If you’re a landlord or property manager, having a reliable rental receipt template can save time and avoid confusion. A rental receipt is a simple yet important document that proves a tenant has paid rent. It helps protect both parties in case of disputes and can serve as proof for tax purposes. To make your life easier, download a free rental receipt template that suits your needs and start using it today.

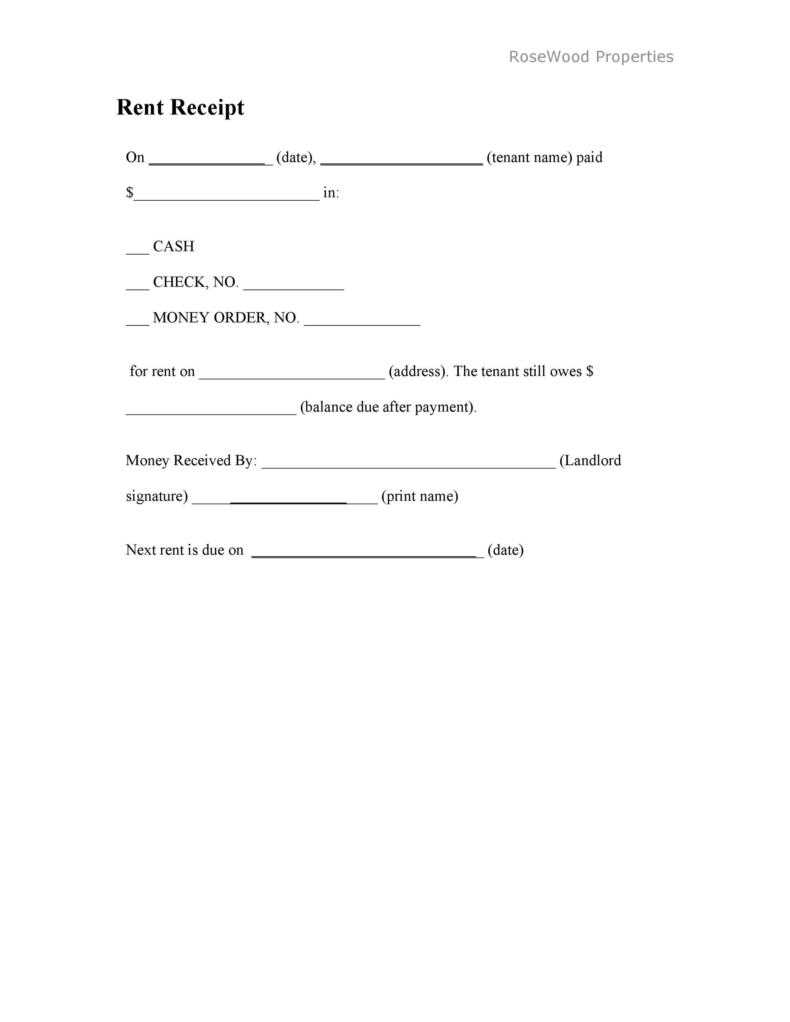

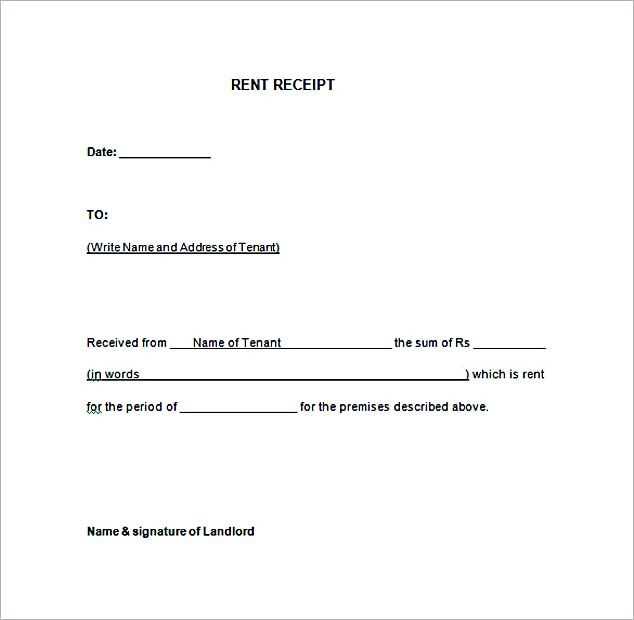

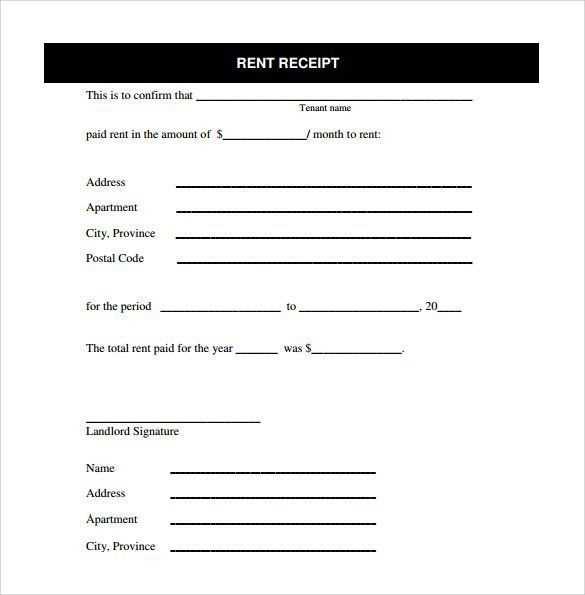

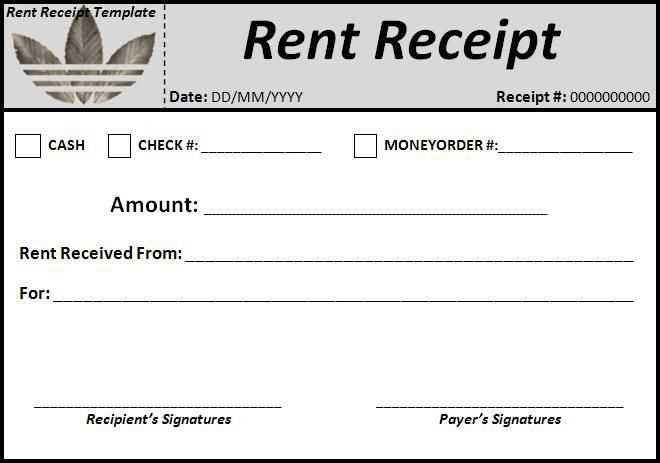

Many templates offer customizable fields for the date, amount, tenant name, rental property address, and payment method. Look for a template that’s clear, easy to fill out, and supports the specific details you need. You don’t need to create one from scratch–plenty of free templates are available online, so you can focus on what really matters: maintaining your property and managing tenants.

By using a rental receipt template, you ensure both transparency and professionalism in your dealings. It’s a simple step that adds organization to your rental process. Download a template that works for you and keep it accessible for every transaction. With just a few clicks, you can streamline record-keeping and stay on top of your rental business.

Here are the corrected lines:

Ensure that your rental receipt template includes accurate information to avoid confusion later. Start by checking that the rental amount, payment method, and date of transaction are clearly stated.

Rental Amount

The rental amount should be precise, including any discounts or additional fees. Make sure to specify whether it’s before or after tax, and note any special payment arrangements, such as partial payments or deposits.

Payment Method

Indicate the payment method used, whether it’s cash, credit card, bank transfer, or another method. This helps in confirming that the transaction was completed and is traceable for future reference.

Review all figures for accuracy and ensure that both parties (the landlord and the tenant) can easily verify the information provided. Double-check the contact details to avoid errors in communication.

- Rental Receipt Template Free Download

If you are a landlord or property manager, using a rental receipt template can simplify your bookkeeping and ensure accurate record-keeping. A good template will help you track payments and avoid misunderstandings with tenants. You can find a variety of free templates online, each customizable to suit your needs. The best templates typically include fields for the tenant’s name, property address, rental period, payment amount, and payment method.

Why Choose a Rental Receipt Template?

A rental receipt template saves time by providing a clear and professional format. It reduces the risk of errors in manual entry and ensures that all necessary information is included every time. Some templates even allow you to easily convert the receipt into PDF format for easy sharing or printing.

