Use a book receipt template to create a professional and clear record of a transaction. Whether you’re buying or selling books, having a well-structured receipt ensures transparency and can help in managing finances or returning items. It serves as proof of purchase, listing the title, author, price, and date of transaction.

Customize the template to include details like book condition, seller information, and any discounts applied. A clean layout with clearly defined sections enhances readability and allows both parties to reference the receipt easily in case of questions or issues.

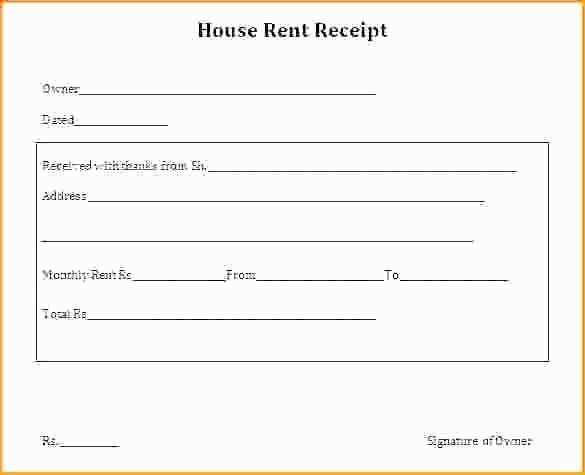

Ensure the template contains spaces for both buyer and seller signatures to confirm the agreement. This small but important detail adds credibility to the receipt, providing peace of mind to everyone involved in the transaction.

Here’s the corrected version:

