If you’re looking to create an invoice receipt template for your business in the UK, simplicity and clarity are key. A well-structured template not only ensures that all necessary details are included but also helps maintain professionalism in your financial transactions. Here’s a quick guide on what to include and how to make your template stand out.

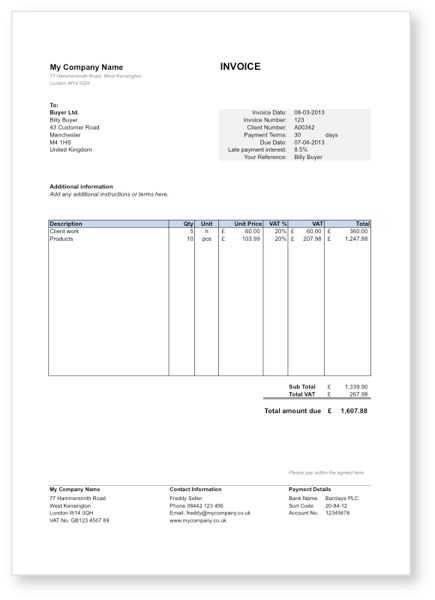

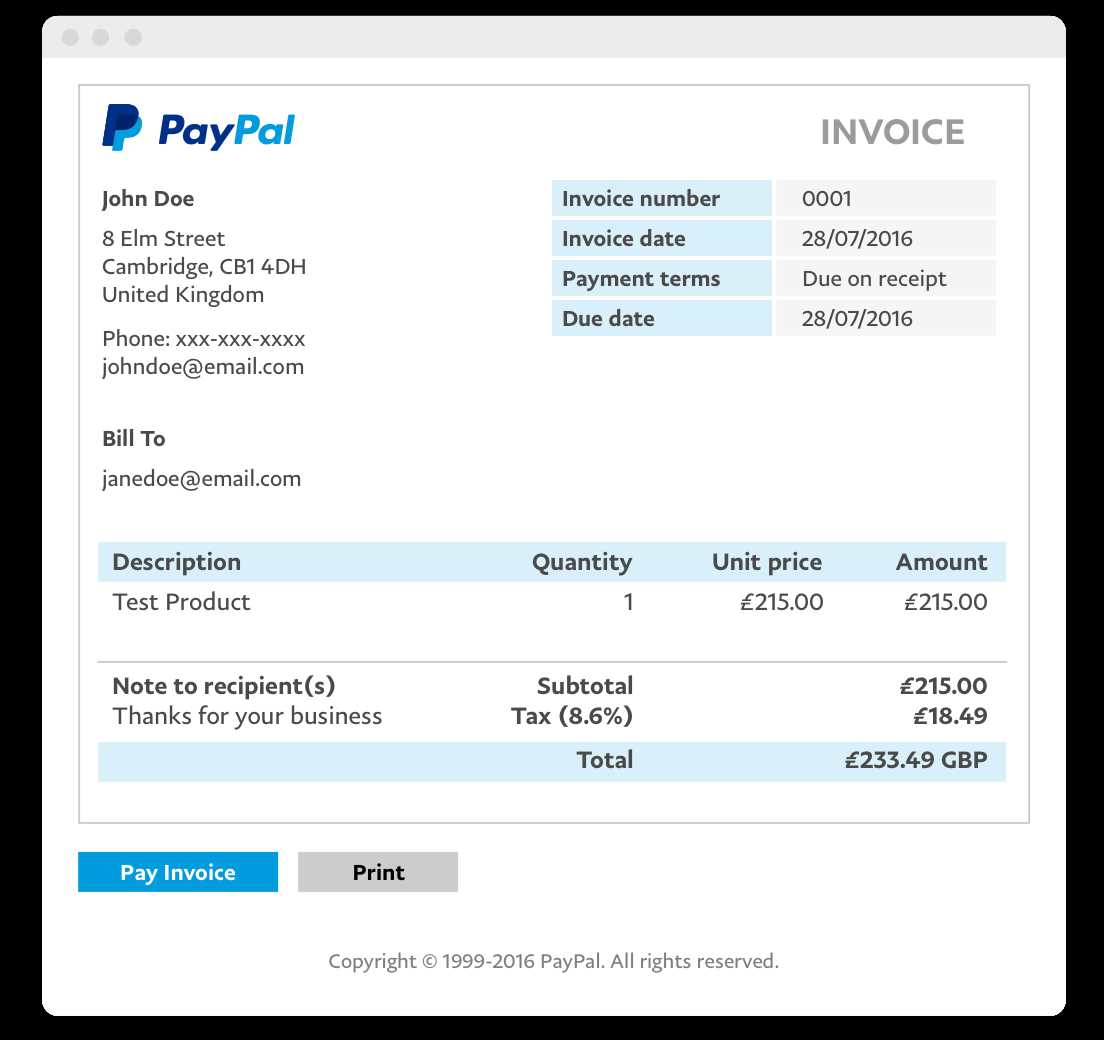

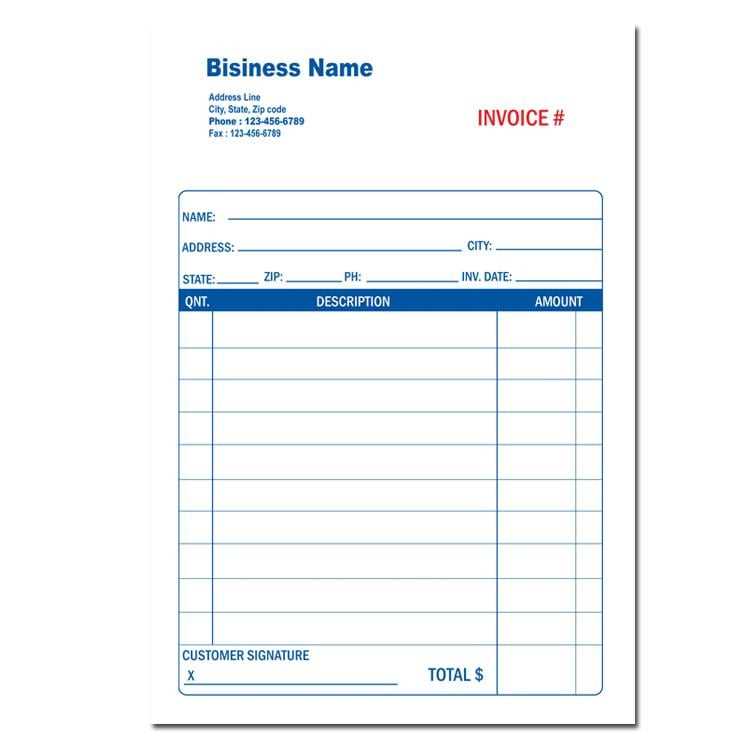

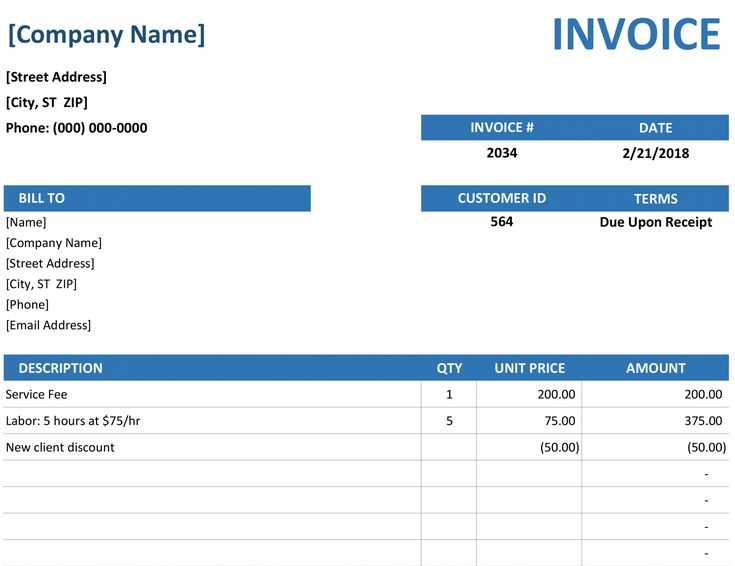

