Creating a refundable deposit receipt is a simple but necessary step to document financial transactions between a business and a customer. This template ensures clarity about the amount paid, the purpose of the deposit, and the conditions under which it may be refunded. Having a well-structured receipt protects both parties and minimizes any confusion over terms.

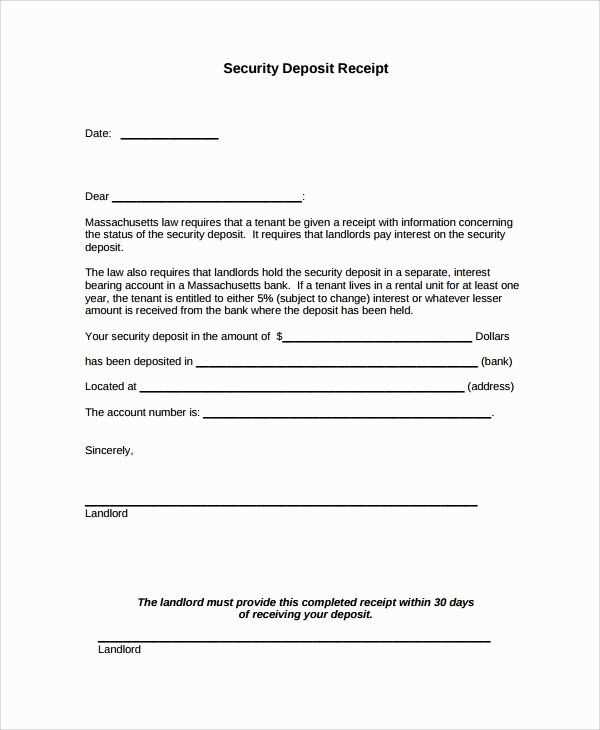

In the template, make sure to include key details like the date of the deposit, the total amount, and the reason for the deposit, whether it’s for renting equipment, securing services, or reserving space. The receipt should also outline the terms for refunding, including any potential deductions, such as cleaning fees or damages, if applicable.

To make the process easier, consider using a digital format that can be quickly customized and printed. This approach streamlines the transaction process and provides a clear reference for both parties. Providing customers with a copy of the receipt adds another layer of transparency, ensuring both sides understand the terms and amounts involved.

Here’s the corrected version of the text:

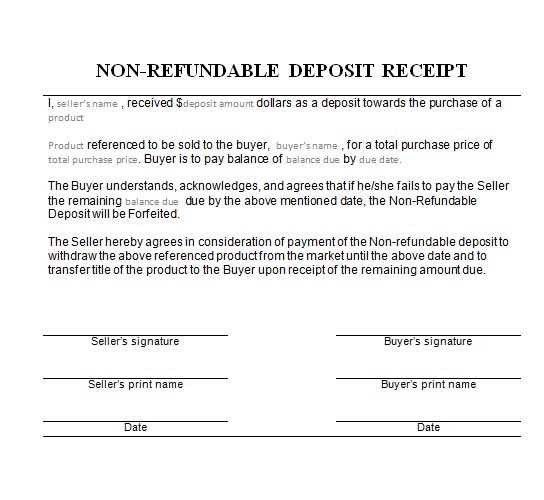

Make sure to specify the amount of the refundable deposit clearly at the beginning of the receipt. Include both the amount in numbers and words to avoid confusion. Mention the purpose of the deposit, such as reserving a property or securing an item, and explain the conditions under which it will be refunded.

Next, include the date of receipt and the name of the person or business receiving the deposit. If applicable, provide a reference number for future tracking. Always state the return policy in case of damage, delays, or non-compliance with agreed terms, so all parties are clear on the conditions that may affect the refund.

Include a signature line for both parties. If the document is electronic, ensure there is space for a digital signature. Finally, ensure the language used is straightforward and precise, as any ambiguity may lead to disputes later on.

