To simplify the management of receipts, an Excel template can provide a streamlined solution. This tool helps you track expenses and keep everything organized in one place. Instead of juggling multiple receipts and spreadsheets, an Excel template consolidates everything into a structured, easy-to-use format.

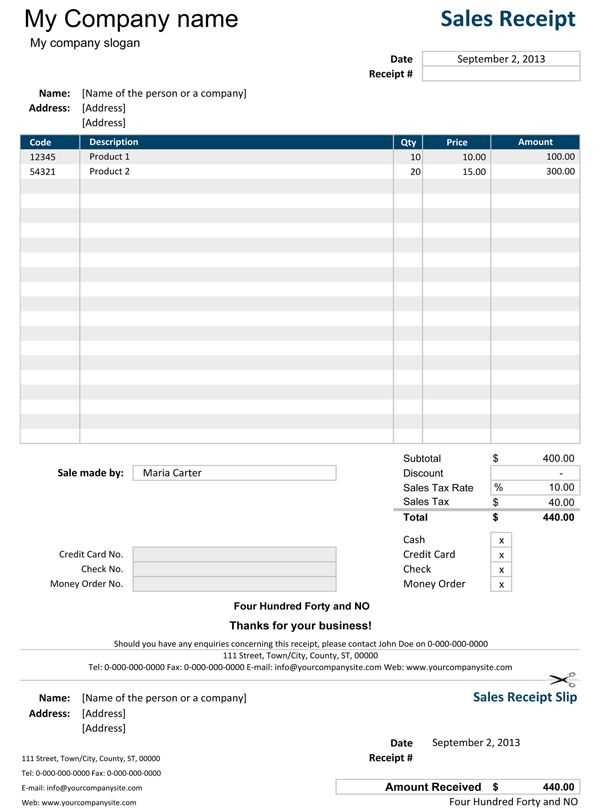

The template allows you to input key details like date, vendor, amount, and payment method. Customizable columns let you adjust it to your specific needs, making it a versatile solution whether you’re organizing business or personal expenses. You can even categorize transactions to analyze spending habits or monitor budgets more effectively.

Using Excel also opens up the ability to apply filters, sort by date, or create automated calculations. This ensures you can quickly assess your financial records without manually checking each entry. Over time, this system helps you stay on top of your finances and reduces the chance of missing any important details during tax season or expense reporting.

Here’s the corrected version:

Organize receipts easily by creating columns for key details such as the date, vendor, amount, and payment method. Include a category field to sort expenses and track specific spending. This approach helps you stay on top of your budget and makes it simpler to find specific receipts later. Add a “notes” section for extra information like discounts or special offers. Consider color-coding different categories to speed up the review process. You can also use conditional formatting to highlight amounts above a certain threshold, helping you quickly spot larger expenses.

Use simple formulas for total calculations. For instance, use the SUM function to add up each category’s total. If you want to track tax separately, you can create a tax column and calculate it by multiplying the amount by the tax rate. Keep the template clean and straightforward by limiting unnecessary details, which will keep it user-friendly.

If you need additional flexibility, set up filters for each column to sort receipts by different categories or amounts. This will make it easier to analyze your spending over time. Save the file in a shared folder or cloud storage for easy access from any device.

