To create an occupancy tax receipt, using a Word template can save time and ensure uniformity across documents. A well-structured template will capture all the required details such as the guest’s name, dates of stay, total rent amount, and the tax rate applied. The template should also include a section for payment confirmation and any relevant booking information.

Begin by including the property’s details at the top of the receipt, such as the name, address, and contact information. Then, incorporate space for the guest’s details, including the check-in and check-out dates. Make sure to clearly list the rental charges and tax calculations to maintain transparency. Include a breakdown of the occupancy tax rate and the total amount paid, allowing for clarity in case of inquiries.

A professional and straightforward format will help reduce errors and simplify the process for both you and the guest. You can also customize the template to meet local tax regulations, ensuring compliance with local laws. Avoid unnecessary sections and focus on accuracy for a streamlined and user-friendly document.

Here’s the corrected version:

To create an occupancy tax receipt template, follow these key guidelines:

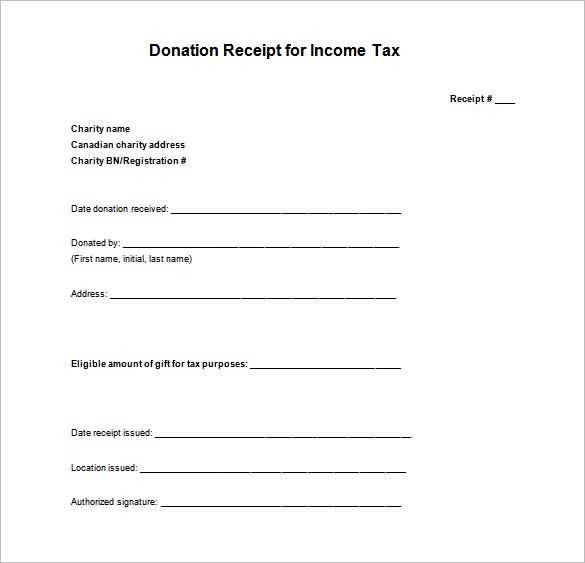

- Heading Section: Include the title “Occupancy Tax Receipt” at the top of the document. Add the date the receipt is issued, along with the name of the property owner or management company.

- Tenant Details: Specify the tenant’s name and contact information. This should be clearly outlined next to the address or unit number of the rental property.

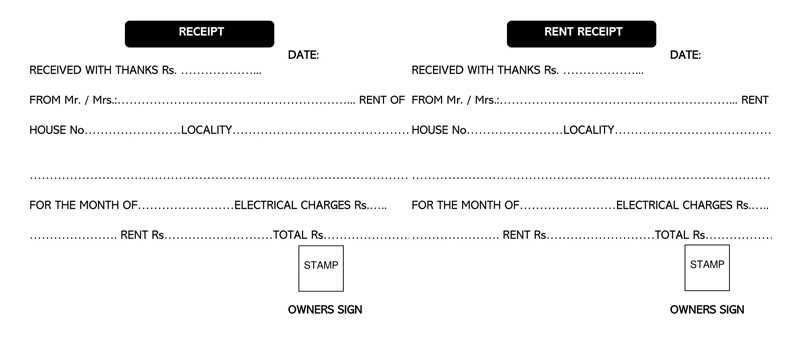

- Rental Information: List the rental period (start and end dates) and the specific rental rate per day or month. Ensure the details are easily visible for verification.

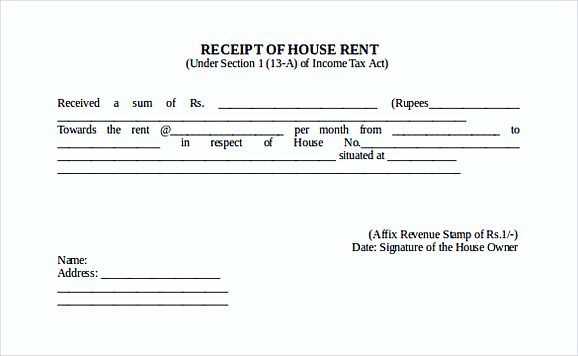

- Tax Information: Clearly state the total occupancy tax amount collected. Include the tax rate and any applicable deductions, if relevant.

