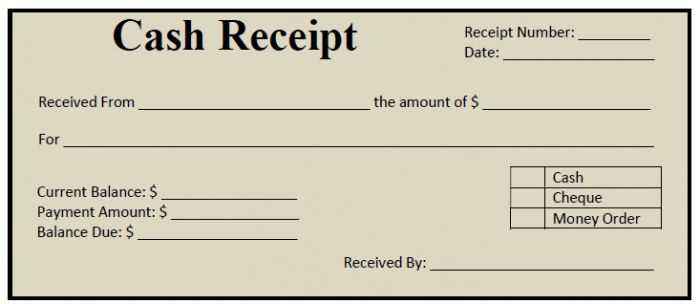

To ensure clarity and accuracy in financial transactions, use a structured receipt template for cash payments. This template should detail the amount received, the purpose of the payment, and the date of the transaction. It’s important to include both the payer’s and recipient’s names, ensuring that both parties have a clear record for their financial tracking.

Include a unique receipt number for easy reference in case of any disputes or future inquiries. This can help maintain organized records, especially if you’re dealing with frequent transactions. A clear breakdown of the payment type (cash, in this case) and any applicable fees or discounts should be noted as well.

Keep the receipt concise, but make sure all relevant details are captured. This includes a signature line for the recipient, which adds a level of formality and acknowledgment to the transaction. Finally, don’t forget to provide a copy of the receipt to the payer, ensuring both parties are on the same page.

Here’s the revised version:

For a receipt template, ensure all essential details are included, like the date, the amount received, and the name of the payer. Be specific with the payment method used, whether it’s cash, check, or card. Clearly state the transaction’s purpose to avoid any confusion in the future.

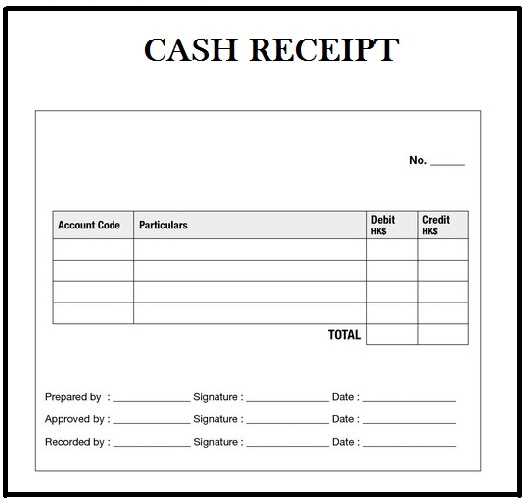

Template Structure

Start with the title “Receipt for Payment” at the top. Below that, add fields for the payer’s information, the amount, and a brief description of the service or product paid for. Don’t forget to include a unique receipt number for tracking purposes.

Payment Details

It’s crucial to specify the exact amount received and the currency. If applicable, note any taxes or discounts. For cash payments, include the denomination breakdown to ensure transparency. If the payment is partial, mention the remaining balance due.

Finally, include a signature or a confirmation line to make the receipt official. This adds an extra layer of validation for both parties.

- Receipt of Cash for Payment Template

Use a clear and concise receipt template for recording cash payments. Include the payer’s name, payment amount, date, and a brief description of the transaction. This documentation ensures transparency and serves as proof of payment for both parties involved.

Key Elements to Include

The receipt should contain the following details:

- Payer’s Information: Name or company name, contact details if needed.

- Amount Received: Specify the exact cash amount received.

- Date of Payment: The day the payment was made.

- Description: A short note describing the reason for the payment (e.g., invoice number, service/product purchased).

- Signature: Both the payer and payee signatures to verify the transaction.

Why It Matters

Maintaining an accurate record of cash payments helps prevent disputes and facilitates smoother business operations. It also protects both the payer and payee in case of future inquiries or audits.

To create a simple cash payment receipt, begin by including the following key details:

