Creating a vehicle purchase receipt in Australia requires attention to detail and adherence to local legal standards. Use this template to ensure you cover all necessary aspects, including buyer and seller details, vehicle information, and payment terms. This simple yet comprehensive format streamlines the transaction process while providing both parties with the clarity they need.

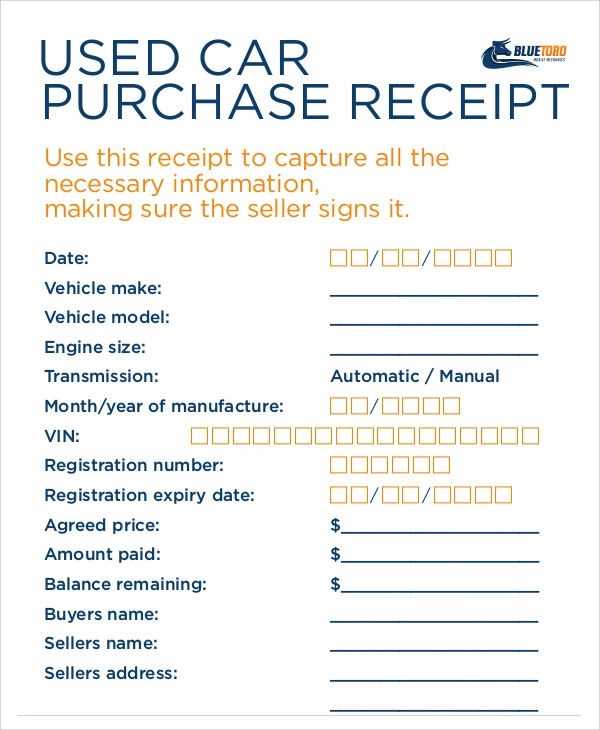

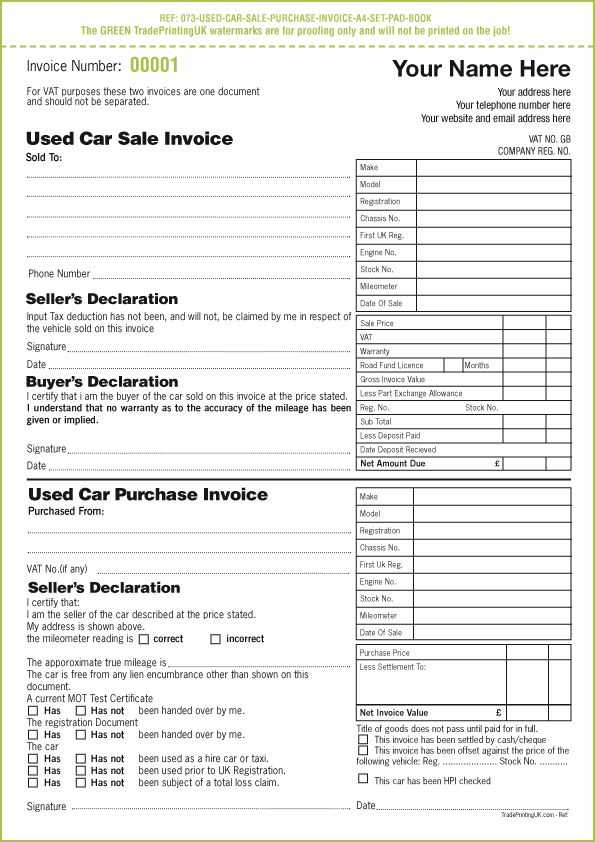

Include the buyer’s full name, address, and contact details, along with the seller’s information. It’s critical to provide the vehicle’s make, model, year, and VIN (Vehicle Identification Number) for proper identification. Ensure the purchase price is clearly stated, and include any additional charges or adjustments, such as taxes or fees. Make sure to document the date of the transaction and the payment method used.

Use this template as a reference to maintain transparency and avoid potential disputes. Keep copies of the receipt for both parties to guarantee the sale is legally binding and can be referred to in case of future needs or issues.

Here are the corrected lines with minimal repetition of words, preserving meaning and accuracy:

To create a precise vehicle purchase receipt in Australia, ensure all necessary details are included without redundancy. The receipt must contain the seller’s full name, address, and contact details, along with the buyer’s information. The vehicle’s make, model, year, and VIN (Vehicle Identification Number) should be listed clearly. Provide the date of sale, the agreed price, and any applicable taxes or fees. Specify payment methods and any additional agreements or warranties attached to the purchase.

