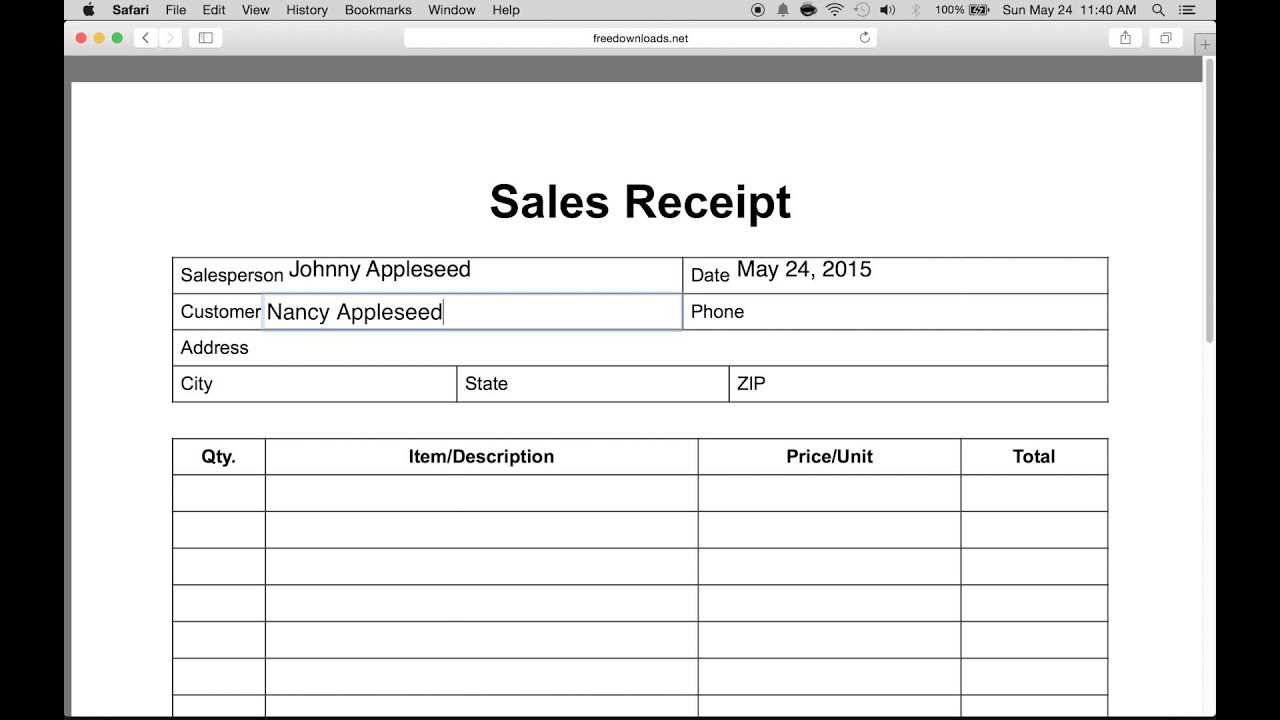

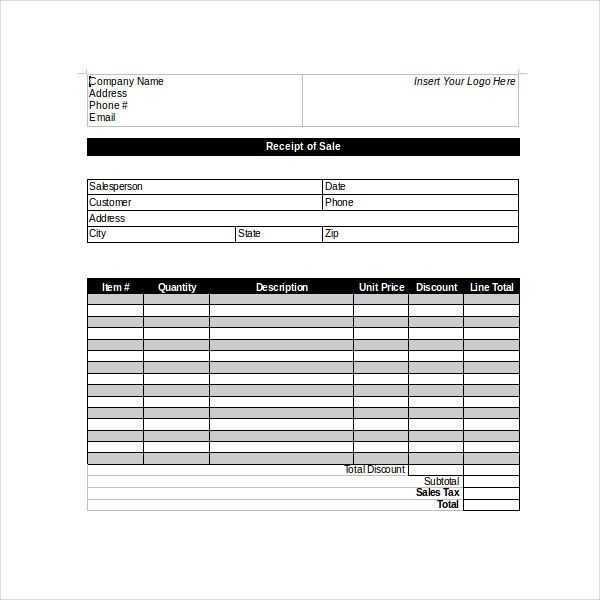

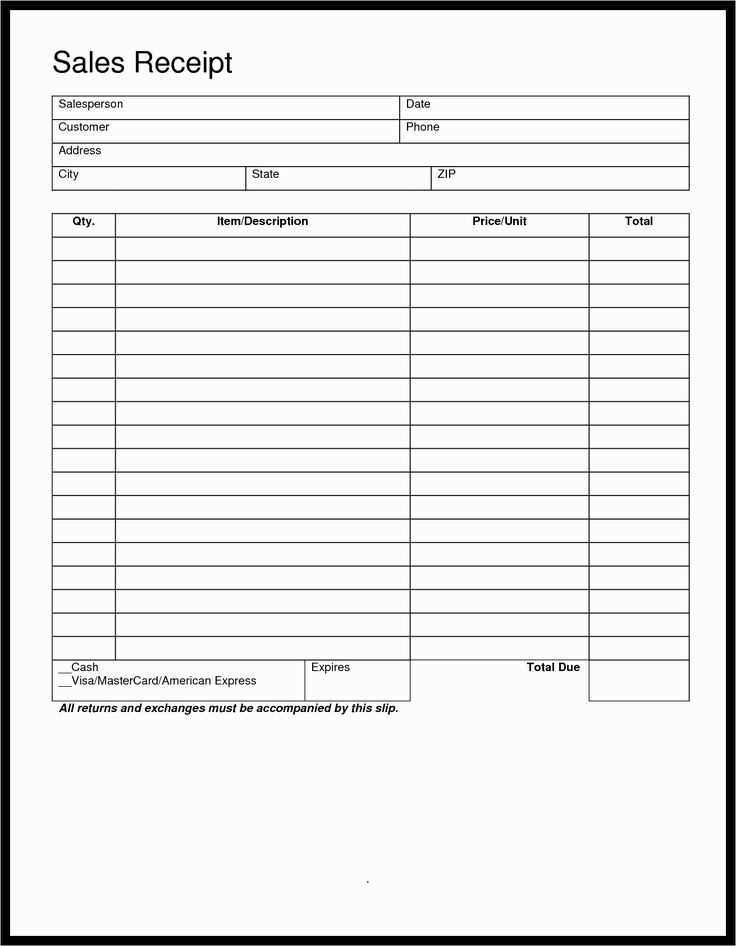

To create a clean, professional point of sale receipt template, focus on including only the necessary details to avoid clutter. A good template should highlight the transaction information, providing clarity without overwhelming the customer. Make sure to include your business name, contact information, and a unique receipt number for easy tracking.