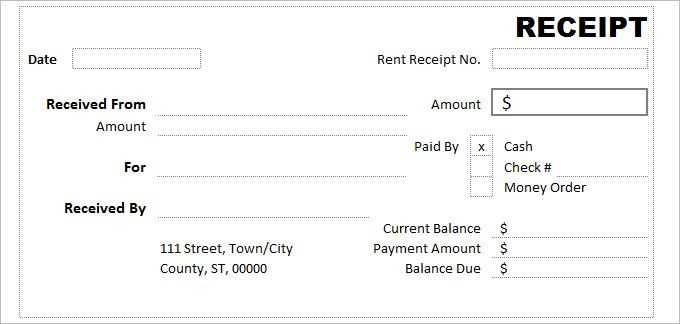

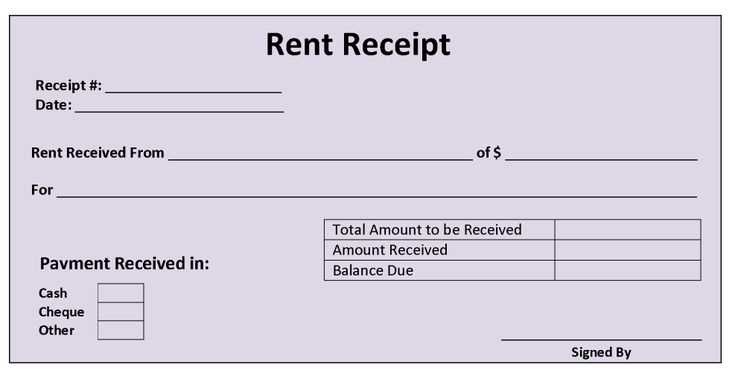

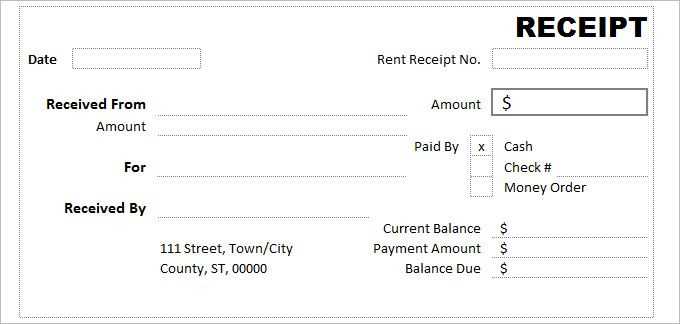

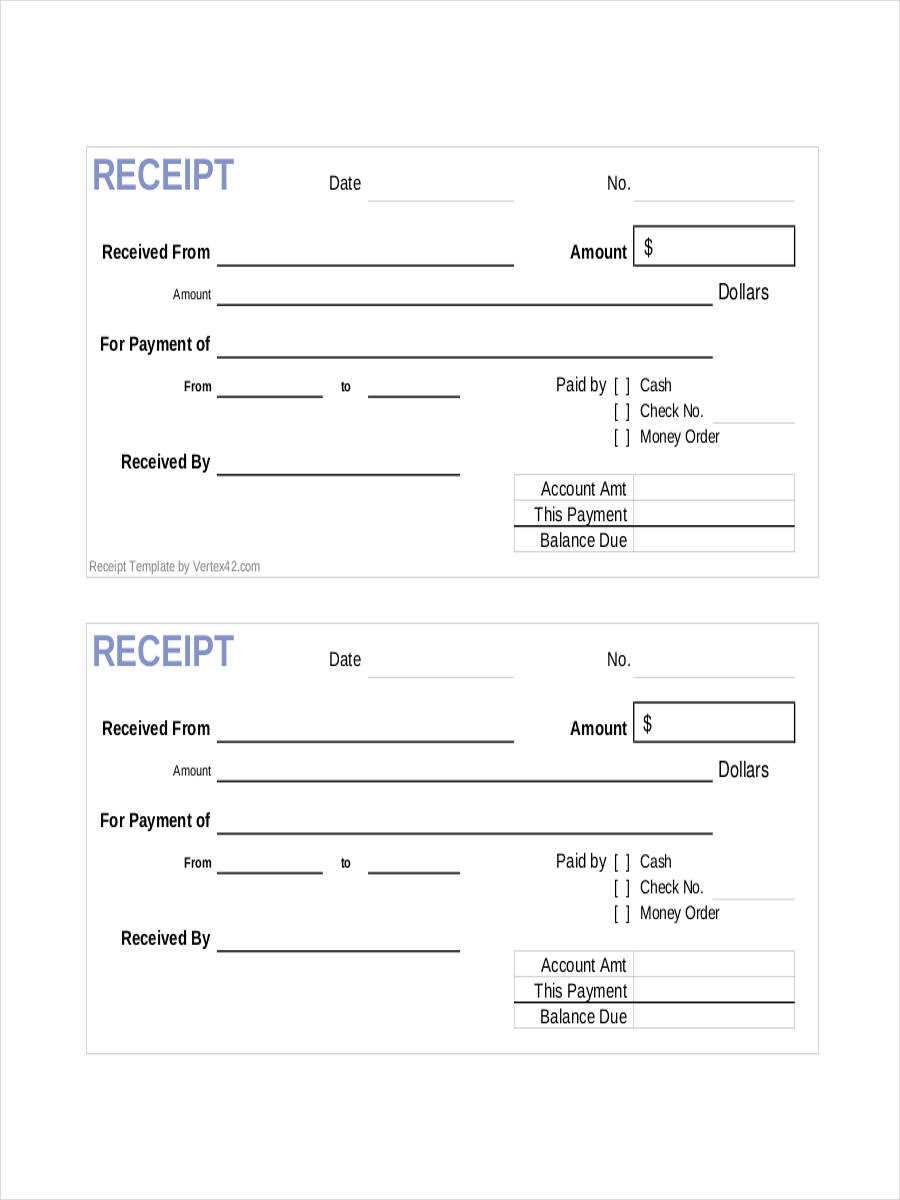

- Payment Information: Specify the total amount paid, the payment method (e.g., credit card, cash), and any payment references or transaction IDs for tracking purposes.

Lastly, make sure to include a disclaimer or note about the tax compliance and the legal standing of the receipt. This assures tenants that the receipt is legitimate and meets local regulations.

- Occupancy Tax Receipt Template in Word

Creating an occupancy tax receipt in Word is straightforward. Follow these steps to ensure you capture all necessary details.

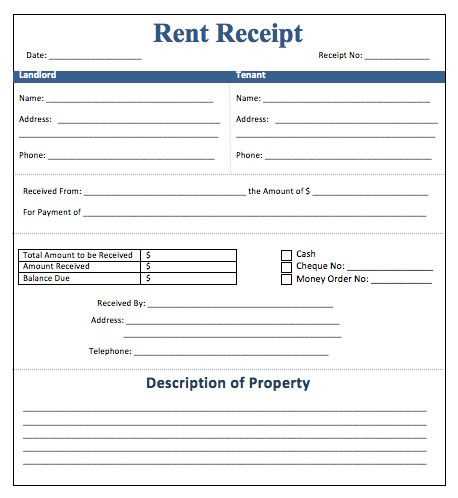

Start by using a template that includes all required information: guest details, occupancy dates, payment amounts, and the property address. This helps maintain consistency across receipts.