Key Elements to Include in a Vehicle Purchase Receipt

The receipt should reflect the exact sale amount, including the breakdown of any taxes or fees. It’s crucial to list the vehicle’s odometer reading at the time of purchase, confirming its mileage. Both parties must sign the document to validate the transaction. If the vehicle is financed or leased, include clear terms of the financing agreement. Always verify that the seller’s details match the registered ownership on the vehicle’s title to avoid disputes.

- Vehicle Purchase Receipt Template Australia

A vehicle purchase receipt template in Australia should include specific details to ensure it meets legal requirements and protects both the buyer and seller. Start by adding the full name and address of both parties involved, clearly indicating the buyer and the seller. Next, include the vehicle’s unique identifiers such as the make, model, year, Vehicle Identification Number (VIN), and odometer reading at the time of sale. These details help verify the authenticity of the transaction and the vehicle’s history.

Specify the agreed purchase price and the payment method used. If applicable, note any deposit or down payment made and the balance to be paid. If the transaction involves a trade-in, mention the trade-in value and how it impacts the total price of the vehicle. It’s also useful to include the date of the transaction, so both parties have a clear record of when the agreement was made.

It is important to include a section confirming that the vehicle is sold “as-is” unless a warranty is provided. Any warranties or guarantees should be clearly stated, including the terms and duration of coverage. Also, if the seller has disclosed any defects or issues with the vehicle, make sure this is documented in the receipt to avoid future disputes.

Finally, ensure that both parties sign the receipt to acknowledge agreement on the terms. This ensures legal validity and provides proof of the transaction. A well-drafted vehicle purchase receipt template serves as a useful document in case of future issues or inquiries regarding the vehicle purchase.

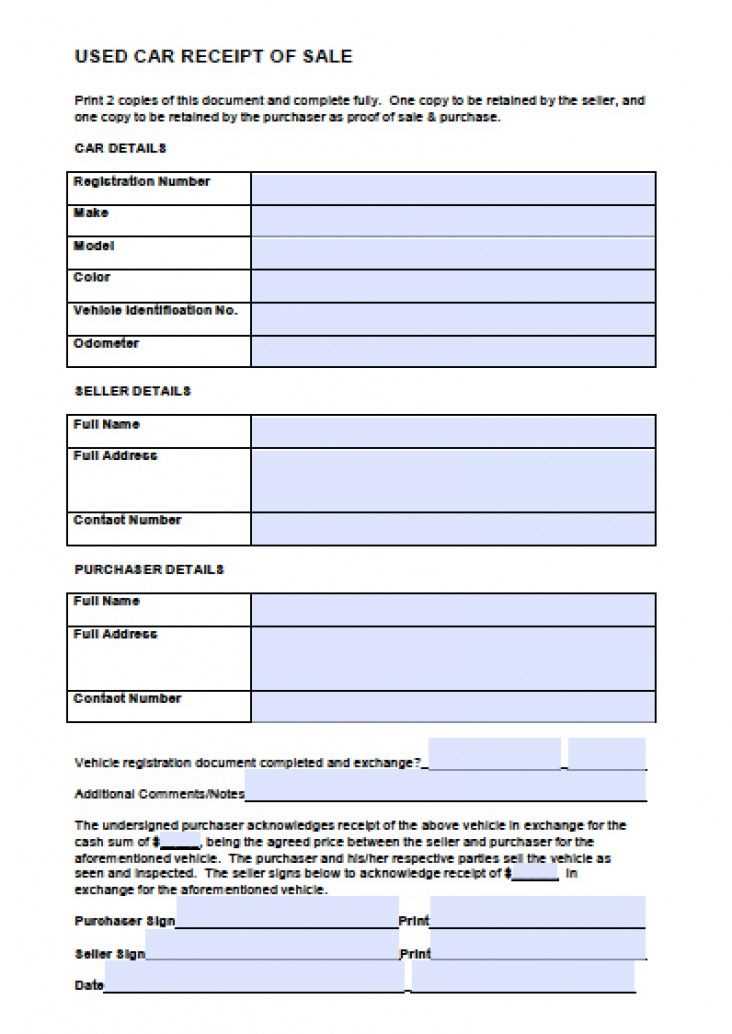

Ensure the vehicle receipt clearly identifies both the buyer and the seller. Include full names, addresses, and contact details for both parties. This helps avoid any future disputes about the transaction.