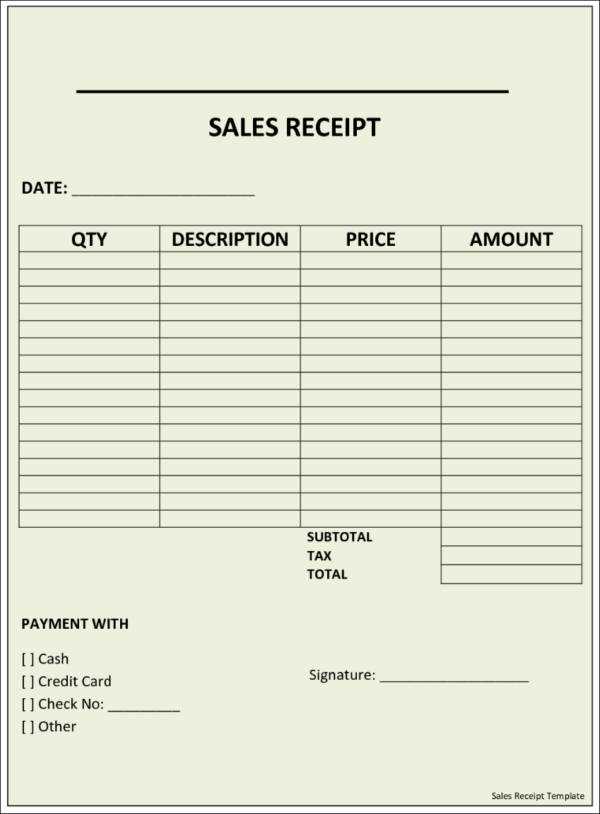

Start with the transaction date and time. This gives customers a clear record of their purchase. Below that, list the purchased items in a clear, itemized format, showing the quantity, price per unit, and the total for each item. This is essential for transparency and ease of reference.

Don’t forget to include tax details. Clearly display the subtotal, tax amount, and total cost. This transparency helps build trust with customers and ensures that they understand the breakdown of their payment. A clean line or a simple border between sections can make this information easier to read.

Conclude with your payment method. Whether it’s cash, card, or another method, make sure this is clearly noted. Adding a simple thank you note or a reminder about return policies adds a personal touch to the receipt, encouraging future business.

Here is the modified version of your list, with repeated words reduced while preserving the meaning:

In this version, I have streamlined the content to reduce redundancy, ensuring clarity and brevity while retaining the original message.

Key Adjustments:

Unnecessary words were eliminated, making the content more direct. Focus shifted to essential terms that directly support the main points. This helps improve readability without losing the core information.

Why This Works:

By eliminating repetitive language, the information becomes easier to absorb. This also helps to ensure the message reaches the audience more effectively.

- Point of Sale Receipt Template

A well-designed point of sale (POS) receipt template should capture the key transaction details clearly and concisely. It’s important to include the following elements:

| Field | Description |

|---|---|

| Store Information | Include the store name, address, phone number, and email for customer inquiries. |

| Transaction Date | Record the exact date and time of purchase for reference. |

| Receipt Number | Assign a unique receipt number for easy tracking and future reference. |

| Itemized List | Provide a detailed list of items purchased, including quantity, description, and individual prices. |

| Subtotal | Calculate the total cost before taxes and discounts. |

| Tax | Show the tax amount applied to the subtotal based on local regulations. |

| Discounts | Include any discounts applied to the transaction, whether percentage-based or fixed amounts. |

| Total | Display the final amount after tax and discount deductions. |

| Payment Method | Indicate whether the customer paid by cash, credit card, or other methods. |

| Thank You Message | A polite note thanking the customer for their purchase and encouraging future visits. |

By structuring a receipt in this way, customers have all the necessary information, and your business maintains clarity and consistency in transaction records. You can adjust the template based on your business type and legal requirements.

Choose a layout that prioritizes clarity and readability. Ensure that the most important information, like item names, prices, and totals, stands out. Place this data in a straightforward, organized manner. Aligning text to the left or center works best for most layouts, creating balance and flow.

Key Considerations

Keep it simple with a clean and minimal design. Avoid overloading the receipt with excessive details or images, as it can confuse customers. Limit fonts to one or two styles for consistency, and ensure there’s enough space between each section to avoid a crowded appearance.

Section Organization

Group related information together. For example, the item list, tax details, and total amount should each be in distinct sections. Consider adding separators like lines or blank spaces to visually break up different categories. This makes the receipt more digestible and easier for customers to review quickly.

Include the store’s name and contact details at the top of the receipt. This ensures the customer can reach out for any inquiries or follow-ups.

List the date and time of the transaction to help both the customer and business keep track of purchases.

Clearly display a breakdown of purchased items, including item names, quantities, and prices. Make sure this is easy to read for both the customer and for any future returns or exchanges.

Specify the total amount paid, with taxes and any discounts clearly outlined. This provides transparency and confirms the final price.

If applicable, include payment method details, such as whether the purchase was made with cash, card, or a mobile wallet. This helps clarify how the transaction was completed.