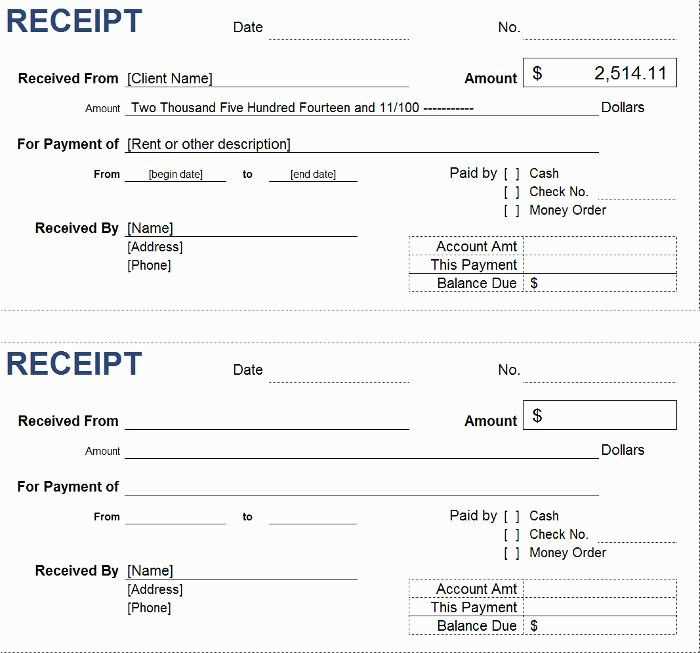

1. Receipt Title and Number

Label the document clearly as “Cash Payment Receipt” at the top. Add a unique receipt number for easy tracking of transactions.

2. Payment Date and Time

Include the exact date and time when the payment is made. This ensures that both the payer and receiver have a clear reference of the transaction timing.

3. Payer and Payee Information

List the names of both the payer and the payee. This helps to identify the involved parties and avoid confusion if any discrepancies arise later.

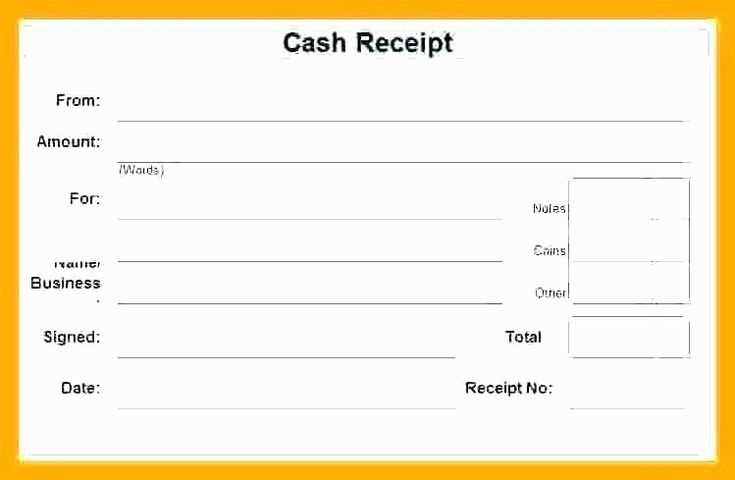

4. Payment Amount

Clearly state the amount paid in both numeric and written form. This helps avoid misunderstandings about the payment amount.

5. Payment Method

Even though it is a cash receipt, include a line that specifies “Cash” as the payment method. This makes the payment method explicit in the document.

6. Purpose of Payment

Briefly explain the reason for the payment, whether it is for goods, services, or a loan repayment. This section ensures both parties know the purpose of the transaction.

7. Signature of Payee

Include a space for the payee to sign the receipt, confirming the payment has been received. This adds authenticity and legal weight to the document.

8. Additional Notes

If needed, include any terms or conditions related to the payment or special notes. For example, you may mention that this receipt is final or list any outstanding balances.

Cash payment receipts must meet specific legal criteria to ensure they are valid and compliant. A receipt should include the date of the transaction, the amount paid, the method of payment (in this case, cash), and the description of the goods or services provided. This ensures transparency and avoids disputes between parties.

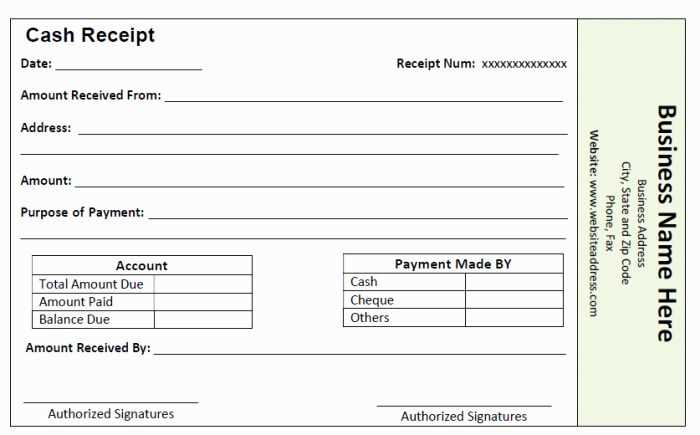

The receipt should also state the name and address of the business or individual receiving the payment. If applicable, including a tax identification number can help verify the legitimacy of the transaction. This helps the recipient to properly report their income for tax purposes and gives the payer assurance that the transaction is properly documented.

In some jurisdictions, receipts for cash payments must be issued promptly, often on the spot. Failure to provide a receipt at the time of payment may result in penalties or fines for the business or individual receiving the payment. Always verify the local laws to ensure full compliance with cash transaction regulations.

For businesses subject to VAT or sales tax, the receipt must indicate whether tax was included in the total amount or if it was exempt. This is critical for record-keeping, especially during audits or tax assessments.

