Provide a clear and detailed rental deposit receipt to avoid misunderstandings between landlords and tenants. A proper receipt outlines the amount paid, the property rented, and both parties’ responsibilities. The receipt should include essential information such as the tenant’s name, rental property’s address, and the date of payment.

Ensure the document includes the exact rental deposit amount and specify whether it’s refundable. A receipt also serves as proof of payment, protecting both parties in case of disputes. To create a well-organized template, include spaces for the tenant’s signature, the landlord’s signature, and any relevant comments about the deposit conditions.

Make it easy for tenants to understand the terms of the deposit by including clear language. Additionally, you can provide a section for itemized deductions if applicable, such as damages or unpaid utilities, to avoid confusion about future returns. Stay transparent with your rental deposit receipts to build trust and ensure smooth transactions.

Here’s the revised version:

Make sure to include the following elements in your rental deposit receipt to ensure clarity and avoid disputes:

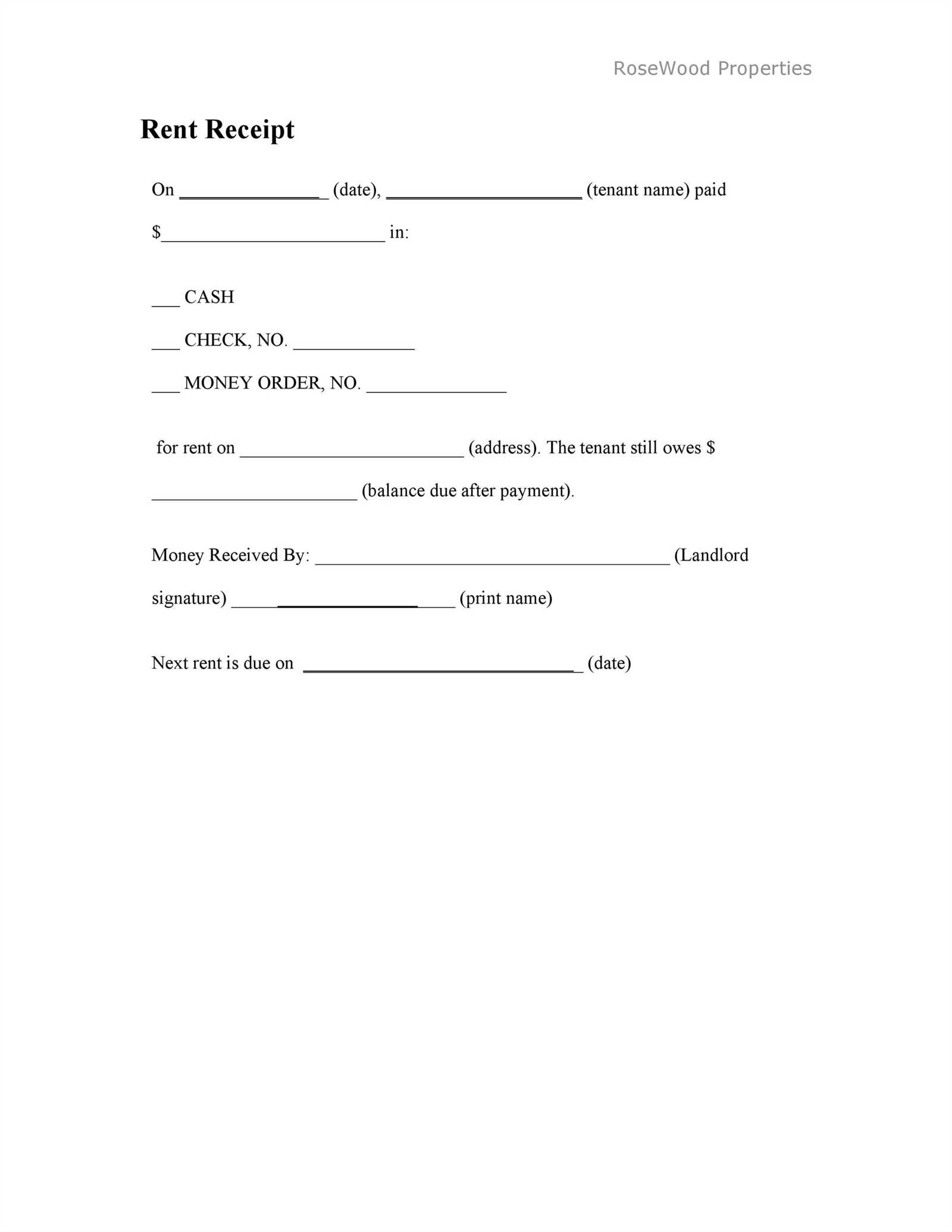

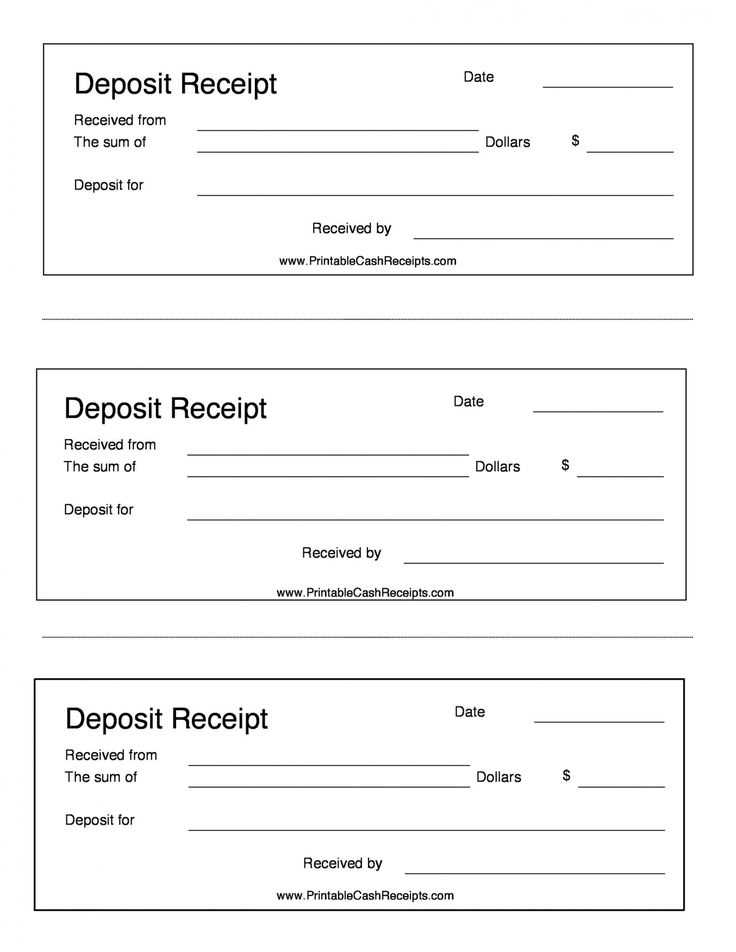

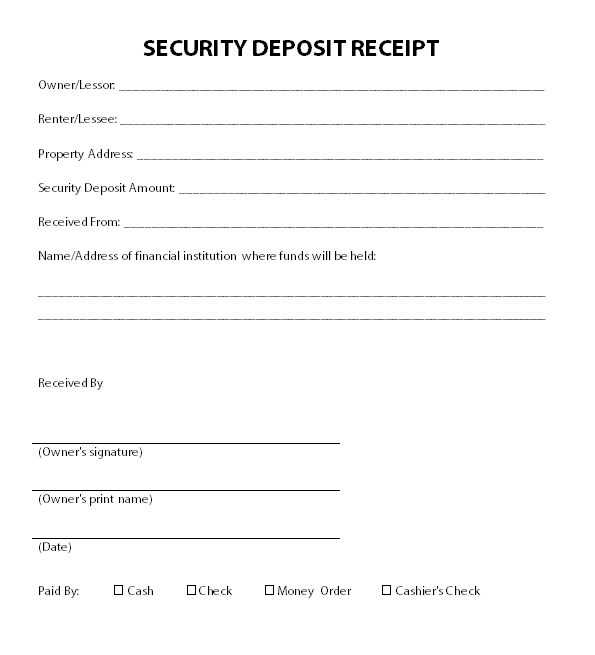

- Tenant Information: Clearly state the tenant’s full name and contact details.

- Landlord Information: Include the landlord’s name and address.

