Creating a clear, professional receipt for art sales not only ensures transparency but also helps maintain accurate records. A well-structured receipt template saves time and reduces errors when documenting transactions between artists, galleries, and buyers.

A good template should include the artist’s name, the artwork’s title, its price, the date of sale, and buyer details. Make sure to list any applicable taxes or discounts and include payment methods for clarity. This documentation serves both as proof of purchase and as an essential reference for both parties.

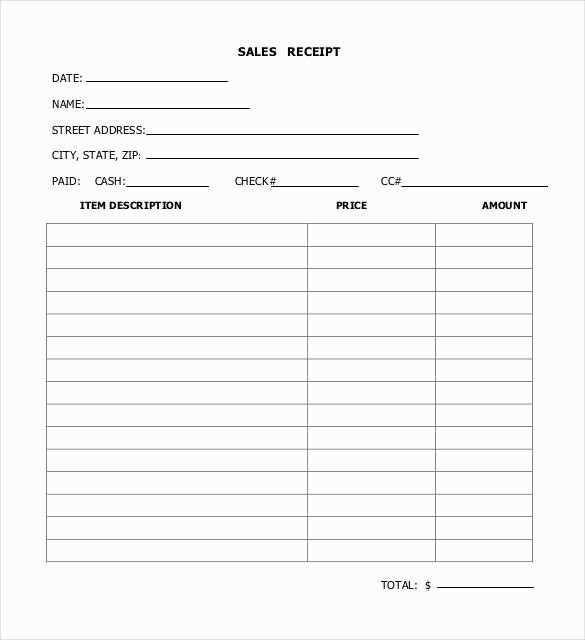

For smooth transactions, provide a space for the buyer’s signature, ensuring both buyer and seller acknowledge the terms of the sale. Incorporating a unique receipt number can help track sales efficiently, especially when handling multiple transactions. Keep your template clean and professional, with easy-to-read fonts and organized sections.

Here’s the revised version:

Ensure all necessary information is included when creating an art sales receipt. This should cover the buyer’s and seller’s details, artwork description, sale price, payment method, and date of transaction. If applicable, include any applicable taxes or shipping fees. The receipt must also contain the signature of both parties to confirm the authenticity of the sale.

Key Details to Include:

- Buyer Information: Name, contact info, and address.

- Seller Information: Artist’s name or gallery details.

- Artwork Information: Title, dimensions, medium, and year created.

- Transaction Amount: The agreed price, with any tax or shipping charges clearly separated.

- Payment Details: Mode of payment (e.g., credit card, bank transfer, cash).

- Sale Date: The exact date of the transaction.

- Signatures: Both buyer and seller signatures to confirm the sale.

Best Practices for Clarity:

Use clear, concise language. Avoid any ambiguous terms that could cause confusion. Ensure the information is organized logically to make the receipt easy to understand. A professional tone helps establish trust between the parties involved.

- Art Sales Receipt Template Guide

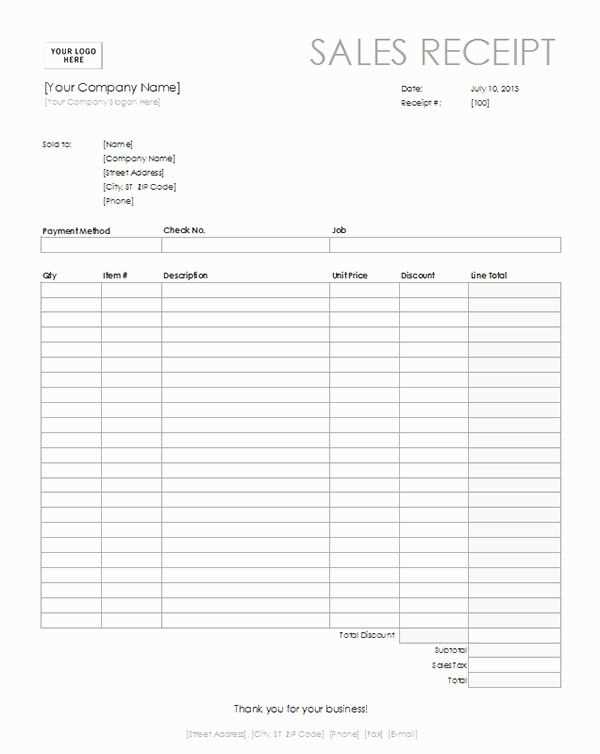

Creating an art sales receipt template requires a few key details to ensure clarity and professionalism. A solid receipt template helps both the seller and the buyer understand the transaction and maintain accurate records. Below is a quick breakdown of what to include and how to structure the receipt.

