Use a clear and simple template for tracking child support payments. This helps avoid any confusion between both parties, ensuring that all payments are documented accurately. The receipt should include the date, amount, payment method, and any relevant details, such as the period the payment covers.

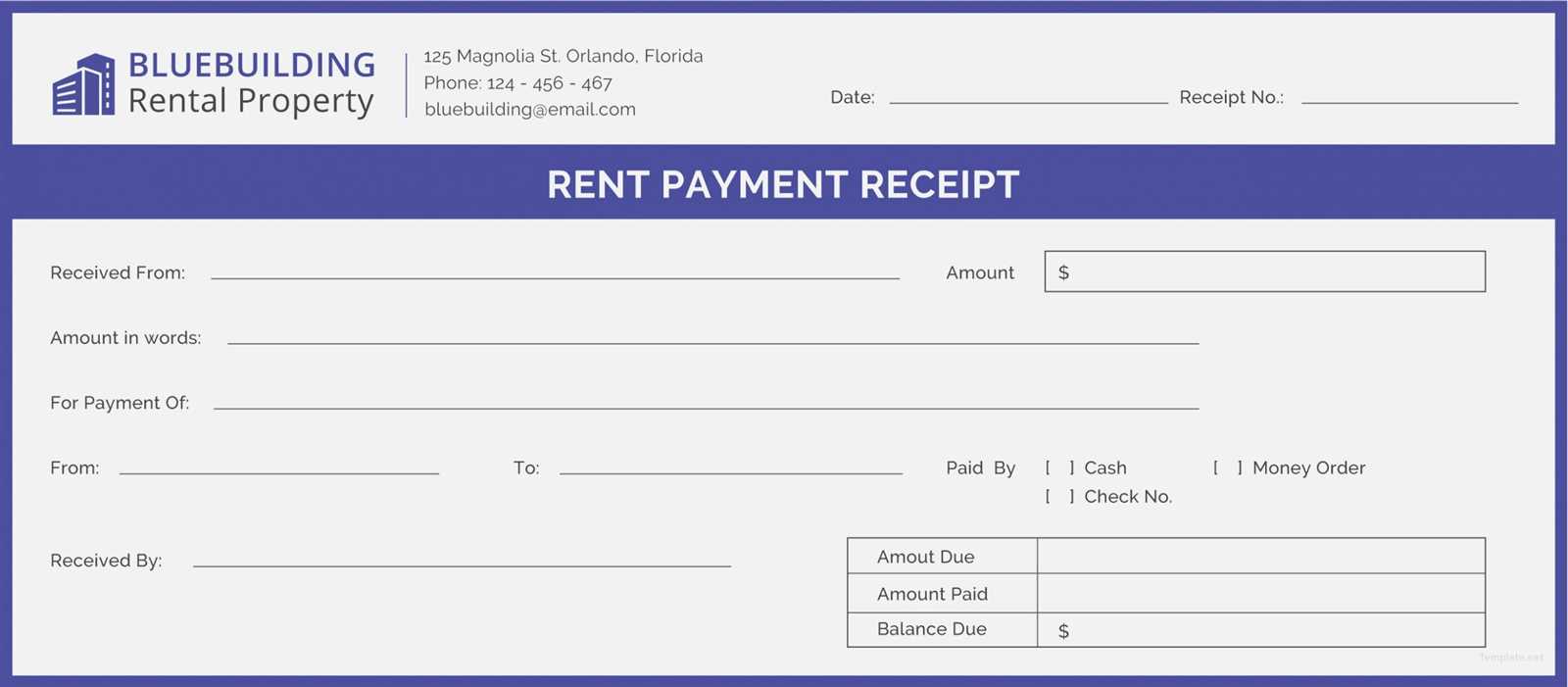

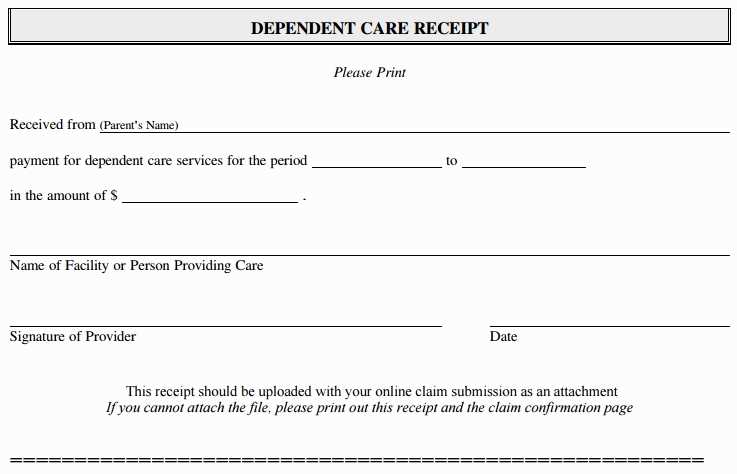

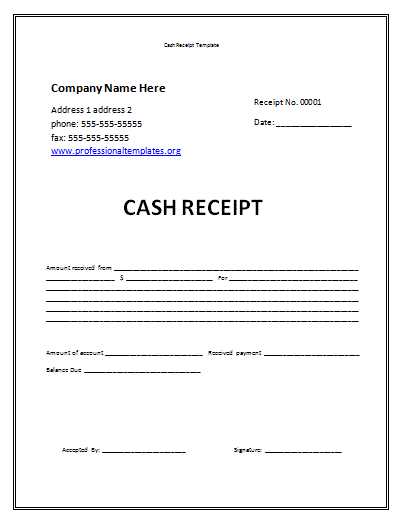

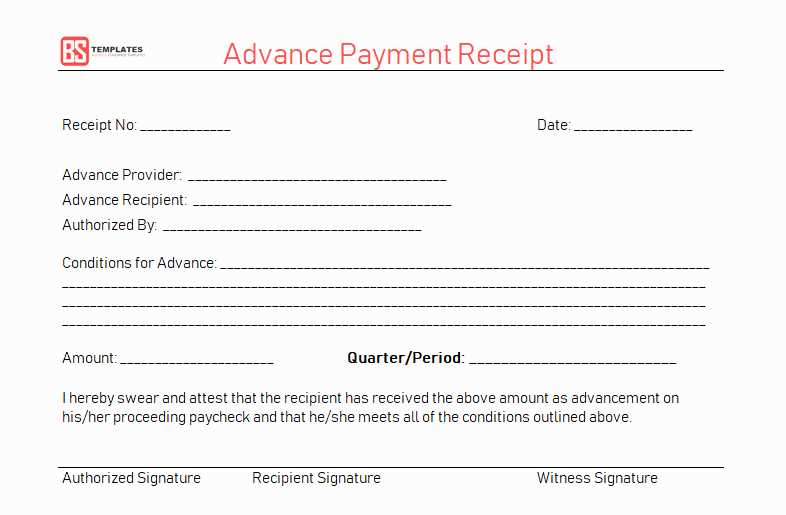

Include all necessary details: Start by noting the payer’s name, recipient’s name, and the child’s name for whom the payment is intended. Specify the exact amount paid and the payment method–whether it’s cash, check, or electronic transfer. Don’t forget to include the date of payment and a unique reference number for easy tracking.

Clarity matters: A simple, organized format allows both parties to quickly verify the details. Make sure that the template includes a section where the payer can sign and a space for any additional notes, if necessary. This makes the receipt not only useful for tracking but also for future reference if any issues arise.

By creating a template with these key elements, you help ensure that both sides are clear on what has been paid, providing a solid record for future reference.

Here are the corrected lines where word repetitions have been removed:

Review the following adjusted sentences to ensure clarity and precision:

- Payment received for the month of January is confirmed.

- The total amount due for child support is $500.

- Payment was processed successfully on the 15th of each month.

- The regular payment schedule is outlined below for your reference.

- We confirm receipt of the payment as of this date.

These revisions help avoid redundant language while maintaining the clarity of the document.

- Child Support Payment Receipt Template

For creating a child support payment receipt, it’s crucial to include specific details to ensure both parties have a clear record of the transaction. A well-structured template should capture the essential information for accurate documentation.

