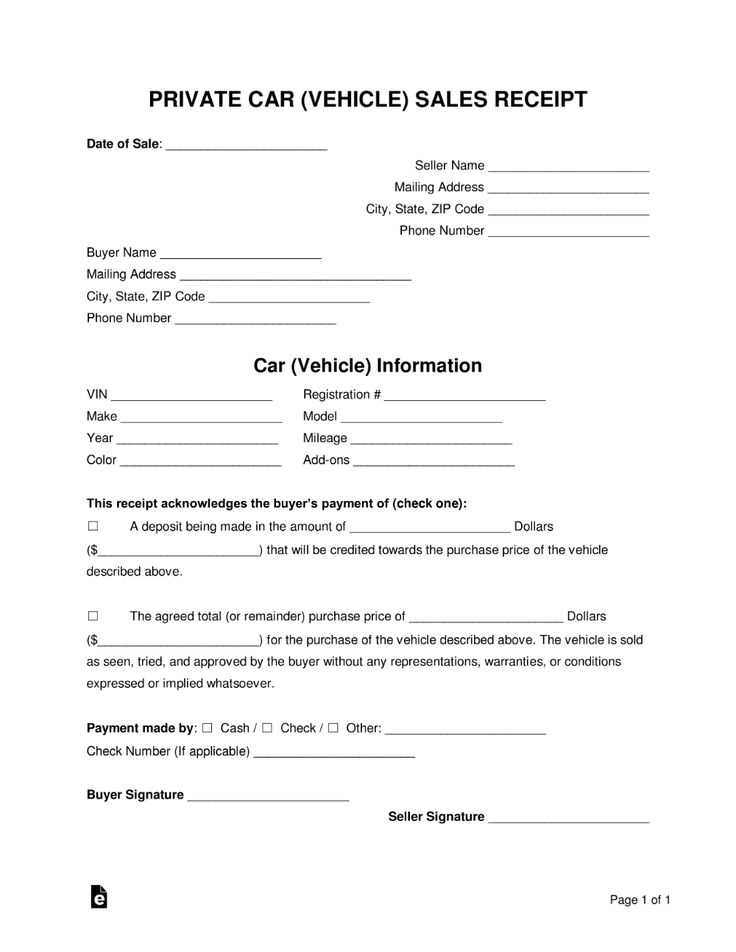

To create a used car deposit receipt, focus on key details that ensure clarity for both the buyer and the seller. Start by listing the date the deposit was made, along with the amount paid. The receipt should also include the car’s make, model, and year, as well as any specific terms agreed upon for the sale. Clear identification of both parties, with full names and contact details, should follow for accountability.

The deposit amount section should specify the agreed sum and note that it serves as a part of the overall price. Ensure the remaining balance is clearly mentioned, with a due date for full payment. If the deposit is refundable or non-refundable, make that distinction clear to avoid future confusion.

Lastly, include a space for both parties to sign and date the receipt, confirming their agreement. These simple but necessary elements will help maintain transparency and ensure both sides are aligned throughout the transaction process.

Here’s the corrected version:

For creating a used car deposit receipt, make sure to include the following key details:

Deposit Amount and Payment Information

Clearly state the amount of the deposit and specify the method of payment, whether it’s cash, check, or another form. This helps avoid confusion about the transaction.

Buyer and Seller Details

Include the full names, addresses, and contact details of both the buyer and the seller. This makes the receipt legally binding and ensures that both parties can be contacted if necessary.

Make sure the receipt contains the vehicle’s details, including make, model, year, and VIN (Vehicle Identification Number). This helps to avoid disputes regarding the vehicle being sold.

Lastly, state the terms of the agreement, such as whether the deposit is refundable or non-refundable, and if any specific conditions need to be met for the deposit to be returned. This will protect both the buyer and the seller from any misunderstandings.