1. Include Basic Transaction Information

Start with the basic information about the sale: the date of purchase, the buyer’s and seller’s names, and the artwork details. This includes the title of the artwork, the artist’s name, and any identifying numbers or codes (like inventory IDs or certificates of authenticity). Adding a reference number for the transaction can also help keep track of the sale later.

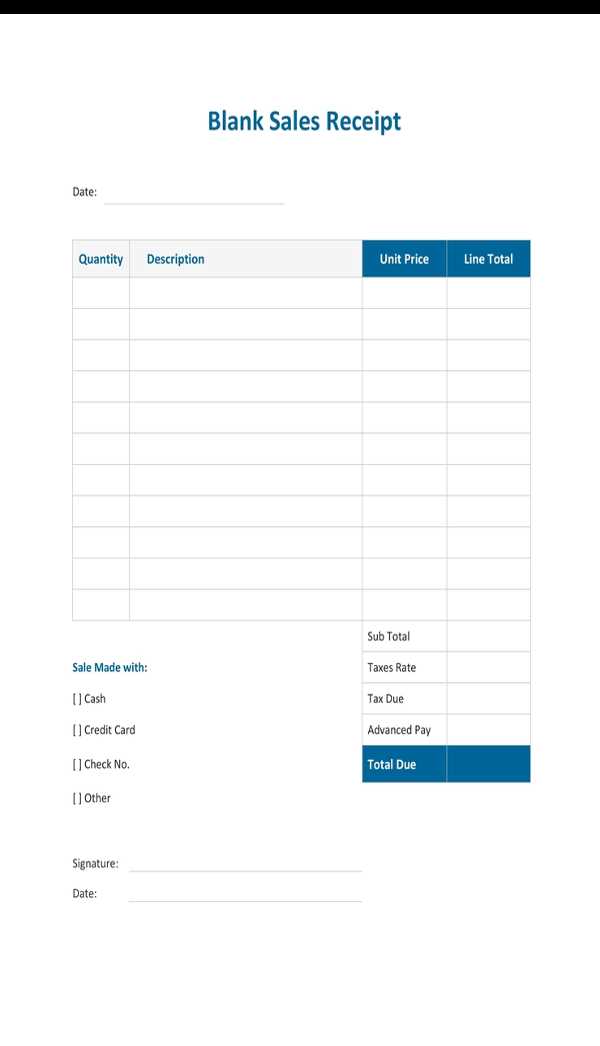

2. Price Breakdown and Payment Method

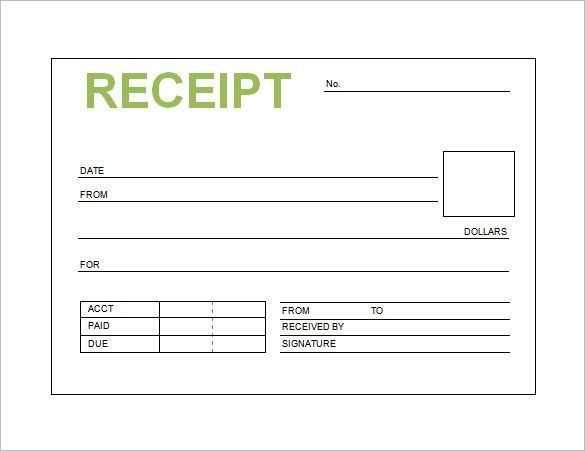

Specify the total sale price of the artwork, and if there are any additional costs such as tax, shipping, or framing. Mention the payment method used, whether it’s cash, credit card, or another method, and indicate if a deposit was made or if the full payment was received.

Tip: Ensure the receipt is clear on whether the sale is final or if there are any pending amounts, especially in the case of installment payments.

3. Include Seller’s Terms and Conditions

Attach a brief note on the seller’s return or exchange policy. While not always necessary, it helps clarify the terms should any issues arise post-sale. Buyers will appreciate having the policy available for reference, even if it’s a simple “no returns” clause.

