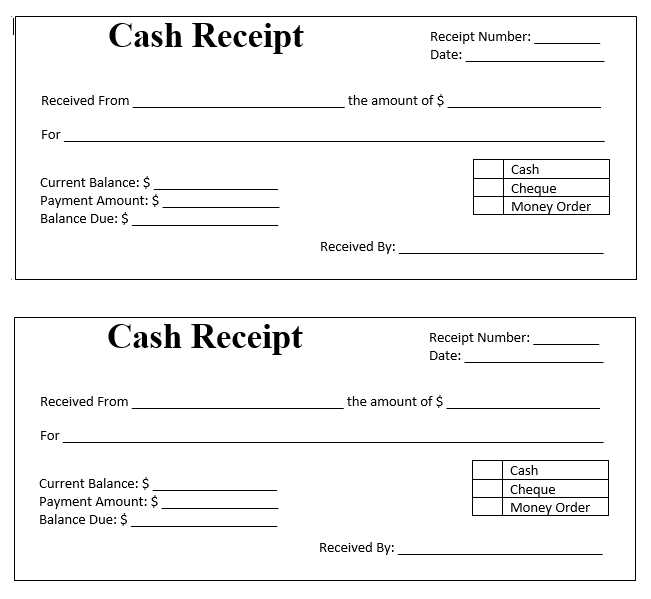

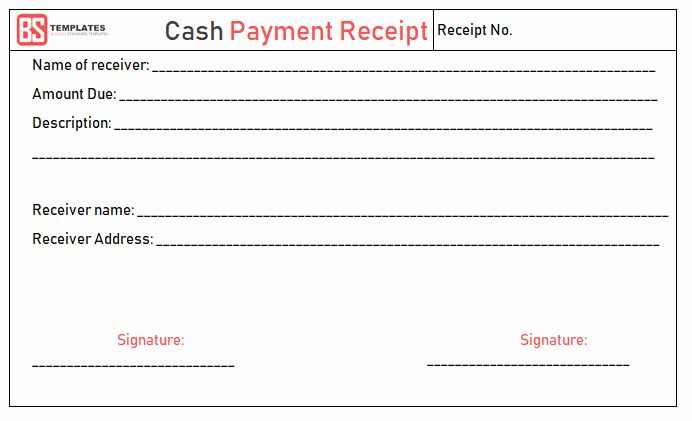

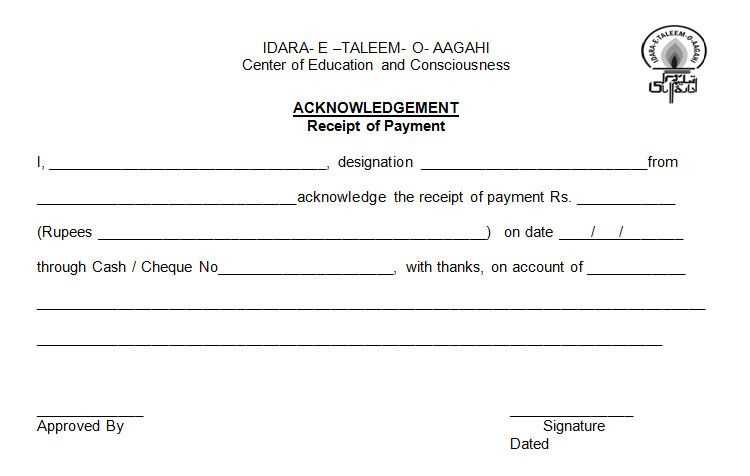

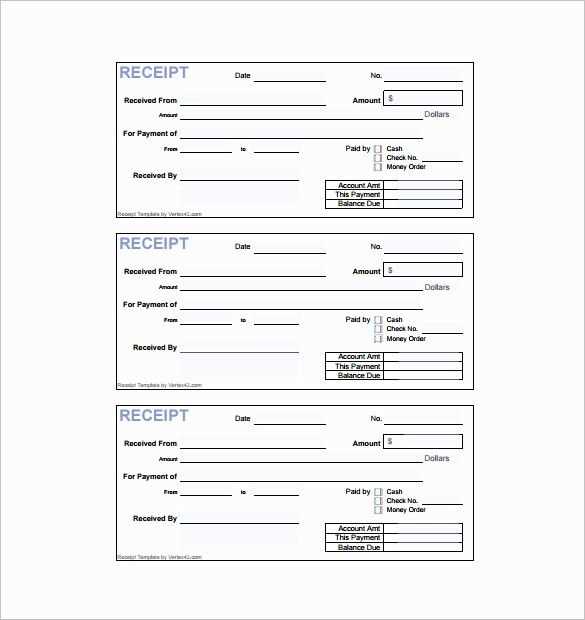

To create a receipt of payment, ensure the document includes all relevant details of the transaction. Begin by specifying the payer’s name and contact information, followed by the recipient’s details. This helps identify both parties involved and confirms the legitimacy of the transaction.

Include the payment amount clearly, with the currency indicated. Make sure to detail the date of payment, and if applicable, mention the method used for the transaction. This could be cash, card, or bank transfer. For online transactions, consider adding transaction or reference numbers for easy tracking.

Break down any additional fees or taxes separately to avoid confusion. If a deposit or installment plan is involved, note the terms and remaining balance. Always leave space for both parties to sign, as a physical signature can act as a form of confirmation and validation.

Here’s a detailed plan for an informational article on “Template for Receipt of Payment,” structured with six specific, practical headings using HTML format

Overview of Payment Receipt Template

A payment receipt template is a ready-to-use document that records transactions. It ensures transparency and helps keep track of financial exchanges. You can customize these templates for various payment methods, such as cash, credit card, or bank transfer.

Key Components of a Payment Receipt

The template should include essential fields: the payee’s name, payer’s name, payment amount, payment method, date, and transaction reference number. Each section should be clear and easy to complete, ensuring all details are accurately captured.

How to Customize Your Template

Make sure the template suits your business needs. You can add extra sections for tax amounts, discounts, or services provided. Adjust the layout to match your brand’s style, ensuring the receipt looks professional and aligns with your other documents.

Common Payment Receipt Formats

Receipts can be created in different formats, including Word, Excel, and PDF. PDF is most commonly used for professional purposes because it ensures the layout remains consistent when opened on different devices.

How to Use the Payment Receipt Template