Provide a detailed description of the vehicle being sold. Include the make, model, year of manufacture, Vehicle Identification Number (VIN), odometer reading, and registration details. This guarantees the receipt serves as an accurate record of the transaction.

State the agreed-upon purchase price, including any taxes or additional fees. Be transparent about whether the price is inclusive or exclusive of GST, if applicable. This ensures clarity for both parties and aligns with tax obligations.

Specify the date of the transaction and the method of payment. Indicate whether the payment was made in full or through installments. This helps confirm the completion of the sale and protects both parties.

If applicable, include details of any warranties, conditions, or guarantees provided as part of the sale. This section should clarify whether the vehicle is being sold “as is” or with certain guarantees attached.

Finally, both parties should sign and date the receipt. This legal acknowledgment confirms that both the buyer and seller agree to the terms of the sale, making the receipt legally binding.

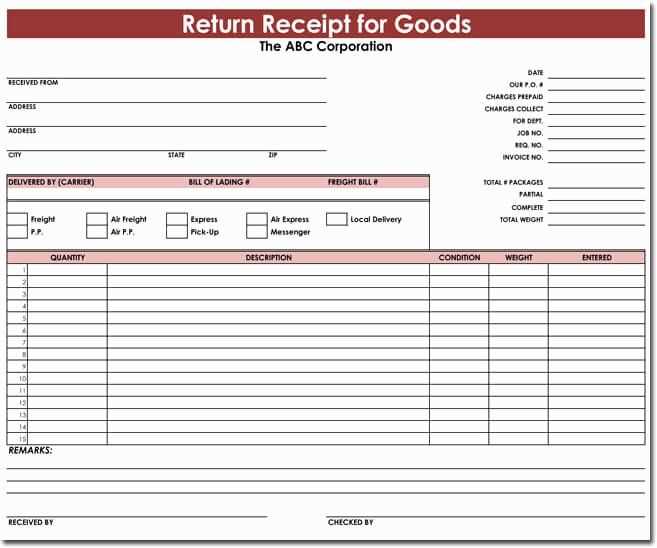

A vehicle purchase document should clearly outline specific details to ensure both parties are on the same page. Begin with the full name and contact information of the buyer and seller. This establishes who is involved in the transaction.

Next, include the vehicle identification number (VIN), make, model, and year of the vehicle. These details confirm the vehicle’s identity and ensure it matches the description provided by the seller.

Clearly state the purchase price and the payment method. Specify whether the transaction was made via cash, bank transfer, or any other form of payment. This removes ambiguity around the financial aspect of the deal.

Incorporate the date of sale and the location of the transaction. These details help track the timing and place of the exchange.

For additional transparency, outline the vehicle’s condition, including whether it is sold as-is or with any warranties. If the seller offers a warranty or guarantees, document the terms and duration.

Both buyer and seller should sign and date the document. This indicates that both parties agree to the terms of the sale and prevents future disputes.

By including these details, you protect both parties and ensure that the purchase is recorded accurately and legally.