- Property Address: Specify the full address of the rental property.

- Deposit Amount: Mention the exact amount of the deposit paid, both in words and figures.

- Payment Date: Include the date on which the deposit was paid.

- Payment Method: State how the deposit was paid (e.g., bank transfer, check, cash).

- Purpose of Deposit: Note that the deposit is to cover potential damage or unpaid rent.

- Refund Terms: Outline the conditions under which the deposit will be refunded or withheld.

- Signature of Both Parties: Include space for both tenant and landlord signatures to acknowledge the receipt.

By following this structure, both parties will have a clear understanding of the rental deposit terms and conditions. It can also serve as proof of the agreement in case of disputes.

- Receipt Template for Rental Deposit

When creating a receipt for a rental deposit, it’s crucial to include specific details that protect both the tenant and the landlord. This ensures transparency and can help avoid disputes in the future. The following template includes all necessary elements for a comprehensive rental deposit receipt.

Key Elements of a Rental Deposit Receipt

- Tenant’s Name: Clearly state the name of the person who paid the deposit.

- Landlord’s Name: Include the name of the landlord or property management company.

- Property Address: Provide the full address of the rental property.

- Deposit Amount: Clearly specify the exact amount received for the deposit.

- Date of Payment: Note the exact date the deposit was paid.

- Payment Method: Indicate how the payment was made (e.g., cash, check, bank transfer).

- Purpose of Deposit: Mention that this deposit is held as security for damages or non-payment of rent.

- Signatures: Both tenant and landlord should sign the receipt for confirmation.

Example Template

Here’s a sample rental deposit receipt template to guide you:

- Receipt Number: #123456

- Date: February 5, 2025

- Received From: John Doe

- Amount: $1,000.00

- Payment Method: Bank Transfer

- For Property: 123 Maple Street, Apartment 4B, City, State, ZIP

- Deposit Purpose: Security deposit for rental agreement

- Landlord’s Name: Jane Smith

- Signature of Tenant: ____________________

- Signature of Landlord: ____________________

Begin by including the names of both parties involved: the landlord and the tenant. Clearly state the full names, as this helps in identifying the responsible parties if any issues arise later.

Key Information to Include:

Next, detail the rental property address and the specific amount of the deposit. This ensures clarity on what the payment pertains to. Specify the method of payment as well (e.g., cash, bank transfer, check) to avoid any ambiguity.

Payment Terms

Indicate the date of the payment and outline whether the deposit is refundable or non-refundable, along with the conditions for its return. If deductions are allowed, such as for damages, make these terms clear and concise.

| Details | Information |

|---|---|

| Landlord Name | [Full Name] |

| Tenant Name | [Full Name] |

| Property Address | [Full Address] |

| Deposit Amount | [Amount] |

| Payment Method | [Method] |

| Payment Date | [Date] |

| Refund Terms | [Terms] |

Finally, ensure both parties sign the receipt with the date, confirming they understand and agree to the terms stated. Keep a copy for future reference.

Specify the amount of the deposit clearly. State the exact figure, ensuring there is no ambiguity about the amount the tenant has paid. This helps avoid disputes later on.

Include the date of payment and the method used (e.g., cash, bank transfer, check). This provides a clear record of the transaction and helps track payment history.

Provide a description of the rental property, including the address and unit number if applicable. This connects the deposit to the specific rental agreement.

Note the reason for the deposit, such as “security deposit” or “damage deposit.” Clarifying the purpose avoids confusion in case of a refund or any deductions from the deposit.

List the tenant’s name and the landlord’s name. This establishes accountability and links the transaction to the correct parties involved.

If possible, include a receipt number or reference number for easy tracking. This is helpful for both parties in case they need to refer to the transaction later.

Include the terms regarding the refund of the deposit. Specify under what conditions the deposit will be returned, and any potential deductions that could apply, such as for damages or unpaid rent.

Finally, provide a signature section for both the tenant and the landlord, confirming that the payment has been received and agreed upon.

A rental deposit receipt should contain key information to ensure transparency between the landlord and tenant. Use the following format as a guide:

- Date: The exact date the deposit is received.

- Tenant Information: Full name of the tenant, along with their contact details.

- Property Address: The full address of the rental property where the deposit applies.

