. By tracking each receipt, you can easily monitor your cash inflows, improve budgeting accuracy, and keep a solid financial record for the business.

Organize your journal with clearly defined columns that track key information. Start with the date of receipt, followed by the payer’s name, amount received, payment method, and the purpose or description of the payment. This format ensures you capture all the necessary details without redundancy.

1. Date: List each transaction with its specific date to maintain a clear timeline of receipts.

2. Payer Information: Record the payer’s full name or business name to easily identify the source of the payment.

3. Amount: Ensure you list the exact amount received in the correct currency, keeping consistency throughout the month.

4. Payment Method: Specify whether the payment was made by cash, check, credit card, or another method for transparency and future reference.

5. Purpose/Description: Write a brief note explaining the reason for the receipt (e.g., sale, deposit, service fee) to keep track of your income sources.

Finally, reserve a section for monthly totals at the bottom of the journal. Add up all receipts and check the total against your bank statement or cash flow records to ensure accuracy. Keep your entries up-to-date and review them periodically to catch any discrepancies early.

Select a format that aligns with your workflow and provides clear, organized data. A simple spreadsheet can be sufficient for most small businesses, offering flexibility and ease of use. Ensure that the layout includes clear columns for date, description, amount, and method of payment to avoid confusion. If you expect to handle larger volumes of transactions, consider software that automates entries or integrates with other financial tools. This approach can save time and reduce errors in the long run.

Keep in mind that the format should be adaptable, especially if you plan to scale your business. Structured templates with predefined fields offer consistency and help maintain clarity. A digital format allows for easy updates and storage, minimizing the risk of losing records. Focus on making the template user-friendly so it’s easy to enter data, track progress, and analyze trends quickly.

Each monthly cash receipt journal template should include a set of columns that allow for clear, organized tracking of transactions. A few key columns will help streamline recordkeeping and ensure accuracy in your financial logs.

Date

Include a column for the transaction date to easily track when each payment was received. This helps with sorting and ensures the proper recording of transactions within the correct time frame.

Receipt Number

Assign a unique receipt number to each transaction for reference and tracking purposes. This is crucial for cross-referencing with bank statements or accounting software and reduces the likelihood of errors.

Payer Name

A column for the payer’s name ensures that you can identify who made the payment. This is important for keeping accurate records and resolving any discrepancies that might arise later.

Payment Amount

Track the exact amount received in a separate column. This enables quick verification and comparison with other records, such as invoices or contracts.

Payment Method

Include a column for the method of payment, whether cash, check, credit, or debit. This adds clarity on how the payment was made and can be useful when reconciling cash flow.

Description

Provide space for brief notes or a description of the payment, such as the purpose or invoice number. This extra context helps clarify the nature of the transaction without needing to look up additional details.

Account Reference

If applicable, include a column for the account number or reference code related to the transaction. This helps ensure that receipts are tied to the correct financial account and simplifies audits or reconciliations.

Track cash inflows and outflows accurately by maintaining a monthly cash receipt journal. This helps you stay on top of all financial transactions and ensures your records are complete and up to date. Begin by documenting each transaction immediately as it occurs, including the date, source, amount, and purpose. This will provide a clear picture of how funds move in and out of your business, making it easier to spot any discrepancies or patterns.

