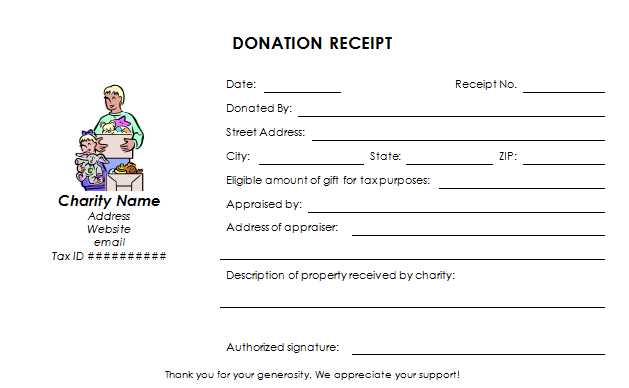

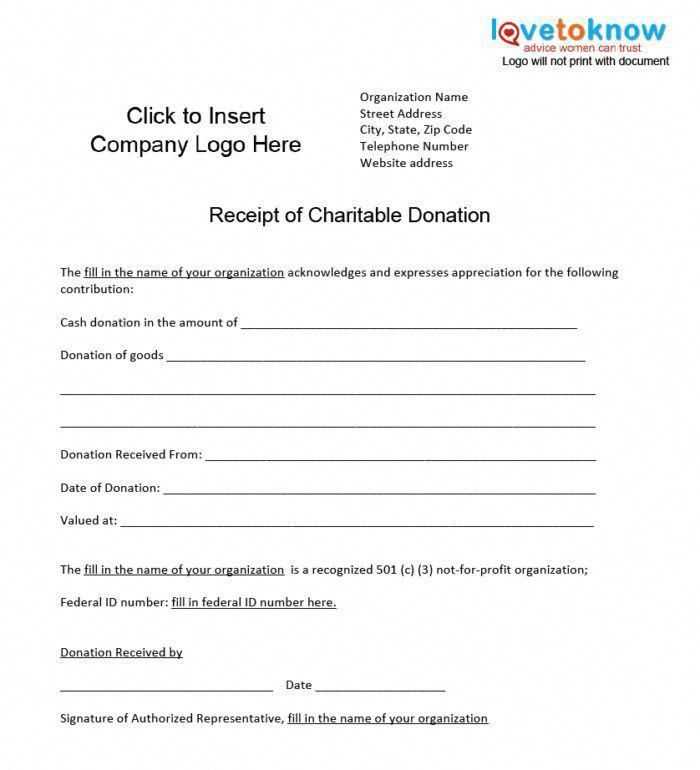

Include the donor’s name, address, and donation details clearly in your receipt. Specify whether the contribution was in cash, check, or goods. If you provided any goods or services in exchange for the donation, state their value. This ensures that the donor can accurately claim deductions on their taxes.

Make sure to mention your non-profit’s 501(c)(3) status. This confirms the organization is recognized by the IRS and allows donors to take the appropriate tax deductions. Include the date of the donation and the amount received, ensuring all information is accurate and easy to reference.

Wrap up with a heartfelt thank-you note for the donor’s support. Let them know their contribution is making a significant impact on the organization’s mission. Always sign the letter personally, adding a personal touch that encourages continued support.

Here’s the corrected text:

