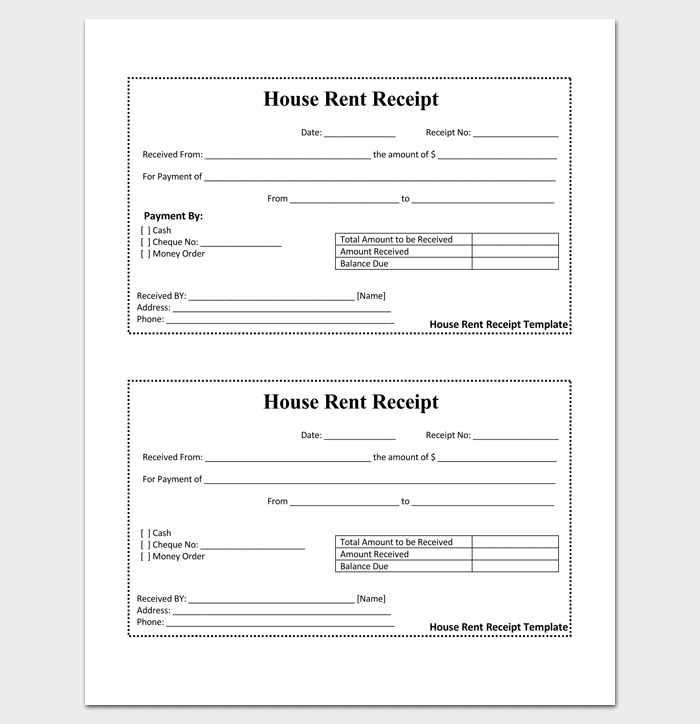

Use a bill pay receipt template to keep track of your payments. This simple tool helps you organize receipts, making it easy to track your financial history and stay on top of your bills. A well-designed template saves you time and ensures accuracy in documenting each payment.

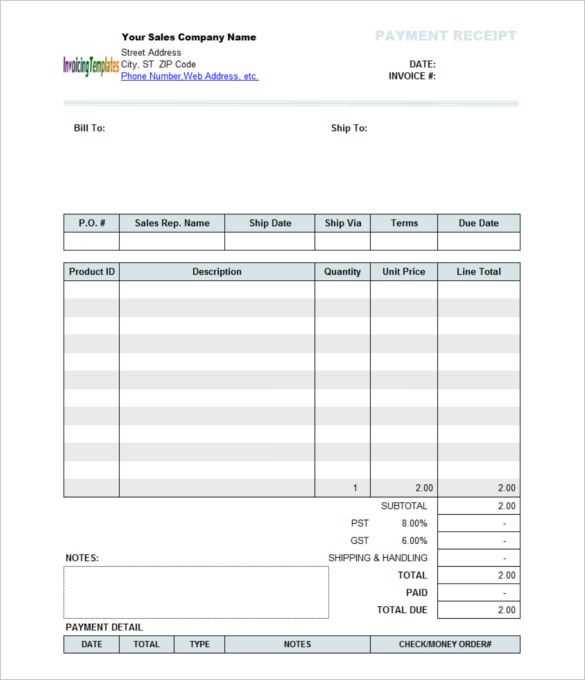

When selecting a template, focus on essential fields like date of payment, payment amount, bill issuer, and method of payment. This ensures clarity for future reference or in case you need to resolve any discrepancies with the service provider.

Choose a customizable template that allows for quick updates. Whether you’re using it for monthly utilities or one-time purchases, a flexible template will ensure that every detail is captured properly without any hassle.

Storing these receipts digitally is a smart way to avoid paper clutter. You can easily search through your records and back up important documents online. A simple, consistent format across all your receipts enhances accessibility and organization over time.