- Used Car Deposit Receipt Template

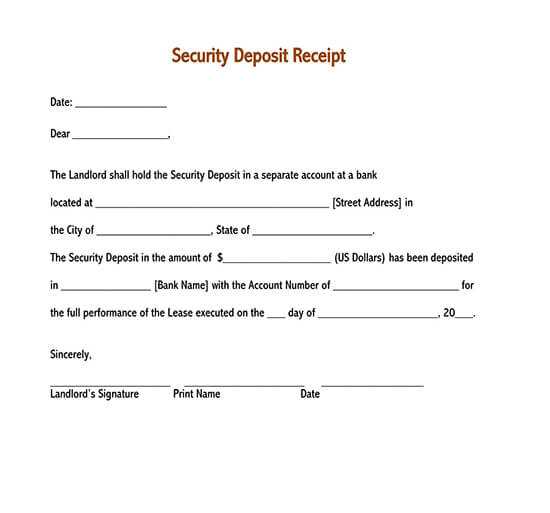

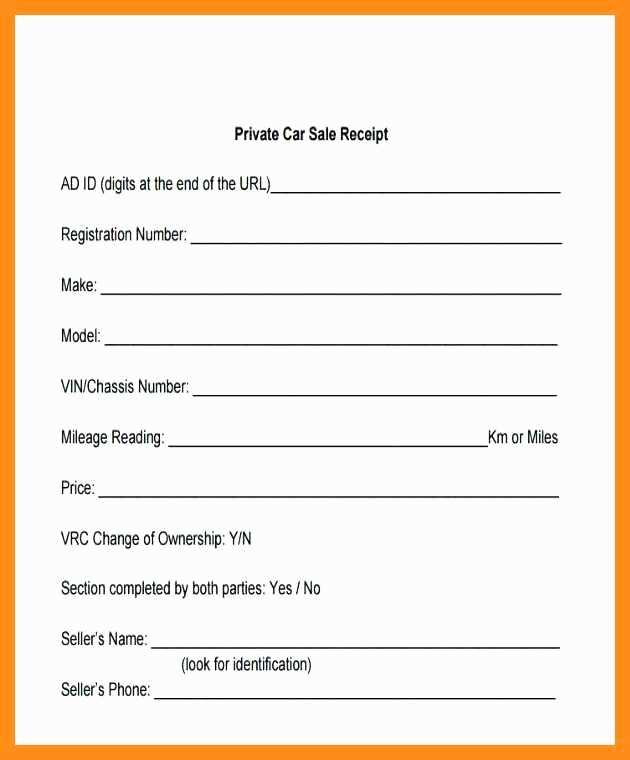

A Used Car Deposit Receipt is a formal document that acknowledges the payment made as a deposit toward purchasing a used vehicle. It serves as proof of payment and can protect both the buyer and the seller in case of disputes. The receipt should include key details like the amount of the deposit, the car’s make and model, and the agreed terms for completing the purchase. Below is a simple template that can be adapted for your needs:

Key Components of a Deposit Receipt

The following components should be included in a used car deposit receipt template:

- Buyer Information: Full name, address, and contact details of the buyer.

- Seller Information: Full name, address, and contact details of the seller or dealership.

- Car Details: Vehicle make, model, year, VIN (Vehicle Identification Number), and color.

- Deposit Amount: The specific amount paid as a deposit.

- Deposit Date: The date when the deposit was made.

- Purchase Terms: Agreement on the total price, balance due, and timeline for completing the purchase.

- Signatures: Signature of both parties to confirm the agreement.