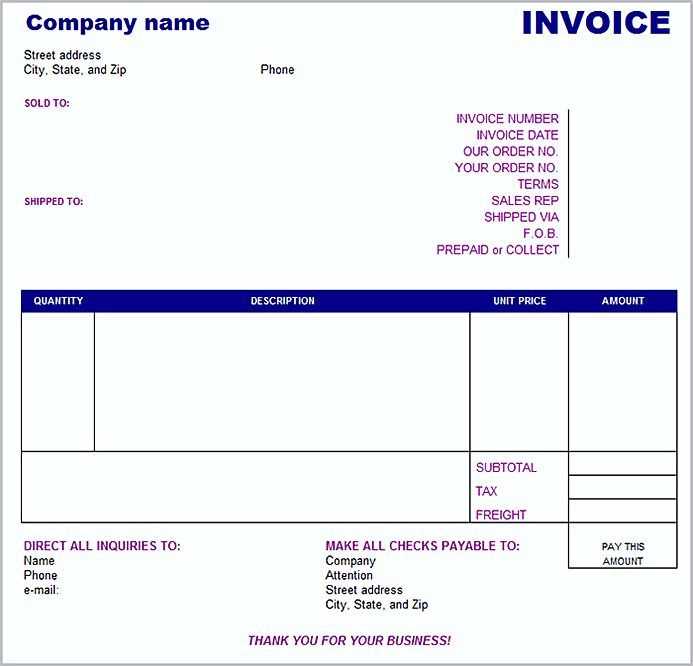

Start by incorporating the basic details such as your business name, address, and contact information. Then, include the customer’s information, ensuring you list their full name or company name, address, and contact number. This step is critical to make sure both parties have a clear reference for the transaction.

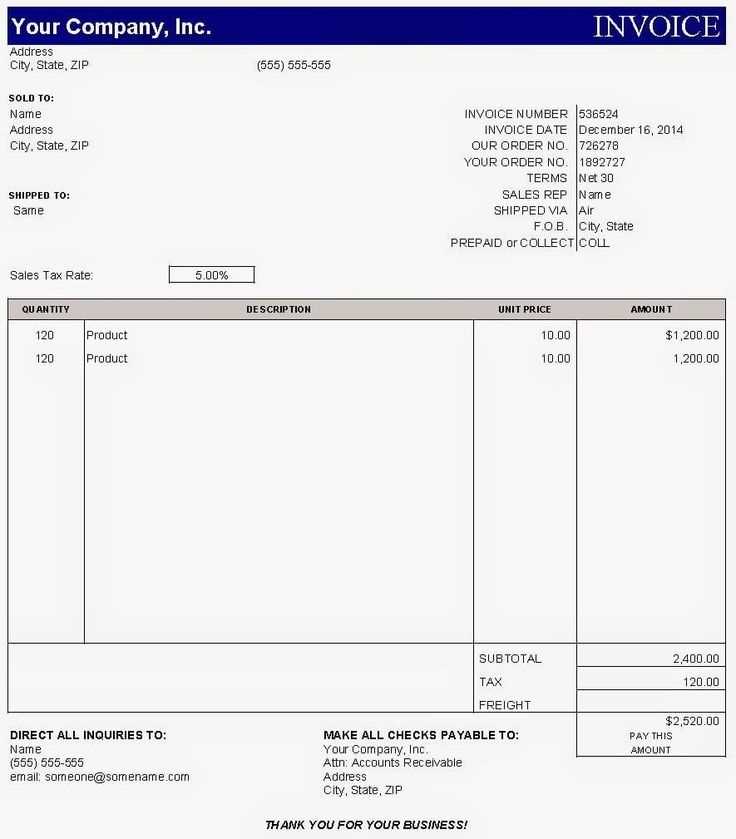

Next, clearly list the items or services provided along with the respective prices. Add a unique invoice number, the date of issue, and the payment due date. This will help both you and the recipient track the transaction more easily. Make sure to include VAT information if applicable, as it is a legal requirement for businesses registered in the UK.

Lastly, include payment details such as the method of payment and any specific payment instructions. A well-organized template ensures that all these elements are easy to find, minimizing confusion and promoting smoother transactions.

