A well-structured service invoice receipt ensures smooth transactions and builds trust with clients. Using a clear template not only saves time but also helps maintain professionalism. Whether you’re offering consulting services or repairing equipment, having a consistent format makes the process more transparent and easy to follow.

Start with basic details: Include your business name, address, and contact information, along with the client’s details. This establishes who is involved in the transaction and ensures both parties are clear on their roles. Including an invoice number also helps track each receipt for future reference.

Include specific services provided: Detail the services rendered, along with their individual costs. This prevents misunderstandings about what the client is being charged for. Breaking down services into clear line items shows transparency in pricing and ensures that clients understand exactly what they are paying for.

Don’t forget payment terms: Clearly state the payment method accepted and any deadlines for payment. A concise reminder of any late fees or discounts for early payment adds an extra layer of clarity to your transactions.

Creating a Service Invoice Template from Scratch

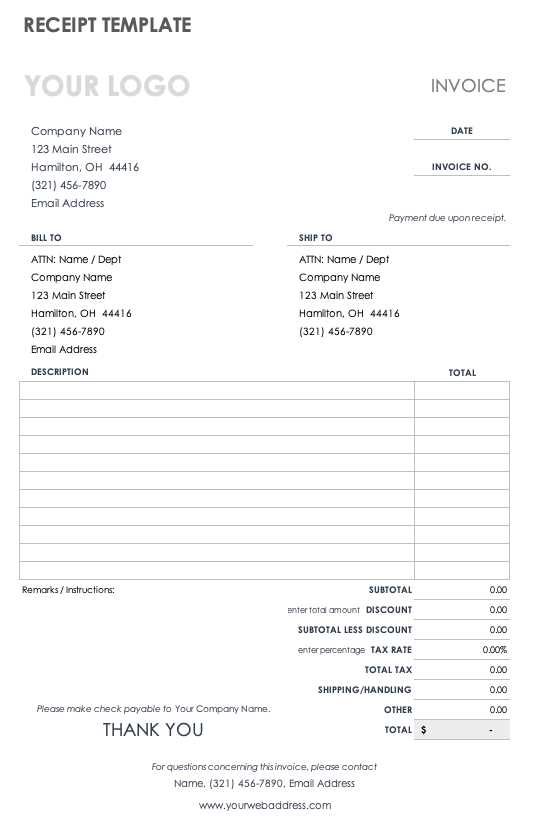

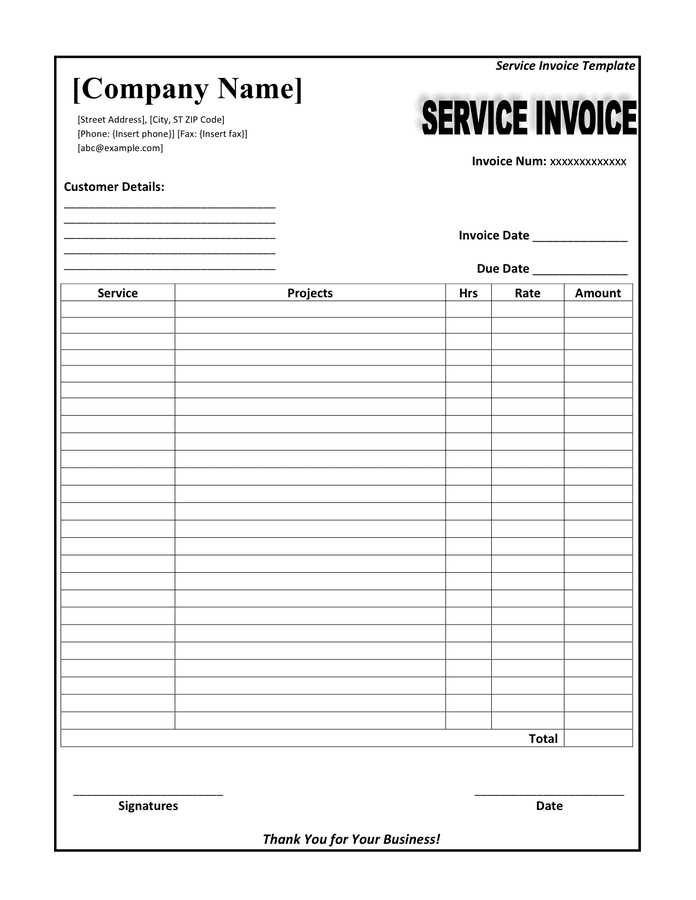

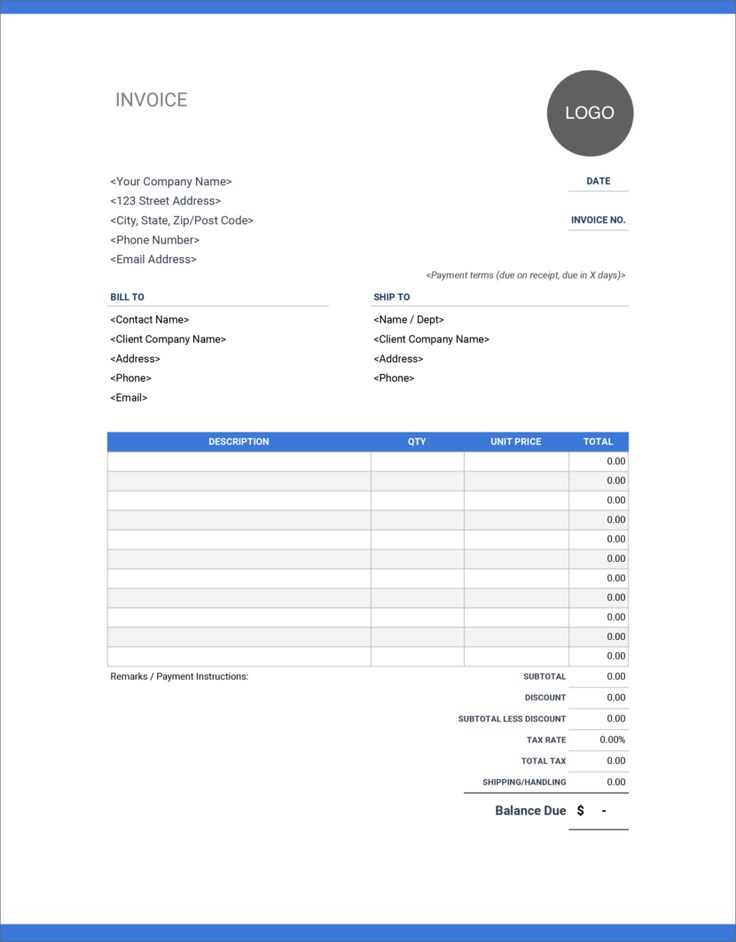

Begin by setting up a clear and structured layout. Use a simple table format for organizing the key components of the invoice. This ensures that all the necessary information is displayed in an easy-to-read manner.

Designing the Header

The header should include your business name, logo, and contact details. Make sure your company name stands out. Include your address, phone number, email, and website URL, so customers can easily reach you if needed. Position this information at the top of the template for immediate visibility.

Adding Itemized Information

Create a table with columns for item description, quantity, unit price, and total cost. This breakdown provides transparency for both you and your client. Include a row for each item or service provided. Ensure that the total cost for each item is calculated automatically if using a tool that supports formulas.

Use a section for taxes or additional fees. Clearly label these and show how they are calculated based on the subtotal of the items.

Providing Payment Terms

At the bottom of the invoice, include your payment terms, such as due date, payment methods, and any late fees. Keep the language straightforward and professional, so there’s no confusion about how and when payment is expected.

After creating the basic structure, you can refine the design, adjust fonts, and apply color schemes that align with your brand. Keep the layout clean and uncluttered for a professional look that will leave a lasting impression.

Customizing Your Template for Different Services

Adapt your service invoice template to match the specific requirements of each service you offer. For instance, if you’re providing consulting, include a detailed breakdown of hours worked and the hourly rate. For repair services, list parts and labor separately, ensuring transparency for your clients.

