To create a professional installment payment receipt, make sure to include clear and specific details such as the total amount due, the payment plan, and the dates of each installment. This will help both parties stay on track and avoid confusion.

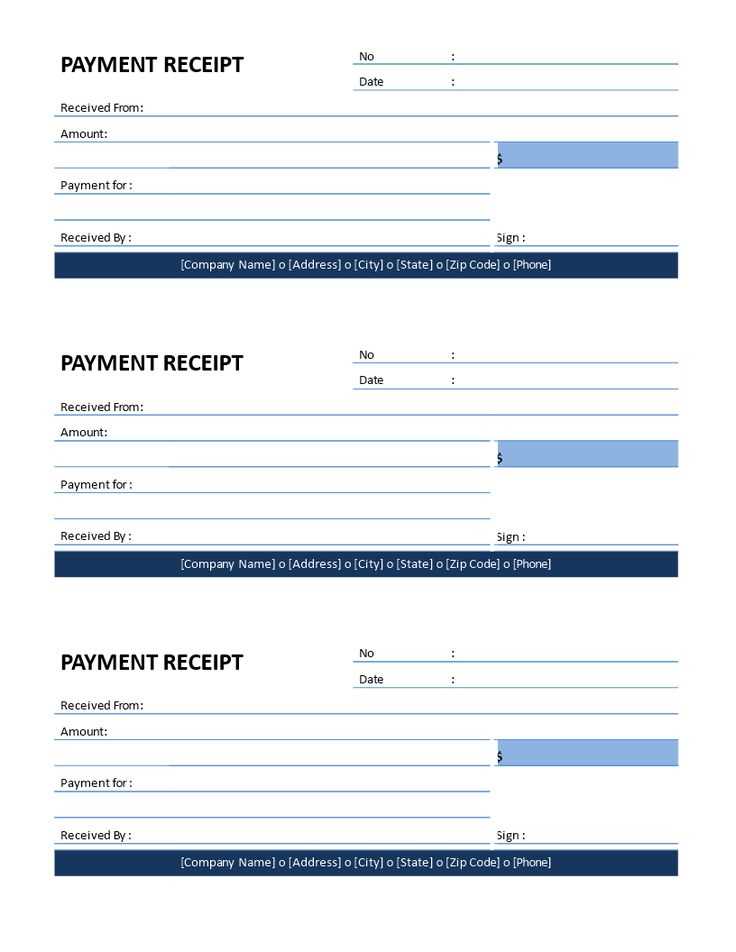

Start with a header that clearly states “Installment Payment Receipt,” followed by the receipt number and date of issue. Next, provide the full name and contact details of both the payer and the payee. This ensures that all involved parties are easily identifiable.

Clearly list the total amount of the payment and break it down into individual installment amounts. Be specific about the dates for each payment and the method of payment. This transparency keeps everyone informed and ensures proper record-keeping.

Finish with a section that acknowledges the receipt of each installment, making sure to include any relevant terms or conditions. The template should also offer space for signatures from both parties, validating the agreement and payment process.

Here is the revised version with reduced word repetition:

To streamline an installment payment receipt, ensure all essential details are clearly listed. Include the payer’s name, payment amount, and date of the transaction. Break down the installment terms–such as frequency and due dates–without redundancy.

