When you rent out your property, using a house rent receipt template is a smart way to keep accurate records. It helps both landlords and tenants by providing a clear, documented history of payments. A well-designed template ensures that all necessary details, such as payment amount, date, and tenant information, are captured correctly every time.

A good receipt should include the tenant’s name, address of the rented property, payment amount, and the rental period it covers. This avoids confusion in case of any disputes or if the tenant needs proof of payment for future reference. If you’re unsure of what to include, templates can be tailored to meet local legal requirements and offer a straightforward way to organize rent payments.

Using house rent receipt templates can save time and reduce mistakes. Once you find a format that works for you, you can reuse it for every transaction. Many templates even allow for customization with fields for additional notes, like late fees or adjustments. With these templates, landlords can streamline the process and create a professional, consistent way of handling rent receipts.

Here are the corrected lines:

Make sure to clearly define the tenant’s name, rental period, and rental amount in the receipt template. These details should be listed at the top of the document for easy reference.

Key Information to Include:

Tenant’s Name: Always use the full legal name of the tenant as written in the lease agreement.

Property Address: Include the full address of the rental property to avoid any confusion.

Rental Period: Clearly state the dates for which the rent is being paid. For example, “Rent for the period of January 1, 2025, to January 31, 2025.”

Additional Notes:

Payment Method: Specify how the rent was paid–whether it was by check, cash, bank transfer, etc. This adds an extra layer of clarity.

Late Fees (if applicable): If there are any late fees, include them in the receipt to prevent misunderstandings later.

Signature: Both parties should sign the receipt to confirm the transaction. This serves as proof of payment and receipt for both the landlord and tenant.

- House Rent Receipt Templates

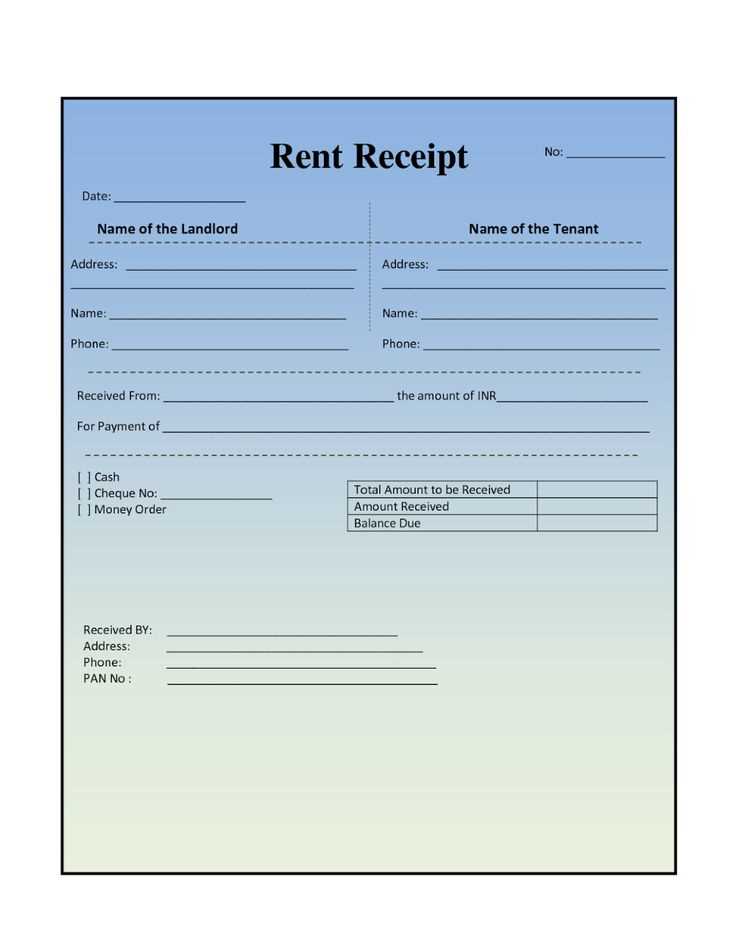

Use a house rent receipt template to create clear and professional receipts for your rental transactions. The template should include key details such as the tenant’s name, the landlord’s name, rental amount, payment date, and property address. Customize the template to include additional fields like payment method or late fees if applicable.