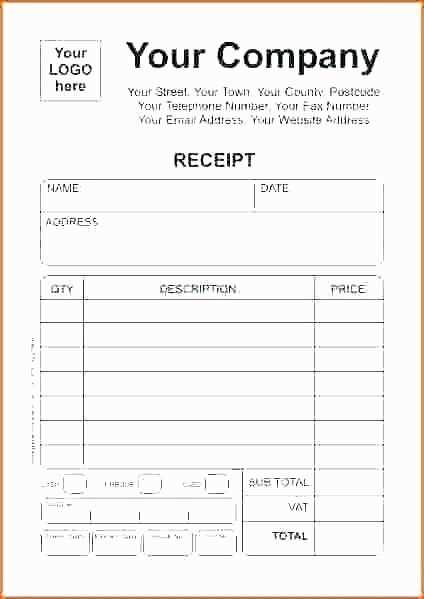

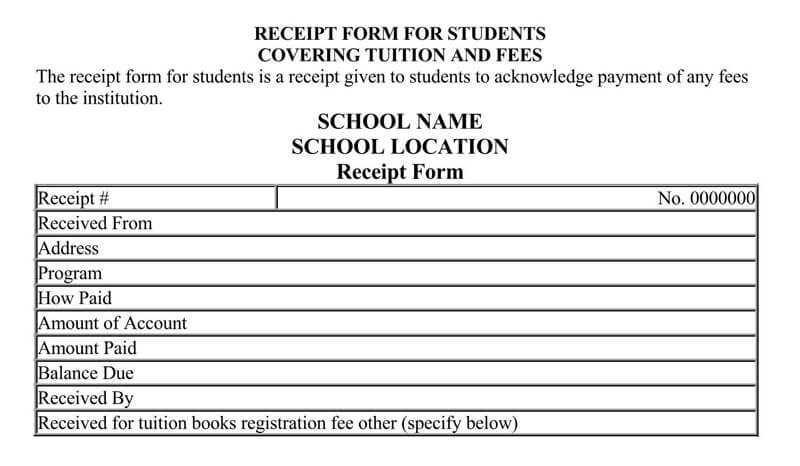

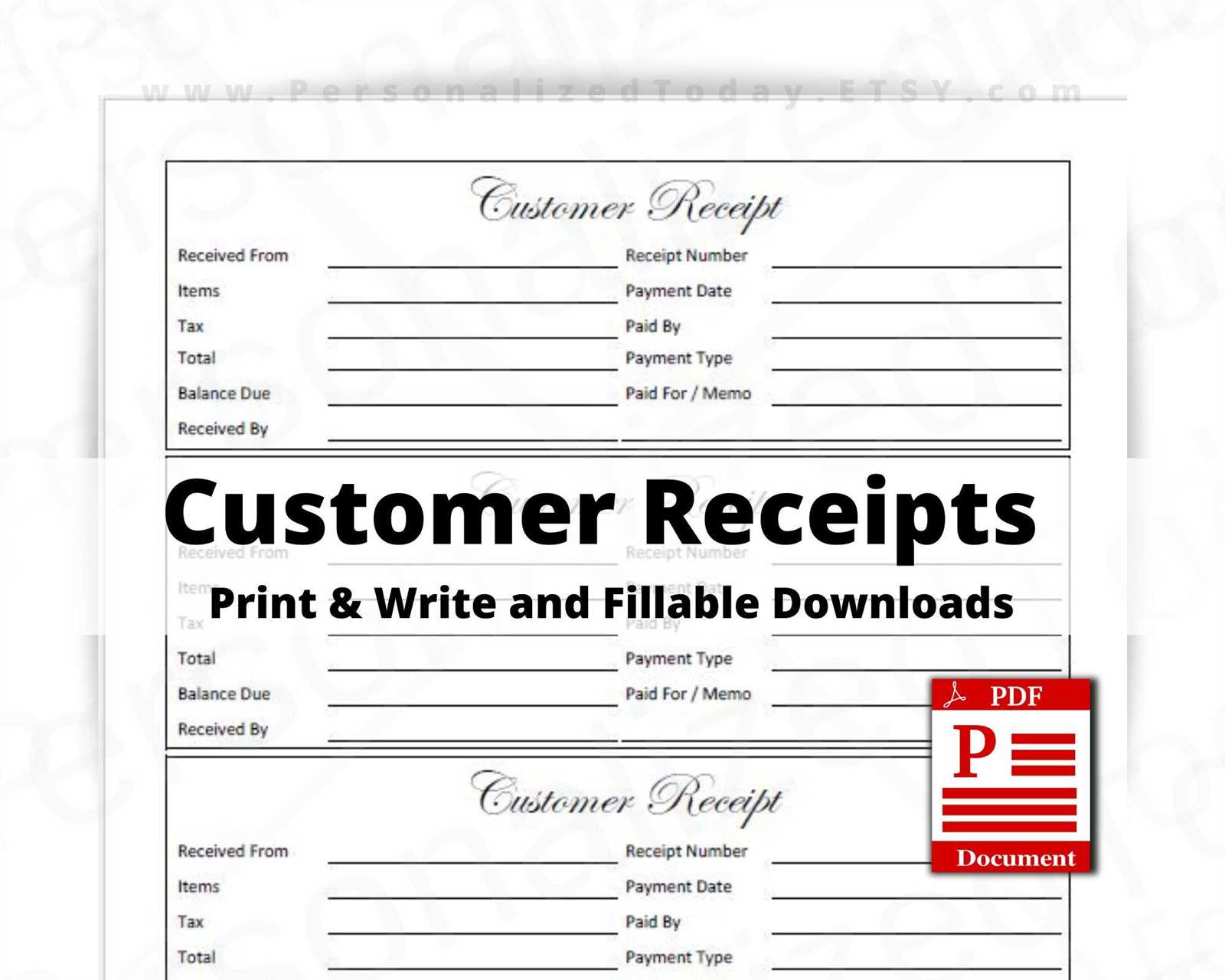

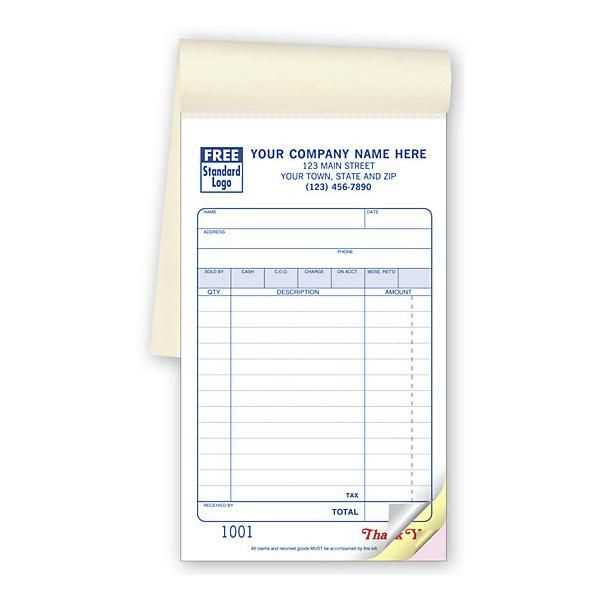

Ensure the receipt template clearly outlines the transaction details. Include the name of the business, date, receipt number, and itemized list of purchases. This helps prevent confusion and provides necessary information for both parties.