Payment Breakdown

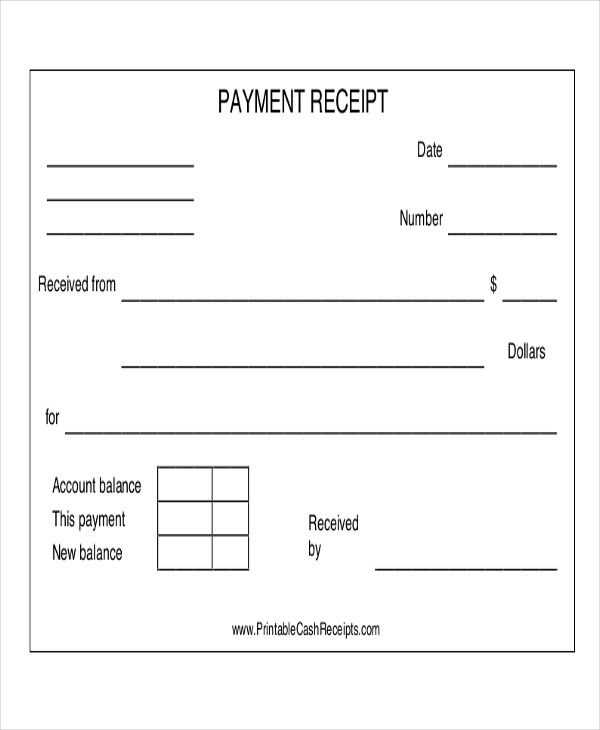

Clearly state the total amount due, the installment amount, and the payment schedule. For example, “Total due: $500. Payment 1 of 5: $100 due on March 1st.” This makes tracking payments simple and reduces confusion.

Signature and Confirmation

Leave space for both the payer and recipient’s signatures. Include a confirmation section to mark when the payment is received and processed. This adds clarity and confirms the completion of each installment.

- Installment Payment Receipt Template

To create a detailed and accurate installment payment receipt, include key information that confirms the transaction’s terms and amounts. This will ensure clarity for both the buyer and the seller.

Key Elements to Include

Here are the crucial elements you should always include in an installment payment receipt:

| Element | Description |

|---|---|

| Receipt Number | A unique identifier for tracking the payment. |

| Payment Date | The specific date the payment was made. |

| Buyer’s Name | The full name of the person making the payment. |

| Seller’s Name | The business or individual receiving the payment. |

| Payment Amount | The specific amount paid in this installment. |

| Remaining Balance | The remaining balance due after this installment. |

| Due Date | The next payment due date, if applicable. |

| Payment Method | Cash, check, or any other method used for the payment. |

Sample Template

Here is a simple format to follow when creating an installment payment receipt:

| Field | Example |

|---|---|

| Receipt Number | RPT-001234 |

| Payment Date | February 5, 2025 |

| Buyer’s Name | John Doe |

| Seller’s Name | ABC Electronics |

| Payment Amount | $150.00 |

| Remaining Balance | $350.00 |

| Due Date | March 5, 2025 |

| Payment Method | Credit Card |

Ensure the payment receipt clearly shows the details of each installment, including the date of payment, the amount paid, and the remaining balance. This creates transparency and avoids any confusion for both parties involved.

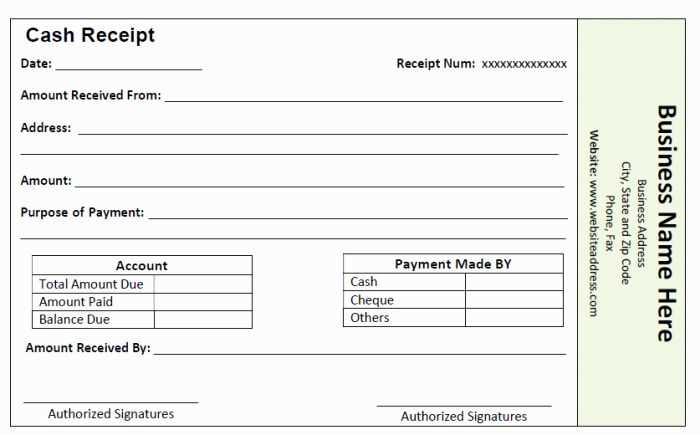

Include Key Information

Each receipt should include the full name of the payer, the recipient’s name, and the unique reference number for the installment plan. Also, include the total amount agreed upon and the payment terms (e.g., number of installments, due dates). This information helps track payments and keeps records clear.

Break Down the Payment Structure

List the payment amount for each installment and how much has been paid versus what is still owed. Include payment dates for each transaction. This breakdown makes it easy to track progress and ensures there are no misunderstandings about the remaining balance.

Include the full names and contact details of both parties–the buyer and the seller. This helps to establish clarity and accountability for the transaction.

Clearly state the total amount due for the installment payment plan, breaking it down into individual installments if necessary. It should be easy for both parties to see the overall cost and how it is divided.

Specify the payment schedule, including the due dates for each installment. Include the start date and how often payments should be made, whether weekly, monthly, or according to another interval.

Provide details of the payment method(s) accepted, such as bank transfer, credit card, or other methods. Clarify if there are any additional charges, such as late fees, for missed payments.