Here is the corrected version without word repetition:

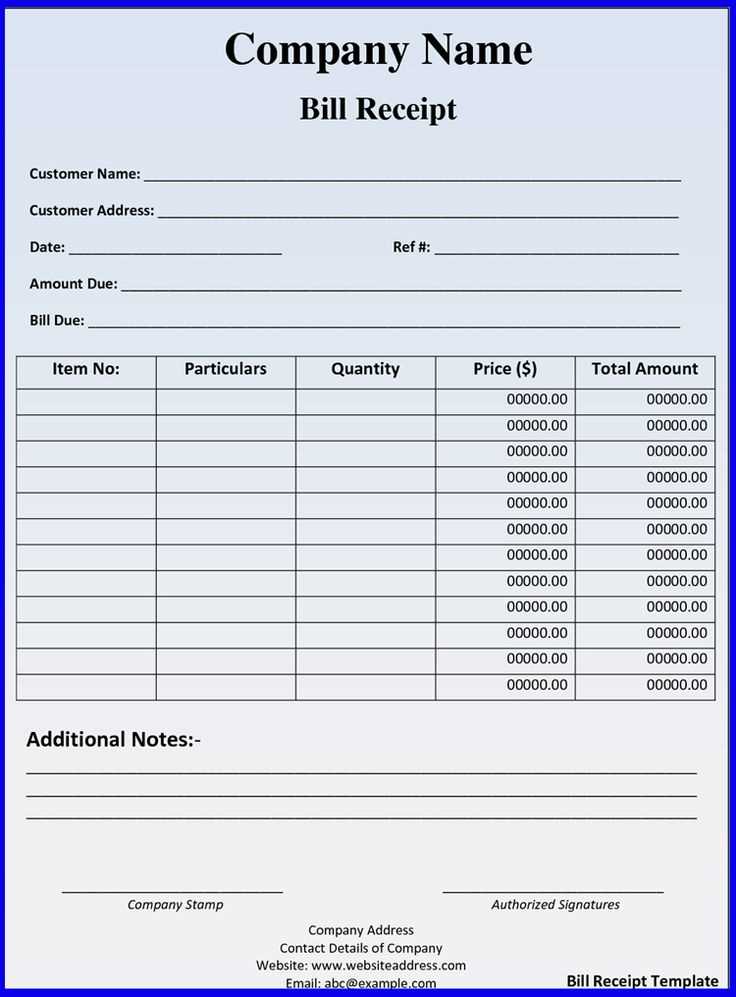

When creating a bill pay receipt, make sure it includes the necessary details to avoid confusion. Focus on clarity and accuracy in each field. For instance, list the payment amount, date, and the services covered by the payment. Always provide a reference number for easy tracking. Using a clear format enhances the user experience and minimizes errors.

Key Components to Include:

Ensure the payer’s information, including their name and contact details, is correctly entered. Include the payee’s details for verification. The payment method (whether online, check, or cash) should also be specified. Provide a breakdown of the charges and any taxes or fees applied. Lastly, mention the payment due date, if applicable, to ensure both parties are on the same page.

- Bill Pay Receipt Template for Personal Use

Creating a bill pay receipt template for personal use can simplify tracking your payments. A clear and organized template helps maintain accurate records for future reference and avoids confusion when reviewing transactions. Follow these steps to design a functional bill pay receipt template:

Key Information to Include

Include the following details in your template to make it comprehensive:

- Recipient Information: Include the name and address of the person or business receiving the payment.

- Payer Information: Add your own name and contact details for easy reference.

- Date of Payment: Specify the exact date the payment was made.

- Amount Paid: Clearly state the total payment amount, including any applicable taxes or fees.

- Payment Method: List the method used, whether by check, credit card, or another form.

- Invoice Number or Account Number: Include any relevant reference numbers for easy tracking.

- Payment Description: Include a brief description of what the payment covers.

Designing Your Template

Keep the layout simple and easy to read. Use sections with clear labels and spacing for each piece of information. This will help you quickly locate and understand the details of any payment when reviewing receipts later. You can use basic tools like Microsoft Word, Excel, or Google Docs to create your template. Save a blank version for future use, and customize it as needed for each transaction.