Adjusting for Various Industries

Different industries have unique needs when it comes to invoicing. In healthcare, for example, it’s important to include specific treatment codes or diagnostic information. If you’re in the creative field, such as design or photography, list project milestones and deliverables. Customize sections based on what is relevant for each service, so clients can quickly understand the charges.

Adding Service-Specific Information

Incorporate relevant fields such as project timelines, warranty details, or follow-up instructions, depending on the nature of your service. For recurring services like subscriptions or maintenance contracts, add payment terms that reflect the ongoing nature of the agreement. This ensures your invoice is tailored to the service and makes tracking and payment easier for both parties.

Adding Required Legal Information to the Invoice

Ensure your invoice includes the necessary legal information to avoid issues with tax authorities and customers. Start with the full business name, address, and contact details. This confirms your identity and provides transparency in case of inquiries.

Business Identification Number

Include your tax identification number (TIN), VAT number, or other relevant registration numbers based on your business type. This helps in verifying your business and streamlines tax reporting.

Terms of Payment and Penalties

Clearly outline payment terms, including deadlines and late fees. Specify whether you accept partial payments and include interest rates for overdue invoices. This protects you in case of delayed payments.

| Legal Requirement | Description |

|---|---|

| Business Name and Address | Full name and contact address of the business issuing the invoice. |

| Tax Identification Number (TIN) | Unique number assigned by tax authorities for tax reporting purposes. |

| Payment Terms | Conditions specifying the due date, payment methods, and any penalties for late payments. |

Ensure these details are accurate and easily visible on your invoices to maintain clarity and legal compliance.

Integrating Payment Details and Methods

Include clear and precise payment instructions on the invoice. Specify whether the customer should pay by credit card, bank transfer, or other payment options. For credit card payments, provide the necessary fields such as card type, number, expiry date, and CVV. If bank transfer is preferred, include the bank account number, routing number, and payment reference.

Ensure all payment methods are correctly aligned with the region and customer preferences. For online payments, offer secure platforms like PayPal, Stripe, or other reliable gateways. Include links or QR codes to make payments as simple as possible for your clients.

Clearly state the due date and any applicable late fees for overdue payments. This helps avoid confusion and sets clear expectations. If installment payments are available, break down the payment schedule with dates and amounts due.

Double-check that all payment details are accurate, including the currency, tax calculations, and discounts. Any discrepancies can lead to delays or disputes, so accuracy is key to a smooth transaction.

Incorporating Taxes and Discounts in the Template

Include tax and discount fields in your service invoice receipt template to ensure accurate billing. The tax amount should be clearly separated from the total cost and calculated based on the applicable tax rate for your region. Similarly, any discounts offered should be applied before tax calculations to avoid discrepancies.

Adding Taxes

- Determine the tax rate based on your location or the client’s location.

- Include a separate line for taxes below the subtotal, indicating the percentage and amount charged.

- Ensure that the tax is calculated correctly based on the pre-discount amount to maintain transparency.

Applying Discounts

- Provide a discount field for both percentage-based and fixed amount discounts.

- Apply the discount before tax calculation to avoid incorrect tax rates.

- Display the discount clearly on the receipt so clients can easily verify the reduction in cost.

Tips for Automating Invoice Generation

Set up automatic triggers for invoice creation when a service is completed or payment terms are met. Integrate your invoicing system with your sales or project management software to capture all relevant details instantly. This reduces human error and ensures accurate information on every invoice.

Use templates to simplify the design process. Customize your templates to include placeholders for client details, service descriptions, and prices. This speeds up invoice creation and ensures consistency across all documents.

Integrate payment gateways directly into your invoices. Include links or buttons for clients to pay immediately, helping to streamline the process and reduce delays in payments.

Consider cloud-based invoicing tools that can automate recurring billing cycles. These tools can schedule invoices to be sent at regular intervals, reducing administrative work and providing timely reminders for clients.

Set up notifications to track unpaid invoices. Many invoicing systems can send automatic reminders to clients about overdue payments, which helps maintain cash flow without manual intervention.

Leverage batch processing to generate invoices for multiple clients at once. If your business handles numerous transactions, batch processing will save time and ensure that no invoice is overlooked.