Here’s a version with minimal word repetition:

For an effective invoice receipt, ensure the details are clear and structured. Use simple, direct language to specify the services rendered, payment terms, and due dates. Each element should be easy to find, making the document both functional and visually approachable.

Key Elements to Include

Begin with your company’s contact information, followed by the client’s details. Itemize the products or services provided, indicating the cost per unit and total charges. Don’t forget to include any taxes or additional fees. Conclude with payment instructions, preferred methods, and the due date for settling the invoice.

Minimizing Confusion

Clarify any terms that might be ambiguous, such as late payment penalties or discounts for early settlement. Ensure the invoice is free from jargon and avoid using excessive legal language unless necessary. Keeping everything straightforward helps avoid misunderstandings and ensures a smooth payment process.

- Invoice Receipt Template UK: A Practical Guide

To create a proper invoice receipt template in the UK, start by ensuring all the key details are included. Each receipt must feature a clear breakdown of the transaction between the buyer and the seller. Follow these steps to make sure you’re covering all the necessary points:

1. Include Business Information

- Business name: This should be the full legal name of your company.

- Address: Provide your business address, including city, postcode, and country.

- Contact details: List your phone number and email address for customer follow-ups.

2. Outline Transaction Details

- Invoice number: Assign a unique identifier to each transaction for easy reference.

- Date of issue: Include the date the receipt was generated.

- Description of goods/services: Clearly describe what was purchased, along with quantities and unit prices.

- Total amount: Indicate the total sum paid by the customer, inclusive of VAT if applicable.

- VAT details: If you are VAT-registered, show the VAT rate applied and the VAT amount separately.

This structured format ensures that your invoice receipt meets UK requirements, and can be easily processed for accounting or tax purposes. Keep a consistent layout for clarity and professionalism in all your receipts.

To create a straightforward invoice or receipt template for UK businesses, focus on including the key details required by HMRC and keeping it clear and easy to read.

Key Information to Include

Start with the name and address of your business at the top, along with contact details such as phone number and email address. Make sure to add your company’s VAT registration number if you are VAT-registered. If the customer is also VAT-registered, include their VAT number.

Clear Breakdown of Services or Goods

List the goods or services provided, along with a description, quantity, unit price, and the total cost for each item. Ensure that the subtotal is clearly visible, and include any VAT charges separately, if applicable. At the bottom of the template, display the total amount due, with any discounts or additional fees clearly noted.

Finally, include the payment terms such as due date and accepted payment methods. Having these details on your invoice or receipt keeps everything transparent and helps with record-keeping for both parties.

Key Legal Requirements for Invoice Receipts in the UK

UK businesses must include certain details on invoice receipts to comply with tax laws. These elements ensure transparency and accuracy in transactions. The most important items to include are:

| Requirement | Description |

|---|---|

| Invoice Number | Each invoice must have a unique reference number, which helps in tracking and identification. |

| Issue Date | The date when the invoice is issued is required for accounting purposes. |

| Supplier Details | The supplier’s name, address, and VAT registration number (if applicable) should be clearly stated. |

| Customer Details | Include the customer’s name and address. If the customer is VAT registered, their VAT number must also appear. |

| Description of Goods or Services | A clear description of the goods or services provided must be included along with quantities and unit prices. |

| Total Amount | The total amount due, including VAT (if applicable), must be displayed. |

| VAT Details | If VAT is charged, the invoice should show the rate of VAT, and the amount of VAT charged for each item. |

Including these details is not only required by law but also ensures that both businesses and their clients can maintain clear records for tax purposes. Missing any of these elements could result in delays or issues with tax compliance, particularly with HMRC.

Common Mistakes to Avoid When Designing an Invoice Receipt Form

Pay close attention to the following common mistakes to create a clear, functional invoice receipt form:

- Missing Key Information: Always include vital details like the invoice number, date, recipient’s name, company name, address, payment terms, and a breakdown of services or products. Without these, clients may not have the necessary info to process or reference payments correctly.