A properly issued receipt is not only a requirement for legal compliance but also a useful tool for both the payer and payee in case of refunds, exchanges, or disputes.

Include the transaction date, which clearly states when the payment occurred. This ensures clarity and helps track the timing of financial exchanges.

Provide the name or business of the recipient. Identifying the entity receiving the payment prevents confusion and ensures accountability.

Specify the amount paid, breaking it down if necessary. For example, list taxes, discounts, or other adjustments to make the payment details clear.

Reference the payment method, such as cash, credit card, or bank transfer. This confirms the type of transaction and helps with future reconciliation.

List a unique receipt number for tracking purposes. This is especially useful in case of disputes or for maintaining accurate financial records.

Include a brief description of the products or services purchased. This ensures the payment is tied to the correct transaction.

Offer the payer’s information, including name and contact details, if relevant. This makes it easier to follow up with them, if needed.

Incorporate any terms or conditions that are relevant to the payment, such as refund policies or warranties. These help clarify the terms of the transaction.

For accurate financial tracking, customizing a cash receipt based on the transaction type is crucial. Tailoring the receipt ensures that every transaction is properly documented and categorized for both clarity and future reference.

- Sales Transactions: For sales payments, include the product or service description, quantity, unit price, and total amount. Additionally, note any applicable taxes or discounts, and clearly indicate whether the sale was a cash purchase or paid by another method.

- Refunds or Returns: In the case of returns, modify the receipt to reflect the returned item(s), the amount refunded, and the reason for the return. The original transaction reference number helps to link the receipt to the previous sale.

- Loan Repayments: When receiving cash for loan repayments, include the loan reference number, the outstanding balance before payment, and the updated balance after payment. Make sure to mention the payment terms and any relevant dates.

- Deposits: For deposits, specify the type of deposit (e.g., security deposit, down payment), the associated contract or agreement number, and the total amount deposited. Clearly state if the deposit is refundable or non-refundable.

- Charitable Donations: Customizing receipts for donations involves including the donor’s information, the donation amount, and the purpose of the donation (if applicable). A note that the donation is tax-deductible helps ensure compliance with relevant regulations.

Always ensure that each customized receipt contains essential details such as the receipt number, transaction date, and payment method. This approach helps maintain clear and accurate financial records for both your business and your customers.

Start by ensuring the receipt includes the following key details:

- Receipt number: Assign a unique identifier to each receipt for tracking purposes.

- Business information: Include the company name, address, and contact details.

- Date of transaction: Indicate the exact date when the payment was made.

- Payment method: Specify the method used (cash, credit card, bank transfer, etc.).

- Transaction details: Provide a clear description of the goods or services provided.

- Amount paid: List the total amount, breaking it down by product or service if necessary.

- Customer information: Include the customer’s name and any relevant details (if applicable).

Next, check the clarity of the details. Ensure everything is easy to read and there are no errors in the transaction data. Accuracy helps prevent any confusion or disputes later on.

Once all the details are correctly filled in, sign the receipt if required. Some businesses may also want to add a stamp or company logo for added legitimacy.

Finally, give the receipt to the customer either in physical form or digitally. If it’s a digital receipt, make sure it’s sent via an official business email address or other reliable platforms.

Always verify the details before issuing a receipt. A common mistake is to overlook key payment information such as the payment amount, date, or method. Double-check each detail to ensure accuracy, as errors can lead to misunderstandings or disputes.

Missing or Incorrect Date

Ensure the receipt includes the exact date the payment was made. Failing to do so can create confusion, especially in cases where payment verification is needed later. Always provide an accurate date to avoid this issue.

Not Including Enough Payment Details

Don’t forget to specify the payment method, whether it was by cash, credit, or another method. Leaving out such details can create problems if there’s a need to trace the transaction in the future. Clear payment information establishes a reliable record.

Another mistake is using vague or unclear descriptions for goods or services. Be specific about what the payment covers to avoid disputes about what was paid for.

Receipt of Cash for Payment Template

When creating a receipt for cash payments, clarity is key. A well-structured receipt ensures both parties understand the transaction details. Begin by specifying the date and time of the payment, followed by the payer’s name and payment amount. Include the purpose or description of the payment, as this helps clarify the nature of the exchange.

Use a clear breakdown of amounts when applicable. If the payment includes multiple items or services, list them individually for transparency. This eliminates any confusion about the specifics of the transaction.

Ensure the receipt includes a signature line for both the payer and the recipient. This serves as a confirmation of the transaction. Finally, add any additional details, such as the method of payment, to complete the record.

| Date | Payer’s Name | Amount | Description | Method of Payment | Signature |

|---|---|---|---|---|---|

| 2025-02-05 | John Doe | $500 | Payment for services rendered | Cash | ________________ |