If you’re managing a rental property, creating a lodger deposit receipt template is a must. This simple yet vital document provides a clear record of the deposit received from the lodger. It helps prevent any misunderstandings later on and can serve as a legal proof of the transaction. By using a template, you ensure consistency and professionalism in your rental agreements.

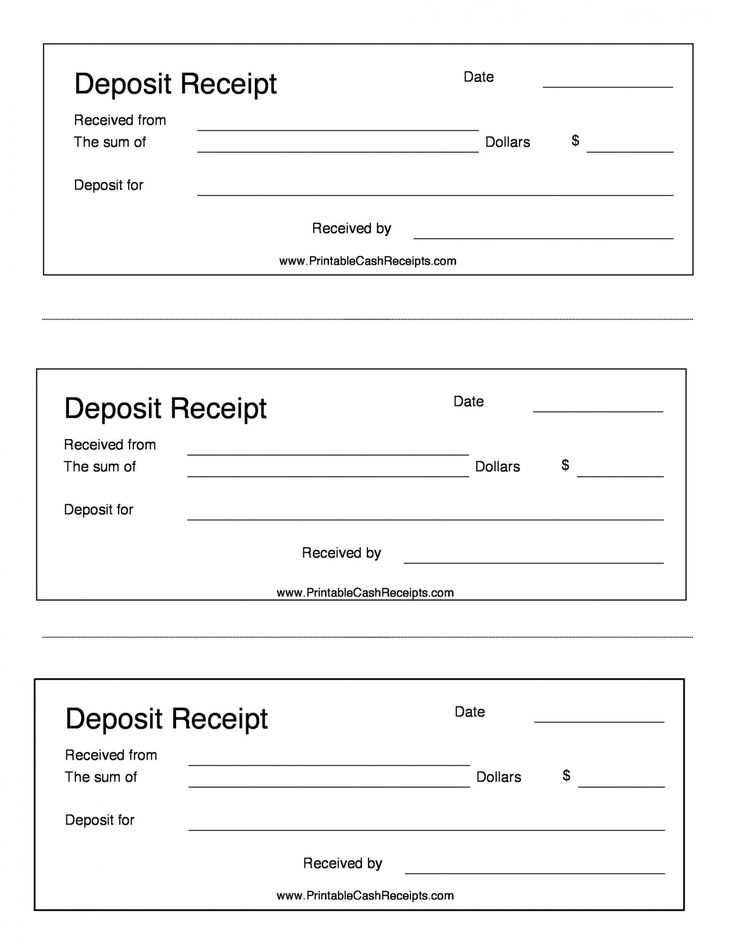

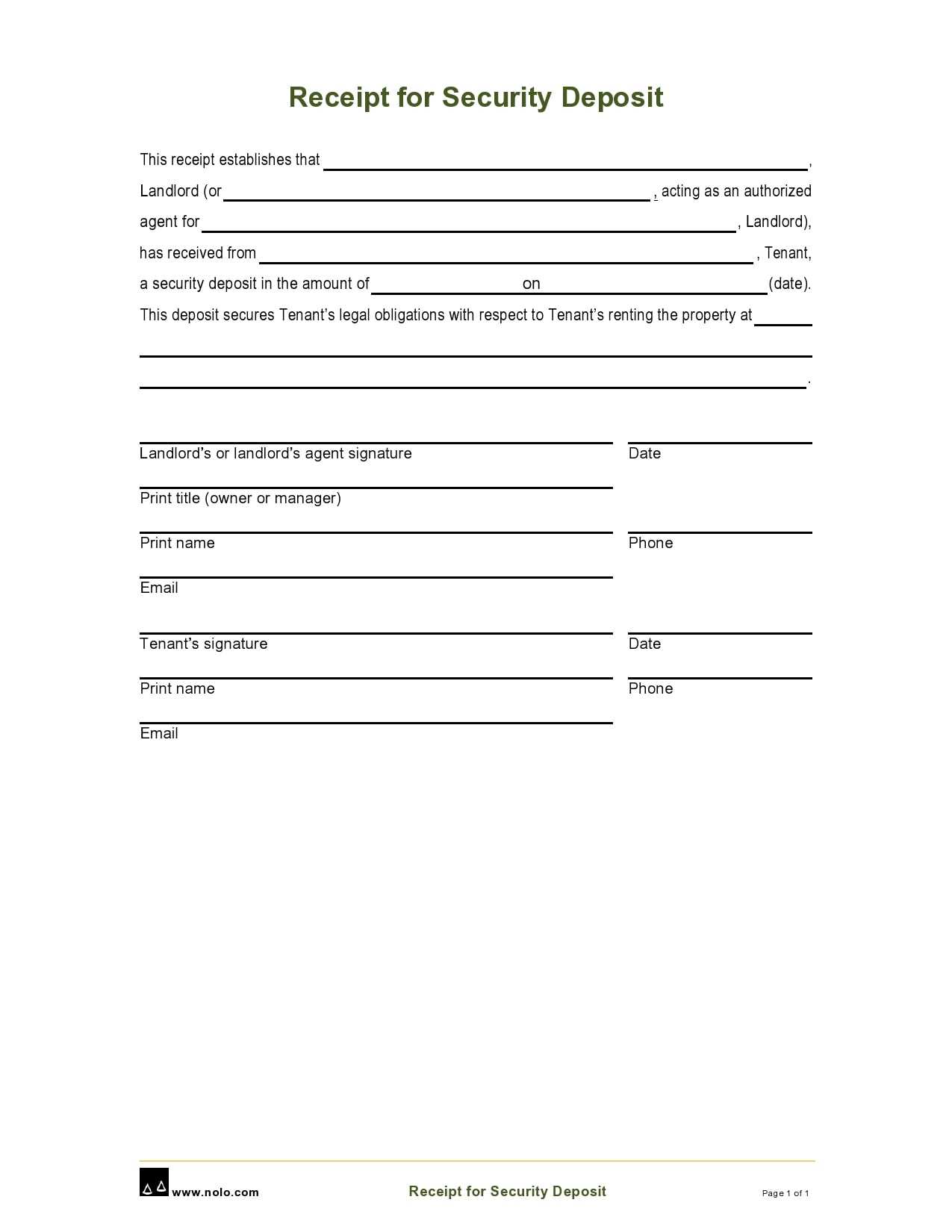

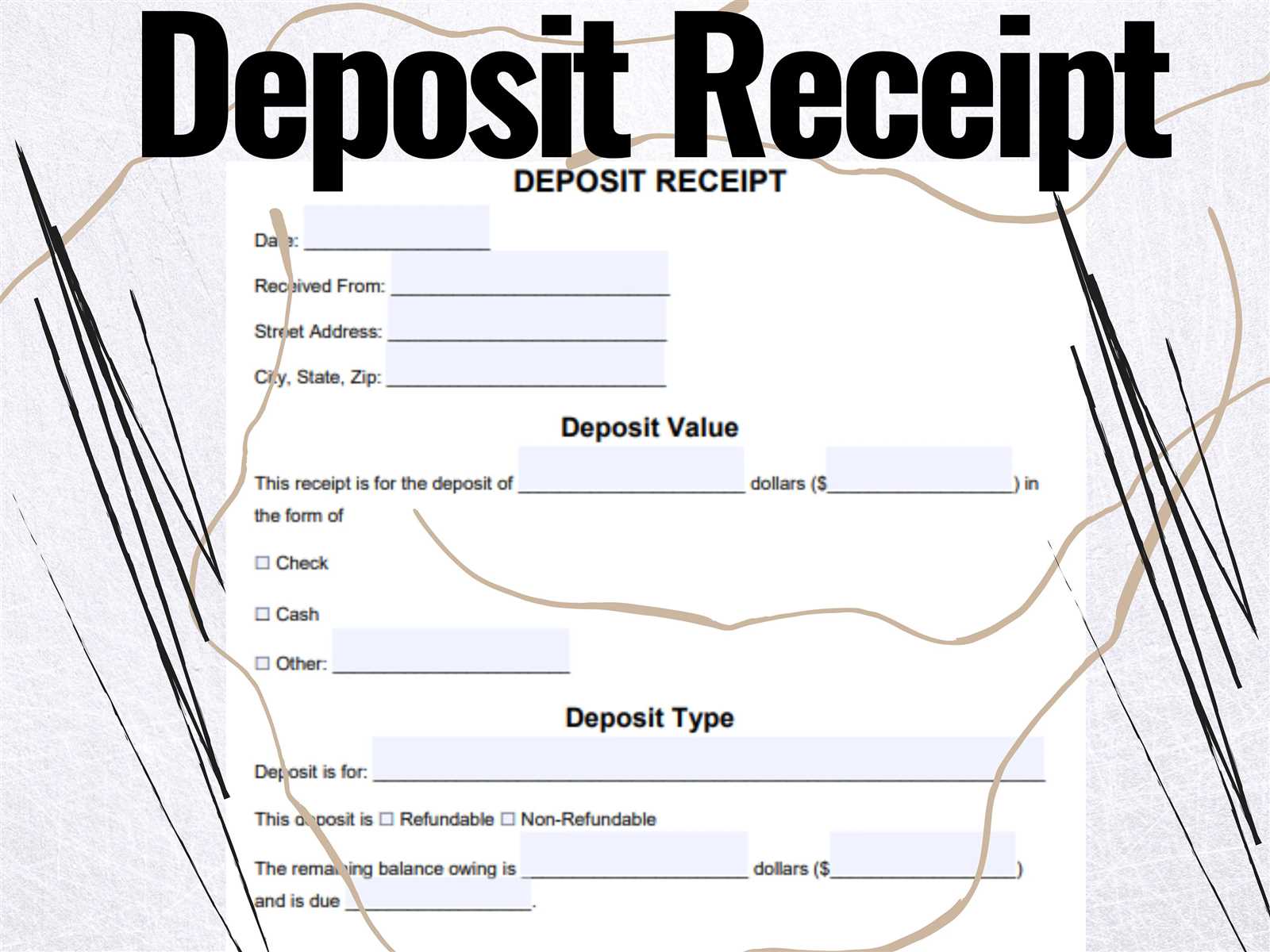

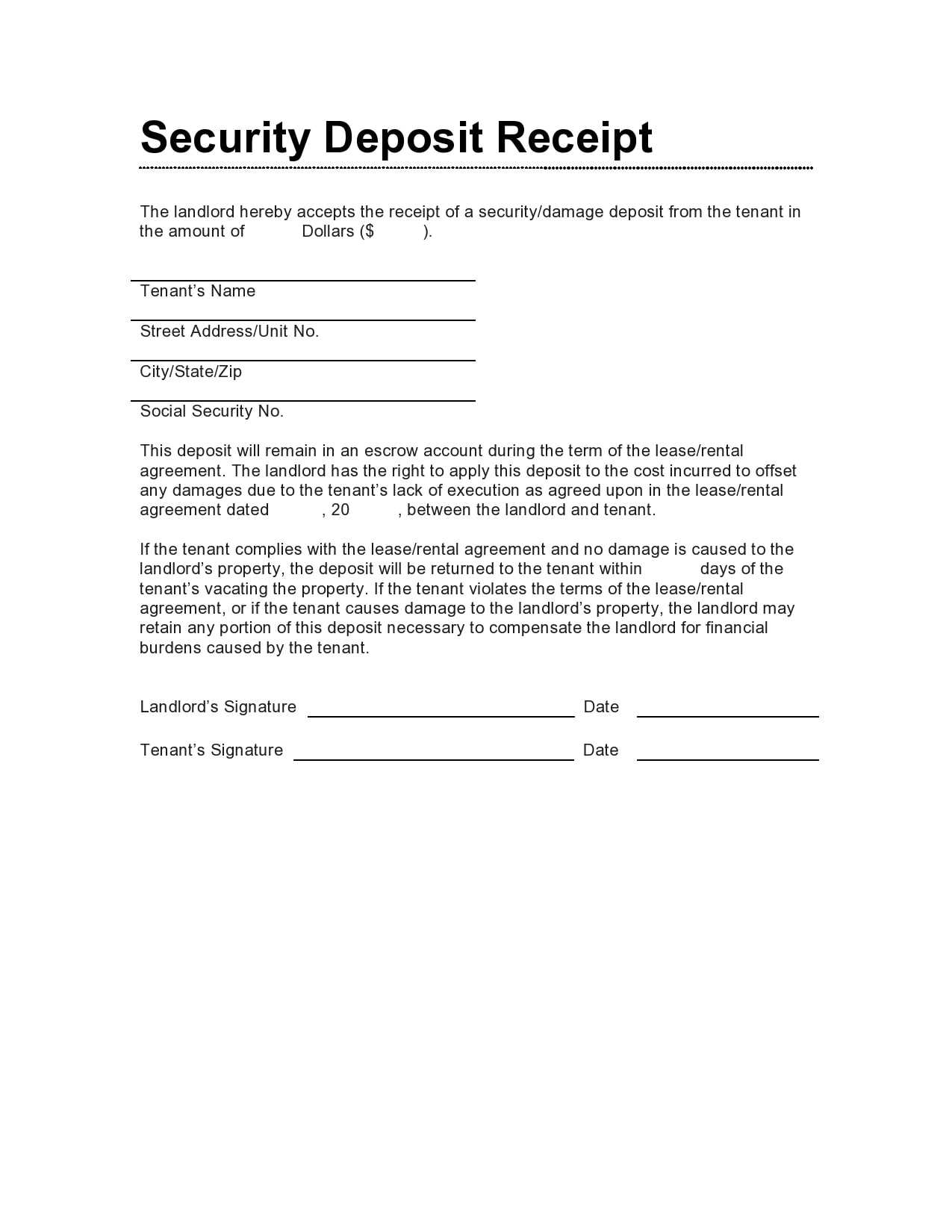

A well-structured deposit receipt should include key details such as the amount of the deposit, the date it was received, and any specific conditions regarding its return. You should also specify the property’s