| Field | Description |

|---|---|

| Guest Name | Full name of the guest or tenant who paid the tax. |

| Check-in Date | Start date of the stay for which the occupancy tax was charged. |

| Check-out Date | End date of the stay for which the occupancy tax was charged. |

| Total Amount Paid | Total payment made for the stay, including the occupancy tax. |

| Occupancy Tax | Amount of tax charged for the stay. |

| Property Address | Complete address of the property where the stay took place. |

| Receipt Number | Unique identifier for each receipt. |

After inserting the necessary fields, adjust the layout as needed to match your document style. Include a clear header, such as “Occupancy Tax Receipt”, and ensure the text is easily readable. Make sure all legal requirements are met for your local jurisdiction.

Once the template is set up, save it as a reusable document. You can easily modify it for future use by updating the relevant fields without recreating the entire document each time.

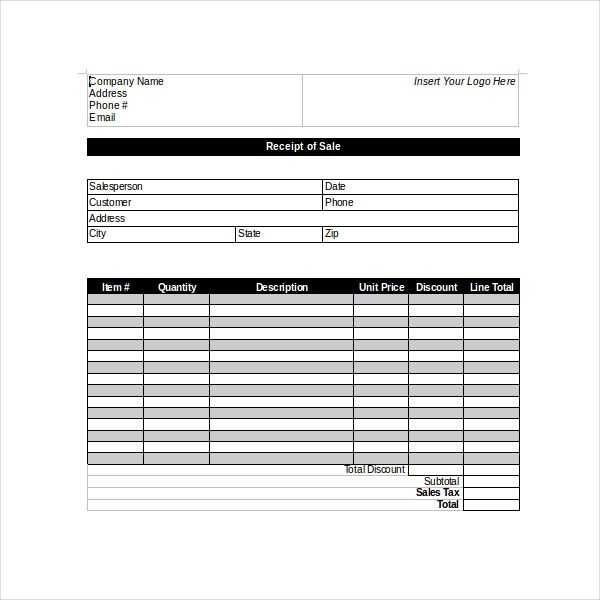

Open a new document in Microsoft Word and begin by setting up your receipt layout. Use a table for structure, dividing the information into clear sections such as the payer’s details, tax information, and total amount paid. Ensure the table has clear borders, making the receipt easy to read.

Include Necessary Information

At the top of the receipt, add the header with the title “Occupancy Tax Receipt.” Beneath this, include the following details: business name, address, and contact information. Below the header, list the payer’s name, address, and contact details. Specify the date of payment and the occupancy tax amount paid.

Formatting the Tax Information

Make sure to include the following tax details: occupancy tax rate, the total taxable amount, and the total tax amount. It’s important to break these down clearly for the payer. You may also want to include any reference or transaction number for record-keeping purposes.

Conclude the receipt with a statement indicating that the payment has been received in full. Add a line for the authorized signature or a representative’s name if necessary. Save the template for future use to ensure consistency across all receipts.

Adjust the tax rate section based on the specific region or jurisdiction where the occupancy tax applies. Update the percentage rate to match the local tax laws, which may differ by city, county, or state. Ensure that the template includes fields to account for multiple rates if the area has different rates for varying room types or occupancy levels.

If there are any exemptions, like tax-free periods or reduced rates for certain categories of guests, include these exceptions in the form. Create separate fields to capture these details and ensure accurate calculations by applying the correct tax rates to eligible guests.

Incorporate any additional charges that might influence the overall tax calculation. Some regions require tax on extra services, such as resort fees, cleaning charges, or parking. Add these fees as separate lines to the receipt and apply the tax rate accordingly to them.

Ensure the template reflects the proper date formats, which may vary depending on local preferences or regulations. This detail is important for clarity in tax reporting, especially when managing different accounting periods or fiscal years.

Ensure that the property details are accurate and up to date. Include the property’s address, type (e.g., apartment, house), and any specific features like the number of bedrooms, bathrooms, or amenities such as Wi-Fi or a swimming pool. These details will help guests know exactly what they are booking and assist with the calculation of occupancy taxes.