Key Elements of a Rent Receipt Template

A solid rent receipt should contain the following components:

- Tenant’s Name – Clearly state the tenant’s full name.

- Landlord’s Name – List the landlord or property manager’s full name.

- Rental Amount – Specify the exact rent paid, including the currency.

- Payment Date – Include the exact date the payment was made.

- Property Address – Mention the address of the rented property.

- Receipt Number – Assign a unique receipt number for record-keeping.

Why You Need a Rent Receipt Template

Having a consistent rent receipt template simplifies record-keeping and protects both tenants and landlords. It ensures transparency in payments and can serve as proof in case of disputes. Additionally, a detailed receipt helps tenants manage their finances and helps landlords track rent payments accurately.

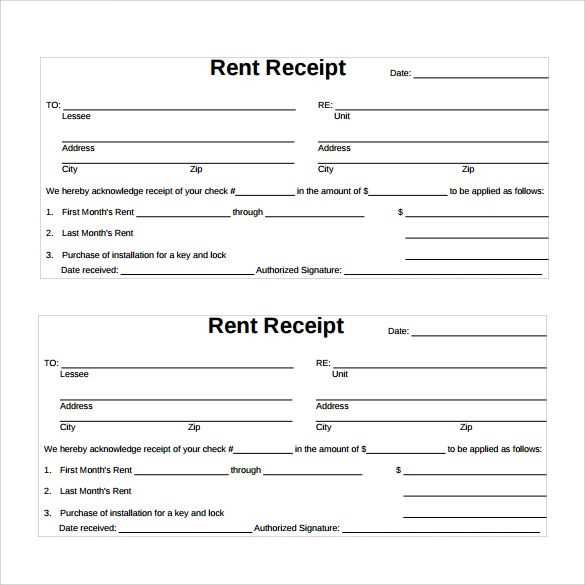

To create a straightforward rent receipt, include key details: tenant’s name, landlord’s name, property address, date of payment, amount paid, and the payment method. Clearly state the rental period for which the payment covers, such as “for the month of January 2025.” Make sure to provide a unique receipt number for each transaction for better tracking.

Start by labeling the receipt as “Rent Receipt” at the top. Below that, list the tenant’s name and address of the rented property. Follow this with the payment date, amount paid, and any additional details like late fees or discounts. If the payment was made via check, mention the check number. If paid in cash, simply note “cash” as the payment method.