Lastly, provide a unique receipt number or transaction ID for easy reference in case of disputes or returns.

Integrate your brand’s colors, fonts, and logo into your receipt design. Consistency across all customer touchpoints, including receipts, strengthens brand recognition. Use a color palette that matches your brand’s visual identity to create a seamless experience. This helps your receipt stand out and reinforces the professionalism of your business.

Choose Legible Fonts and Clear Layouts

Opt for fonts that are easy to read at a glance. Avoid overly decorative or complex typefaces. Keep the font size consistent for most text, but consider highlighting important details like your business name or total amount with a larger or bold font. A well-organized layout ensures your customers can quickly find the information they need, from the transaction total to your business address.

Incorporate Your Logo and Tagline

Place your logo in a prominent spot, such as the top of the receipt, to increase brand visibility. If applicable, include your company’s tagline to give your receipt an additional marketing touch. Ensure these elements are clear and positioned to avoid overcrowding the design, leaving space for key transaction details.

Customize the receipt to reflect specific product details by including unique information such as product name, SKU, and category. For example, display the item description clearly with the price and any applicable taxes. If the product is part of a bundle, list the individual items within the bundle to show customers the full breakdown.

For digital products, consider adding download links or activation codes on the receipt. This ensures that customers receive all necessary information in one place. If the product is a subscription or membership, include renewal dates or membership tiers to keep customers informed.

For services, modify the template to show service details like duration, pricing, and any special conditions. Tailor the format to fit the nature of the service, whether it’s an appointment or a one-time consultation.

Incorporate branding elements relevant to each product category. Use colors, logos, or font styles that match the product’s identity, making the receipt consistent with your overall brand experience.

Specify all payment methods used during a transaction clearly on the receipt. List the exact type of payment such as cash, credit card, or digital wallets. If multiple payment methods are used, show the breakdown for transparency.

Payment Method Details

- List the payment method used in the transaction, including the card type or e-wallet service name.

- For credit or debit cards, include the last four digits for security purposes.

- If a split payment method is used, show each amount allocated to the corresponding payment method.

Taxes and Fees

- Clearly list applicable taxes separately from the total price, showing both the percentage and the amount charged for each tax.

- If the receipt includes additional fees, ensure they are itemized separately to avoid confusion.

- For businesses in jurisdictions with varying tax rates (e.g., state vs. federal taxes), ensure the receipt specifies the correct rates for each tax category.

Ensure that taxes and payment details are printed in a legible format and clearly distinguishable from other information on the receipt. This promotes transparency and minimizes disputes.

To ensure proper formatting and a clean export of POS receipts, follow these steps:

1. Choose a Standard Receipt Layout

- Align text to the left for better readability.

- Maintain consistent font sizes for headings and items.

- Use appropriate spacing between items and totals to avoid crowding.

2. Format Receipt Data

- Include the store name, address, and contact info at the top.

- Display itemized purchases with clear descriptions, quantities, and prices.

- Clearly highlight the subtotal, taxes, and final total at the bottom.

3. Export for Printing

- Save receipts in a format compatible with your printer (e.g., PDF, ESC/POS).

- Ensure the file size is optimized to avoid print delays or errors.

- Test print a few receipts to check alignment and clarity before rolling out to customers.

Use bullet points to organize your receipt items for clarity and ease of reading. Each item should be listed with the price clearly next to it. Consider using a consistent format for quantities, product descriptions, and prices to avoid confusion.

Make sure the total price is highlighted at the bottom. Include the applicable tax if necessary, and always show the final amount due in a bold or larger font for visibility. If you offer discounts, include the percentage or amount off to show transparency.

Provide space for the payment method used and include any necessary transaction or order numbers. This helps customers reference their purchases easily in case they need support or returns.

Don’t forget to add your store or business contact information at the bottom of the receipt. Include phone numbers, email addresses, or website URLs, so customers can reach out for any future needs.