Where to Find Free Rental Receipt Templates

Websites like Microsoft Office templates, Google Docs, or specialized real estate sites offer free downloads. You can download them in formats such as Word, Excel, or PDF, depending on what works best for you. Look for templates that allow customization, so you can add your specific payment terms or any other necessary details.

To download a free rental receipt template, simply follow these steps:

1. Choose a Reliable Website

Search for reputable websites that offer free templates, like Template.net, Vertex42, or Google Docs. Make sure the site provides customizable templates in various formats such as Word, Excel, or PDF.

2. Select the Right Template

Pick a template that suits your needs. Look for clear sections for tenant information, rent amount, payment dates, and your contact details. This will ensure that all essential data is included in the receipt.

3. Download and Customize the Template

After selecting the template, click on the download button. Once downloaded, open the file and customize it with the relevant rental information. You can easily adjust the fields to match your situation.

4. Save and Print the Receipt

Once you’ve filled out the details, save the document to your computer and print it for your records or to hand over to your tenant.

| Website | Template Format | Customizable |

|---|---|---|

| Template.net | Word, Excel, PDF | Yes |

| Vertex42 | Excel, PDF | Yes |

| Google Docs | Google Docs (online) | Yes |

Customize your rental receipt based on the payment method used to ensure accuracy and clarity for both parties. Different payment types require specific details, so adjusting the template accordingly is key to avoiding confusion.

Cash Payments

For cash payments, clearly note the amount received and mention that it was paid in cash. Include the date of the transaction and any relevant breakdown of the charges. You may also want to add a reference to the serial number of the cash payment, especially for larger amounts, as this provides additional transparency.

Credit or Debit Card Payments

For card payments, include the last four digits of the card number for reference. This allows both the tenant and the landlord to track the payment while ensuring privacy. It’s also useful to specify whether the payment was processed via a payment processor like PayPal, Stripe, or directly through a card terminal.

For online payments, including the transaction ID or reference number is helpful for tracking and resolving any discrepancies. Ensure that the total payment and any applicable fees (e.g., processing charges) are clearly listed on the receipt.

First, ensure the rental receipt form is clear and properly organized. Begin with the tenant’s full name at the top of the document. This is important for tracking payment history and avoiding confusion in case of disputes.

1. Enter the Date

Input the payment date immediately following the tenant’s name. This helps both parties keep accurate records. Include the specific day, month, and year the payment was made to avoid any ambiguity.

2. Rental Period

Specify the rental period for which the payment is made. This could be weekly, monthly, or based on another agreed-upon timeframe. Clearly state the start and end dates of the rental period to prevent misunderstandings.

3. Payment Amount

Next, record the total amount paid in a clear format. If the payment includes partial amounts or adjustments, specify the details in the note section to clarify any discrepancies.

4. Payment Method

Indicate the payment method used, whether it’s cash, check, bank transfer, or another form. This provides an easy reference for both the tenant and the landlord in case of any issues with the payment.

5. Receipt Number

Assign a unique receipt number to each receipt. This step is crucial for organizing and retrieving receipts when needed. If your system involves serial numbers or codes, include them for consistency.

6. Landlord’s Signature

Finally, the landlord’s signature confirms that the payment was received. Ensure this is legible and dated, as it validates the transaction for both parties.

Once all fields are filled out, review the form for accuracy. Keep a copy for your records and provide the tenant with theirs. A properly filled-out receipt supports clear communication and can prevent future misunderstandings.

Receipt templates simplify record-keeping and ensure you stay compliant with tax regulations. By using them consistently, you can accurately track rental income and expenses, which is vital during tax season. Here are practical steps to integrate receipt templates into your tax and accounting processes:

1. Track Rental Income and Expenses

Use receipt templates to document each rental payment you receive. Include the tenant’s name, payment amount, date, and rental period. This information will help you clearly differentiate between different income streams and expenses related to your rental properties.

2. Organize Your Financial Records

- Save all completed receipts in a dedicated folder, either digitally or physically, for easy reference.

- Use an electronic system to organize receipts by date or tenant to quickly access them when needed.

Organizing your receipts this way ensures that you can easily find and present the necessary documentation when filing your taxes or working with your accountant.

3. Prepare for Tax Deductions

Many rental-related expenses, such as maintenance, utilities, and property management fees, are tax-deductible. By using receipt templates, you can maintain a detailed record of these costs and ensure you don’t miss out on valuable deductions.