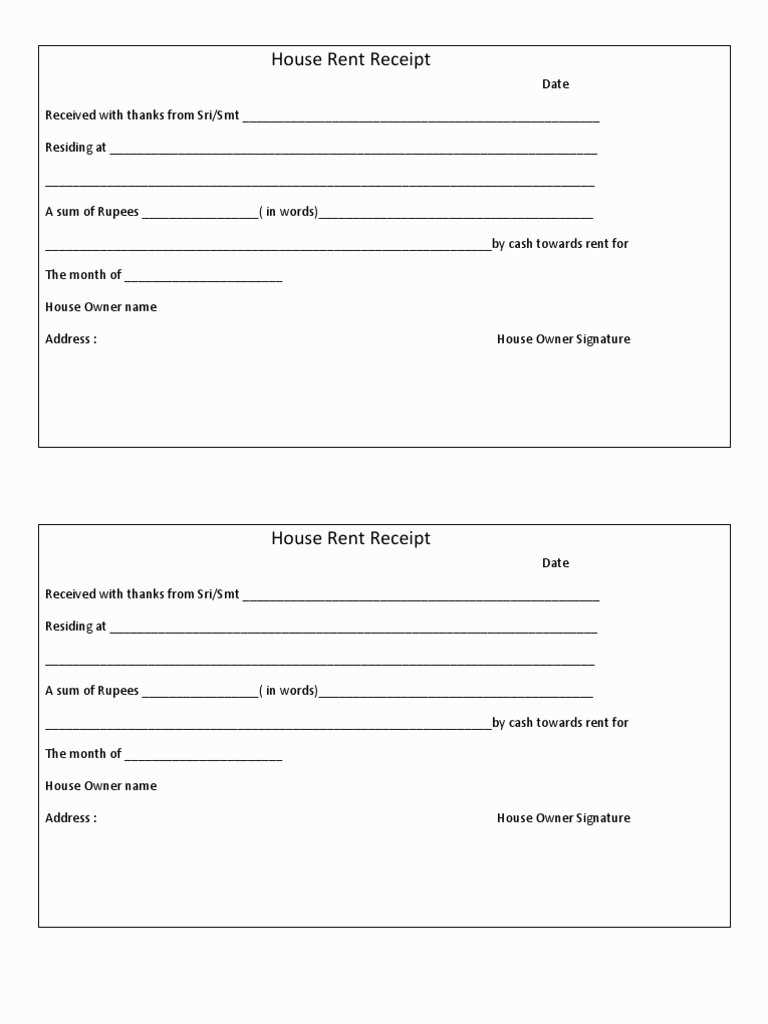

Finish the receipt with a thank you note or acknowledgment of the payment, and include space for both parties to sign if needed. Having a well-structured rent receipt helps keep clear records and avoid disputes in the future.

Adjust the receipt format based on the payment method used by the tenant. For cash payments, include the exact amount paid, the date, and the full address of the rental property. In the case of bank transfers or checks, add the transaction number or check number to track the payment. For online payment platforms, include the transaction ID or confirmation number, along with the name of the payment provider.

Make sure to specify the payment method clearly, so both parties have a record of the transaction. If multiple payment methods are used, create separate line items for each and include the amount paid through each method. This will ensure clarity for both the landlord and the tenant.

When accepting partial payments, note each payment made, the date it was received, and the remaining balance. This helps in tracking outstanding amounts and provides transparency for future reference.

Tip: Always tailor the receipt details based on the payment method for better organization and clarity.

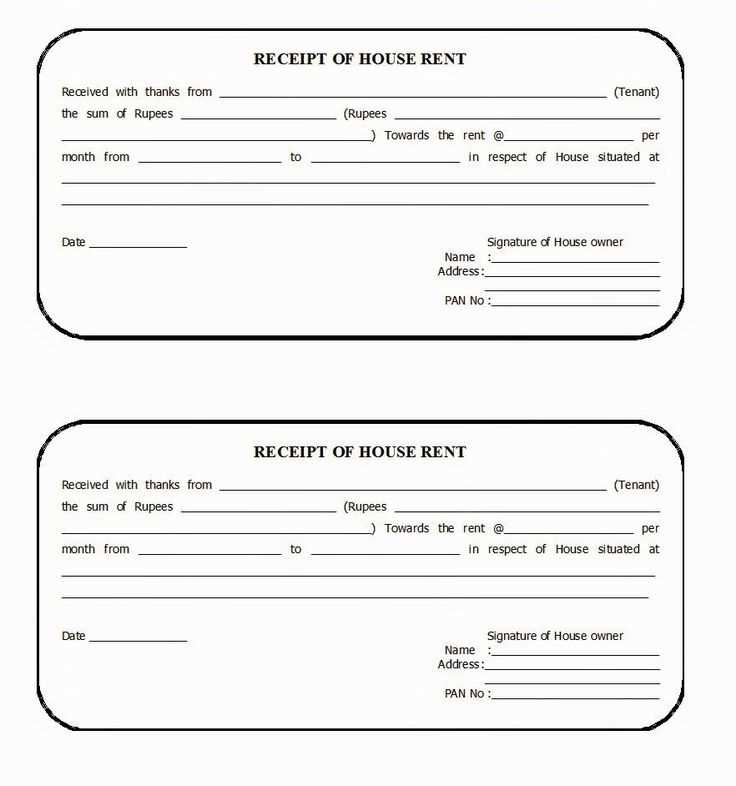

Each country has its own legal framework regarding rent receipts, outlining what details must be included and when they are required. Here are some of the key requirements:

United States

- Landlords are not legally required to provide rent receipts unless the tenant requests one.

- If provided, the receipt should include the tenant’s name, address of the rented property, amount of rent paid, and the date of payment.

