If you’re looking for a clear and concise rental receipt template in India, it’s key to include essential details like the date, the tenant’s name, the property address, and the amount paid. This ensures both the landlord and the tenant have accurate records of each transaction. The template should also cover payment terms, the rental period, and any additional charges, like maintenance fees, that apply to the property.

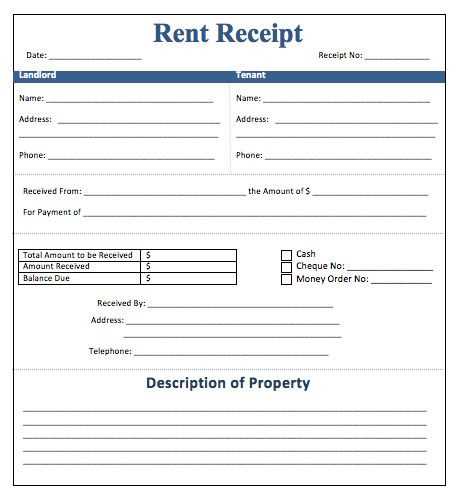

Use a simple and organized layout for easy understanding. The tenant’s details, rental amount, and payment method should be clearly listed. Including a space for both parties to sign the receipt adds an official touch, confirming the transaction. It’s also helpful to include a reference number for future inquiries or disputes.

Ensure that all information is accurate and up-to-date. Regularly updating your template can help avoid confusion and streamline the rental process. With a well-structured template, both tenants and landlords can ensure transparency and smooth communication throughout the rental agreement.

Sure, here is the revised version:

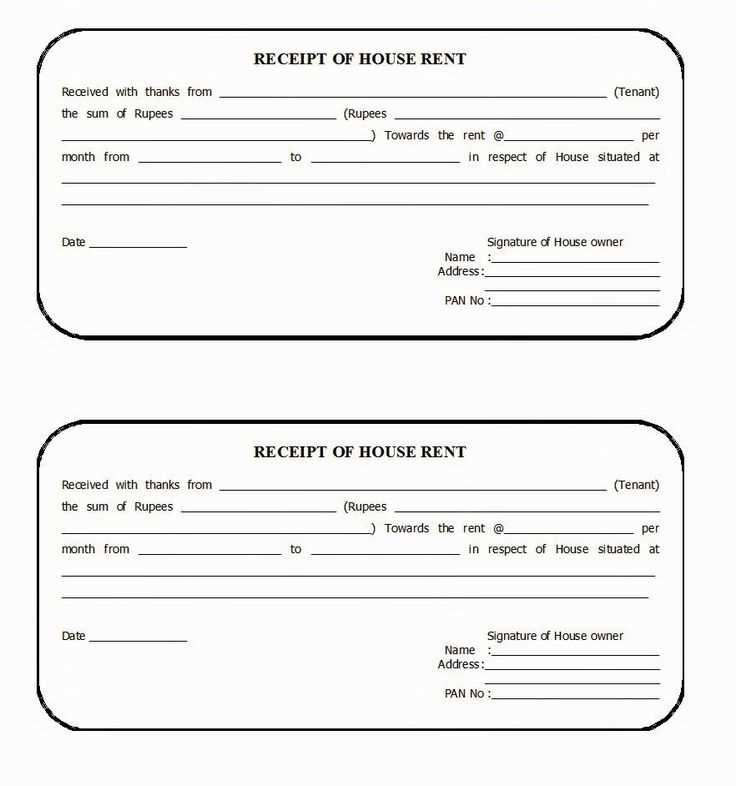

For creating rental receipts in India, ensure that you include all necessary details to make the document legally valid. Start by mentioning the date of the transaction clearly at the top of the receipt. This helps in tracking the payment timeline. Next, include the landlord’s name, tenant’s name, and address of both parties involved. This information ensures that both the payer and payee are clearly identified.

