For parents seeking to claim pre-kindergarten tuition on their taxes, ensuring you have the correct documentation is key. A tax receipt for pre-K tuition must clearly outline the amount paid, the service provider’s information, and confirmation that the payment was for educational purposes. If you’ve paid for a pre-K program that qualifies as an education expense, a tax receipt can help you maximize potential deductions or credits.

What to include in a tax receipt: Ensure the receipt lists the name of the educational institution, the parent’s name, the child’s name, and the tuition payment amount. The receipt should also include the program’s start and end dates, and a statement affirming that the payment was for tuition or educational services, not other expenses like food or transportation. This simple yet comprehensive information is what the IRS looks for when verifying educational tax deductions.

Tip: If your pre-K program is part of a larger daycare or child care facility, make sure the receipt specifically distinguishes between tuition costs and other fees. Only tuition may qualify for tax deductions.

Here’s the improved version of the text, minimizing repetition:

If you’re seeking a tax deduction for Pre-K tuition, make sure to request a tax receipt from the institution. This document should include the child’s name, tuition paid, and the institution’s tax ID. Ensure the receipt clearly states that the payment was for educational services for children aged 4 or 5, as this qualifies for tax deductions under certain conditions.

Key Information to Include in the Tax Receipt

The receipt should contain the following details:

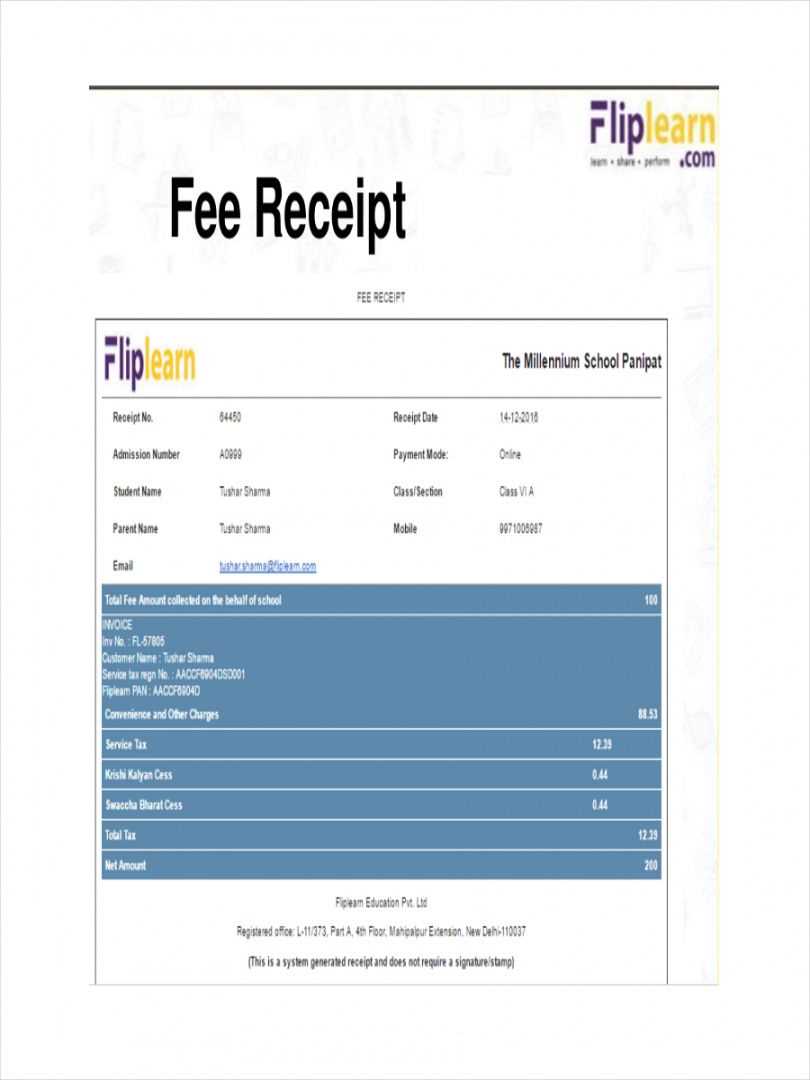

| Information | Description |

|---|---|

| Child’s Name | The name of the child receiving the education. |

| Tuition Amount | The exact amount paid for the Pre-K program. |

| Tax Identification Number (TIN) | The institution’s TIN for tax reporting purposes. |

| Type of Services | Explicit mention of educational services for children aged 4 or 5. |

Additional Tips for Filing

Keep the receipt for your records and ensure it is submitted with your tax return. If the institution does not provide a tax receipt, reach out to request one or inquire about other ways to prove your eligibility for the deduction. Always cross-check with the IRS guidelines to confirm that your tuition qualifies under current tax rules.