Check that the total amount is accurate and displayed prominently. Include tax breakdown if applicable. Provide space for the customer’s name and contact details, which can be useful for follow-up purposes.

| Field | Description |

|---|---|

| Business Name | Name of the store or service provider |

| Date | Exact date of the transaction |

| Receipt Number | A unique identifier for each transaction |

| Itemized List | Each item purchased with price and quantity |

| Total Amount | Sum of all items plus applicable taxes |

| Tax Information | Breakdown of tax rates and amounts |

| Customer Information | Name, email, or phone number for contact |

Double-check for readability and consistency. Ensure all figures are clear, and formatting is clean to avoid misunderstandings. A good template should be straightforward and easy to use for both customers and businesses.

- Detailed Guide on Book Receipt Format

A book receipt format should be clear and easy to read. Ensure all essential details are included, such as the name of the bookstore, transaction date, book title, price, and the buyer’s contact information if needed. Here’s how you can structure a book receipt:

1. Store Information

Include the bookstore’s name, address, phone number, and email. This helps the customer contact the store if any issues arise after the purchase.

2. Transaction Details

The receipt should list the book’s title, author, quantity, price per unit, and any applicable taxes or discounts. Clearly indicate the total amount paid at the bottom. Additionally, note the method of payment (e.g., credit card, cash, or mobile payment).

By following this format, you create a document that is both functional and professional, making it easy for customers to reference their purchase in the future.

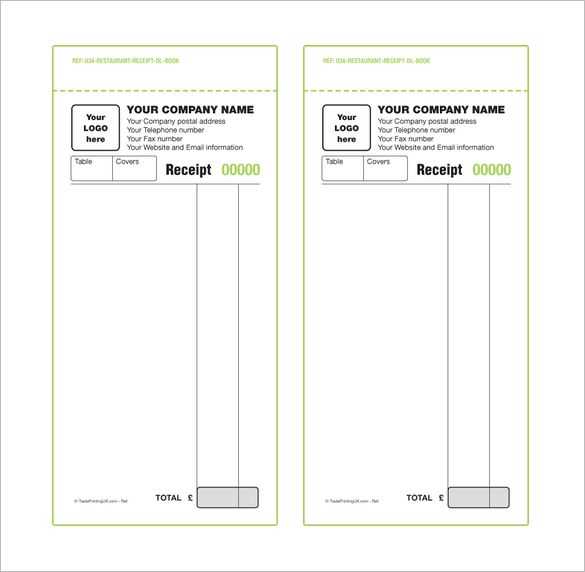

Begin by adjusting the layout to match your brand’s style. Choose a clear and simple font that aligns with the overall design of your bookstore or library. The font should be readable and professional, but also reflect the tone you want to convey.

Incorporate Brand Elements

Customize your receipt with your logo and business name at the top. This provides a visual connection to your brand and helps customers remember where they made their purchase. You can also include your store’s address and contact information, but keep it concise to avoid clutter.

Include Purchase Details

List the title, author, and quantity of each book purchased. Include the price for each item and the total amount at the bottom. Ensure the numbers are aligned properly, making them easy to read. Additionally, provide a space for transaction details like the date and method of payment.

To make the receipt more personalized, you can add a thank-you note or a reminder for customers to return to your store. Personal touches like these make the receipt feel less like a transaction and more like an interaction with your brand.

Each receipt should include key details that ensure both the buyer and seller have clear records. Start with the transaction date and time to establish when the purchase occurred. This helps prevent disputes and keeps track of financial history.

Seller Information

Clearly state the business name, address, and contact information. This ensures the customer can reach out in case of issues and verifies the legitimacy of the transaction. Adding the tax ID number or registration number is also recommended for legal transparency.

