For employees claiming House Rent Allowance (HRA), submitting a rent receipt is a simple yet important step. A properly filled-out rent receipt template helps in validating the rental payments made by the employee. Using a standardized format ensures transparency and avoids confusion when submitting claims to the employer or tax authorities.

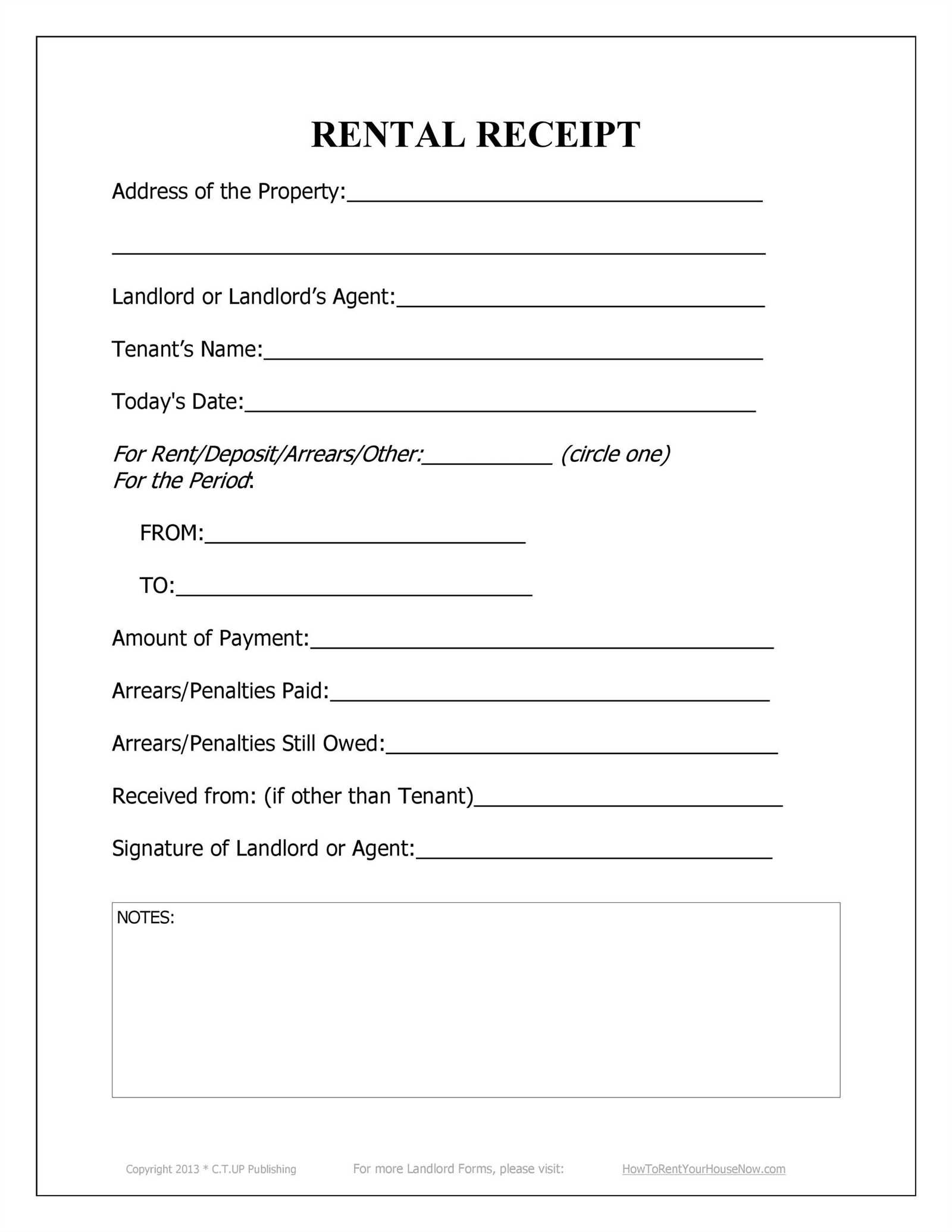

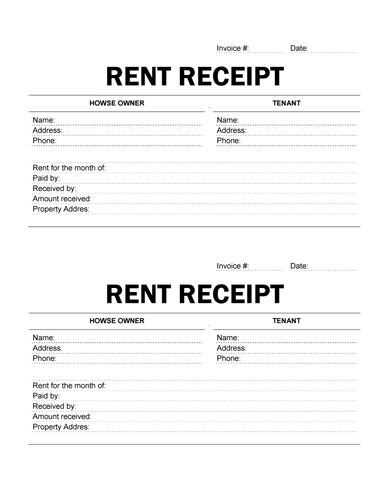

The rent receipt should clearly indicate the names of the landlord and tenant, along with the rental amount, the address of the rented property, and the payment period. It should also state whether the rent includes utilities or other additional costs. By following a structured template, both parties can ensure all necessary information is recorded correctly.

Template Example: Include fields such as date of payment, month of rent, and the total amount paid. Adding a signature line for the landlord further authenticates the receipt. It is also recommended to maintain a copy for personal records in case of future audits or disputes.

