Make sure to use a clear and professional template when providing a refundable car deposit receipt. This document should outline all important details such as the deposit amount, terms of refund, and the condition of the vehicle at the time of deposit. It helps both parties understand their responsibilities and avoids confusion.

Clearly state the amount paid and the payment method on the receipt. Include a section that explains how and when the deposit will be refunded, underlining any conditions that may affect the refund process. This ensures that the customer understands the full process and expectations.

Don’t forget to include the vehicle identification number (VIN) and any relevant details about the vehicle’s condition. This can help avoid disputes related to damage claims. Always use concise language and a straightforward layout, making it easy for anyone to read and understand the terms quickly.

Finally, have a section where both the customer and the dealer can sign, confirming the terms. A receipt that is easy to read and thorough will protect both the car dealer and the customer from future misunderstandings.

Here’s the revised version with reduced repetitions:

To simplify and streamline the receipt template for refundable car deposits, focus on clarity and concise information. Begin by clearly stating the terms of the deposit and the conditions under which it can be refunded. Avoid unnecessary repetition of the same details and ensure that each section serves a distinct purpose.

Deposit Terms and Conditions

List the deposit amount, payment method, and the date it was received. Specify the refundable conditions, such as return of the car in good condition and within the agreed time frame.

Refund Process

Detail the steps for refunding the deposit, including any deductions or charges for damages or late returns. This section should be short, clear, and cover the timeline for processing the refund.

| Item | Amount |

|---|---|

| Deposit Paid | $500 |

| Refunded Amount | $500 |

| Damage Charges (if applicable) | $0 |

| Late Return Charges (if applicable) | $0 |

- Refundable Car Deposit Receipt Template

A Refundable Car Deposit Receipt ensures both parties are clear about the terms of the deposit agreement. It serves as documentation for the amount paid and outlines the conditions under which the deposit will be returned.

- Receipt Header: Include your business name, contact information, and the date the deposit was made. This should appear at the top for easy identification.

- Depositor Details: Clearly list the name, address, and contact number of the person providing the deposit.

- Deposit Amount: State the exact amount paid as a deposit. Include both the currency and any applicable taxes if necessary.

- Purpose of Deposit: Specify the reason for the deposit, such as “Car Rental” or “Vehicle Purchase,” to avoid confusion.

- Conditions of Refund: Outline the conditions under which the deposit will be refunded, such as returning the car in good condition, or the cancellation policy. If there are any fees deducted from the deposit, mention those as well.

- Refund Timeline: State the time frame in which the deposit will be refunded after the car is returned, including any inspection periods.

- Signatures: Both parties should sign and date the receipt to confirm the agreement. This helps ensure that the terms are agreed upon and legally binding.

Having a clear and concise Refundable Car Deposit Receipt template helps prevent misunderstandings and ensures that both parties are on the same page regarding the return of the deposit.

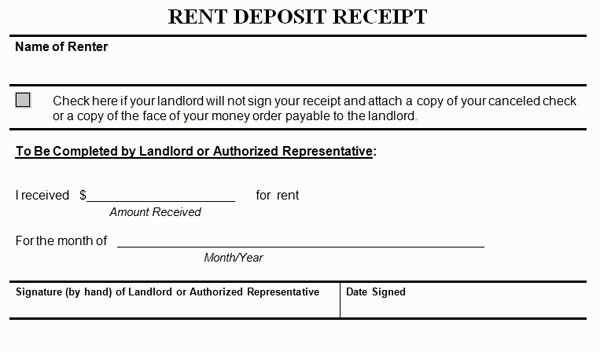

Begin by clearly identifying the parties involved. The receipt should include the names and contact details of both the depositor and the recipient (such as a landlord or rental company).

- Deposit Amount: Specify the exact sum of money being deposited, along with the currency type.

- Date of Payment: Clearly state the date the deposit was made.

- Purpose of Deposit: Indicate the reason for the deposit (e.g., car rental, security for damages).

- Refund Conditions: Outline the terms under which the deposit will be refunded. Include any requirements, like returning the car in good condition or fulfilling the rental agreement.

- Refund Timeline: Specify the period within which the refund will be issued, such as 10-14 days after returning the car.

- Signatures: Both parties should sign the receipt to confirm their agreement to the terms.

Conclude by adding a statement confirming the deposit is refundable, and include a section for the date of the refund and the manner in which it will be processed (e.g., via bank transfer). This helps ensure clarity and prevent disputes later.

The car deposit receipt should clearly display the following details:

1. Date and Time of Transaction

Include the exact date and time the deposit was made. This provides a clear reference point for both parties.