For your personal bill pay receipt template, choose a format that fits your needs while being clear and easy to customize. The most common formats are Word, Excel, and PDF, each offering distinct advantages. Word provides flexibility for adding text and adjusting layouts, making it ideal for quick changes. Excel is better for handling calculations and organizing data systematically, while PDF ensures the template remains consistent across different devices and is less prone to accidental edits.

When deciding on the format, think about the level of detail you need to include. If you only need a simple receipt for personal use, a Word document might be sufficient. If you prefer automated calculations for amounts or tax, Excel is more suited for this task. For static receipts that don’t need further editing, PDF offers a secure and polished presentation.

Consider also how you plan to store and share the template. PDF files are easier to store and share via email or cloud services without worrying about formatting issues. Word and Excel files might require specific software versions, so ensure compatibility with your devices before committing.

Lastly, always ensure the format you choose aligns with how you intend to access or print the receipt. If you plan to print frequently, make sure the format offers easy adjustments for paper size and layout without losing quality or readability.

Accurately presenting payment details in your bill pay receipt helps both you and the payer maintain clear financial records. Focus on these key elements for clarity and transparency:

1. Include Payment Date

Always list the exact date when the payment was processed. This timestamp ensures both parties know when the transaction occurred and can easily match it with bank statements or account records.

2. Specify Payment Method

Clearly mention how the payment was made–whether through credit card, bank transfer, check, or any other method. If applicable, include the last four digits of the payment method to identify it without disclosing sensitive information.

3. Payment Amount

State the exact amount paid, including any applicable taxes or fees. This avoids confusion if the payment differs from the original bill or invoice amount.

4. Reference Number or Transaction ID

If possible, include the transaction reference number or ID. This number will help both parties track the payment in case of any issues or disputes.

5. Payer’s Information

Include the name and contact information of the person or entity making the payment. This ensures that both parties have all the necessary details in case follow-up is required.

6. Bill or Invoice Number

Always reference the related bill or invoice number. This establishes a clear link between the payment and the specific bill being paid, preventing confusion in the future.

7. Payment Status

Indicate whether the payment is confirmed, pending, or failed. This provides a quick snapshot of the transaction’s current state.

By incorporating these details in your bill pay receipt, you can create a clear, organized document that supports easy verification and future reference.

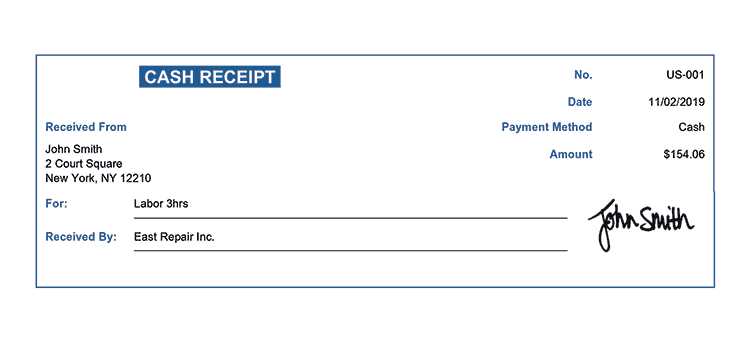

Adjust your bill pay receipt template to suit different payment methods like credit cards, bank transfers, or cash payments. For each type, include fields that match the specific details related to the transaction.

Credit Card Payments: Include spaces for the credit card type (Visa, MasterCard, etc.), last four digits of the card number, and the transaction approval code. You can also add a field for the cardholder’s name and billing address if necessary.

Bank Transfers: Add sections for the sender’s and recipient’s bank names, account numbers, and routing numbers. Make sure there’s space for the transaction reference number, as it helps track payments in case of disputes.

Cash Payments: Since there’s no electronic trace, focus on the amount paid, the currency used, and the person or business receiving the payment. Include a section for the cashier’s signature or a stamp to confirm the transaction took place.