Here is the revised version with minimal repetition:

Ensure your rent receipt template for HRA is clear and straightforward. Avoid unnecessary text while maintaining all required details. This allows the document to be easy to read and process. Below are key elements to include:

Key Elements of the Rent Receipt Template:

- Tenant Information: Name, address, and contact details.

- Landlord Details: Include the landlord’s name, contact information, and address.

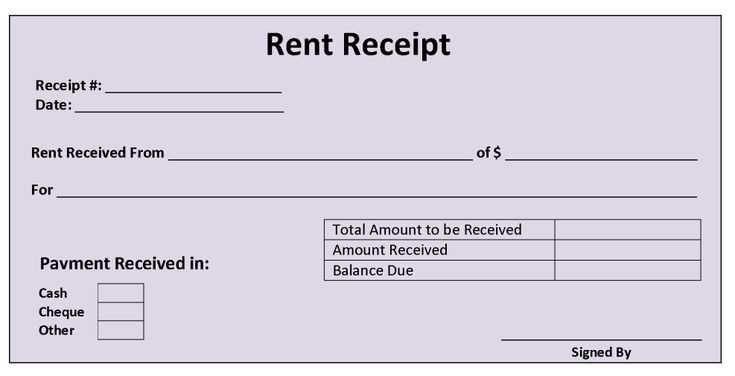

- Rent Amount: Clearly state the rent amount and any applicable taxes or fees.

- Payment Date: Specify the exact date the payment was made.

- Payment Mode: Indicate how the payment was made (e.g., bank transfer, cash, cheque).

- Property Address: Mention the full address of the rented property.

- Lease Period: Include the start and end date of the rental agreement, if applicable.

Formatting Tips:

- Keep the language simple and direct.

- Ensure a clear, professional layout with ample space between sections.

- Use bold or italics sparingly to highlight important information.

- Rent Receipt Template for HRA Claims

A rent receipt template for HRA claims should include key details to ensure smooth processing. The basic components to include are:

1. Landlord and Tenant Details

List the full name and address of both the landlord and tenant. This information confirms the rental agreement and establishes the identity of both parties.

2. Rent Payment Details

Clearly state the rental amount, the payment date, and the period it covers. This helps HR departments confirm the validity of the rent paid for the given month.

For convenience, include space for any additional notes or conditions that may apply, such as late payment or early payment discounts.

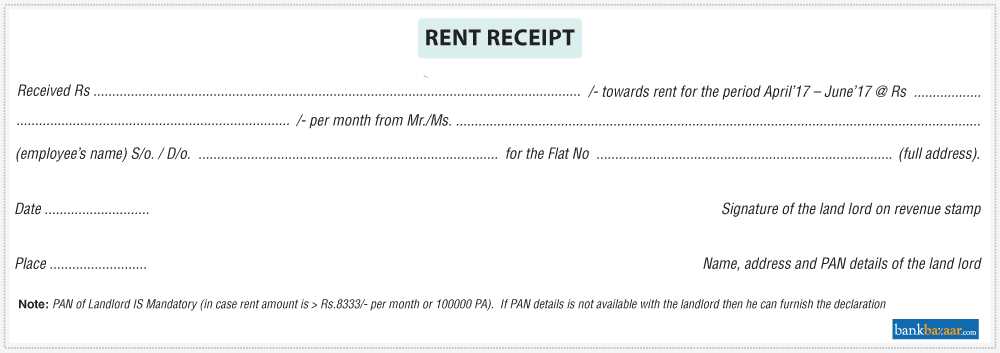

Rent receipts for HRA are necessary documents for employees to claim House Rent Allowance exemptions. The receipt serves as proof of rent payment, allowing employees to reduce their taxable income by the amount of rent paid. To ensure that the rent receipt is valid for HRA claims, it must meet specific criteria.

Here are the key elements that must appear on a rent receipt:

| Item | Description |

|---|---|

| Date | The exact date of the rent payment must be mentioned. |

| Landlord’s Name | The full name of the landlord or property owner. |

| Tenant’s Name | The tenant’s name, clearly identifying the person paying the rent. |

| Address of the Property | The address of the rented property where the tenant resides. |

| Amount Paid | The total rent amount paid for the specified period. |

| Signature of the Landlord | A signed acknowledgment from the landlord confirming the receipt of the rent payment. |

It’s important to note that rent receipts should be signed by the landlord, and it’s advisable to keep a copy of the receipt for your records. The document helps ensure transparency in rent payments and serves as evidence for any potential future HRA claims or tax-related audits.

A rent receipt template must include certain key elements to ensure clarity and accuracy for both the landlord and the tenant. These elements help to create a record that can be referred to in case of disputes or for financial documentation purposes.

Tenant and Landlord Information

Always include the full names of both the tenant and the landlord. Additionally, it’s important to list addresses or contact details. This ensures that both parties can be identified easily in case further communication is needed.

Details of Payment

Clearly specify the payment amount, the date it was made, and the rental period being covered. This provides transparency and avoids confusion. If the payment includes partial rent or late fees, that should be indicated as well.

Ensure that the receipt includes a statement confirming that the rent has been received in full. This serves as proof of payment and can prevent future misunderstandings.