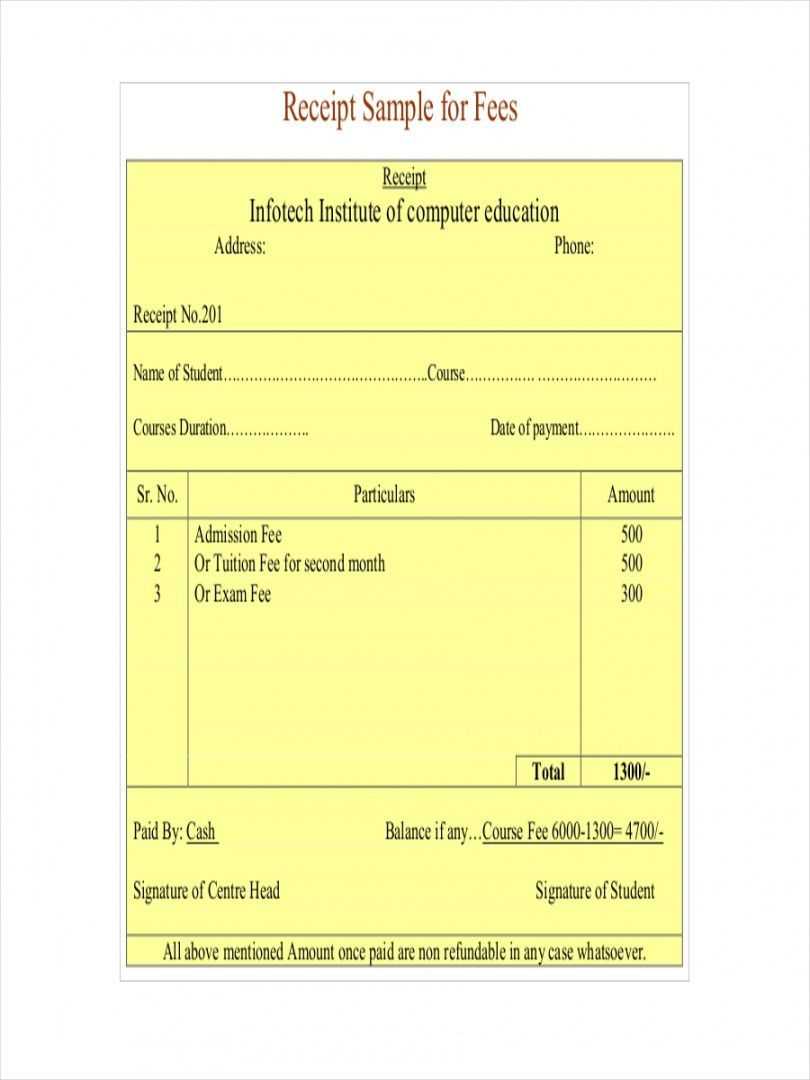

- Pre-K Tuition Tax Deductible Receipt Template

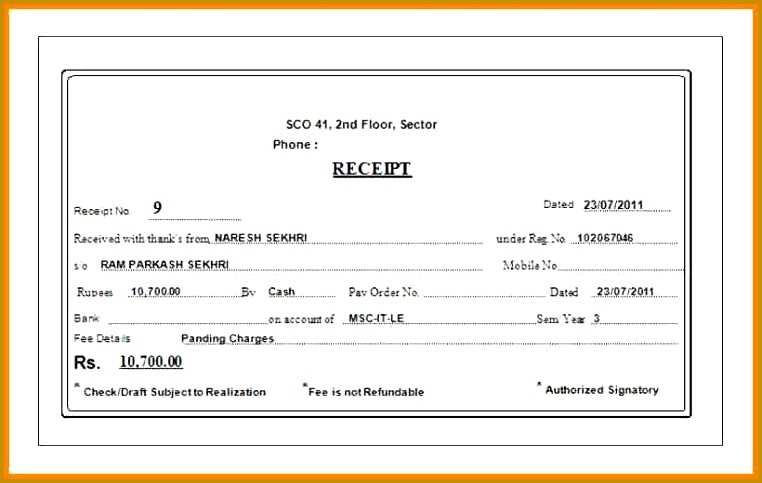

To claim Pre-K tuition as a tax deduction, ensure that the receipt from the educational institution includes specific information. Below is a sample template for a tax-deductible receipt:

- Institution Name: Include the full legal name of the preschool or educational organization.

- Address: List the address of the institution (street, city, state, and ZIP code).