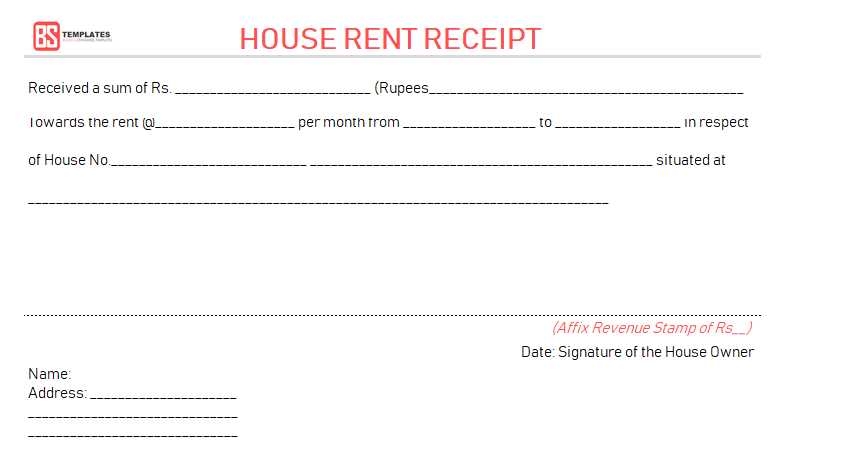

Then, specify the rent amount paid, including whether the amount is for a month or a specific period. For clarity, break down any additional charges (like maintenance fees) separately to avoid confusion. Including a payment mode (e.g., cash, bank transfer, etc.) helps in validating the transaction method.

Do not forget to mention any security deposit if applicable, specifying whether it’s refundable or adjusted against the final rent payment. Lastly, include the signature of the landlord or property manager, which will serve as acknowledgment of the transaction. By following these steps, you can create a receipt that covers all necessary details, ensuring both parties’ protection and compliance with Indian rental laws.

- Rental Receipts Template in India

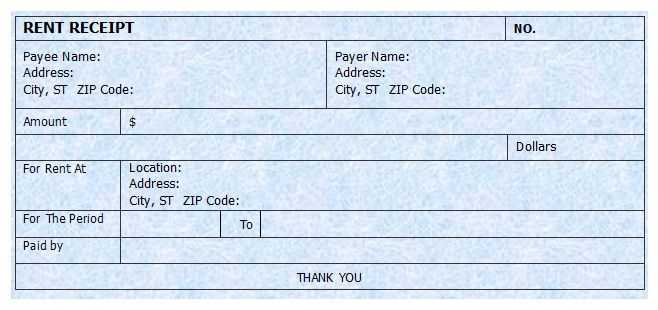

To create a rental receipt template in India, include the following key elements: tenant details, property details, rent amount, payment date, payment method, and the landlord’s signature. The document should also mention the rental period and any additional charges, if applicable.

Key Details to Include

Ensure the receipt includes the tenant’s name, address, and contact details. The property address should be clearly mentioned. The rent amount must be stated in both figures and words to avoid confusion. Specify the due date for payment and if the payment is for a particular month or period.

Legal Considerations

According to Indian law, rental receipts should also mention whether GST (Goods and Services Tax) applies to the rental charges. If the landlord is registered under GST, the receipt should include GST details. It is advisable to keep a record of all rental receipts for legal and tax purposes.

Rental receipts serve as proof of payment between the tenant and the landlord. They offer clarity regarding the amount paid, payment method, and the rental period. It is crucial for tenants to receive a rental receipt each time a payment is made to avoid future disputes or confusion.

Key Components of Rental Receipts

A well-structured rental receipt includes the following details:

| Component | Description |

|---|---|

| Tenant Name | The person who made the payment. |

| Landlord Name | The individual or entity receiving the payment. |

| Amount Paid | The total amount paid by the tenant. |

| Payment Method | Cash, cheque, bank transfer, etc. |

| Date of Payment | The exact date when the payment was made. |

| Rental Period | Duration of the rental agreement covered by the payment. |

Why Rental Receipts Matter

For tenants, a rental receipt is proof of timely payments, which can help in case of future disputes or when verifying rent history. For landlords, it ensures transparency and serves as a record for tax purposes. A rental receipt also helps both parties track payments accurately, minimizing any chances of miscommunication.

Begin with clear identification of the business. Include the company name, address, and contact details. This information provides legitimacy to the receipt.

Next, mention the transaction date. This helps track payments and prevent any confusion in the future.