| Field | Description |

|---|---|

| Receiver’s Name | Name of the individual receiving the child support payment |

| Payer’s Name | Name of the individual making the child support payment |

| Payment Amount | The total amount of money paid for child support |

| Payment Date | The date on which the payment was made |

| Payment Method | Indicate whether the payment was made by check, cash, bank transfer, etc. |

| Transaction ID | Provide any relevant transaction identification or reference number |

| Additional Notes | Any specific notes or details relevant to the payment, such as child support period or adjustments |

This template serves as a clear and effective method to record child support payments. By including all relevant details, both the payer and receiver can maintain transparent financial records for future reference.

Include the following key elements to make your child support payment receipt clear and legally valid:

1. Recipient and Payer Details

At the top of the receipt, clearly state both the payer’s and recipient’s full names, addresses, and contact details. This ensures proper identification of all involved parties.

2. Payment Information

Specify the exact amount paid, the payment method (check, bank transfer, etc.), and the payment date. Make sure to include the payment reference number or any relevant identifiers to track the transaction.

3. Payment Period

Indicate the specific period for which the payment is made. For example, “January 2025 – March 2025.” This prevents any confusion about what the payment covers.

4. Child Support Agreement Reference

Refer to the child support agreement or court order number that outlines the payment terms. This provides legal context for the payment.

5. Signature and Acknowledgment

Both parties should sign the receipt to confirm the transaction. If applicable, include a witness or notary acknowledgment for added security.