Lastly, make sure to include a space for signatures if required. This adds an extra layer of legitimacy to the document.

Begin by setting up a clean, simple layout that highlights the most important details. Include the name and contact information of both the artist and the buyer at the top. This ensures that both parties can easily reference the transaction in the future.

Next, include a clear section for the sale details. List each artwork sold with its title, medium, dimensions, and price. For accuracy, add a unique identifier or catalog number to each piece. If there is a discount applied or a sale condition, specify that in the same section.

Ensure to include the date of the sale and the payment method. Whether it’s cash, credit card, or another method, clarity here is key for both parties’ records. If applicable, include sales tax and the final total amount. If you’re using a digital template, consider adding automatic calculations for totals and tax.

Don’t forget about terms of the sale. Briefly outline your return and refund policy, and include any delivery or shipping details if relevant. This helps manage expectations and provides clear communication between you and the buyer.

Finally, create a space for signatures. Both parties should have a chance to sign, acknowledging the terms and confirming the transaction. For digital receipts, consider implementing a secure e-signature option.

Once the structure is in place, you can customize the template further to match your branding or style. The goal is to make sure the receipt is professional, easy to understand, and contains all necessary information for both parties.

For an art sales receipt to be clear and legally sound, include the following key details:

- Seller’s Information: Include the artist’s or gallery’s full name, business address, and contact details. This ensures the receipt is traceable and can be used for future reference.

- Buyer’s Information: Record the buyer’s full name, address, and contact details. This is important for both record-keeping and any necessary follow-up.

- Date of Transaction: Clearly state the exact date the sale took place. This helps track the timeline for tax and warranty purposes.

- Item Details: Provide a thorough description of the artwork sold. Include the title, medium, dimensions, year of creation, and any unique identifiers like the edition number or a certificate of authenticity.

- Price: Include the total sale price, specifying whether taxes are included or added separately. Mention the payment method, such as credit card, bank transfer, or check.

- Terms of Sale: If there are any return policies, warranties, or installation requirements, include them on the receipt. This helps manage expectations and provides transparency.

- Signature: The artist or gallery’s signature validates the transaction, adding a layer of authenticity.

Additional Considerations

In some cases, you might also include:

- Invoice Number: For record-keeping, include a unique invoice number.

- Art Fair or Exhibition Details: If applicable, mention the exhibition or event where the artwork was sold.

Keep your receipt clear and easy to read. Use a clean, well-organized layout with consistent fonts and spacing. A simple sans-serif font like Arial or Helvetica works well for readability.