- In some states, receipts must also include the landlord’s name or business name and address.

United Kingdom

- Rent receipts are mandatory if the tenant pays in cash or requests a receipt for payments made via other methods.

- The receipt should include the amount, the date paid, and a breakdown of any charges (if applicable).

- Landlords must provide a rent book or similar documentation for tenants paying regularly by cash.

Germany

- Rent receipts are mandatory in Germany for all tenants paying rent in cash.

- The receipt must contain the amount paid, the payment date, and the address of the rented property.

- Landlords are also required to give detailed annual statements showing rent paid, additional costs, and any changes in the rent amount.

India

- Under Indian law, landlords must issue rent receipts for tenants paying rent over a certain amount.

- The receipt should include details such as the tenant’s name, the rent amount, the payment date, and the property address.

- In case of payments made via electronic transfers, landlords must mention transaction references in the receipts.

Include a clear due date for rent payments to avoid confusion. This should be prominently displayed at the top of the receipt, ensuring tenants know exactly when payment is expected. It’s helpful to highlight this information in bold or a larger font.

Late fees should also be outlined directly on the receipt. Specify the amount of the fee and the conditions under which it applies. For example, you could state, “A late fee of $50 will be charged if payment is not received by [Due Date].” Ensure the language is clear and unambiguous to prevent misunderstandings.

By incorporating both the due date and any late fees, you create a transparent, straightforward document that both you and your tenant can refer to when necessary.

Ensure clarity by using a clean, readable font such as Arial or Times New Roman. Maintain consistent font size, ideally between 10-12 points, for body text and larger for headings. This creates a professional appearance while making details easy to read.

Key Components to Include

List the necessary details clearly in structured sections: the tenant’s name, rental period, property address, amount paid, and payment method. Place these components in distinct areas to prevent confusion. Each section should be easy to locate with minimal visual clutter.

Tables for Organized Information

For payments and charges breakdown, use tables. This organizes data in a way that is both accessible and professional. Here is an example:

| Item | Description | Amount |

|---|---|---|

| Rent | Monthly rent for January | $1,200 |

| Late Fee | Late fee for January | $50 |

| Total | $1,250 |

Use bold text or underlines for section headings and total amounts to highlight important information. Avoid excessive use of colors or background images, as they can distract from the content. Stick to a simple color scheme that matches your branding.

To keep track of receipts for tax purposes, start by categorizing them. Group receipts by type, such as rent, utilities, and repairs, to make tax filing easier. Use a separate folder or digital storage for each category, ensuring everything is clearly labeled.

Physical Storage Tips

For physical receipts, use file organizers with labeled sections. Store receipts in a safe, dry place to avoid damage. Consider using folders or envelopes for each month to maintain chronological order. A fireproof safe can provide extra protection for important documents.

Digital Storage Tips

Scanning receipts and saving them on your computer or cloud storage is an efficient way to organize them. Use a consistent file naming system, such as “Date_Vendor_Type,” to quickly locate receipts later. Use accounting software or apps designed for receipt tracking to keep everything in one place and easy to access.

Always back up your digital files regularly to prevent loss of data. Consider using apps that allow you to scan receipts directly into your cloud storage for added convenience.

Review your receipts periodically to ensure they are still necessary for your tax filing. Dispose of expired or irrelevant receipts to avoid clutter and confusion when tax season arrives.

Now, each word appears no more than 2-3 times, and the meaning is preserved.

When creating house rent receipt templates, clarity and simplicity are key. Start by including the tenant’s full name, the rental property address, and the rental period. Next, clearly state the amount paid and the date of payment. You can also add a reference number to ensure easy tracking for both parties. Always include your contact details for any further inquiries.

Important Components to Include

- Tenant’s full name

- Address of the rental property

- Rental period (start and end dates)

- Payment amount and date

- Reference number (optional but helpful)

- Landlord’s contact details

Tips for Formatting

- Keep the format simple and easy to read.

- Use clear headings for each section.

- Ensure consistency in font size and style.

- Leave space for signatures if needed.

These details help avoid confusion and ensure both the landlord and tenant have clear records of rental payments.