address and identify the parties involved. A clean, organized format makes it easier for both you and your lodger to reference in the future.

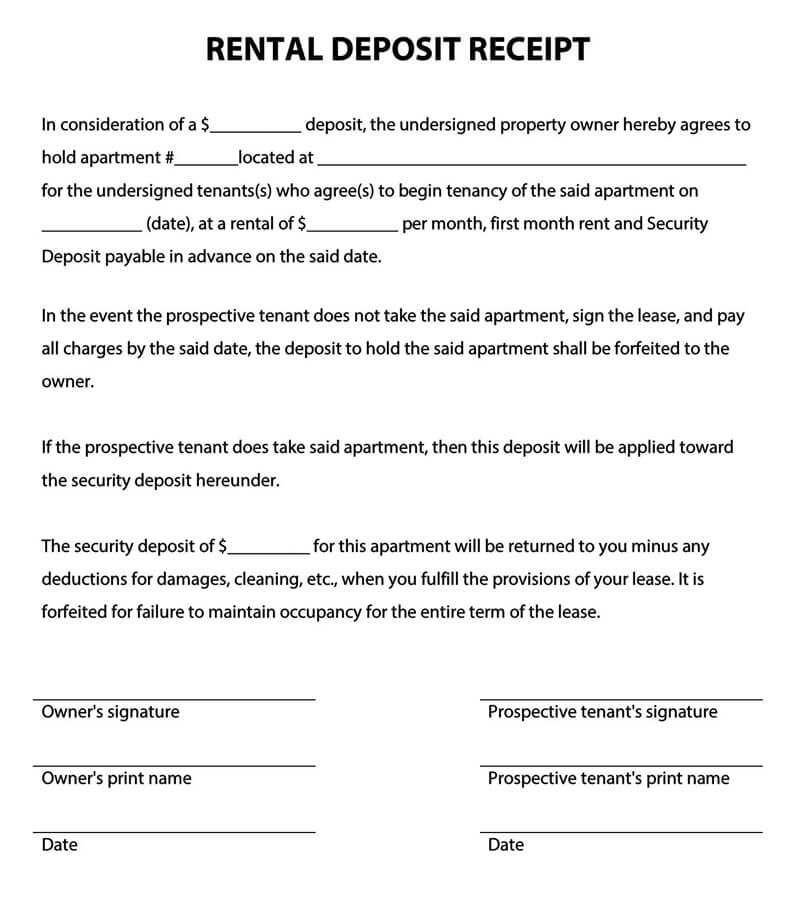

Consider including a section that outlines any deductions that may be taken from the deposit at the end of the lodger’s stay. This may include damages or unpaid rent, which can avoid potential disputes. Additionally, a clear explanation of the return process will help both parties understand what to expect once the agreement ends.

Using a template saves time and ensures that all important aspects are covered. It’s an efficient tool to make sure you stay organized and compliant with rental regulations while providing transparency and clarity to your lodgers.