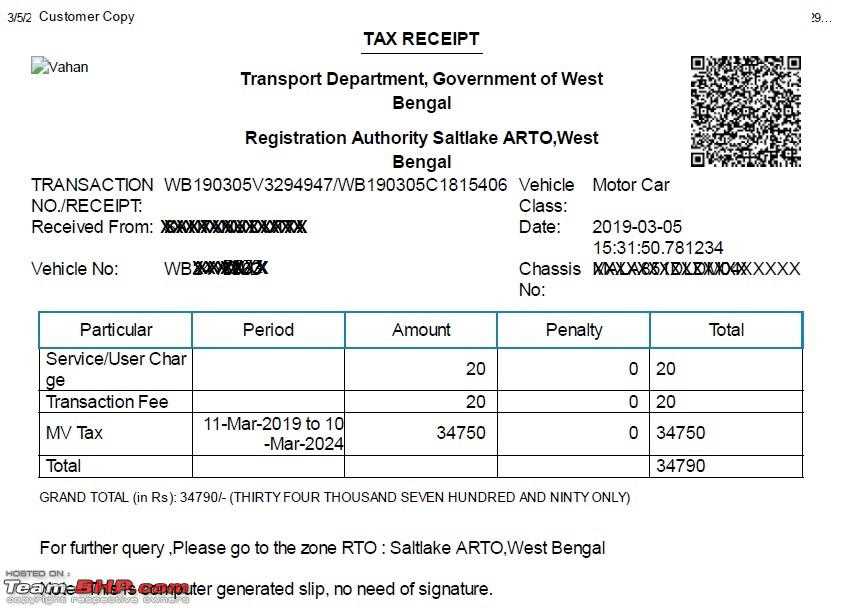

- Tax Identification Number (TIN) or EIN: This is necessary to validate the receipt for tax purposes.

- Date of Payment: Specify the date when the tuition payment was made.

- Tuition Amount Paid: Clearly state the total amount paid for the tuition, including any specific courses or activities if applicable.

- Terms of Payment: Indicate whether the payment was made in full or in installments, and any outstanding balance if applicable.

- Child’s Name: Mention the name of the child enrolled in the program.

- Type of Service: Specify that the payment relates to Pre-K education services.

- Signature: The receipt should be signed by an authorized representative of the institution for validation.

Ensure all relevant details are included in the receipt to avoid any delays when filing taxes. Keep this receipt in a safe place for future reference or auditing purposes.

To determine if Pre-K tuition qualifies for a tax deduction, start by checking whether the institution is accredited and recognized by the IRS. Only educational expenses for accredited programs may be eligible for certain tax benefits.

1. Check if the Program Qualifies as Education

For Pre-K tuition to be tax-deductible, the program must meet the IRS requirements for “qualified education expenses.” This typically includes programs that offer instruction similar to kindergarten, with a focus on basic educational skills. If the program offers daycare or custodial care rather than educational instruction, it likely does not qualify for a tax deduction.

2. Understand Available Tax Credits

Pre-K tuition is not always directly deductible, but you might be eligible for tax credits such as the Child and Dependent Care Credit or the American Opportunity Credit, depending on your circumstances. These credits can offset childcare or education-related costs, including some Pre-K expenses. Check IRS guidelines to verify eligibility based on your income and filing status.

Make sure to keep accurate records of payments made for Pre-K tuition, including receipts and tax forms provided by the school. These documents will be required when claiming deductions or credits.

A Pre-K tuition deduction receipt must contain specific details to ensure its eligibility for tax deductions. Here are the key elements to include:

- Child’s Name: The name of the child enrolled in the Pre-K program should be clearly stated.

- Provider’s Information: Include the name, address, and contact details of the educational institution or provider offering the program.

- Date of Payment: Record the exact date or dates when payments were made for tuition fees.

- Amount Paid: The total amount of tuition paid should be specified, including any additional fees if applicable.

- Description of Services: A brief description of the program (e.g., “Pre-Kindergarten Tuition”) helps clarify what the payment was for.

- Tax Identification Number (TIN): The provider’s TIN or Employer Identification Number (EIN) should be listed for tax reporting purposes.

- Payment Method: Specify whether the payment was made via check, credit card, or other methods.

- Signature or Confirmation: The receipt should include an authorized signature or a statement confirming payment.

By including these details, you ensure that your receipt meets the necessary criteria for claiming a tax deduction on Pre-K tuition. Make sure to keep all receipts organized and accessible for tax filing purposes.

To create a Pre-K tuition tax deduction document, first gather all relevant payment receipts and proof of tuition costs. Ensure the document lists the name of the educational institution, the child’s name, and the exact amount paid. This will be crucial for tax purposes.

