When issuing a prepayment receipt, clarity and accuracy are key. A well-structured template ensures both parties are on the same page regarding the amount paid, the services or goods covered, and any remaining balance. Start with clear identification of both the payer and recipient to avoid any confusion. Include the transaction date and a unique reference number for easy tracking.

Break down the payment details by specifying the exact amount paid in relation to the total cost. It’s also helpful to indicate the remaining balance due, if applicable. If the prepayment is part of an ongoing arrangement or subscription, make sure to note the period it covers and any future payments expected.

Don’t forget to include terms or conditions regarding refunds, cancellations, or any actions to be taken if the full payment isn’t made. This section helps prevent misunderstandings later on. Ensure that the document is clear and straightforward, so the receiver knows exactly what they’ve agreed to.

Here is the corrected version where words are not repeated more than 2-3 times:

When creating a prepayment receipt, it’s crucial to keep the template clear and concise. Avoid overcomplicating the layout by focusing on key details that matter to both the business and the customer. Start by clearly stating the payment amount and the date of the transaction. Make sure the terms of the prepayment are specified, including any deadlines or conditions for refunds.

Prepayment Details

| Payment Amount | Payment Date | Refund Conditions |

|---|---|---|

| $150 | 2025-02-05 | Refund possible within 7 days |

| $250 | 2025-02-10 | Non-refundable |

Additionally, it’s helpful to include the customer’s information and a unique transaction ID for easy reference. A clear breakdown of what the prepayment covers will provide transparency. Avoid redundant phrases and make sure that only the necessary details are displayed. This ensures clarity and improves the overall experience for all parties involved.

Customer Information

| Customer Name | Transaction ID |

|---|---|

| John Doe | TXN123456 |

| Jane Smith | TXN789101 |

Lastly, the format should be user-friendly, with clear sections that are easy to fill out. A clean layout helps prevent misunderstandings. Double-check for accuracy, especially when noting the amount and dates. Keep all terms simple to ensure that the receipt is easily understood by anyone who reads it.