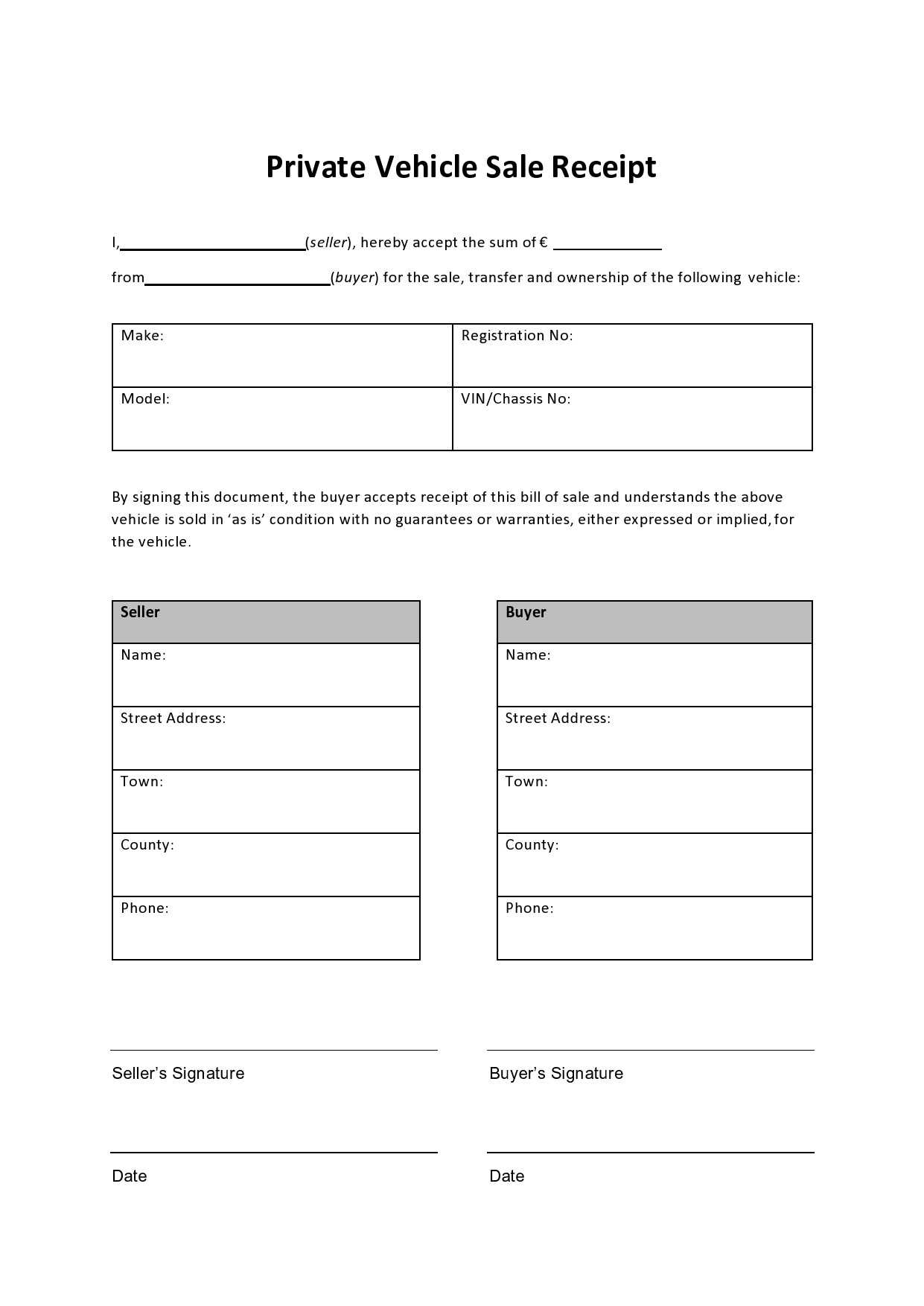

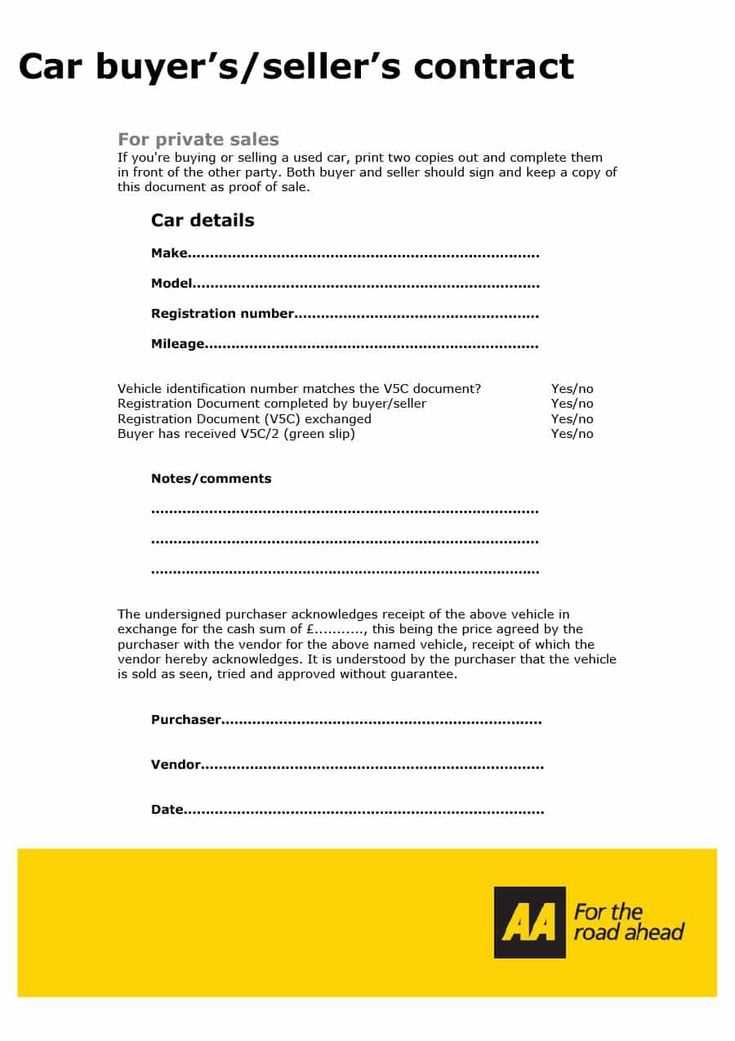

Ensure your vehicle receipt includes specific details tailored for private sales. Highlight the vehicle’s make, model, year, VIN (Vehicle Identification Number), and registration details. These key data points verify the authenticity of the sale and avoid confusion later on.

Personalizing the Buyer and Seller Information

Include full names, addresses, and contact details for both the buyer and seller. This ensures both parties are identifiable and reachable in case of future queries. Be sure to note the date of the sale and the agreed purchase price. For private sales, it’s crucial to specify whether the vehicle is sold “as is” without warranty or with a limited guarantee if applicable.

Payment Method and Acknowledgments

Clearly state the payment method–whether by bank transfer, cash, or cheque. This transparency avoids potential disputes regarding payment. Add a section for both parties to sign, confirming that the transaction is complete and agreed upon. The receipt should be dated and include a space for any additional notes, such as agreements on conditions or pending repairs, if necessary.

When purchasing a vehicle in Australia, understanding how GST (Goods and Services Tax) affects the receipt is crucial for both consumers and businesses. The GST is a 10% tax on most goods and services sold or consumed in Australia. This directly influences the price of vehicles and how it is reflected on the purchase receipt.

GST Inclusion in Vehicle Purchase Price

Typically, the GST is included in the total vehicle price. The dealer should provide a receipt that shows the GST amount separately. This is especially important if you plan to claim the GST back through business-related tax returns or other business purposes.

- For instance, if the vehicle is priced at $30,000, the GST will be $3,000, and the total receipt will show $33,000.

- Ensure that the receipt clearly distinguishes between the price of the vehicle and the GST portion.

GST and Businesses: Claiming Back the Tax