Here are the corrected lines:

Make sure to include the full address of the property and the tenant’s full name. This ensures clarity in case of any disputes.

Verify the payment amount and ensure it’s listed correctly. Any discrepancies could lead to confusion or further legal issues.

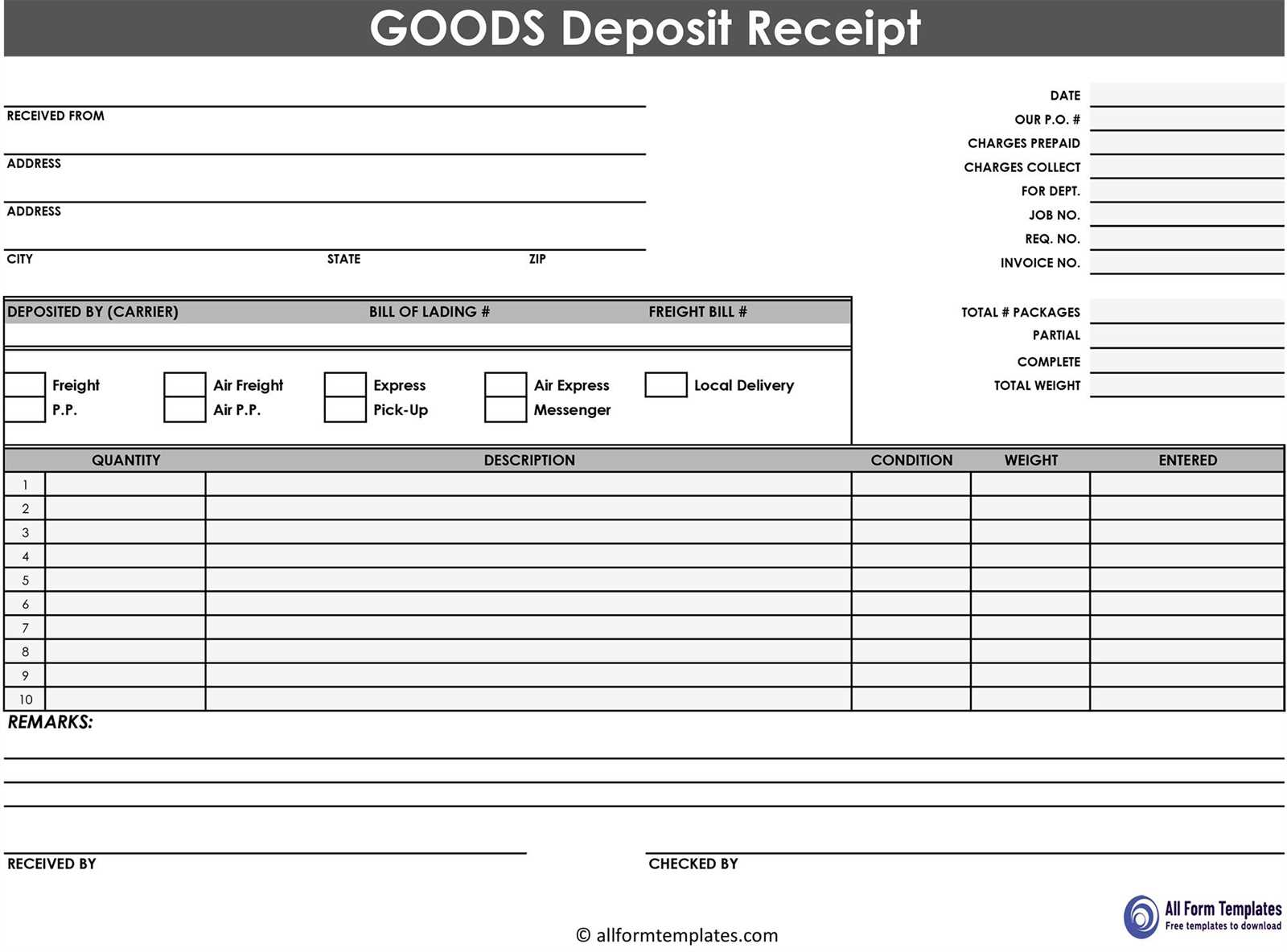

Indicate the payment method clearly, whether it’s cash, cheque, or bank transfer. This helps establish transparency and avoids misunderstandings.