2. Amount of Deposit

Specify the exact amount being paid as the deposit. This eliminates any confusion and confirms the commitment made by the payer.

3. Car Details

Provide the make, model, year, and vehicle identification number (VIN) to ensure that both parties are referencing the correct car.

4. Payer’s Information

Include the full name, contact number, and address of the person making the deposit. This is crucial for follow-ups and future correspondence.

5. Terms of Refund

Clearly state the conditions under which the deposit is refundable, including any timeframes or actions that may affect its return.

6. Signatures

Both the buyer and the seller should sign the receipt to confirm the transaction and agreement.

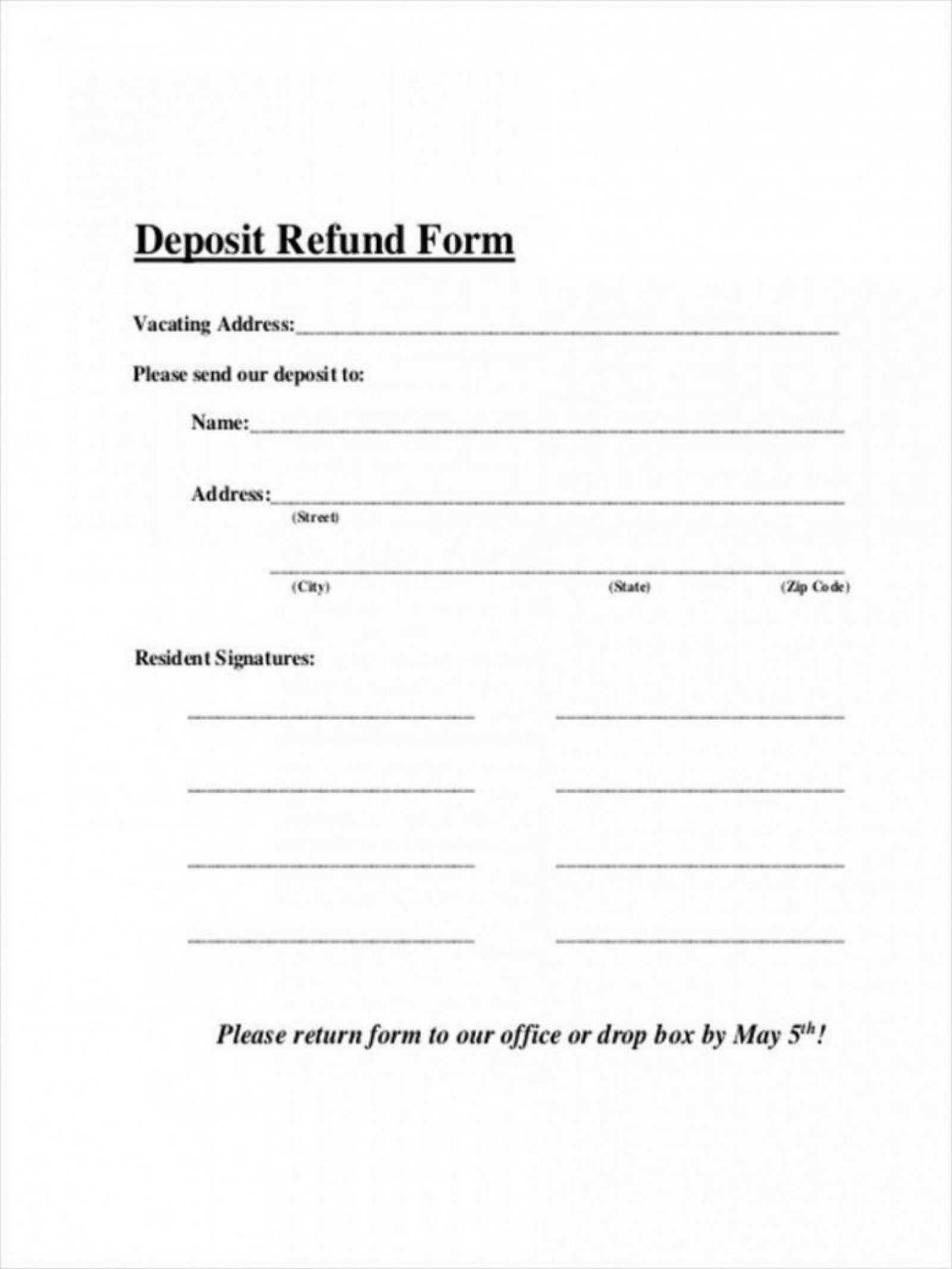

Include clear headings to organize the key sections of the receipt, such as “Deposit Amount,” “Date,” “Customer Details,” and “Refund Terms.” These headings help users find the information they need quickly.