If the vehicle purchase is for business use, you may be able to claim the GST back from the Australian Taxation Office (ATO). To do this, the vehicle receipt must meet the ATO’s tax invoice requirements, which include:

- The seller’s ABN (Australian Business Number).

- A clear breakdown of the GST amount charged.

- The total price of the vehicle (including GST) and the price before GST.

Without these details, you may not be able to claim back the GST, potentially increasing the cost of the vehicle. Make sure the purchase receipt complies with these requirements for efficient tax processing.

Ensure that all required information is included. Missing details like the vehicle’s VIN, the buyer’s or seller’s name, or the transaction date can create confusion and legal issues. Double-check that the vehicle description matches the one in the sale agreement to avoid discrepancies later.

Incorrect Pricing and Payment Information

Accurately record the sale price and payment method. Common mistakes include failing to indicate any deposits or additional fees, which could lead to misunderstandings. Make sure the total matches the agreed-upon amount, and don’t forget to note if the payment was made in full or in installments.

Unclear Warranty or Guarantee Terms

Clearly state any warranties or guarantees that apply to the vehicle. Avoid vague language that can lead to disputes. If no warranty is provided, ensure that this is explicitly stated to prevent confusion.

Ensure the receipt is legible and easy to read. Poor formatting or handwriting can lead to errors, which may cause problems when the receipt is used for future references. Consider using a digital template to avoid these issues.

Keep your vehicle purchase receipt in a secure, easily accessible place. Use both physical and digital storage methods to ensure its safety and availability when needed.

- Physical Storage: Store the receipt in a dedicated folder or file with other important documents, such as the vehicle’s registration papers and insurance details. A fireproof safe is an excellent choice for additional protection.