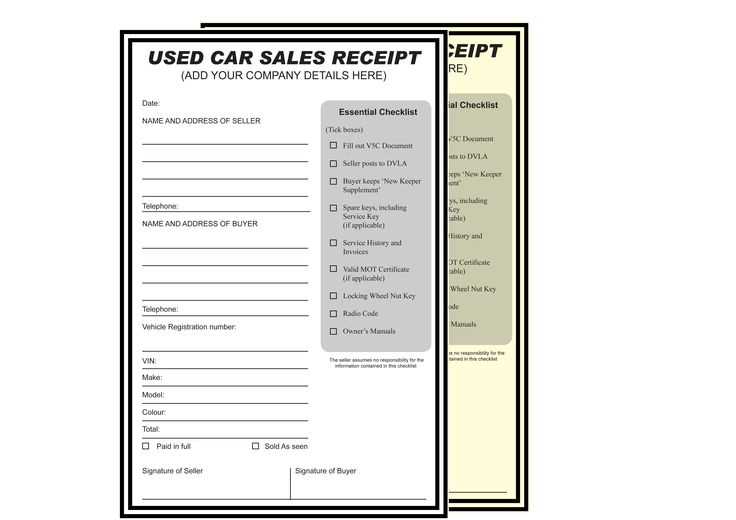

Sample Template

Here’s a basic example of how to structure the receipt:

Used Car Deposit Receipt Buyer Name: ___________________________ Seller Name: ___________________________ Vehicle Make: ___________________________ Vehicle Model: ___________________________ Year: ___________________________ VIN: ___________________________ Color: ___________________________ Deposit Amount: $____________ Deposit Date: ________________________ Purchase Price: $____________ Remaining Balance: $____________ Final Payment Due: ____________________ I, the undersigned, acknowledge receipt of the deposit for the vehicle described above. The remaining balance will be paid as per the agreed terms. Buyer Signature: ______________________ Seller Signature: ______________________ Date: ___________________________

Be sure both parties sign the receipt and retain a copy for their records. This document provides clarity and legal assurance for both buyer and seller.

Begin by clearly stating the purpose of the receipt at the top. Mention the sale of a used car and indicate that the document serves as proof of a deposit paid by the buyer. This ensures both parties understand its intent immediately.

Key Elements to Include:

- Receipt Title: Label the document as “Deposit Receipt” to avoid confusion.

- Date: Specify the exact date when the deposit was made. This helps track the transaction in case of future disputes.

- Buyer’s Information: Include the buyer’s full name, contact details, and address.

- Seller’s Information: List the seller’s full name, business name (if applicable), and contact details.

- Vehicle Details: Provide the make, model, year, VIN (Vehicle Identification Number), and mileage of the car.

- Deposit Amount: Clearly state the amount paid by the buyer as the deposit.

- Total Purchase Price: Mention the total price of the car to avoid any misunderstanding later.

- Payment Terms: Specify whether the deposit is refundable or non-refundable and any conditions attached to the deposit (e.g., securing financing, inspection). Include the remaining balance to be paid and the due date.

- Signature Fields: Provide space for both the buyer and seller to sign and date the receipt.

Additional Tips:

- Make the language clear and simple to avoid any legal complications.

- Keep a copy of the signed deposit receipt for future reference.

- If the deposit is refundable, clarify the conditions under which the refund will be processed.

To create a solid and clear car deposit receipt, be sure to include the following key details:

- Seller’s Information: Include the full name, address, and contact details of the seller. This ensures both parties know who is involved in the transaction.

- Buyer’s Information: List the full name, address, and contact details of the buyer to confirm who is making the deposit.

- Vehicle Details: Specify the make, model, year, VIN (Vehicle Identification Number), and any other relevant identifying information about the car. This guarantees clarity on which vehicle the deposit is associated with.

- Deposit Amount: Clearly state the amount being deposited. This section should also indicate if the deposit is refundable or non-refundable, with any conditions outlined.

- Payment Method: Mention how the deposit was paid (e.g., cash, check, bank transfer) to avoid confusion about the transaction method.

- Transaction Date: Include the exact date the deposit was made. This helps track the timing of the agreement and any follow-up actions required.

- Balance Due: State the remaining balance that is owed for the car purchase, including any details about how and when it is to be paid.

- Agreement Terms: Note any important terms or conditions regarding the sale, such as deadlines for full payment or return policies. This protects both parties by establishing clear expectations.

- Signatures: Both the buyer and seller should sign the receipt, confirming the agreement and acknowledging that all the information provided is correct.

Additional Notes

- Receipt Number: For organizational purposes, consider adding a receipt number. This helps track transactions efficiently, especially for multiple sales.