Ensure the date of the transaction is accurate. This is crucial for future reference and any potential legal concerns.

Check that the rental period is properly defined, including the start and end dates. This prevents any ambiguity about the length of the tenancy.

Always include both the landlord’s and tenant’s signature along with the date. This confirms that both parties agree to the terms of the deposit receipt.

- Lodger Deposit Receipt Template

A Lodger Deposit Receipt is a document confirming that a deposit has been paid by a lodger to the landlord or property owner. This receipt serves as proof of payment and outlines the terms of the deposit. Make sure to include these key details in your template:

| Field | Description |

|---|---|

| Receipt Number | A unique identifier for each receipt issued. |

| Date of Payment | The exact date the deposit was paid. |

| Lodger’s Name | The full name of the lodger making the payment. |

| Landlord’s Name | The name of the landlord or property manager receiving the payment. |

| Amount Paid | The total amount of the deposit received from the lodger. |

| Payment Method | Details of how the payment was made (e.g., cash, bank transfer, check). |

| Purpose of Deposit | Specify if the deposit is for damages, security, or other reasons. |

| Terms of Refund | Explain under what conditions the deposit will be refunded to the lodger. |

| Signature | Signature of both the landlord and lodger to acknowledge the transaction. |

This template ensures that both parties have a clear understanding of the transaction, protecting both the landlord and the lodger in case of any disputes. Always make sure that the receipt is provided in a timely manner and is kept as part of the rental agreement documentation.

To create a clear and valid deposit receipt, include all necessary details that confirm the transaction between you and the tenant. The receipt should clearly state the amount of the deposit, the date of payment, and the rental property involved.

Key Information to Include

Start with the name of the landlord or property manager, and the name of the tenant. Then, specify the exact amount of the deposit paid, followed by the date of the transaction. It’s also important to mention the address of the rental property, so both parties are clear on which property the deposit refers to. Lastly, indicate the reason for the deposit, such as “security deposit” or “damage deposit.”

Additional Details to Consider

If applicable, note any terms or conditions regarding the return of the deposit, including any deductions that may occur at the end of the lease. Include any legal references or clauses from the rental agreement that apply to the deposit, ensuring both parties have a mutual understanding of the terms.

Provide the following details to ensure clarity and avoid future misunderstandings:

- Full names of both parties: Clearly state the names of both the landlord and the lodger. This ensures proper identification in case of disputes.

- Amount of deposit: Specify the exact sum of money being paid as the deposit. This helps avoid any confusion regarding the amount agreed upon.

- Date of payment: Include the precise date when the deposit is made. This is important for tracking payment history.

- Address of the property: Include the full address of the property where the lodger resides. This clarifies the location of the arrangement.

- Conditions of the deposit: Detail any conditions attached to the deposit, such as return upon leaving or deductions for damages. This provides transparency regarding potential changes to the deposit.

- Purpose of the deposit: State whether the deposit is for damages, security, or another specific purpose. This adds clarity for both parties.

- Signature of both parties: Both the landlord and lodger should sign the receipt. This confirms that both parties agree to the terms laid out in the document.

Optional Details to Consider

- Deposit return timeframe: Specify how long it will take for the deposit to be returned after the lodger vacates the property.

- Interest on the deposit: If applicable, note whether interest will be paid on the deposit amount over time.

Each region has specific rules governing deposit receipts to protect both tenants and landlords. These regulations may vary in terms of required information, timelines, and methods of handling disputes. It’s important to understand the legal framework applicable to deposit receipts where the property is located.

United States

In the U.S., state laws generally require landlords to provide a written receipt when a tenant pays a deposit. The receipt must include the amount of the deposit, the date it was received, and the purpose for which the deposit is held. Some states mandate that landlords return deposits within a certain period after the lease ends, typically 30 to 60 days. Failure to comply may result in penalties, such as the tenant receiving double the deposit amount.

United Kingdom

In the UK, deposit receipts must be issued within a reasonable time, and the deposit itself should be protected in a government-approved scheme. Landlords must provide tenants with the details of the deposit protection scheme and how to claim the deposit back at the end of the tenancy. The receipt should also specify the amount paid and the terms of returning the deposit, including any deductions for damage or unpaid rent.