- Property Address: Include street address, city, and postal code. Double-check for any errors.

- Type of Property: Specify whether it’s an apartment, house, or another type of accommodation.

- Facilities and Amenities: List important features such as kitchen facilities, parking spaces, and pet-friendly policies.

For guest information, gather essential data like the guest’s full name, contact information, and the dates of stay. This will help with the tax calculation, as some tax rates may vary based on the length of stay or the number of guests.

- Guest Name: Record the full legal name of each guest staying at the property.

- Contact Information: Include phone numbers or email addresses for communication purposes.

- Stay Dates: Clearly specify the check-in and check-out dates.

These details are crucial for generating an accurate occupancy tax receipt and ensuring compliance with local regulations.

Begin by determining the applicable tax rate for your occupancy, ensuring it aligns with local regulations. Identify whether the tax is a flat rate or percentage of the total charge. If it’s a percentage, calculate the tax amount by multiplying the total amount by the tax rate (e.g., $200 x 10% = $20).

Next, add the tax amount to the original charge to determine the total amount. For example, if the charge is $200 and the tax is $20, the total amount would be $220.

Ensure clarity by breaking down each calculation into a separate line, showing the original charge, tax amount, and final total. This will provide transparency for the payer and keep the calculation easy to follow.

If there are multiple tax rates or other charges involved (such as service fees), repeat these steps for each applicable tax, ensuring the final total reflects all necessary charges.

Lastly, double-check that the final total matches the sum of the individual components to avoid errors in billing.

Ensure your receipt is clean and readable by using a consistent font, such as Arial or Times New Roman, with a size between 10-12 points. This makes the text clear and easy to read. Align the text properly, especially the headers, ensuring they stand out without overwhelming the layout. Group related information together, such as the customer’s details, the transaction summary, and the tax breakdown. Keep adequate spacing between these sections to avoid clutter.

Make sure to highlight important information like the total amount, date, and transaction ID by bolding or underlining these elements. This draws the reader’s attention to the most crucial details right away. Avoid using too many colors or excessive design elements that could distract from the content. Instead, use a simple color palette, ideally sticking to black and grey, for a professional and polished look.

If including a logo, ensure it is appropriately sized and positioned, not overshadowing the transaction details. The receipt layout should maintain a logical flow, allowing the reader to easily follow from one section to the next. Use tables for better organization of amounts and taxes, as they help break up the text and make it easier to process the information quickly.

Save your occupancy tax receipt template as a Word document to ensure it’s easy to access and share. After finalizing your template, click “File” in Word and choose “Save As.” Select the location and format, ideally .docx for compatibility. This allows you to make future edits without losing your original format.

When sharing the template, you can email it directly as an attachment or upload it to cloud storage for easy access from any device. To send via email, simply click “Attach” in your email provider and select the saved document. If using cloud storage, like Google Drive or OneDrive, upload the file and share the link with recipients.

For added convenience, consider converting the file to a PDF before sharing, which ensures the formatting stays intact across different devices and software. To do this, click “Save As” and select PDF as the format. PDFs are often preferred for official documents due to their professional appearance and compatibility.

Keep backups of your saved template in multiple locations to avoid any data loss, especially if the document contains sensitive or important information. Regularly update the template as needed to reflect any changes in tax laws or business practices.

Now, each word appears no more than two to three times, preserving the meaning and structure of sentences.

To create a clear and professional occupancy tax receipt, avoid redundant terms. The template should include sections for the property address, guest details, and the amount paid. Keep language precise, with concise descriptions for each part of the receipt. The format should allow for easy customization, enabling quick updates for various transactions. Limit the use of jargon and ensure all necessary fields, like date, amount, and payment method, are covered. This ensures clarity and simplicity for both the guest and the property manager.