Provide a unique receipt number. This number serves as a reference for both the business and the customer, ensuring easy tracking.

Specify the items or services purchased. Break down each product or service with its quantity, unit price, and total cost. It offers transparency and clarity for both parties.

Include the total amount paid, showing any taxes or discounts applied. This makes it easy for customers to understand how the final amount was calculated.

Don’t forget the payment method. Whether the transaction was made by cash, credit, debit, or online payment, stating it clearly helps record the transaction properly.

Lastly, provide a section for any additional notes or terms. This is helpful for special conditions like refunds or warranties, creating an added layer of clarity.

Receipts in India must meet specific legal requirements to ensure their validity. The following points highlight the key considerations for creating legal receipts:

- GST Compliance: If the business is registered under Goods and Services Tax (GST), the receipt must include GSTIN (Goods and Services Tax Identification Number). The receipt should also clearly mention the amount of GST charged and the GST rate applicable.

- Details of the Transaction: The receipt must contain the name of the buyer and seller, the date of the transaction, a description of the goods or services, the quantity, and the price.

- Signature: While not always required, a signed receipt can add an additional layer of authenticity. The seller’s signature on the receipt confirms that the transaction has occurred.

- Serial Number: Receipts should have a unique serial number or identification code for tracking and record-keeping purposes.

- Payment Method: Clearly state the method of payment, such as cash, cheque, or online payment. This helps in maintaining accurate financial records.

- Tax Information: For businesses falling under the Income Tax Act, receipts related to services provided may require the inclusion of applicable tax information, ensuring transparency.

Ensuring that your receipts meet these requirements will help prevent any legal issues in India. It’s advisable to consult a legal expert if in doubt about the specifics of your receipt format.

Begin by updating the header section of the template. Include your property’s name, logo, and contact details. This makes it clear to the renter where the receipt is from. Add the date of the transaction and a unique receipt number for easy tracking.

Next, adjust the payment breakdown. Specify the rental amount, any applicable taxes, and additional fees like maintenance or service charges. Make sure each component is clearly labeled and easy to understand.

Ensure the template includes payment methods, such as bank transfers, credit cards, or cash. Also, include a section for payment confirmation or transaction ID for verification purposes.

For a professional touch, customize the footer with your rental policies, payment terms, and any other relevant information, like return policies or security deposit details. This ensures the receipt remains informative.

Lastly, make sure the template is mobile-friendly. Many renters prefer to view receipts on their phones, so ensure it is formatted for easy reading across devices.

Digital receipts are faster and easier to store. With just a few clicks, they’re saved in email or an app, reducing clutter and minimizing the risk of losing them. Paper receipts, while traditional, can fade over time, especially if exposed to heat or sunlight.

- Digital receipts: These are more eco-friendly and can be stored on devices, reducing paper waste. They are also searchable, making it simpler to locate them later.

- Paper receipts: You get an immediate physical record, useful in places where digital tools aren’t available. However, they take up space and can deteriorate quickly.

If you want an organized, space-saving system, go digital. On the other hand, if you prefer physical documentation or don’t have easy access to technology, paper might be your best option. The key is finding what works best for your record-keeping style and needs.

Ensure that the receipt includes accurate information about the transaction. Double-check the amounts and dates before issuing it to avoid errors that can complicate record-keeping.

Incorrect Amounts or Missing Taxes

Always confirm that the amount reflects the correct value, including taxes. Missing taxes can lead to discrepancies and legal issues. A well-detailed receipt should clearly indicate the tax rate applied and the total cost, so nothing is left ambiguous.

Omitting Business Information

Ensure that your receipt has complete business details. Missing business names, addresses, or tax identification numbers can make it hard to verify transactions, especially in case of audits or disputes. Always include this information for clarity and compliance.

Ensure your rental receipt template includes the tenant’s full name, address, and contact information. Clearly specify the rental period, payment amount, and due dates. Add a section for property details, such as the address and unit number, for clarity. List any additional fees or deposits separately to avoid confusion. The receipt should also include the date of payment and the payment method used. Include a signature field for both the landlord and tenant, confirming the transaction. A well-organized layout with these elements ensures transparency and smooth communication.