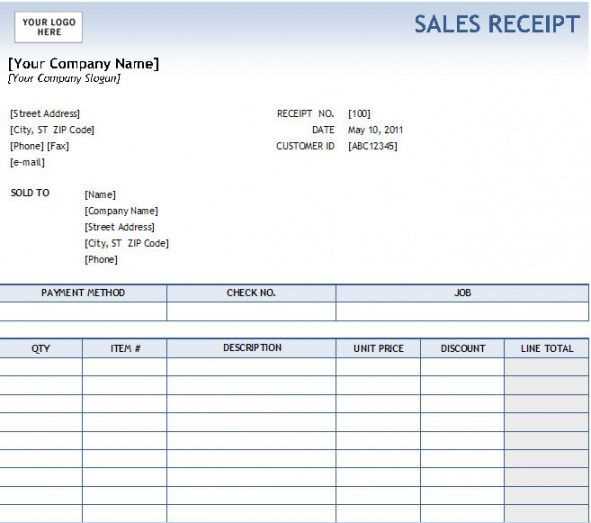

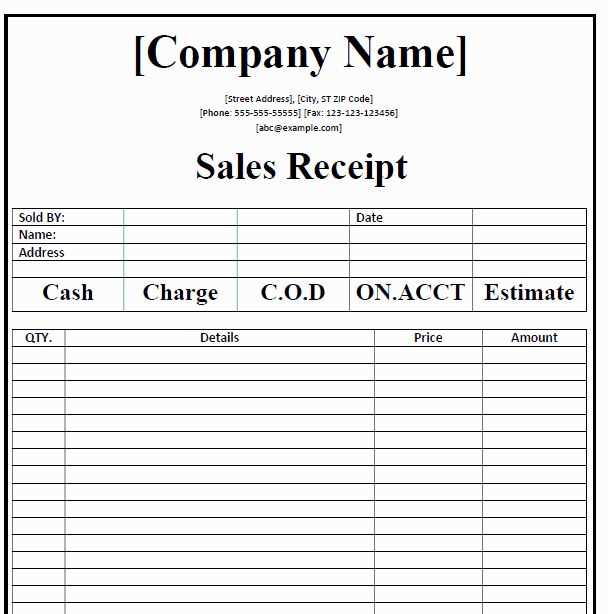

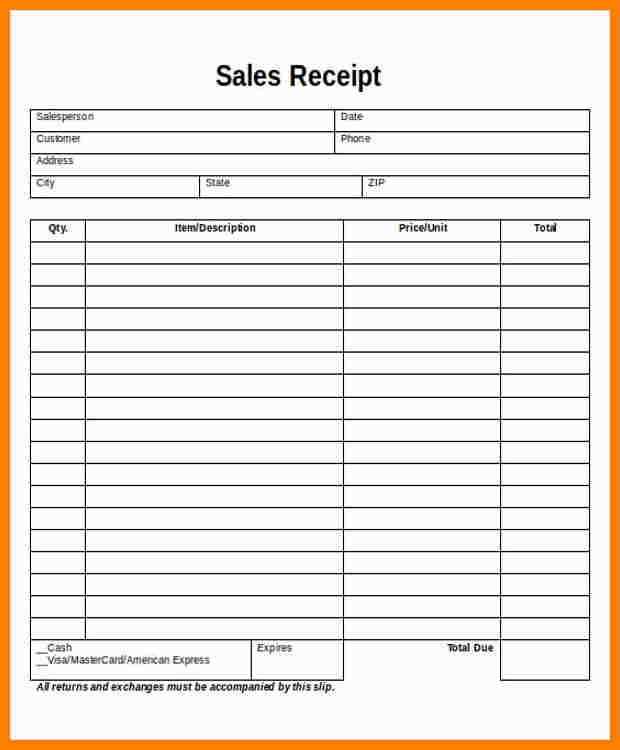

1. Use a Structured Layout

Align all text properly, with headings for key sections like “Items Purchased,” “Total Amount,” and “Payment Method.” This helps customers quickly find what they need. Group related details together, and use lines or borders to separate sections for a neat, organized appearance.

2. Highlight Key Information

Emphasize important details like the total amount and the date of the sale. Bold these items or use a larger font size. This draws attention to the most critical information, ensuring it stands out.

3. Include Accurate Item Descriptions

Be specific with item names, including details like size, color, or model numbers if applicable. This eliminates confusion and provides customers with clear records of their purchases.

4. Consistent Date Format

Use a consistent date format throughout your receipts. Stick to one style (e.g., MM/DD/YYYY or DD/MM/YYYY) to avoid confusion and keep your documents looking uniform.

5. Keep it Brief but Informative

Avoid overloading your receipt with unnecessary information. Include only what’s relevant to the transaction–itemized purchases, taxes, discounts, total price, and payment method. This ensures that your receipt is both useful and concise.

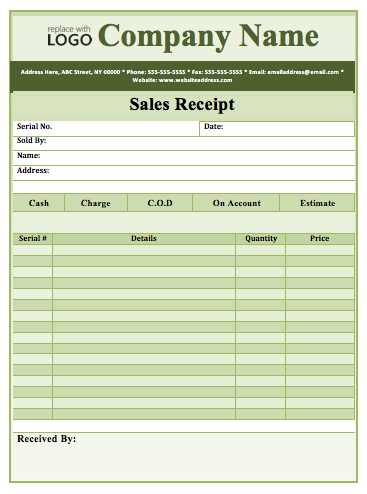

6. Incorporate Branding Elements

Including your logo or brand name in the header gives your receipt a professional touch. Make sure your branding fits within the overall layout without overcrowding the document.

7. Provide Clear Payment Information

Clearly indicate the payment method used (credit card, cash, etc.) and include the transaction number or any other identifiers related to the payment. This adds legitimacy to the transaction and serves as a reference in case of inquiries.

8. Keep Contact Information Accessible

Include your business address, phone number, and email at the bottom of the receipt. This provides customers with easy access to reach you for returns or questions without making the receipt look too cluttered.