- Prepayment Receipt Template Guide

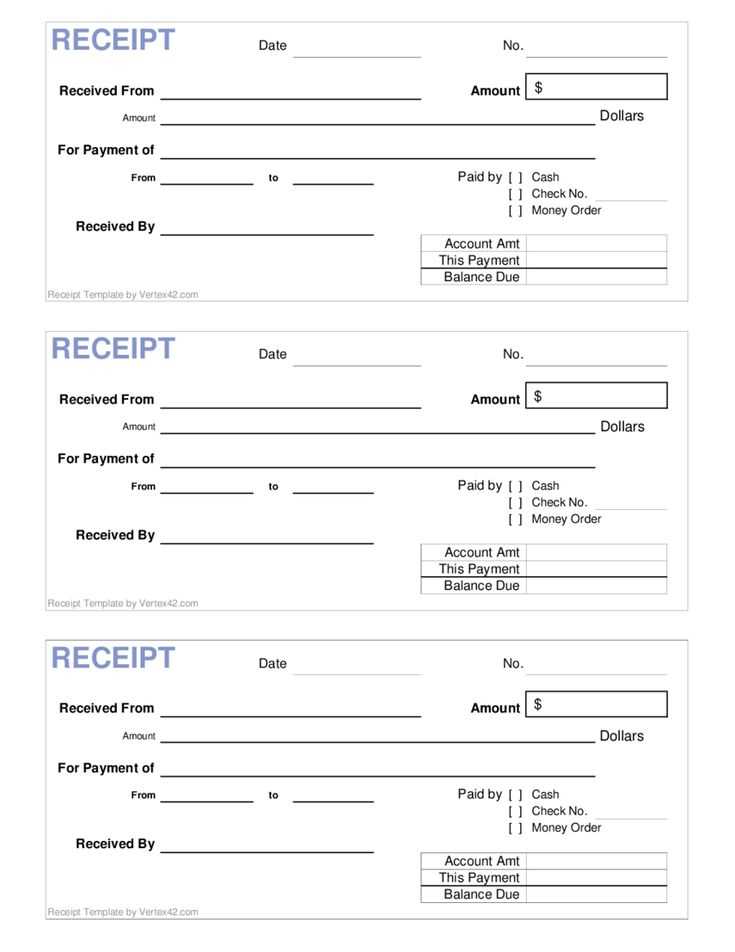

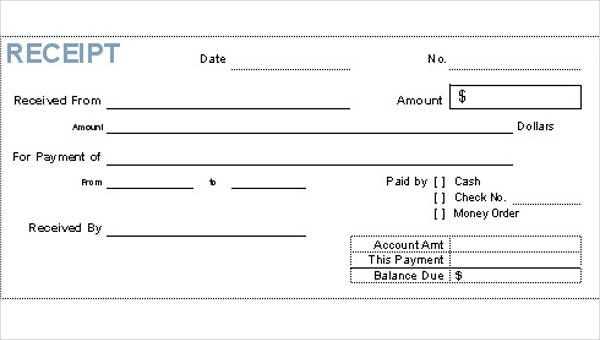

To create a prepayment receipt, include key details such as the date, the amount received, the purpose of the payment, and the recipient’s information. The receipt should clearly state that the payment is for a specific service or product, and that it is a partial or full advance. Ensure the payment method is specified (e.g., cash, credit card, bank transfer).