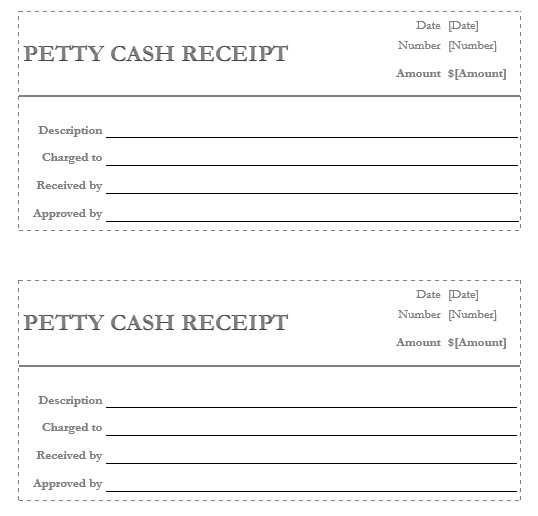

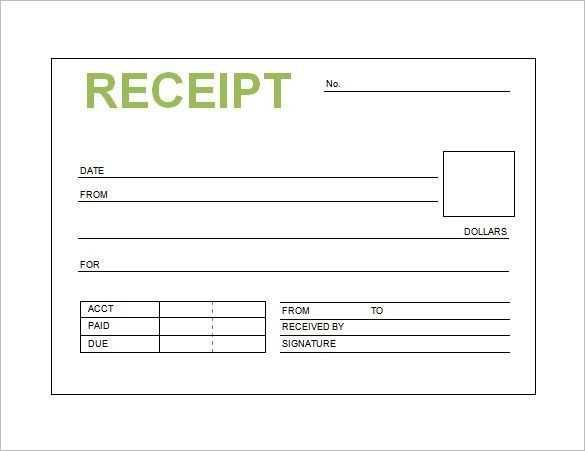

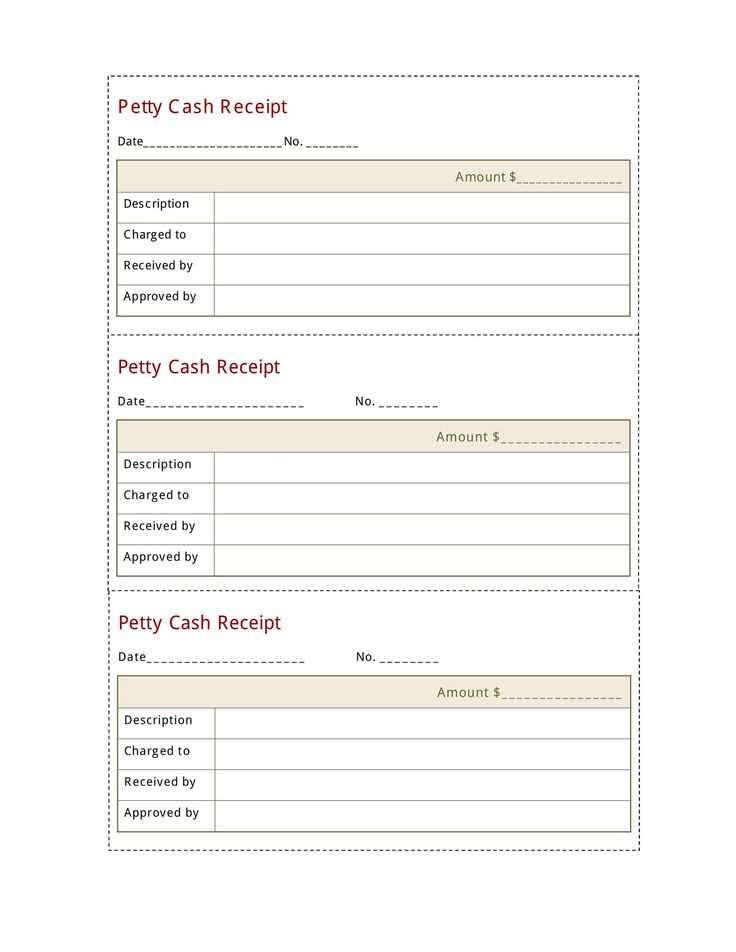

Documenting Each Cash Receipt

For each cash receipt, record the payer’s name, the amount received, and any relevant notes about the transaction. This ensures that you capture all the necessary details for future reference. Assign a unique transaction number to each entry, which will help with tracking and organizing the entries for reporting or auditing purposes.

Analyzing the Cash Flow

Regularly review your journal to identify trends in cash receipts. Look for fluctuations in income or payments that could affect the overall financial health of your business. Tracking funds in this manner provides insight into the consistency and timing of cash flow, allowing you to forecast future needs and adjust accordingly.

To streamline your accounting process, set up automated entries for regular transactions. Begin by identifying repetitive transactions such as monthly rent, utility bills, or subscription fees. Automating these entries reduces the risk of errors and saves time. Below are the steps to establish automated entries:

1. Choose an Accounting Software

Pick a software that supports automated transactions. Most modern tools offer templates for recurring entries. Ensure that the software integrates well with your bank accounts for smooth data syncing.

2. Create Recurring Entry Templates

- Input the transaction details like date, amount, account to be credited, and account to be debited.

- Assign the frequency: daily, weekly, monthly, or annually, depending on the type of transaction.

- Set a start and end date for each recurring entry to match the exact payment schedule.

3. Review and Test Automated Entries

Once the templates are set, review them to ensure the details are accurate. Run a few test entries to verify that they are automatically entered into the records without manual intervention. Check that the amounts and dates are correct before going live.

4. Monitor Regularly

Although automation reduces manual work, you still need to monitor the entries periodically. Ensure that any changes, like rate adjustments or account number changes, are updated promptly in your system.

Begin by reviewing the total cash receipts for each month and comparing them to previous months. Look for noticeable patterns in income sources, such as consistent payments from regular clients or fluctuations in seasonal transactions.

Identify Trends and Patterns

Track increases or decreases in cash inflows and investigate the reasons behind them. For example, check if specific events, promotions, or new customer segments are influencing cash flow. Regularly monitor for periods of lower cash receipts and pinpoint potential causes, such as delayed payments or client attrition.

Assess Cash Flow Consistency

Examine how steady the cash receipts are each month. Consistency helps with forecasting future receipts and managing operational expenses. If receipts are highly irregular, it might be necessary to implement stricter invoicing procedures or explore alternative revenue streams.

Evaluate the effectiveness of your collection processes. Are there delays in payments or missed invoicing opportunities? Streamlining collections could help improve cash flow stability. Keep an eye on aging receivables and address overdue payments quickly to maintain a healthy cash position.

To ensure accuracy and consistency in tracking cash receipts, create a template that organizes the essential data clearly. Each entry should include the date of receipt, the payer’s name, the amount received, and the method of payment (check, cash, or electronic). Be sure to leave space for additional notes or references if needed.

Key Columns for the Template

The template should have the following columns:

- Date: Record the exact date when the receipt was made.

- Payer Name: Include the name of the individual or company providing the payment.

- Receipt Number: Assign a unique receipt number for easy tracking.

- Amount Received: List the amount of money received in the transaction.

- Payment Method: Specify how the payment was made (cash, check, or electronic transfer).

- Notes: Leave space for additional comments or references, such as invoice numbers or special instructions.

Formatting Tips

Ensure the template is clear and easy to fill out. Use consistent fonts and ensure that columns are wide enough to fit all necessary information without cluttering the page. Consider color-coding or adding shading to separate each entry for better readability.