Customizing rental receipts depends on the specific terms and conditions of each rental agreement. Start by ensuring the receipt reflects the details that are relevant to your lease agreement, such as payment frequency, rent due dates, and the property address.

- Adjust Payment Frequency: For monthly rentals, include the payment month; for weekly rentals, indicate the week covered. This helps avoid confusion for tenants.

- Include Additional Charges: If the tenant is responsible for utilities or maintenance fees, list these charges separately in the receipt.

- Specify Lease Term: Mention the period the rent covers (e.g., January 1, 2025, to January 31, 2025) to make it clear which rental term the payment corresponds to.

- Adjust for Partial Payments: If tenants make partial payments, note the amount received and the remaining balance. This ensures clarity on outstanding amounts.

- Indicate Late Fees: If applicable, include details about any late fees incurred, along with a reference to the lease agreement’s late fee policy.

- Tenant’s and Landlord’s Information: Always include the tenant’s and landlord’s names and contact details for proper identification.

- Digital or Paper Receipts: If you offer digital receipts, ensure the format is accessible and easy for tenants to store. Include digital signatures if needed for verification.

By tailoring receipts to these aspects, both landlords and tenants can avoid misunderstandings and maintain accurate records of transactions. Customization reflects the specifics of each lease while ensuring compliance with legal and financial expectations.

Rent receipts are a crucial component when applying for House Rent Allowance (HRA). They must meet specific legal requirements to be valid and accepted by employers or tax authorities.

Details to Include in Rent Receipts

A valid rent receipt should contain the following details:

- Tenant and Landlord Information: The full names, addresses, and contact details of both the tenant and the landlord.

- Rental Amount: The exact amount of rent paid for the month, mentioned clearly.

- Rent Period: The specific dates for which the rent is being paid, typically a calendar month.

- Signature of Landlord: The receipt must be signed by the landlord to verify the payment.

Format and Language

The rent receipt should be printed on a letterhead or on a plain paper with proper formatting. If required, it should be provided in the local language for clarity. Always ensure the receipt is legible and contains no errors to avoid disputes or delays in the HRA claim process.

One of the most frequent mistakes is not including the full address of the rented property. The rent receipt should clearly mention the complete address, including the house number, street name, city, and zip code. This helps avoid discrepancies when submitting the receipt for HRA claims.

Another common mistake is leaving out the rental period. Always mention the specific dates covered by the receipt, such as the month or duration the payment applies to. Without this, the receipt can be rejected as incomplete.

Ensure that the rent amount mentioned matches the amount actually paid. A mismatch can lead to confusion and potential issues when claiming HRA. Double-check the payment details before finalizing the receipt.

Sometimes, people forget to include the landlord’s name and signature. Without the landlord’s proper identification or confirmation, the receipt lacks credibility, which can result in rejection by the employer or tax authorities.

Additionally, not mentioning the mode of payment can be a problem. Specify whether the rent was paid via cheque, cash, bank transfer, or any other method. This provides clear evidence of the transaction.

| Key Information | Common Mistakes |

|---|---|

| Landlord’s Name and Signature | Omitting this detail makes the receipt less valid. |

| Rental Amount | Incorrect or mismatched amounts lead to disputes. |

| Rental Period | Failing to mention the rental period causes confusion. |

| Mode of Payment | Not specifying the payment method can cause issues with verification. |

| Property Address | Incomplete or incorrect addresses can delay HRA claims. |

Avoiding these mistakes ensures that your rent receipts are accurate and reliable for HRA claims. Be meticulous with each detail to prevent unnecessary complications.

To maximize your benefits with rent receipts, ensure they contain all the necessary details for verification. This includes the full address of the rented property, the date and amount paid, and the name and signature of the landlord. Keep these receipts organized by date and month to easily access them during tax filing or HRA claims.

Claiming HRA with Rent Receipts

When claiming HRA (House Rent Allowance), ensure the rent receipts match your actual payments. Employers may request proof of rent paid, and a valid rent receipt acts as this proof. In some cases, the receipts should be submitted along with a rental agreement or a landlord’s declaration to validate your claim.

Track Rent Payments for Tax Deductions

If you’re eligible for tax deductions under section 80GG of the Income Tax Act, rent receipts can be vital. Make sure the receipts align with your income bracket and rental agreement terms. Regularly tracking payments helps in claiming deductions efficiently.

Finally, maintain accurate records of all rent receipts for a smooth process in maximizing your HRA and tax benefits. By doing so, you ensure a hassle-free claim during audits or reviews.

A rent receipt template for HRA should include the following elements:

Basic Information

Clearly list the landlord’s name, address, and contact information at the top of the document. This ensures that the tenant can easily identify the source of the receipt.

Tenant Information

Include the tenant’s name and address to confirm who made the rent payment. This helps in verifying the receipt for HRA purposes.

Rent Payment Details

Provide the amount paid, the date of payment, and the rental period covered. It’s also helpful to mention the payment method (cash, bank transfer, etc.) for clarity.

Signature

Ensure there’s space for the landlord’s signature. This adds authenticity to the document and assures the tenant that the receipt is official.