Transaction Details

List the items or services purchased with clear descriptions, including the quantity and unit price. It’s important to specify if any discounts or promotions were applied. Total costs, including taxes and shipping, should be itemized to avoid confusion.

Lastly, include payment method information, whether it’s cash, card, or another form of payment. For card transactions, the last four digits of the card number can provide further identification without compromising security.

Focus on clarity and readability to ensure the receipt is easy to understand. Use a clean layout with ample white space, avoiding overcrowded sections.

Use Consistent Font Styles

- Choose simple, legible fonts like Arial or Helvetica for body text.

- For headers, opt for a bold or slightly larger font to differentiate sections clearly.

- Avoid using more than two different fonts to keep the design cohesive.

Organize Information in Logical Order

- Start with the company name and contact details at the top for easy identification.

- Follow with a breakdown of items, including clear descriptions, prices, and quantities.

- Finish with the total amount, payment method, and transaction details.

Make sure to include enough spacing between each section, so the user doesn’t have to search for details. Simple lines or boxes can also help separate different parts of the receipt for added organization.

Ensure accurate details in the receipt’s header. Mistakes like misspelled company names, incorrect contact information, or missing tax identification numbers can create confusion and reduce trust in your business. Double-check all of these critical components to prevent errors.

Incorrect Date or Time

Double-check the date and time to avoid discrepancies. A receipt with an incorrect timestamp may confuse both you and your customers, especially for returns or warranty purposes. Always verify that the receipt reflects the correct transaction time.

Missing or Incorrect Payment Method

Be clear about the payment method used. If you list “cash” but the transaction was made by card, it can lead to problems. Make sure that the receipt matches the payment method accurately, especially if it’s related to refunds or exchanges.

Lastly, avoid leaving out the purchase details. Always list the product name, quantity, and price. Vague descriptions or missing information on individual items can make it difficult for customers to verify their purchase later.

Start using a book receipt template to simplify your transaction processes and keep records organized. Ensure your template includes key details such as book title, price, transaction date, and buyer information. This helps you maintain clear and accurate documentation for your business. You can either create a custom template or download a pre-made one to fit your needs.

Customize Templates to Match Your Branding

Tailor the template to reflect your business’s branding by adding your logo, adjusting the font, and incorporating your business colors. A personalized receipt can enhance customer experience and make your business look more professional.

Save Time with Digital Tools

Use digital receipt templates to streamline your operations. Many online tools offer templates that are easy to edit and automate. By switching to digital receipts, you save time and reduce paper waste while maintaining an organized system for tracking transactions.

Choosing between digital and paper receipts depends on your preferences and specific needs. Here’s a breakdown to help you decide:

- Environmental Impact: Digital receipts are eco-friendly, reducing paper waste. If sustainability matters to you, digital is the way to go.

- Convenience: Digital receipts are easily accessible on your phone or email. You can store and retrieve them with just a few taps, making them ideal for keeping track of purchases on the go.

- Organization: With digital receipts, organizing expenses becomes simpler. Many apps let you categorize and search receipts, helping with budgeting and tax filing.

- Space-saving: Paper receipts can accumulate and clutter your space. Digital receipts, on the other hand, take up no physical space, making them more manageable for long-term storage.

- Security: Digital receipts may be easier to secure, as you can back them up and keep them safe with passwords or encryption. Paper receipts are more vulnerable to loss or damage.

For those who prefer physical copies, paper receipts remain a reliable option. However, digital receipts offer clear advantages in terms of accessibility, organization, and environmental responsibility. Assess your priorities to choose what works best for you.

When creating a book receipt template, make sure to include the following key components for clarity and proper documentation:

Basic Information

Start with the title of the book, the author’s name, and the price. These elements give the receipt its purpose and provide immediate identification. Ensure the book title stands out in bold or with a larger font size for easy reference.

Payment Details

Include details about the transaction, such as the payment method (credit card, cash, etc.), the transaction ID, and the date. This helps both parties track the purchase accurately.

Don’t forget to add any taxes or discounts applied to the purchase, making the total amount clear to the customer. This transparency reduces any confusion that may arise post-purchase.