For each payment type, ensure that the template includes a space for the date and time of payment. This provides a clear timeline for both the payer and payee. Tailor the appearance of the receipt for clarity, using bold labels and separating payment details clearly for each transaction type.

Include the date of payment to clarify the exact time when the transaction took place. This helps in keeping track of payments and provides a reference point for future inquiries or disputes. Be specific about the day, month, and year to avoid confusion.

Specify the amount paid. Write the exact amount clearly, including the currency symbol. Double-check the amount to ensure it aligns with the invoice or bill you are paying. This eliminates any potential issues with incorrect amounts later on.

State the payment method used for the transaction. Whether it was made by credit card, bank transfer, cash, or other methods, make sure to note this detail. If applicable, include the last four digits of the card number or reference number for a bank transfer. This can be helpful for verifying the payment if any questions arise.

Keep your bill pay receipts organized by making sure each entry contains detailed and consistent information. This way, you can quickly locate relevant records when needed.

- Use standardized fields for the date, amount, vendor, and payment method. This minimizes ambiguity and makes it easier to identify any discrepancies later.

- Regularly update your receipts. After each transaction, ensure you input the details right away to avoid errors or forgetfulness.

- Track payment statuses (e.g., pending, completed) to easily identify which bills are settled and which are still outstanding.

- Include any relevant reference numbers or invoice numbers. This will help you cross-reference receipts with bank statements or vendor records.

Be mindful of the format you choose for your template. It should allow for easy adjustments or additions, such as custom fields for discounts, taxes, or special instructions. This way, you maintain flexibility while preserving clarity and accuracy.

- Consider adding a section for notes, where you can highlight any unique circumstances related to the payment (e.g., partial payment or late fees). This adds context and aids in future reviews.

- If you use digital tools, enable automatic backups of your receipts to avoid loss of records due to technical issues.

By maintaining a well-structured and up-to-date template, you ensure that all your records remain clear and reliable, making it easier to track payments and resolve disputes, if necessary.

Opt for both digital and printable formats to ensure flexibility when managing your bill pay receipts. Digital copies offer the convenience of storage on your devices, enabling quick access and sharing. You can easily organize receipts into folders or cloud storage, ensuring they are safely backed up and accessible from anywhere.

Digital Receipts

Digital receipts are perfect for those who prefer a streamlined, paperless system. Save them directly to your phone or computer, or use financial management apps to keep them organized. By storing receipts digitally, you eliminate the clutter of paper and can search for specific transactions in seconds.

Printable Receipts

While digital receipts are convenient, printable versions are handy for situations where physical documentation is required. Print your receipts directly from your email or financial app. Keep a binder or file system for easy reference. This method works well for anyone who needs paper copies for tax purposes or prefers a hard copy backup.

Having both options ensures that you can switch between them as needed, offering the best of both worlds.

To create a simple and effective bill pay receipt template for personal use, focus on including the necessary details without overcomplicating the layout. Use clear headings and organized sections to make the receipt easy to read and understand. A clean format ensures all the information is accessible at a glance.

Here’s a structure to follow:

| Field | Description |

|---|---|

| Receipt Number | Assign a unique receipt number for each transaction to maintain proper tracking. |

| Payee Information | Include the name, address, and contact details of the individual or company receiving the payment. |

| Payer Information | Provide your name, address, and contact information to complete the receipt. |

| Date of Payment | Record the exact date the payment was made. |

| Amount Paid | List the exact amount paid in both numerical and written formats for clarity. |

| Payment Method | Specify the method used (cash, check, online transfer, etc.) for transparency. |

| Transaction Description | Briefly explain the purpose of the payment (e.g., utility bill, subscription, etc.). |

| Signature | Both parties should sign or initial the receipt to confirm the transaction. |

By following this simple structure, you can easily generate a bill pay receipt that is clear and serves its purpose. Ensure that the formatting is consistent, and the text is legible for future reference.