Always check the specific legal requirements for your region to ensure compliance and avoid disputes.

A deposit serves as a safeguard for both the landlord and the tenant in a lodging agreement. For the landlord, it acts as a form of security in case the tenant causes damage to the property or fails to pay rent. It provides a financial cushion that can be used for repairs, cleaning, or unpaid rent after the tenant vacates the premises.

For the tenant, the deposit ensures that the landlord fulfills their responsibilities, such as returning the property in good condition and adhering to the terms of the agreement. It can also act as a measure of trust, showing that both parties are committed to maintaining the property’s condition and following the agreed-upon rules.

The deposit also minimizes disputes between the parties. By clearly outlining conditions for its use in the agreement, both landlord and tenant can avoid misunderstandings. For instance, if the property is returned without damage and all rent is paid, the tenant is entitled to the full deposit return, which assures them of fair treatment.

In the event of any disagreement regarding the deposit, having a written agreement with detailed conditions makes it easier to resolve the issue without unnecessary legal action. A transparent process builds trust and reduces potential conflicts, helping maintain a healthy rental relationship.

Ensure the lodger’s name is spelled correctly. Mistakes in personal details can lead to confusion or legal issues down the line. Double-check the spelling and formatting before finalizing the document.

Clearly specify the payment amount. Avoid vague descriptions. Write the exact figure and ensure it matches the agreed-upon terms. This helps avoid disputes later.

Include the payment date. Leaving this out may create confusion about when the transaction took place. A missing or unclear date can affect your record-keeping and complicate future references.

Don’t forget to outline the payment method. Whether the lodger paid in cash, through bank transfer, or other means, noting this detail ensures transparency and creates a clear paper trail.

Always provide a receipt number or unique identifier. This helps both parties track payments easily, especially when multiple receipts are issued for different months or services.

Never issue receipts without confirming the amount received. If there are discrepancies between what was expected and what was actually paid, clarify before providing a receipt to avoid confusion later.

Don’t omit signatures. Both the landlord and lodger should sign the receipt to make it official. This ensures both parties acknowledge the transaction, reducing misunderstandings.

A deposit receipt serves as an official record that the tenant or buyer has paid a deposit. If a dispute arises, this document becomes the key reference point. The first step is to gather and review the receipt to ensure that the details are correct, including the amount, date, and any terms related to the deposit.

In case of disagreements about refund amounts or conditions, the receipt can help clarify whether the deposit was refundable, the conditions under which it could be withheld, and if the payment was properly applied. A clear, signed deposit receipt provides evidence that both parties agreed to the terms at the time of the transaction.

To resolve disputes, start by presenting the receipt to the other party. If both parties disagree about terms, examine any clauses or conditions on the receipt that specify under what circumstances the deposit might be retained. If no such clauses exist, the deposit is likely refundable under standard terms.

| Dispute Scenario | How the Deposit Receipt Helps |

|---|---|

| Claim of non-payment | Receipt proves that the deposit was made, supporting the payer’s claim. |

| Disagreement over the refund amount | Receipt shows the original deposit amount and any deductions that were agreed upon. |

| Failure to return deposit | Receipt outlines the refund conditions, allowing both parties to verify if terms were met. |

If the issue is unresolved, the receipt may serve as evidence in legal settings. Make sure to keep the receipt safe and accessible, as it could be required for resolving disputes formally.

When drafting a lodger deposit receipt, focus on clear documentation of the deposit terms. This will ensure smooth communication and prevent disputes. Include the date of the deposit, the total amount, and the purpose for which it was paid. It’s helpful to break down the deposit into smaller components if relevant (e.g., security deposit, damage waiver, etc.).

Key Components to Include

- Tenant’s Information: Full name and contact details.

- Landlord’s Information: Full name and contact details.

- Deposit Amount: Exact figure and any breakdown.

- Payment Method: Cash, cheque, or bank transfer details.

- Property Address: Specific location of the rented premises.

- Deposit Terms: Refund conditions, deductions, and timeline for return.

Formatting Tips

- Make sure each section is clearly labeled for easy reference.

- Use bullet points or numbered lists to highlight key details.

- Include spaces for both parties to sign and date the receipt.

Keep the tone neutral, and avoid unnecessary legal jargon. This document is a simple transaction record, so clarity is key.