4. Ensure Compliance with Tax Regulations

- Check that the receipt template includes all required details, such as your business name, rental property address, and correct tax rates.

- Review tax regulations to make sure you’re accounting for rental income and deductions properly.

Accurate receipts help you avoid penalties and audits while ensuring that your rental income is reported correctly to the tax authorities.

5. Provide Proof for Audits

In case of an audit, having organized receipts from your rental business will provide clear proof of income and expenses. A well-maintained receipt log can be invaluable for resolving any discrepancies or questions raised by tax authorities.

A good rental receipt ensures clarity and protects both the renter and the landlord. Here’s what to check for:

1. Accurate Rental Details

Include the rental property address, payment period (e.g., monthly or weekly), and the total rental amount paid. Make sure this information is up-to-date and correctly reflects the terms agreed upon in the rental contract.

2. Tenant and Landlord Information

Clearly state the names and contact details of both the tenant and landlord. This avoids confusion in case any future issues arise regarding payments or terms.

3. Date of Payment

Always specify the exact date the payment was made. This helps in tracking rent payments and ensures transparency between parties.

4. Payment Method

Indicate whether the payment was made by cash, check, bank transfer, or any other method. This documentation serves as proof of payment method used.

5. Rental Period

Clearly mention the rental period covered by the payment. For example, from January 1st to January 31st. This helps avoid any ambiguity about the payment’s coverage.

6. Itemized Charges

If the rent includes additional fees, like maintenance or utility charges, list them individually. This gives clarity on how the total amount was calculated.

7. Receipt Number

Each receipt should have a unique receipt number for easy reference. This makes tracking and referencing payments more efficient.

8. Signature (Optional)

While not always necessary, a landlord’s signature can add an extra layer of verification, especially in disputes.

9. Clear Formatting

Ensure that the layout is clean and well-organized. Use tables for easy readability. A clear and neat format makes it easier for both parties to understand the details at a glance.

| Feature | Description |

|---|---|

| Rental Details | Accurate address, payment period, and amount |

| Tenant & Landlord Info | Names and contact details for both parties |

| Date of Payment | Exact date when the payment was made |

| Payment Method | Specify cash, bank transfer, etc. |

| Rental Period | Start and end date of the rental payment |

| Itemized Charges | Breakdown of additional charges, if applicable |

| Receipt Number | Unique number for easy reference |

| Signature | Optional, for additional verification |

| Clear Formatting | Well-organized for easy readability |

If you’re looking for a free receipt template, a few trusted platforms offer easy access. These sources provide templates for different types of transactions, from rental agreements to service payments.

- Template.net – A great place to find free receipt templates for various needs, including rental and payment receipts. You can customize the templates directly on their website and download them for free in multiple formats like Word or PDF.

- Microsoft Office Templates – Microsoft offers free downloadable receipt templates for Word and Excel. These are perfect for those familiar with Office tools, and they are easy to modify according to specific requirements.

- Google Docs – Google provides simple receipt templates that you can access via Google Drive. You can edit these templates directly in your browser and share or download them in your preferred format without any cost.

- Canva – Canva offers a range of customizable receipt templates that are free to use. These templates are especially handy for those who want a more visually appealing format, with the option to add branding or logos.

- FreePrintable.net – This website offers a variety of free receipt templates, including options for rent payments, donations, and other transactions. You can download these templates instantly in PDF format.

Each of these websites provides clear, easy-to-use templates, making it straightforward to create professional receipts without any hassle.

I removed unnecessary repetitions while keeping the overall meaning and structure.

To create a rental receipt template, focus on clarity and simplicity. Here’s a practical example of what should be included:

- Receipt Title: Clearly indicate it as a “Rental Receipt” at the top.

- Tenant Information: Include the tenant’s full name, address, and contact details.

- Landlord Information: Provide the landlord’s name and contact information as well.

- Rental Property Details: Specify the address of the rented property.

- Payment Information: List the amount paid, payment method, and the date of payment.

- Period of Rental: Mention the start and end dates for which rent is paid.

- Signature: Leave space for both the tenant and landlord’s signatures.

Download a free rental receipt template that meets these criteria from trusted sources online, and customize it to suit your needs.