Ensure the deposit amount is prominently displayed and easily distinguishable from other details. Use bold or a slightly larger font for the deposit amount to avoid confusion.

Use a logical order for the information. Start with the most important details, such as the deposit amount and customer information, followed by the conditions for refund and any additional notes. This sequence ensures users understand the structure right away.

Include a section for both the company and customer signatures at the bottom. This can serve as proof of agreement and add credibility to the receipt.

Incorporate a refund deadline and conditions clearly within the receipt. A simple statement about when and how the deposit will be refunded eliminates ambiguity and reduces potential disputes.

Design the receipt to be concise and avoid unnecessary jargon. Stick to simple, direct language that’s easy to read and understand.

Lastly, ensure the receipt is printable with proper margins and formatting. This allows the customer to keep a physical copy, making it more useful in case of future disputes or reference.

Clearly state the conditions under which the deposit is refundable. Include specific time frames, such as “Refundable within 7 days after vehicle return” or “Refundable if the vehicle is returned in the same condition as it was received.” Mention any deductions that might apply, such as for damage or cleaning fees. Specify the method of refund, for example, “Refund issued to the original payment method” or “Refunded by check.” Avoid vague language that could create confusion. For example, instead of saying “Refundable in some cases,” state exact circumstances that determine eligibility for a refund.

Be transparent about timelines. Indicate how long it will take for the refund to be processed once the vehicle is returned, such as “Refund processed within 10 business days.” This reduces uncertainty and reassures the customer about the process.

Clarify the impact of late returns. If the refund is contingent on returning the vehicle by a certain time, specify the consequences of delays, like “Refund may be reduced by $10 for every additional day.” Providing these details minimizes misunderstandings and sets clear expectations.

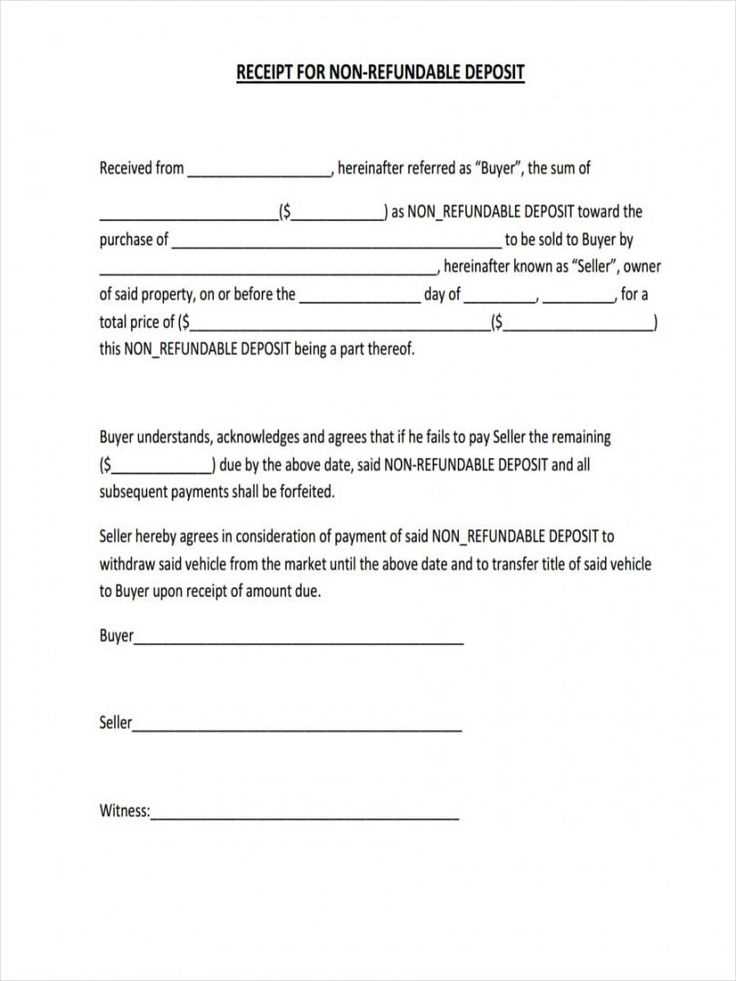

Clearly define the deposit amount, the purpose of the deposit, and any conditions under which it may be refunded or forfeited. The document should explicitly state whether the deposit is refundable or non-refundable. Specify the timeframe for the return of the deposit and any conditions that might affect this, such as the state of the vehicle upon return. If the deposit is tied to specific terms, like the completion of a contract or a rental period, outline these requirements to avoid misunderstandings.