Step 1: Collect all tuition payment receipts. This includes invoices, canceled checks, or electronic payment confirmations that detail the amount paid, date, and the service provided. Be sure these documents reflect payments made within the tax year you are claiming.

Step 2: Prepare a summary of the payments made. Create a table or list showing each transaction’s date, amount, and what the payment covers (e.g., tuition, fees, etc.). This will help organize your claim for easier processing and verification.

Step 3: Confirm the institution qualifies. The educational institution must be a recognized provider of early childhood education, such as a licensed Pre-K program. Check if they can issue tax receipts for tuition, as some programs may not provide this kind of document.

Step 4: Format the tax receipt. Include the institution’s full name, address, phone number, and tax identification number (TIN). Specify the total amount paid for the Pre-K services and the child’s name. If applicable, list any other charges, like registration fees, that are part of the tuition.

Step 5: Add a statement of eligibility. This statement should confirm that the tuition paid qualifies for tax deductions. The document must specify that the services provided are for educational purposes and not for activities outside of the curriculum, such as childcare.

Step 6: Keep records. Store all receipts, summaries, and documents for at least three years. These might be required if the IRS requests further information about your claim.

Once the document is ready, submit it alongside your tax return, either by attaching it to the paper form or including it electronically with an e-filing submission. Ensure all information is accurate to avoid delays or issues with your tax deductions.

Ensure all information on the receipt is accurate and complete. A common mistake is missing out on the child’s full name or not including the name of the educational institution. Without these details, the IRS may not accept your receipt for a tuition deduction.

1. Missing Required Details

Check that the receipt includes the exact amount paid, the date of payment, and the specific tuition charges. Omitting this information can lead to difficulties when claiming the deduction. Always request a breakdown of any fees to make sure the tuition portion is clearly identified.

2. Incorrect Date Format

Using an incorrect date format or failing to include the date of the transaction can delay your tax filing. Ensure that the receipt has the full date (month, day, and year) to avoid confusion during the tax review process.

Another frequent error is failing to clarify whether the payment is for a full or partial year. This distinction matters because it impacts the amount you can claim for the deduction. Be specific about which year the tuition pertains to and double-check this detail with the provider.

Collect your Pre-K tuition receipt before filing your tax return. This receipt provides details like the school’s name, the amount you paid, and the tax year. You will need it to claim deductions or credits for child care expenses on your taxes.

Keep a copy of the receipt with your tax documents. The IRS may ask for it if you are audited. Make sure the amount on the receipt matches what you report on your tax forms.

For parents using the child care tax credit, the receipt is key for showing proof of expenses. You will typically report the amount from the receipt on Form 2441, Child and Dependent Care Expenses, along with the provider’s name, address, and taxpayer identification number (TIN). Ensure all information is accurate to avoid issues during processing.

If your tuition falls under state-specific tax benefits, check local rules to see if you need to submit additional forms. Some states allow deductions or credits for Pre-K tuition, but their requirements may differ.

In addition to Pre-K tuition, several other education-related expenses may qualify for tax deductions. These include costs for supplies like books, educational toys, and materials needed for class activities. If your child attends a private institution, certain fees for extracurricular programs such as art, music, and sports may also be deductible. Child care expenses, including before- and after-school care, might qualify under the Child and Dependent Care Credit, especially if they are required for your employment.

Transportation costs can be another overlooked deduction. If your child needs transportation to and from their Pre-K program, you can claim some of these expenses if they are part of a larger package of educational services. Additionally, special education services, including assessments or therapy sessions, may qualify for deductions if required for your child’s learning needs.

Keep detailed receipts and documentation to ensure you can claim these deductions when filing your taxes. Consulting with a tax professional is always a good idea to confirm eligibility and maximize your savings.

Tax Deductibility of Pre-K Tuition: A Practical Guide

Taxpayers may claim deductions for pre-kindergarten (Pre-K) tuition under specific conditions. If the tuition is considered a qualified expense for child care, it may qualify for the Child and Dependent Care Credit. Ensure that your pre-K provider provides an itemized receipt showing the amount paid and specifying that the payment is for educational services for a child under the age of 13.

How to Obtain the Tax Receipt

Request a formal tax receipt from the pre-K institution that includes the provider’s name, address, Tax ID number, the child’s name, dates of service, and total tuition fees. Ensure the receipt explicitly states that the payment is for educational purposes, as this is crucial for the IRS verification process.

Requirements for Deductions

To qualify for the tax deduction, your pre-K tuition must be for services that allow your child to attend a structured educational program. Keep in mind that costs related to extracurricular activities or supplies typically do not qualify. Review IRS guidelines on child care deductions to ensure compliance.