Using cash receipt template software can save valuable time and reduce the risk of errors when documenting payments. Whether you’re a small business owner or managing a larger organization, these tools automate the process of creating accurate and professional-looking receipts. No more manually filling out each field–everything is done with just a few clicks.

Customization options are key when choosing the right software. Look for features that allow you to add company logos, adjust layout styles, and include necessary details such as transaction ID, date, and customer information. A personalized template enhances your brand’s professionalism while making record-keeping simpler.

The best software will integrate with your existing financial systems, streamlining both data entry and tracking. This integration cuts down on redundant tasks and ensures consistency across your records. Plus, many tools offer cloud-based storage, making it easy to access your receipts at any time and from any device.

By using a cash receipt template, you maintain accuracy and clarity in your financial transactions. You’ll not only save time but also reduce the chances of making mistakes that could lead to customer disputes or accounting issues. Choose wisely, and your software will handle the paperwork so you can focus on growing your business.

Here’s the revised version:

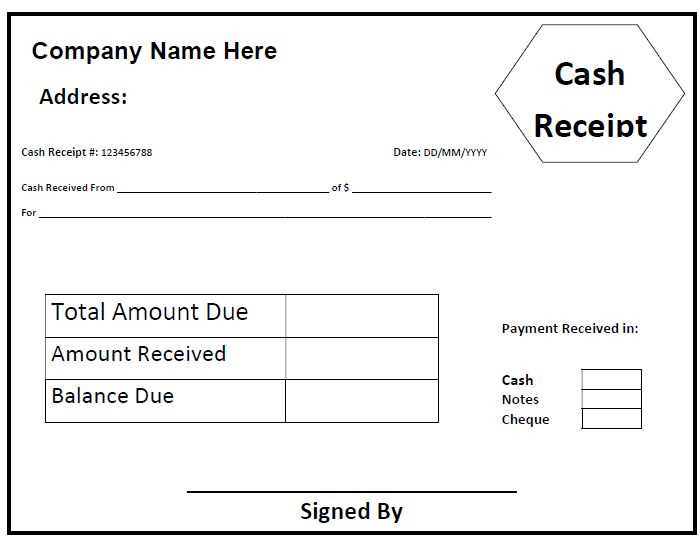

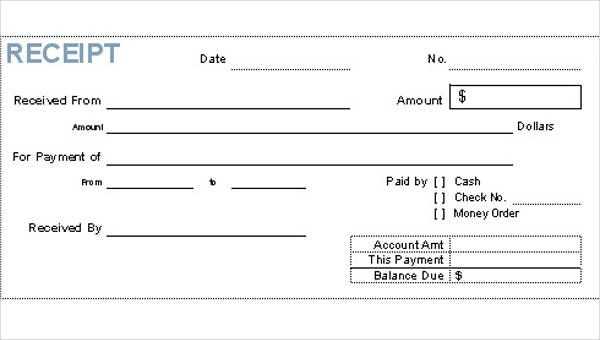

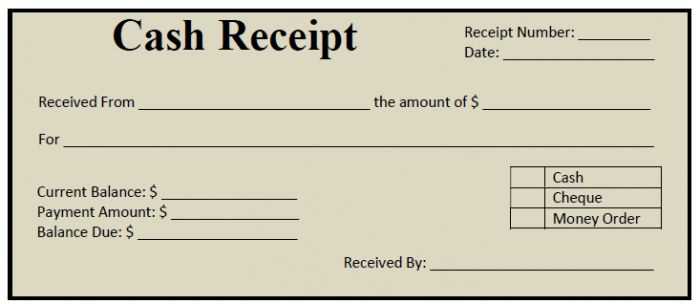

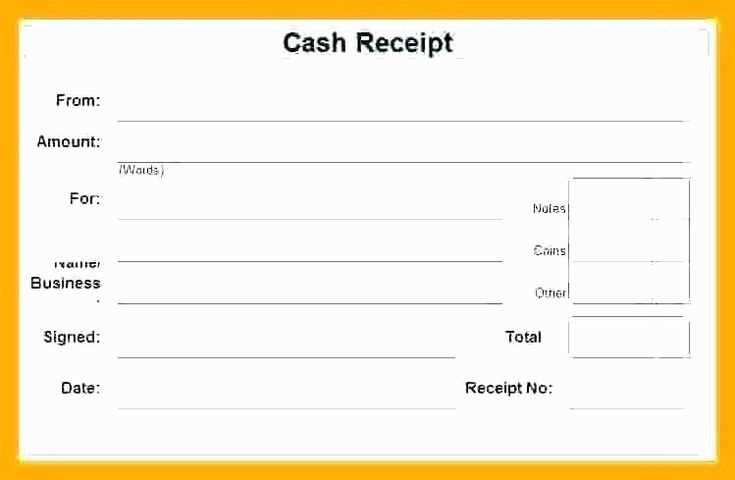

Use a straightforward template to capture all transaction details quickly. Ensure it includes fields for the transaction amount, payment method, and date. Customizing templates to match your business’s needs is key. Consider adding unique identifiers such as receipt numbers or customer names for tracking. This simplifies future reference and record-keeping.

Keep the design simple and intuitive. Limit unnecessary details that could distract from the core information. If possible, integrate the template with your point-of-sale system to automate entries, reducing manual errors. This setup streamlines both creation and retrieval of receipts.

Incorporate a section for both tax and non-taxable items. It’s important for clarity and helps prevent mistakes during audits. Be sure to include a signature field when required for additional verification.