Specific Terms and Conditions

- Include clear details on what happens if either party breaches the terms of the agreement.

- List any fees that may be deducted from the deposit (e.g., cleaning fees, damage charges).

- Clarify how the deposit will be returned (e.g., in cash, by check, or via bank transfer).

Legal Language and Enforcement

- Use precise and unambiguous language to avoid future disputes.

- Ensure that the agreement is enforceable in your jurisdiction by adhering to local laws and regulations regarding deposits and refunds.

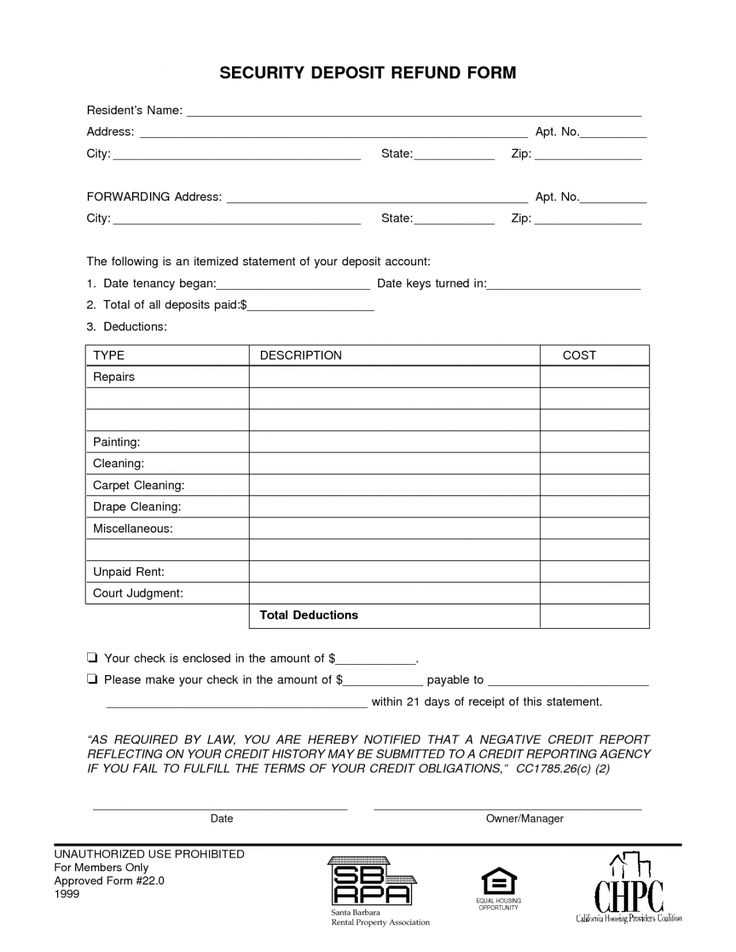

Adjust the template to match the specifics of each rental agreement. For instance, if the car rental duration is longer, increase the deposit amount. Include additional clauses for late return fees or vehicle damages. If the renter is a corporate client, modify the contact details and add the company’s information in the receipt. For rentals with higher risk (luxury or sports cars), you might want to include more detailed terms on damage and liability.

| Situation | Adjustment to Template |

|---|---|

| Long-term rental | Increase deposit amount. Add clauses for early return or extended duration fees. |

| Corporate client | Replace personal details with the company’s information. Specify authorized contacts. |

| Luxury or high-risk car rental | Clarify insurance coverage and add specific damage responsibility terms. |

Ensure that the template matches local laws and regulations by adding any required disclaimers or legal statements based on your location. This ensures that both parties are aware of the legalities tied to the deposit. Adjust the format or sections depending on the rental company’s requirements, making sure to cover all potential scenarios that might affect the deposit or refund process.

Deposit Receipt Template: Key Elements to Include

Ensure your refundable car deposit receipt includes the following essential details: the name of the payer, the car’s make, model, and registration number, the deposit amount, and the date of payment. These are key to verifying the transaction and ensuring both parties understand the terms. Mention the refundable nature of the deposit clearly to avoid any confusion later.

Deposit Terms and Conditions

Include clear terms specifying the deposit’s refund policy, including the timeframe for returning the deposit and any conditions that might lead to deductions. The receipt should also state if there are any fees related to late payments or damages that could affect the refund. These terms ensure that both parties are on the same page about expectations.

Additional Details for Clarity

For extra clarity, include a section for signatures from both the payer and the recipient. This confirms the agreement and solidifies the deposit terms. Also, make sure to specify the payment method used for transparency. These simple yet important steps can prevent potential disputes and help maintain a professional transaction.