Excel Receipt Organizer Template: A Practical Guide

Creating a Basic Template for Receipt Tracking in Excel

Designing Categories for Easy Expense Sorting

Automating Date and Amount Entry Using Excel Formulas

Incorporating Scanning Features into Your Template

Setting Up Automatic Summaries for Monthly Reports

Customizing the Template for Various Expense Types

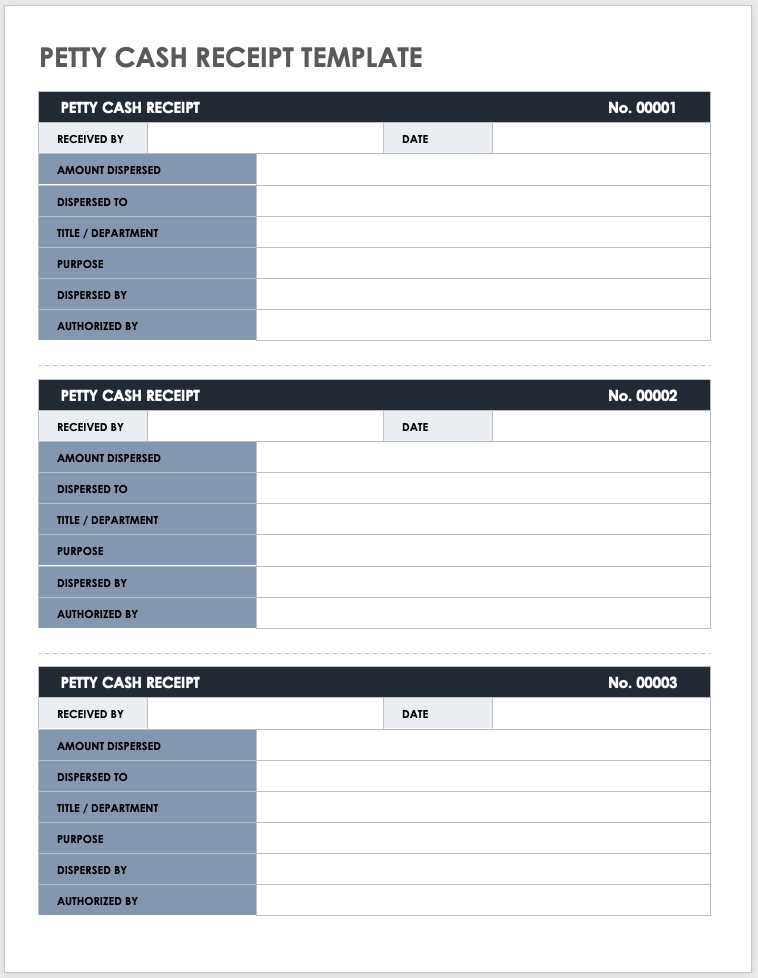

Start with setting up a simple layout in Excel to track receipts. Create columns for essential details like Date, Vendor, Amount, Payment Method, Category, and Notes. These are the key data points you’ll need to record each transaction. This format keeps things clear and allows for easy filtering and sorting later.

Designing Categories for Easy Expense Sorting

Set up predefined categories such as “Office Supplies”, “Travel”, “Meals”, “Entertainment”, and “Utilities” in the “Category” column. This helps you quickly sort and group expenses, making it easier to track spending in specific areas. To ensure consistency, use data validation for category entries, which limits the options to the ones you’ve defined.