A payment receipt for child support should clearly reflect the transaction details to ensure transparency. The following key elements must be included for both the payer and recipient’s reference:

1. Date of Payment

Include the exact date the payment was made. This helps both parties track the timeliness of payments and provides a clear reference for future transactions.

2. Amount Paid

State the exact amount paid for child support, ensuring no ambiguity. This figure must match the amount agreed upon in the legal documents or previous agreements.

3. Payment Method

Specify how the payment was made, whether via bank transfer, check, or any other method. This helps both parties understand the transaction process and provides a clear record of the payment method used.

4. Payer’s Information

Include the payer’s name and any identifying information, such as an address or contact details, especially if required by law. This confirms the identity of the individual making the payment.

5. Recipient’s Information

List the name of the recipient along with their contact details. This ensures that the payment is credited to the correct person and avoids confusion in case of disputes.

6. Payment Period

Specify the period the payment covers (e.g., for the month of January 2025). This ensures both parties are aligned on the time frame of the support being provided.

7. Outstanding Balance (if applicable)

If there is an outstanding balance from previous payments, include the amount left unpaid. This helps track how much remains to be paid or owed over time.

8. Payment Reference Number

Assign a unique reference number to the payment. This allows both parties to easily track the transaction in case further verification is needed.

Including these elements ensures clarity and helps avoid misunderstandings regarding child support payments.

Adjust the payment amount field in the template to match the exact value for each payment. This ensures accuracy and clarity for both the payer and recipient. Start by modifying the “Amount” section where you can input the specific sum for each payment cycle.

- Replace placeholders with the actual payment amount, such as $500 or any agreed-upon sum.

- Ensure the payment amount is clearly displayed in both numerals and words to avoid confusion.

If the payment varies from month to month, include a detailed breakdown to reflect the specific amount for each payment period.

- Use dynamic fields to insert amounts based on specific dates or payment cycles.

- Consider adding a “Total Amount Due” section to sum up multiple payments, if applicable.

Review the formatting to make sure the payment amount stands out and is easy to find, especially when the recipient needs to refer to it in the future.

For a child support payment receipt to be legally valid, ensure that it contains specific details, including the date of payment, the amount, and the names of both the payer and the recipient. This helps establish a clear record of transactions, which is important if disputes arise.

Include Payment Method and Reference Numbers

Always note the payment method used, whether it’s cash, check, or bank transfer. Including any relevant transaction reference numbers ensures transparency and makes it easier to trace payments if necessary.

Signatures and Acknowledgment

Both the payer and the recipient should sign the receipt. This acknowledgment helps verify that both parties agree to the details outlined in the document, reinforcing its validity in legal contexts.

Distribute child support receipts immediately after the payment has been made. Provide a copy of the receipt to the payer and the recipient. This can be done via email or physical mail, depending on preference. Make sure the receipt includes all relevant information, such as the payment date, amount, and any specific payment references.

Store all receipts in a secure, organized manner. Use either digital or physical storage solutions, ensuring that the receipts are easy to locate for future reference. Digital receipts can be stored in a dedicated folder with appropriate naming conventions to make searches faster. For physical receipts, keep them in a filing system with clear labels by year or by payer.

Ensure both parties have access to their receipts for transparency. If digital, consider sending copies through secure email or encrypted files to maintain privacy. For physical receipts, use secure mail services or in-person handover for sensitive cases.

Regularly back up digital receipts to avoid data loss. Store copies on cloud services or external hard drives to provide redundancy. Physical receipts should be kept in a fireproof or water-resistant file for additional security.

Use child support payment receipts to document and verify all payments made throughout the year. Keep receipts as proof of the amounts paid, ensuring they match the amounts reported on tax filings. This helps prevent discrepancies during tax season and may assist in resolving disputes over unpaid child support.

When filing taxes, report child support payments on your tax return if you are the payer. Receipts are crucial for showing that these payments were made, which can impact your eligibility for certain deductions or tax credits.

If you’re the recipient, retain receipts to demonstrate that the payments have been received. This can be useful in case of any tax-related inquiries or disputes. While child support payments themselves are not taxable, keeping accurate records is necessary for both parties to avoid complications.

At the end of the year, ensure that all receipts are organized and accessible for tax filing. You may need to provide them as supporting documents if requested by the IRS or another tax authority.

Include a clear title on the receipt, such as “Child Support Payment Receipt.” This immediately tells both parties the purpose of the document.

Receipt Details

Start with the payer’s and recipient’s names. Include their addresses, phone numbers, and email addresses for further contact. Make sure the child’s name is listed to clarify which child the payment relates to.

Payment Information

Provide the exact amount paid, the payment method (check, bank transfer, etc.), and the date of payment. If the payment is part of a regular schedule, note that along with the agreed-upon frequency. You should also mention the reference number or transaction ID for verification purposes.