Include the total number of installments and the amount due for each. This will eliminate confusion and make tracking easier for both parties.

Outline the terms of any late payment penalties or grace periods, including the consequences for failure to adhere to the payment schedule. This ensures both parties know the financial consequences in case of missed payments.

Include a section for both parties to sign and date, confirming that the agreement is valid. This step makes the document legally binding.

Break down payments into clear, understandable parts to prevent confusion. Start by listing each installment amount, the due date, and any additional fees that apply. This will make it easy for the recipient to understand their obligations without needing to refer to other documents.

Include Specific Payment Dates

- Ensure that each installment has a clear and distinct due date.

- List the payment frequency (e.g., weekly, monthly) for transparency.

Detail Additional Costs

- Outline any interest rates or service fees that apply.

- Indicate the total amount of interest paid across the entire period.

Presenting this information in a table format can also enhance clarity and ensure that each payment is easily tracked by the recipient. Keep the language simple and direct, avoiding unnecessary details that may obscure the payment breakdown.

Set up a clear schedule for payment dates, including due dates and amounts. Use a calendar or a digital tool to mark these dates for easy reference. Track the payments as they are made and adjust the outstanding balance accordingly. This will help you spot any missed payments early on.

Regularly update the payment history, recording both the payments received and any remaining balance. Be specific about amounts paid and the date of each payment. This transparency will make it easier to follow up on any overdue payments.

In cases where payments are delayed, reach out to the payer with a friendly reminder. Include the exact amount outstanding and the original payment due date. Offering options for partial payments or new dates can help resolve issues without conflict.

Consistency is key. Keep the records up-to-date, and verify the outstanding balance after each transaction. This will help maintain accurate financial tracking and ensure no payment slips through the cracks.

Tailor your receipt to reflect specific payment plans by clearly stating the payment schedule and amounts. For monthly installments, list the amount due for each period, the total number of installments, and the due date for each payment. You can also include a section for early payments or additional fees if applicable.

Ensure that each installment is labeled distinctly, such as “Payment 1 of 6” for clarity. If there are options for flexible payment plans, offer customers the opportunity to modify their payment schedule, ensuring that all details are reflected in the receipt.

In the case of a deferred payment plan, highlight the grace period and when payments will start. For lump-sum payments, indicate the total amount and the due date. Make sure to include any adjustments, discounts, or additional charges that may affect the total balance. This transparency builds trust and prevents confusion.

Lastly, make sure all terms are understandable and free of ambiguity, with sufficient space to note changes or special requests. This customization ensures that customers feel informed and confident about their financial commitment.

Start by including all the mandatory elements required by your local laws to ensure that the installment payment receipt is legally valid. Check if your jurisdiction requires specific wording or disclosures related to interest rates, fees, or payment schedules.

- Clearly state the full name and contact information of both parties involved in the transaction.

- Specify the total amount owed, including any applicable interest or additional charges.

- Detail the payment schedule, including due dates, installment amounts, and payment methods.

- Include a section for signatures or electronic approval, indicating consent to the terms outlined.

- Ensure the receipt includes a clause that addresses consequences in case of non-payment or late payments, such as penalties or interest.

Review applicable consumer protection laws to make sure your document includes necessary disclaimers regarding cancellation rights or refunds, if required. Verify the document complies with data protection regulations, particularly when handling personal or financial information.

Consult with a legal professional to confirm that your template meets all relevant legal requirements in your area.

Installment Payment Receipt Template

Make sure to include the exact breakdown of each payment installment. Specify the amount due, the date of the payment, and the remaining balance. This transparency ensures both parties have a clear understanding of the payment schedule.

Clearly list the total amount, the number of installments, and the frequency (e.g., monthly, quarterly). Include any interest or fees if applicable. If there’s a late fee policy, state it explicitly.

Don’t forget to add a payment reference number for easy tracking. This can be a unique identifier that both parties can use to match payments and receipts quickly.

Include fields for the payer’s and recipient’s details, such as names, addresses, and contact information, ensuring all parties are easily identifiable. This prevents any confusion if there are any questions or disputes regarding the payment schedule.

Finally, leave a section for signatures or digital acknowledgments from both parties to confirm the agreement. This provides an official record of the terms and protects both sides in case of any future discrepancies.