After customizing the template, fill in the transaction details for each payment. For each new receipt, make sure to adjust the date and payment information, ensuring all fields are filled out accurately before sharing the receipt with the customer.

Benefits of Using a Payment Receipt Template

Using a pre-designed template helps maintain accuracy and consistency. It saves time and reduces errors that may occur when creating receipts manually. It also improves the professionalism of your business transactions.

How to Create a Payment Receipt Form

Begin with clear fields that specify the payment details. Include the payer’s name, payment amount, date of payment, and the purpose of the transaction. This ensures both parties are aware of the key information.

Include Necessary Identifiers

Each receipt should have a unique reference number. This helps track transactions and prevents confusion. A simple format like “REC-001” works well and is easy to organize.

Provide Contact Information

For clarity, add the contact details of both parties. This can be the business or individual receiving the payment and the payer. This ensures there’s an easy way to reach someone in case of discrepancies.

Finally, add a section for the signature of the payer or recipient, confirming the transaction. This adds an extra layer of verification for both parties involved.

Selecting the Right Format for Your Document

Choose the format that aligns with your needs and the level of formality required. For a simple receipt, a basic PDF file is ideal, as it offers universal accessibility and is easy to print. If you need to track or store receipts electronically, consider a spreadsheet format like CSV or Excel, which allows easy filtering and searching of information.

Consider the recipient’s preferences

Before deciding on the format, think about how the recipient will access the document. If you’re sending a receipt to a client or customer, a PDF is often preferred because it preserves the layout and can be opened on any device. However, if you’re dealing with internal processes and need to handle large volumes of data, a format like Excel might be more practical for ease of use and flexibility.

Check compatibility with your system

Ensure that the format you choose is compatible with the software you use. Some accounting or invoicing software supports specific file types for automatic processing. Make sure the document can be easily integrated into your workflow without requiring extra steps for conversion.