- Amount of Deposit: The exact amount being paid as a deposit, written both in figures and words.

- Payment Method: Indicate how the payment was made (e.g., bank transfer, cheque, cash).

- Purpose of Deposit: Specify that the deposit is for securing the rental property and cover potential damages or unpaid rent.

- Landlord Information: Full name and contact details of the landlord or property manager.

- Terms and Conditions: Briefly mention the terms under which the deposit will be refunded, such as deductions for damages or unpaid rent.

- Signature of Parties: Both landlord and tenant should sign and date the receipt to confirm agreement.

Ensure clarity in this document to avoid future misunderstandings between both parties. The receipt must be kept by both the tenant and landlord for reference throughout the rental term.

Always ensure your rental deposit receipt is clear, accurate, and legally compliant. A deposit receipt serves as proof of the transaction and can prevent misunderstandings or disputes in the future. It’s critical to include the exact amount paid, the date, and a detailed description of the purpose for the deposit. Specify if the deposit is refundable and outline any conditions for its return. Include the landlord’s or property manager’s contact information and signature, and provide a copy to the tenant.

Terms of Refundability

Clearly state whether the deposit is refundable. Specify the conditions under which the deposit will be returned, such as when the rental property is returned in good condition. If any part of the deposit is non-refundable, explain the reasons–such as cleaning fees or repair costs. This transparency helps prevent confusion about the handling of the deposit when the lease ends.

Legal Compliance

Different jurisdictions have specific rules regarding rental deposits, including the maximum amount a landlord can charge and the timeline for returning the deposit after the lease ends. Familiarize yourself with local laws and ensure your receipt reflects these legal requirements. Failure to comply could lead to fines or other legal consequences.

Choosing between digital and paper rental receipts depends on ease of access, storage preferences, and environmental considerations. Digital receipts offer convenience and immediate access, while paper receipts can serve as tangible proof of transactions. Here’s a closer look at both options:

Digital Receipts

Digital receipts can be stored in cloud services or email, making them accessible at any time and from any device. They eliminate the need for physical storage space and reduce the risk of loss or damage. Additionally, digital records can be easily organized, searched, and shared with others, such as landlords or property management companies. Many rental services now offer online portals, where tenants can view and download receipts directly, which simplifies the process of keeping track of rental payments.

Paper Receipts

Paper receipts provide a physical document that some tenants or landlords prefer for record-keeping. These receipts can be signed and stamped, which may be considered more formal in certain situations. Paper receipts also serve as backup proof in case digital records are lost or compromised. However, they require physical storage and can be easily misplaced or damaged over time.

| Aspect | Digital Receipts | Paper Receipts |

|---|---|---|

| Accessibility | Immediate, accessible from any device | Physical access required, stored in one place |

| Storage | Cloud or email storage, no physical space required | Physical storage needed, can be damaged or lost |

| Sharing | Easy to share via email or portals | Requires physical delivery or scanning |

| Security | Protected with encryption or password | Susceptible to loss or damage over time |

Refunds and deductions should be handled transparently to avoid misunderstandings. Begin by clearly specifying the conditions for refunding or deducting from the deposit in the rental agreement. Always inspect the property thoroughly before determining any deductions. If there are damages, document them with photos and provide a detailed breakdown of repair costs. Notify the tenant in writing of any deductions and offer them a chance to discuss the matter. If no issues are found, refund the full deposit promptly. It’s good practice to return the deposit within a set period, typically 14 to 30 days, depending on local regulations.

Deductible costs typically cover cleaning fees, property damage, and unpaid rent. Each deduction must be justified with receipts or invoices to maintain fairness. Maintain clear records of all transactions, including the return of deposits and any related costs. Provide tenants with a final, itemized statement, ensuring transparency and clarity in all dealings.

Receipt Template for Rental Deposit

Include the tenant’s full name, rental property address, and the exact deposit amount received. The date of payment should be clearly stated. Specify whether the deposit is refundable or non-refundable and outline any conditions under which it might be withheld, such as damage to the property. Make sure to reference the rental agreement to ensure both parties understand the terms. A receipt number or unique identifier will help track the transaction. Always provide a signed copy of the receipt to both the tenant and landlord for record-keeping.