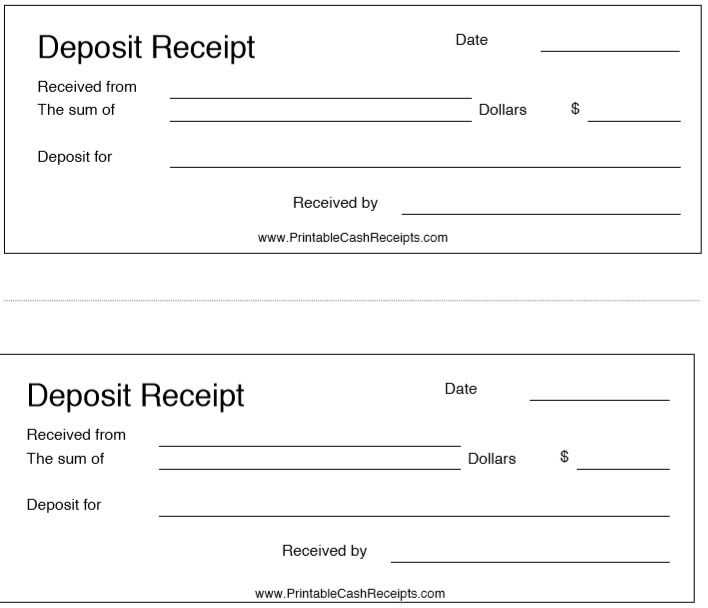

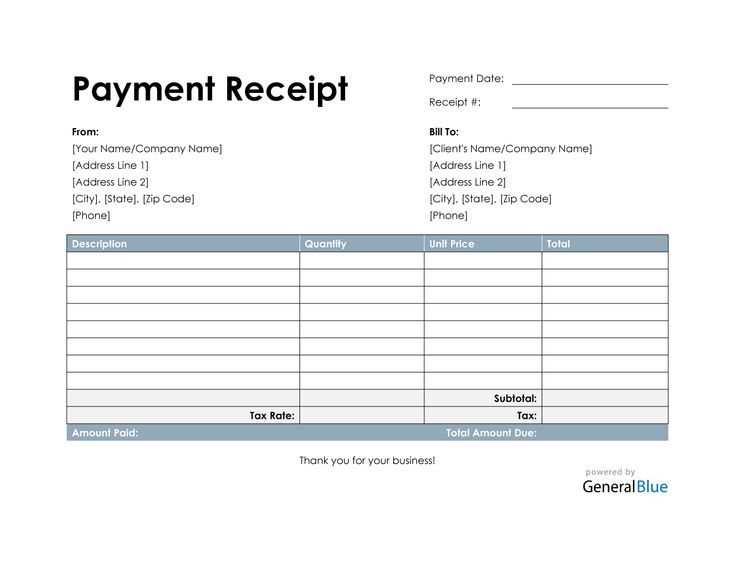

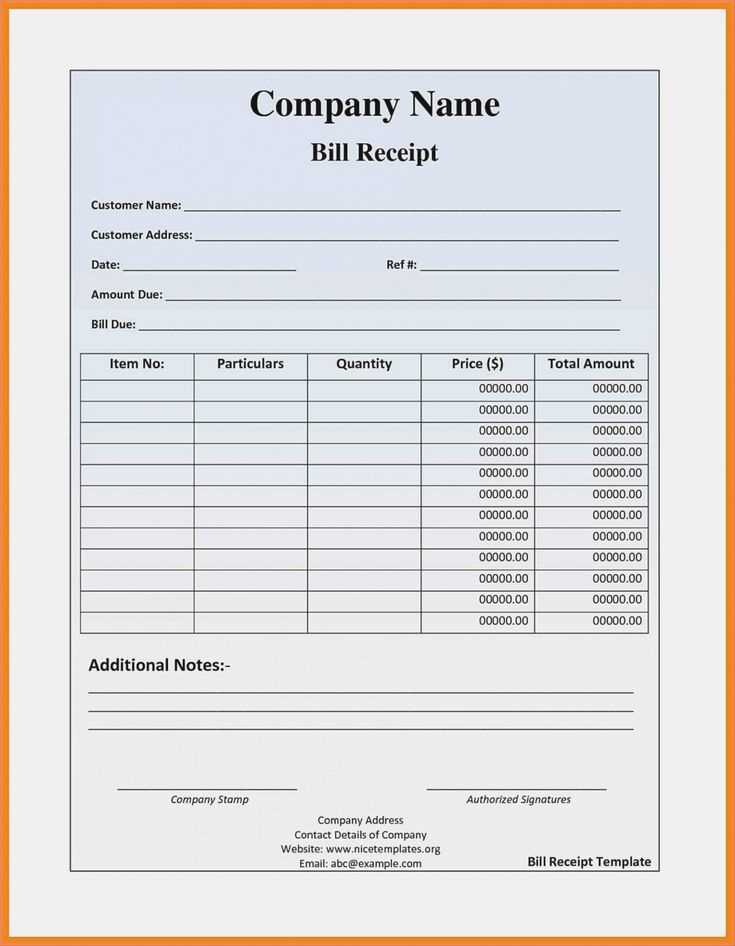

Start with the header section, which should include the name of the business, contact information, and any applicable logo or branding. Below, clearly label the document as a “Prepayment Receipt” to avoid confusion.

Next, include the payment details: the payer’s name, the transaction date, and the specific amount paid. If the prepayment applies to a larger invoice, include the invoice number or description of the item or service paid for.

Provide space for a brief description of the transaction terms, including whether the prepayment is refundable or non-refundable, and any relevant terms regarding the balance due. Clearly state the remaining balance to avoid misunderstandings.

Lastly, finish the template with a thank you note or a short message, reinforcing the relationship with the client. Ensure the document is signed by an authorized person to authenticate the receipt.

Prepayment receipts serve as a record of transactions where payment is made before goods or services are provided. This helps businesses track customer obligations and ensures transparency in financial dealings. By issuing prepayment receipts, companies can secure funds upfront, reducing the risk of unpaid invoices later. It also provides clarity to customers regarding the amount already paid and any remaining balance due.

These receipts are crucial for accurate bookkeeping, as they distinguish between prepayments and regular sales, ensuring that financial statements reflect the correct amounts for revenue recognition. Additionally, having prepayment receipts on hand simplifies the process of refunding or applying credit toward future purchases.

For both businesses and customers, prepayment receipts create a reliable system for monitoring financial exchanges, fostering trust and reducing potential disputes.

Begin with a clear identification of both parties involved: the payer and the recipient. Include full names, addresses, and contact information for each party. This ensures that there is no ambiguity about who is involved in the transaction.

Next, clearly state the amount of the prepayment. This should include the currency, as well as any applicable taxes or fees. Specify whether the amount is a partial payment or the total sum, and indicate what the payment covers, such as products, services, or deposits.

The document should include the date the prepayment is made and, if relevant, the payment method (e.g., credit card, bank transfer). Mention any deadlines or due dates for future payments or delivery of goods/services, to set expectations for both parties.

Another crucial detail is the description of the agreement. Outline the purpose of the prepayment and what the funds are securing. If the prepayment is refundable, clarify the terms under which it can be refunded and any conditions attached to it.