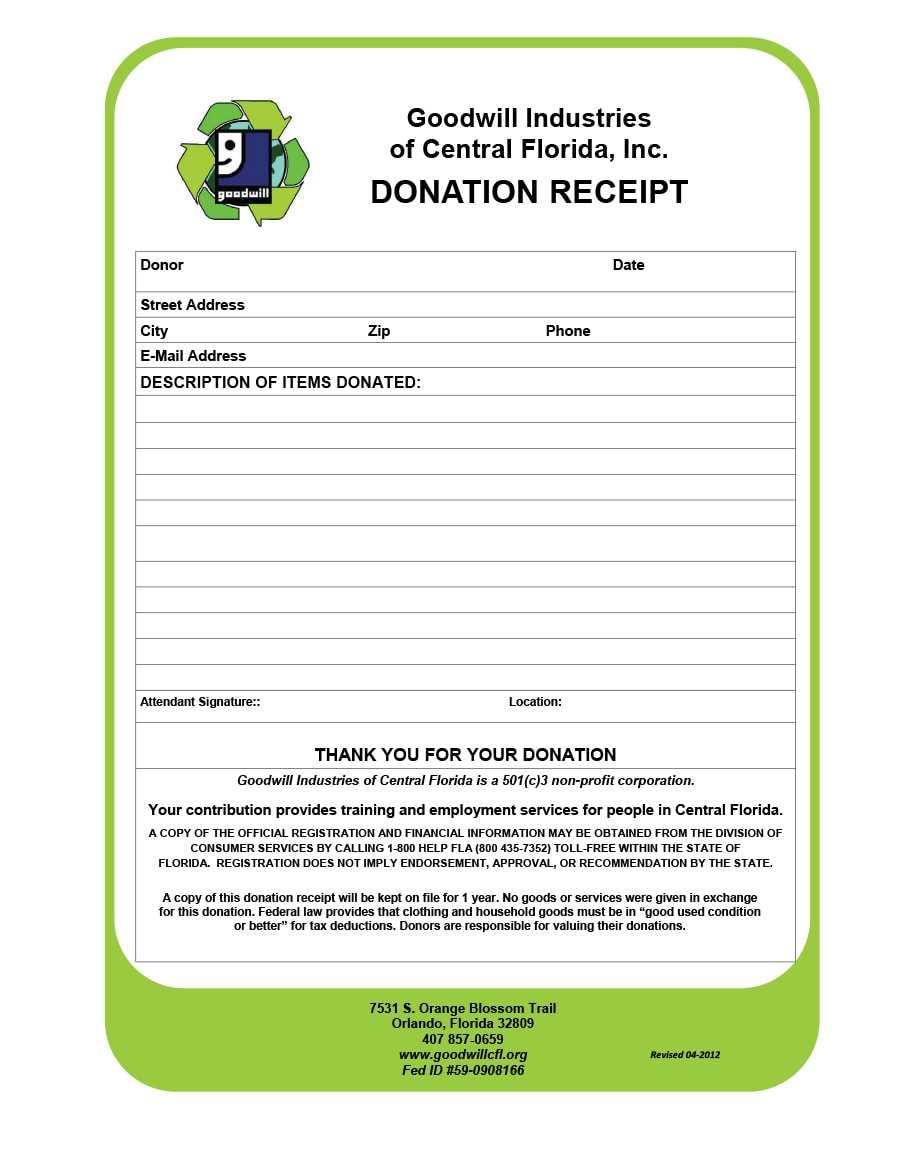

For a nonprofit donation receipt in Florida, the template must include specific details to meet legal and tax requirements. Start by stating the nonprofit’s name and tax identification number. Clearly indicate the donation amount and specify whether the contribution was in cash or goods. If the donation includes goods, describe them, along with an estimate of their value.

Ensure that the letter is dated and includes a statement confirming no goods or services were provided in exchange for the donation, or if they were, an estimation of their value. Provide a statement noting whether the donor received any goods or services as part of the donation. If services or goods were provided, the letter must specify the fair market value of those benefits.

Lastly, maintain a simple and professional tone while following all applicable IRS guidelines. Make sure the donor’s information is accurate, and offer them a copy of the letter for their records.

Florida Nonprofit Donation Receipt Letter Template

Required Information for a Florida Nonprofit Receipt

How to Format a Donation Letter for Tax Purposes

Best Practices for Acknowledging Donors in Letters

Including Legal Language in Florida Donation Receipts

How to Handle In-Kind Contributions in Letters

How to Distribute Receipts to Donors in Florida

For Florida nonprofits, a donation receipt letter must include specific information to meet IRS requirements. This ensures the donor can claim a tax deduction and the nonprofit remains compliant with state and federal laws.

Required Information for a Florida Nonprofit Receipt

Each donation receipt must clearly state the nonprofit’s name, address, and tax identification number (TIN). Additionally, the letter should specify the amount donated, the date of the donation, and a description of any in-kind donations received. If goods or services were provided in exchange for the donation, the receipt must detail the value of those items and explicitly state that the donor only received a partial benefit.

How to Format a Donation Letter for Tax Purposes

The donation letter should be formatted as a formal acknowledgment. Begin with a warm greeting, followed by a clear statement that acknowledges the donation. Include the donor’s name and donation amount or description, ensuring it’s easy to understand for tax purposes. Finish with a closing that emphasizes gratitude and compliance with tax laws.

Use consistent language and avoid using overly complicated terms. For example, instead of “gift,” use “donation” to stay in line with IRS guidelines. Keeping this format helps donors properly record their contributions when filing taxes.

In-kind contributions should be acknowledged separately, with the donor’s estimated value of the goods listed. Make sure to specify that the nonprofit cannot appraise the value of the donated items for tax purposes.

Lastly, ensure the letter includes the necessary legal language, such as a disclaimer stating the nonprofit’s responsibility for no goods or services being provided in exchange for the donation, if applicable.

Sending these receipts promptly to donors via email or mail ensures compliance and enhances donor trust, showing appreciation for their contributions in a clear, tax-friendly format.