- Deposit Purpose: It can be helpful to clarify if the deposit is for holding the car, securing a specific price, or another reason.

By including these details, you ensure the car deposit receipt is clear, enforceable, and serves both parties well throughout the sale process.

Customizing a deposit receipt depends on the type of transaction and the specific details required for clarity. Start by identifying the transaction’s context–whether it’s a vehicle purchase, a rental agreement, or a service contract. Adjust the receipt to include key elements relevant to each type of transaction.

- For a vehicle purchase: Include the vehicle’s make, model, year, and VIN (Vehicle Identification Number). Also, specify the agreed price and the deposit amount. This ensures both parties have clear records of the transaction.

- For rental transactions: List the rental period, location, and any terms regarding deposits or damage fees. You should also specify if the deposit is refundable or non-refundable and under what conditions the refund is processed.

- For service contracts: Include the service type, the start date, expected completion date, and the deposit amount. If the deposit covers a specific part of the service, make that clear to avoid confusion.

- For general transactions: Focus on the buyer’s and seller’s details, the product or service involved, the deposit amount, and the agreed-upon terms for the balance payment.

Each receipt should also feature space for the signatures of both parties, indicating agreement on the deposit and transaction terms. Be sure to include a clear statement that outlines whether the deposit is refundable, the timeline for any refunds, and any deductions that might occur based on conditions set forth in the transaction.

One of the biggest mistakes is failing to specify the terms of the deposit. Clearly outline the deposit amount, date, and any conditions under which it may be refunded or forfeited. This prevents misunderstandings later.

Another issue is leaving out important vehicle details. Always include the make, model, year, and Vehicle Identification Number (VIN) to avoid confusion or disputes.

Omitting signatures is a common oversight. Both the buyer and seller should sign the receipt to confirm agreement to the terms, making it a legally binding document.

Not including payment methods is another mistake. Indicate whether the deposit was paid in cash, check, or another form. This ensures transparency in the transaction.

Vague wording about deposit refund policies can lead to conflict. Be specific about how the deposit is handled if the sale falls through, and state the time frame for any refund process.

Finally, failing to provide a receipt copy to both parties is an error. Both buyer and seller should have a copy for reference, which helps if there are any disputes later on.

Issue a deposit receipt as soon as the buyer commits to purchasing the vehicle and provides a deposit. This signals that an agreement has been made, and both parties are acknowledging the terms of the sale. The receipt should include the amount paid, the vehicle details, and the agreed-upon terms for the remainder of the transaction.

At the Time of Initial Deposit

As soon as the buyer hands over a deposit, it’s time to issue a receipt. This ensures transparency and prevents any misunderstandings. Without it, both the seller and the buyer may have a different understanding of what was agreed upon. The receipt should specify whether the deposit is refundable or non-refundable and provide a clear timeline for completing the full payment.

When Finalizing the Terms

If the sale is contingent upon further negotiations or inspections, issue a receipt to confirm the buyer’s intent to proceed. This document should outline any conditional terms that both parties have agreed upon, ensuring there is a written record that protects both sides.

Used Car Deposit Receipt: Key Details

Make sure to include specific information in the deposit receipt for clarity and legal protection. This document should state the total amount paid, the date of payment, and details about the car being purchased, such as its make, model, year, and VIN (Vehicle Identification Number).

Payment Details

The receipt should clearly specify the amount of the deposit made, noting if it is a partial or full payment. Include payment method (cash, credit card, bank transfer), and make sure to mention if there are any conditions attached, such as refund policies or contingencies tied to the car’s condition or final sale.

Agreement Terms

Incorporate basic terms of the sale agreement. This can include the total agreed purchase price, any additional fees (like taxes or registration), and the agreed-upon date for full payment or delivery. A section outlining the consequences if the deal is canceled by either party helps clarify responsibilities.

Finally, include space for both buyer and seller signatures. This serves as confirmation of the deposit and indicates that both parties agree to the outlined terms.