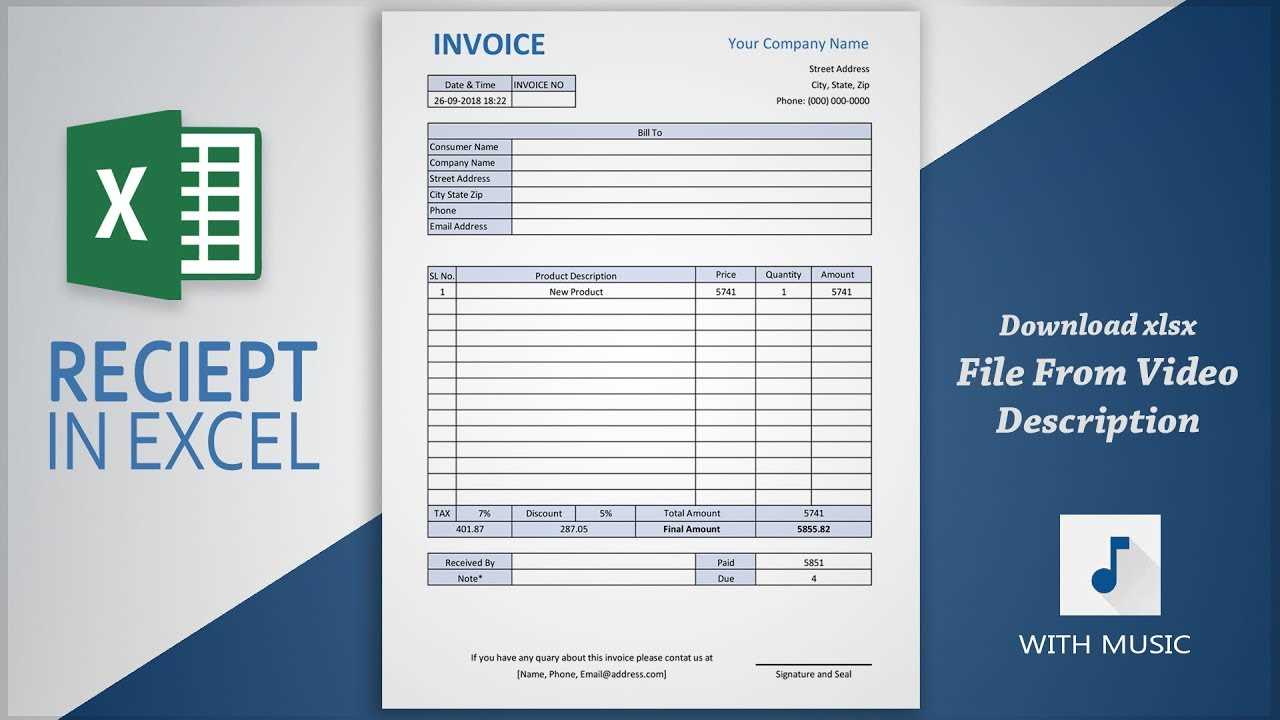

Automating Date and Amount Entry Using Excel Formulas

Leverage Excel formulas to reduce manual input errors. For example, use the “=TODAY()” formula in the Date column to automatically fill in today’s date when you enter a new row. To track totals automatically, use the SUM formula to calculate the total for each category or month. You can also create simple conditional formatting rules to highlight large expenses that exceed a certain threshold.

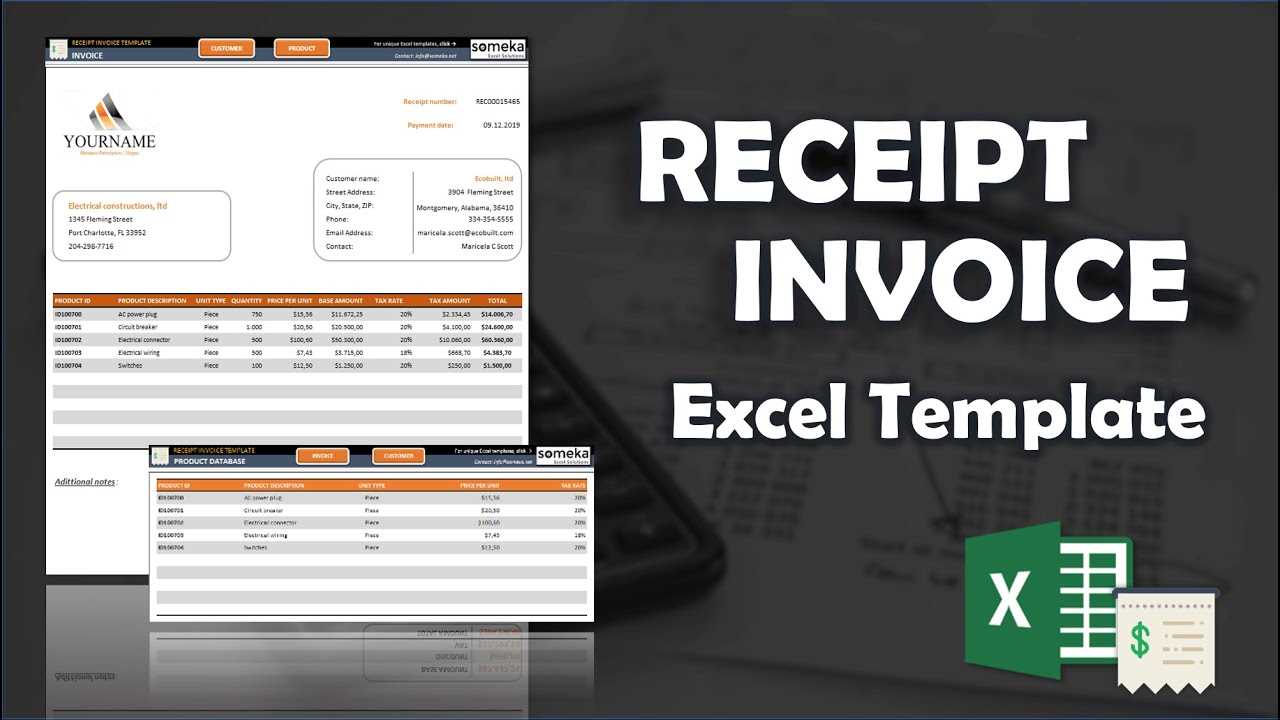

To improve efficiency, consider integrating scanning capabilities. By linking a scanner or smartphone with OCR software to Excel, you can automatically extract details like date, vendor, and amount from receipts, directly populating the relevant cells. This can save time on data entry, especially for large volumes of receipts.

Set up summary fields that automatically update based on your data. Use pivot tables or simple SUMIF formulas to create monthly expense reports. This will give you an overview of your spending without needing to manually calculate totals or categories. As you input more receipts, the summaries will update in real-time, making it easier to track your progress and identify trends.

Finally, customize your template for various expense types by adding specific fields relevant to your needs, such as project codes or payment method details. Adjust the layout and formulas based on your personal or business requirements to make the tracker work for you. A well-organized template keeps everything accessible and saves you time during tax season or budget reviews.