Lastly, include the signature section. Both parties should sign the document, confirming their agreement to the terms. Ensure there is a space for dates to reflect when the document was signed by each party.

Begin by adjusting the layout to match your brand’s identity. Choose a clean, simple design that highlights key information without clutter. Ensure that your logo, business name, and contact details are easy to spot at the top of the template.

Customize Fields

- Include transaction-specific details like invoice number, payment method, and transaction date.

- Add sections for customer name, address, or reference numbers to tailor receipts to different needs.

- Incorporate custom messages or terms, such as “Thank you for your purchase” or “Payment due by [date].”

Modify Fonts and Colors

- Pick fonts that are easy to read and align with your brand’s tone.

- Ensure the text color contrasts well with the background for legibility.

- Use bold or italics sparingly to highlight important items like the total amount due.

Finally, save your template in a reusable format, such as PDF or Word, for easy access. Consider testing the template with a few sample receipts to check its clarity and functionality before going live.

Prepayment receipts are legally binding documents that confirm payment in advance for goods or services. They establish an obligation for the seller to deliver the agreed-upon product or service once the payment is made. The receipt serves as proof that the buyer has fulfilled their part of the transaction, ensuring that both parties have a clear understanding of the agreement.

Contractual Obligations

When a prepayment is made, it forms part of a contract between the buyer and seller. The terms of the contract must specify the conditions under which the prepayment is accepted, what it covers, and the actions to be taken once the full transaction is completed. If the seller fails to deliver the product or service, the buyer is entitled to request a refund or seek compensation, depending on the agreement’s terms.

Tax and Financial Implications

Prepayment receipts can have tax implications for both businesses and individuals. For businesses, the receipt may trigger the recognition of income in some jurisdictions, even if the product or service is not yet provided. It’s essential to understand how prepayment affects accounting practices and tax filings to ensure compliance with local laws and regulations.

Begin by selecting a receipt template that aligns with your business needs. Ensure it includes essential information such as the transaction date, amount, and customer details.

Enter Transaction Details

Fill in the payment amount, any applicable taxes, and the method of payment. Include a description of the products or services provided, along with any relevant reference numbers or order IDs.

Include Your Business Information

Add your business name, address, contact information, and any other relevant details to ensure the receipt looks professional and includes all necessary contact data.

Lastly, double-check all the information before saving or sending the receipt to the customer. This will help avoid any errors and maintain a smooth transaction process.

Always double-check the transaction details before finalizing a receipt. Incorrect amounts or wrong dates can cause confusion and delays in processing payments. Ensure the total amount corresponds accurately with the transaction made. Mistakes in pricing or missing decimal points can lead to significant errors, affecting both parties.

1. Missing Required Information

Make sure all necessary fields are filled in, including the recipient’s name, transaction number, and payment method. An incomplete receipt lacks credibility and may not serve its intended purpose. If any required field is omitted, it could cause issues for both the payer and the payee.

2. Incorrect Date Formatting

Using inconsistent or incorrect date formats can cause confusion for both parties involved. Stick to one clear and universally accepted format (e.g., DD/MM/YYYY). This avoids any potential legal or financial complications later.

3. Failing to Provide a Clear Description of the Transaction

Avoid vague or unclear descriptions in the receipt. Be precise in outlining the products or services provided. A detailed description ensures the receipt can be referenced properly if disputes arise in the future.

4. Overlooking the Payment Method

Always specify the method of payment used, whether it’s cash, credit card, or bank transfer. Leaving this out can lead to confusion, especially for future audits or verification processes.

Prepayment Receipt Template

Ensure clarity in your prepayment receipt by including key details that reflect the transaction accurately.

Key Information to Include

- Receipt Number: A unique identifier for the transaction.

- Payee and Payer Details: Names, addresses, or other identifying information for both parties involved.

- Amount Paid: Clearly specify the prepayment amount, including any applicable taxes or fees.

- Date of Payment: The exact date when the payment was made.

- Description of Service or Goods: Briefly outline what the prepayment covers, ensuring both parties understand the purpose.

Formatting Tips

- Keep the layout simple, with each piece of information clearly separated for easy reading.

- Use a consistent font and size to ensure readability.

- If the prepayment is for a larger service or product, include a payment schedule or balance due section.