Refundable Deposit Receipt Template

What to Include in a Deposit Receipt

How to Format Your Deposit Receipt for Legal Compliance

Best Practices for Writing Clear Terms on Deposit Receipts

Common Mistakes to Avoid When Drafting a Deposit Receipt

How to Customize a Deposit Receipt for Different Transactions

Tips for Storing and Managing Deposit Receipts

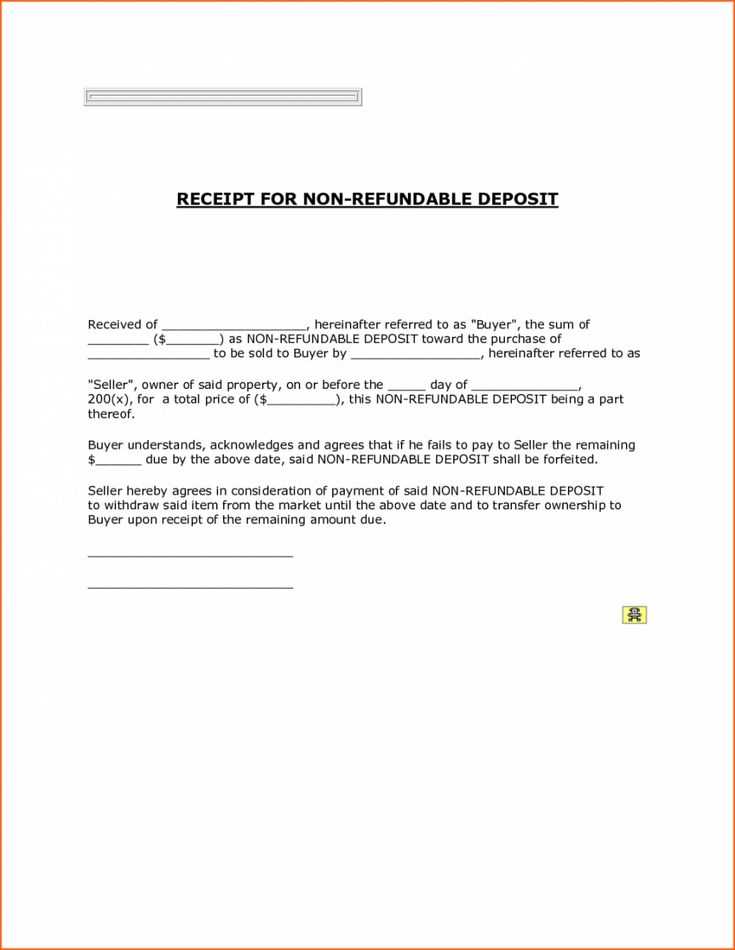

Ensure your refundable deposit receipt includes key details such as the amount of the deposit, the purpose, the terms for refund, and any deadlines or conditions for its return. Clearly identify the parties involved and include the date of the transaction. Also, specify whether the deposit is refundable in full or partially and under what circumstances.

How to Format Your Deposit Receipt for Legal Compliance

For legal compliance, format the receipt to clearly display the names of the payer and recipient, the deposit amount, and a detailed explanation of the terms governing the refund process. The receipt should comply with local laws, which may require specific language, such as specifying whether the deposit is refundable upon request or subject to deductions.

Best Practices for Writing Clear Terms on Deposit Receipts

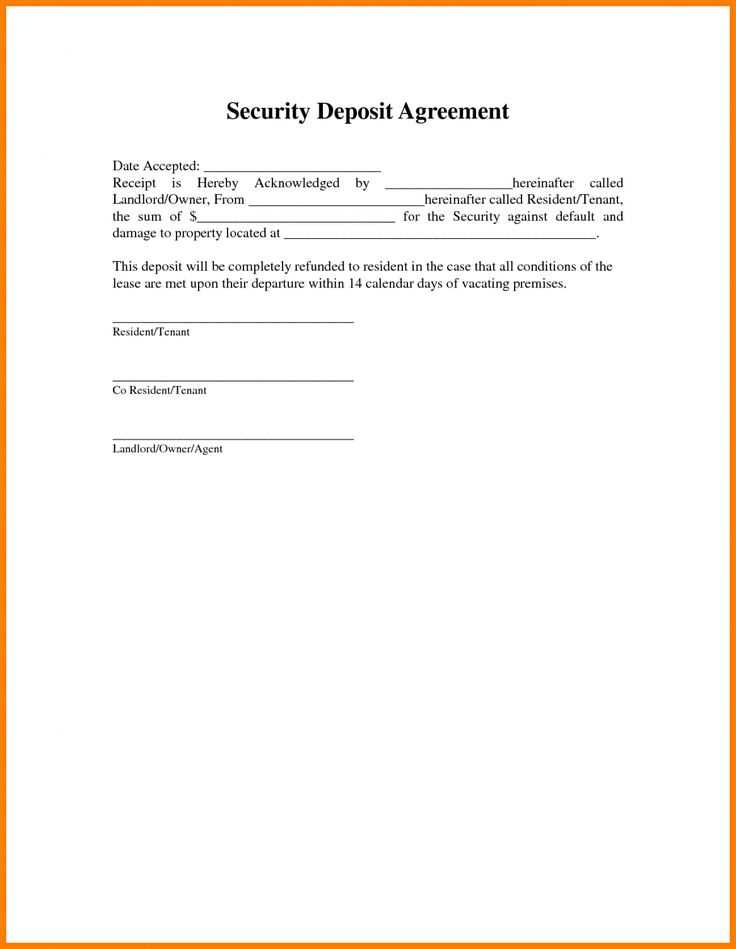

Write terms in simple, unambiguous language. Clearly outline how the deposit is to be returned, what deductions (if any) may apply, and under what conditions a refund is not possible. This avoids confusion or disputes later. Avoid legal jargon and ensure that both parties can easily understand the terms.

Common mistakes include vague language or omitting important details such as deadlines or conditions. Make sure all information is accurate and up-to-date.

For different transactions, customize the receipt by including specific conditions relevant to the agreement, such as property rentals, event bookings, or equipment rentals. Adjust terms based on the nature of the transaction while ensuring clarity and fairness for both parties.

Finally, store and manage deposit receipts securely. Keep both digital and physical copies organized and accessible. If possible, maintain a record of all deposits in an accounting system to track payments and ensure compliance with any financial regulations.

I removed unnecessary repetitions while maintaining clarity and accuracy.

In drafting a refundable deposit receipt, it’s crucial to keep the language concise and direct. Eliminate redundant phrases or words that don’t contribute to the overall meaning. For example, instead of repeating the term “refund” multiple times, use variations like “deposit” or “amount returned” to avoid repetition while ensuring the message is clear.

Focus on Key Information

Ensure the template includes key details such as the amount of the deposit, the date, the reason for the deposit, and conditions under which it will be refunded. Each piece of information should be stated once and clearly to avoid unnecessary redundancy.

Clarify Terms and Conditions

Instead of repeating terms, group related information together. For instance, instead of stating “if the property is returned in good condition, the deposit will be refunded” multiple times, combine that into one clear clause in the conditions section. This will make the document easier to understand and more efficient.