Tailor your art receipt to reflect the specifics of each transaction type. Whether you’re dealing with a direct sale, an online purchase, or a gallery transaction, the receipt should include key details that fit the context of the transaction.

Direct Sales

For direct sales, include the buyer’s full name, address, and contact details, along with the artist’s or gallery’s information. Clearly state the title of the artwork, medium, dimensions, and the agreed-upon price. If applicable, note any applicable taxes, shipping fees, or discounts. Make sure to include the date of the transaction and payment method, whether cash, credit card, or bank transfer.

Online Sales

Online art transactions require additional information. Include the transaction ID, the website or platform name, and the digital payment method (PayPal, credit card, etc.). Add shipping details, including tracking information if available, and mention any delivery fees. If the artwork is a digital file, specify the format and file size for clarity.

For both transaction types, always ensure the receipt reflects the payment status (fully paid or deposit made) and offers a clear breakdown of any terms or conditions tied to the sale. This way, each transaction is appropriately documented, creating clarity for both buyer and seller.

Always include the correct details on a sales receipt to avoid legal and tax issues. Make sure the document includes the buyer’s and seller’s names, the item or service sold, and the price. This basic information serves as proof of the transaction, which is necessary for both legal and tax purposes.

In many jurisdictions, you must collect and remit sales tax on the sale of goods and services. Be sure to apply the correct tax rate based on the buyer’s location and the type of product or service sold. Failing to do so can result in penalties from tax authorities.

- Verify whether the sale is taxable in your jurisdiction.

- List the tax amount separately on the receipt to ensure transparency.

- Keep a record of all transactions for tax filing purposes.

If you’re selling art, note that certain types of art sales may be subject to different tax regulations. Consult local tax authorities to determine if exemptions or special rules apply.

Consider offering digital or physical receipts based on buyer preferences and ensure the receipt format complies with applicable laws, especially if you’re selling across state or national borders. Electronic receipts may also need to include specific disclaimers about refunds or returns depending on the location of the transaction.

- Consult a tax advisor to confirm which rules apply to your business model.

- Ensure compliance with data protection laws if you collect buyer information.

Finally, maintain organized records of all receipts in case of an audit. Keeping accurate documentation will help you prove the legitimacy of your sales and tax calculations.

How to Store and Track Receipts for Recordkeeping

Use a secure and organized system to store and track receipts. Start by categorizing them based on type: purchases, services, or refunds. This allows easy retrieval when needed. You can go digital by scanning receipts into cloud storage or specialized software, ensuring quick access and protection from loss or damage. Regularly back up digital files to avoid accidental deletion.

Organizing Receipts

Designate folders for each category, whether physical or digital. For physical receipts, use a filing system with clear labels for easy sorting. If you’re scanning receipts, use a consistent naming convention–such as date or vendor name–making them easier to find in your files later. Use accounting software or a simple spreadsheet to track each receipt’s purpose, amount, and date, and link this data with the corresponding scanned receipt.

Tracking Expenses

Record each receipt promptly to stay on top of your finances. For small businesses or personal expenses, keep receipts linked to individual transactions in your accounting system. This creates a clear record for future reference. Regularly check the receipts to ensure your records are accurate and up-to-date, helping prevent discrepancies during tax season or audits.

I reduced repetitions while preserving the meaning of each point and avoiding grammatical errors.

Focus on clarity in your art sales receipt. Avoid redundant details and streamline the presentation. Keep it concise but complete, ensuring that the buyer understands all necessary information at a glance. For example, avoid listing the same information multiple times, such as the artist’s name or artwork title. If these details are already present in the body of the receipt, there’s no need to repeat them in the footer or other sections.

Include only the required fields: buyer’s name, artwork title, date of sale, price, and payment method. Keep the formatting clean and logical. Use tables to structure the data, ensuring easy reading. Here’s an example:

| Field | Details |

|---|---|

| Buyer Name | John Doe |

| Artwork Title | “Sunset Over Hills” |

| Date of Sale | February 5, 2025 |

| Price | $1,200 |

| Payment Method | Credit Card |

Ensure there are no spelling mistakes or grammatical errors. Double-check all fields for accuracy. Remember, a well-organized receipt reflects professionalism and clarity.