Important Information to Include in a Receipt

A clear and accurate receipt should reflect all key transaction details. Make sure to include the following information:

1. Transaction Date and Time

List the exact date and time the payment was made. This helps track purchases and resolve potential disputes.

2. Itemized List of Products or Services

Provide a detailed breakdown of purchased items or services. This includes quantity, description, and individual prices. It allows the customer to see exactly what they paid for.

3. Payment Amount

State the total amount received from the customer, including any taxes or fees applied. If the payment method is part of a larger payment plan, mention this as well.

4. Payment Method

Indicate how the payment was made, whether through cash, card, bank transfer, or other methods. This ensures both parties have a record of the payment type.

5. Merchant Details

Include the name, address, and contact information of the business. This ensures that the customer can reach the company for any inquiries or issues.

6. Unique Receipt Number

Each receipt should have a unique identifier or reference number. This helps track individual transactions and simplifies refunds or exchanges.

7. Return or Exchange Policy

Clearly state the business’s return or exchange policy. This sets expectations and avoids misunderstandings with customers.

8. Taxes

Show any applicable taxes, such as VAT, and specify whether they are included in the price or listed separately.

Example Receipt Layout

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product A | 1 | $10.00 | $10.00 |

| Product B | 2 | $15.00 | $30.00 |

| Subtotal | $40.00 | ||

| Tax (8%) | $3.20 | ||

| Total | $43.20 |

Adapting Your Template for Various Transactions

Tailor your receipt template for specific transaction types by adjusting key sections, ensuring it aligns with both your business needs and customer expectations.

1. Include Payment Method Details

Clearly specify the method used for the payment. Whether it’s a credit card, bank transfer, or mobile payment, make sure to include the relevant transaction reference numbers. This enhances transparency and helps in future tracking.

2. Customize for Refunds and Adjustments

- When issuing refunds or adjustments, include fields to reflect the amount refunded and the reason for the adjustment.

- Provide a separate section for any deductions or discounts applied.

3. Add Transaction Specifics for Subscription-Based Services

- Include subscription period and renewal dates.

- Highlight payment frequency (monthly, quarterly, annually) and any promotional offers applied.

By customizing these details, you ensure your receipt is clear, accurate, and appropriate for different transaction types.

Legal Aspects of Issuing a Payment Receipt

Ensure that your payment receipt includes the correct information required by law. The receipt must clearly identify the parties involved, the amount paid, and the date of the transaction. It should also specify the method of payment, whether it was cash, card, or bank transfer. This level of detail helps avoid future disputes and provides proof of the transaction.

Accurate Representation of Transaction Details

The receipt should reflect the exact details of the payment. Include any applicable taxes, discounts, or additional charges. Make sure the description of the goods or services purchased aligns with the terms agreed upon. Accurate descriptions help clarify the transaction and provide transparency to both parties.

Retention of Records

Both parties should keep copies of the payment receipt for record-keeping purposes. This is important for both legal and accounting reasons. Typically, receipts should be stored for at least a few years, depending on local tax and business regulations.

Best Practices for Storing Receipts

Organize receipts by category and date. Keep receipts from transactions for tax purposes, warranties, and returns in separate folders, either physical or digital. This reduces clutter and makes it easier to locate important documents when needed.

Digital Storage Options

Consider scanning or photographing receipts to create a digital record. This saves space and allows for easy access on any device. Use cloud storage services or apps designed for receipt management to store these files securely.

Labeling and Categorizing

Label receipts with clear descriptions, including the store name, item purchased, and the date. This makes it simple to identify them later. For physical receipts, use envelopes or folders with labeled sections for each category, such as “Tax,” “Returns,” and “Warranties.” For digital records, create specific folders for each type of receipt.

- Store receipts in a consistent format, either digital or physical.

- Use a scanner or camera for a digital backup of each receipt.

- Organize receipts by transaction type or category.

Regularly back up your digital records to avoid losing important files due to technical issues. This ensures your receipt management system remains reliable and accessible whenever necessary.