- Digital Storage: Scan or take a high-quality photo of the receipt and store it in a cloud-based service or on an external hard drive. Ensure that the file is clearly labeled with the vehicle’s make, model, and purchase date for easy identification.

- Keep Multiple Copies: Maintain copies of the receipt in both digital and physical formats. This redundancy will help you avoid issues in case one copy gets damaged or lost.

Use the vehicle receipt for the following:

- Warranty Claims: If you need to file a warranty claim, the receipt serves as proof of purchase and the date of sale, which are often required.

- Resale or Trade-in: When selling or trading the vehicle, the receipt verifies the vehicle’s original purchase price, which can affect the value and negotiation process.

- Insurance Purposes: Insurance companies may require the receipt as proof of the vehicle’s value in the event of a claim or loss.

Periodically check your receipt to ensure it is in good condition and remains legible. If any details on the receipt are unclear, consider reaching out to the seller for clarification or a replacement copy. This will save time if you need to use it later for any purpose.

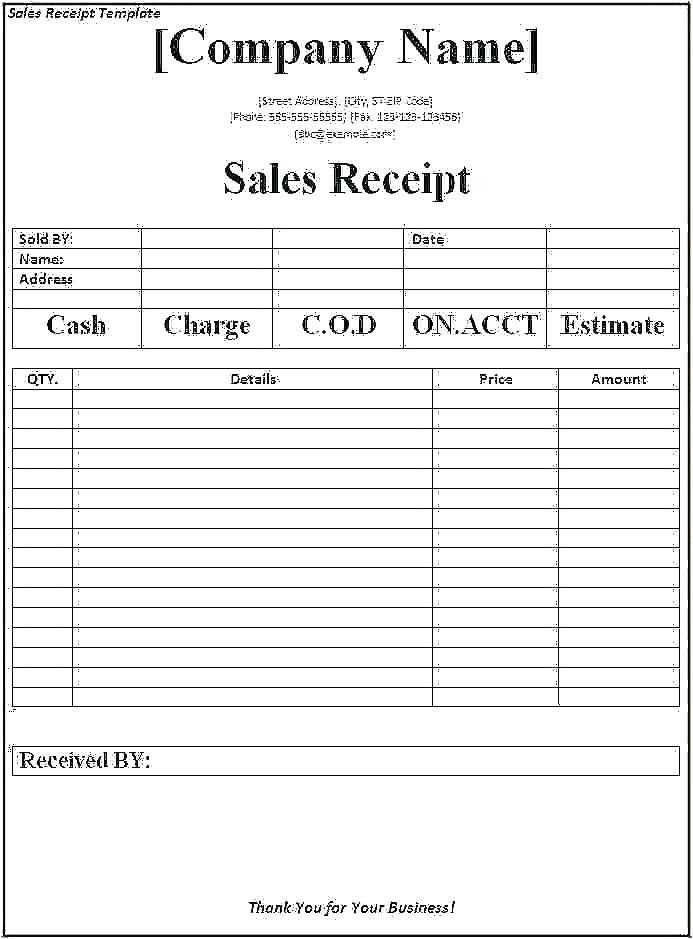

Key Components of a Vehicle Purchase Receipt in Australia

Ensure that your vehicle purchase receipt includes these mandatory details to comply with Australian law:

| Component | Description |

|---|---|

| Seller’s Information | Include the full name, address, and contact details of the seller or dealership. This helps in verifying the legitimacy of the transaction. |

| Buyer’s Information | Clearly state the buyer’s full name, address, and contact details. This provides traceability and accountability for the transaction. |

| Vehicle Details | Provide the Vehicle Identification Number (VIN), make, model, year, colour, and registration details. This uniquely identifies the vehicle and prevents any confusion with other vehicles. |

| Purchase Price | List the total agreed price for the vehicle, including taxes and any additional fees such as registration or licensing. Ensure that any discounts or promotions are clearly mentioned. |

| Date of Purchase | State the exact date the transaction took place to mark the beginning of warranty periods and other time-sensitive matters. |

| Payment Method | Specify the payment method used (e.g., bank transfer, cheque, cash, finance). This creates transparency regarding the payment process. |

| Warranties and Guarantees | Include any warranty details or guarantees offered by the seller, and specify the length of the coverage. |

| Signatures | Both the seller and the buyer should sign the receipt, confirming the validity of the transaction. |