To increase usability, offer both printable and digital versions of the receipt. This ensures customers have immediate access in whichever format they prefer. Providing a digital copy also reduces paper waste, supporting sustainability efforts.

Cash Receipt Template Software: A Practical Guide

Choosing the Right Cash Receipt Template Software for Your Company

Customizing Templates for Various Payment Methods

Integrating Cash Receipt Templates with Financial Software

Setting Up Automated Data Entry for Receipts

Ensuring Compliance with Local Tax and Financial Regulations

Managing and Storing Digital Receipts Securely

For any business, selecting the right cash receipt template software streamlines financial transactions and minimizes errors. Look for software that offers flexibility and ease of use while being scalable to suit your company’s size and needs. Features like pre-built templates, customization options, and cloud storage integration are particularly useful for long-term efficiency. Choose software that allows quick modifications to match your branding and business specifics, while ensuring that receipts remain professional and consistent.

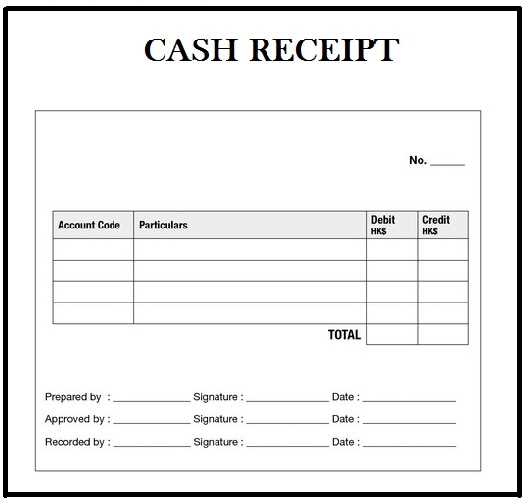

Customizing templates for various payment methods is key for accuracy. Your receipt software should allow you to create different templates for cash, credit card, bank transfer, and even mobile payments. Ensure that each template includes relevant fields like payment date, amount, and payment method, as well as a space for both the payer’s and recipient’s information. This enables seamless tracking across multiple payment channels and ensures that all payment types are properly documented.

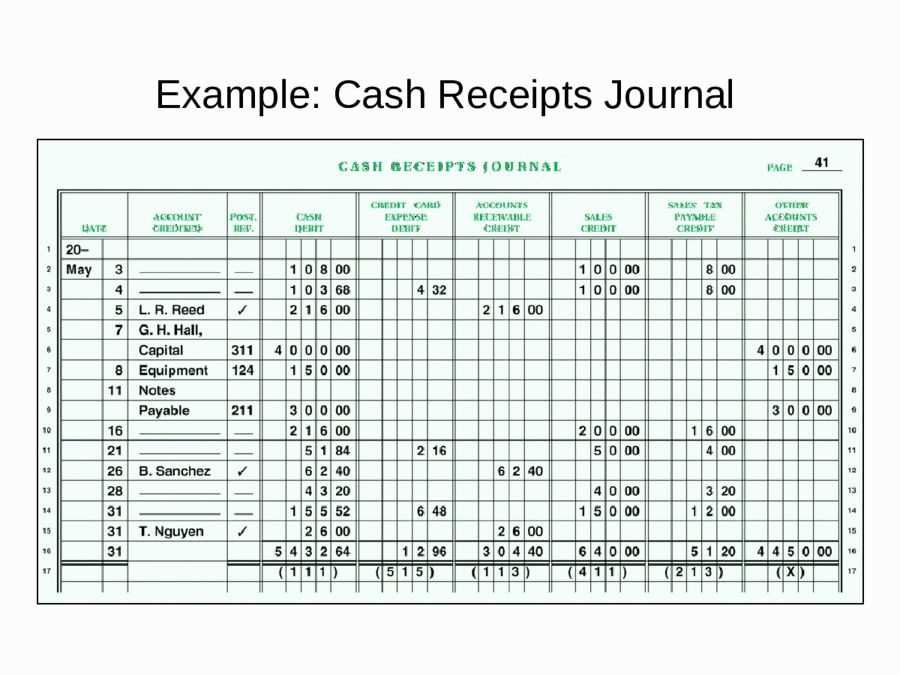

Integrating cash receipt templates with your financial software saves time and reduces the chance of manual entry errors. Choose a template system that can easily sync with your accounting tools like QuickBooks or Xero. Automatic data transfer between systems eliminates the need for manual duplication and ensures that your financial records are updated in real-time, maintaining accuracy across your business operations.

Automated data entry for receipts should be a top priority. Many modern cash receipt software systems allow for auto-population of fields based on the previous transaction or payment records. This automation speeds up the receipt generation process and minimizes human errors. Set up templates that automatically fill in payer details, amounts, and dates whenever possible, reducing the administrative burden and improving workflow efficiency.

Ensure your software complies with local tax and financial regulations by selecting a template system that supports tax calculations and follows your country’s invoicing requirements. Check that the software provides an option to include tax identification numbers, VAT details, and other legal requirements necessary for compliance. This can help you stay on top of tax filings and financial audits, keeping your business aligned with legal obligations.

Finally, securely manage and store digital receipts by using encrypted storage options within your cash receipt software. Many solutions offer cloud storage with multiple layers of security, including data encryption and secure user authentication. Regular backups and access controls should also be set up to ensure that receipts are safe from unauthorized access or data loss. Keeping receipts well-organized and easily accessible is important for audits and customer service inquiries.