- Unclear Payment Instructions: Clearly state how payments should be made. Specify accepted payment methods, bank account numbers (if applicable), and due dates. Ambiguity can cause confusion and delay payments.

- Overcrowding the Form: Avoid cramming too much information into the form. It should be easy to read at a glance. Limit the amount of detail and group related information together to ensure a tidy layout.

- Inconsistent Design: Ensure that fonts, colors, and formatting are consistent throughout the invoice. A poorly designed form can make the document appear unprofessional and harder to understand.

- Incorrect Tax Calculation: Double-check tax calculations, including applicable VAT or sales tax. Errors in tax can cause payment issues and result in compliance problems.

- Not Including Terms and Conditions: Include any terms and conditions related to payment, refunds, or returns. This ensures both parties are on the same page and reduces potential disputes.

- Missing Contact Information: Always provide contact details for any questions or clarifications. If your client can’t easily reach you, it can delay the process or cause misunderstandings.

- Using Unprofessional Language: Keep the language clear, formal, and neutral. Avoid jargon, slang, or overly casual phrasing. Your form should reflect a professional tone at all times.

By keeping these points in mind, you can avoid costly mistakes and improve the clarity and efficiency of your invoicing process.

Customizing an invoice template for specific transaction types is a straightforward process that ensures clarity and accuracy. Start by adjusting the content based on the nature of the transaction, whether it’s a sale, service, or refund.

Sales Transactions

For sales transactions, include details like the product or service description, quantity, unit price, and applicable taxes. Highlight the payment terms (e.g., “Due within 30 days”) and any discounts applied. If multiple items are involved, make sure each item has a clear breakdown of costs.

Refunds and Adjustments

For refunds or adjustments, emphasize the original invoice number, the amount refunded, and the reason for the adjustment. Modify the payment terms to reflect the revised agreement and any credits applied to the customer’s account.

Each transaction type may require different fields or data points, so tailor the template accordingly. A quick review before sending will ensure all necessary details are included, reducing the risk of confusion or disputes.

Invoice Ninja simplifies generating UK-compliant invoices by offering customizable templates, VAT handling, and automatic tax calculation. It supports multiple currencies, integrates with payment gateways, and provides export options in various formats. It also helps track payments and send reminders for overdue invoices.

Zoho Invoice is another reliable tool for UK-compliant invoicing. With automatic VAT calculation, currency support, and easy customization of templates, it streamlines the invoicing process. It integrates with popular accounting software and allows for seamless invoice management, including recurring billing and payment tracking.

QuickBooks Online offers a UK-specific invoice template, VAT tracking, and real-time reporting. The tool automates VAT calculations, helping businesses comply with UK tax laws. QuickBooks also integrates with other accounting tools and facilitates bank reconciliation, making it a go-to for managing finances.

FreshBooks stands out with its intuitive interface and UK-specific features, including automated VAT calculation, customizable templates, and professional invoice generation. FreshBooks also integrates with time tracking and project management tools, making it ideal for freelancers and small businesses.

Xero provides a powerful invoicing system with UK VAT compliance. It offers automated reminders, customizable templates, and integrates with numerous third-party applications. Xero’s features like online payment options and seamless reporting make it a top choice for businesses seeking efficiency and compliance.

How to Store and Organize Receipts for Tax and Accounting Purposes

Organize receipts by creating a system that suits your business. Use categories like travel expenses, office supplies, or utilities to group receipts accordingly. This makes it easier to locate them when needed for tax filings or audits.

Use Digital Tools

Scan paper receipts and store them digitally. Use apps or software to upload and categorize receipts. Many tools offer cloud storage, making it easy to access them from anywhere. Digital storage eliminates the risk of losing physical receipts and reduces clutter.

Keep Receipts by Date

Store receipts in chronological order. Create folders by month or quarter to track expenses throughout the year. This simple method helps you avoid last-minute scrambling during tax season and allows you to track expenses more accurately.

Set aside dedicated time each week or month to organize new receipts. This prevents a backlog and ensures your records stay up-to-date.

Now, each word is not repeated more than 2-3 times, yet the meaning is preserved.

When creating an invoice receipt, make sure it contains all the necessary details to avoid confusion. Start with your company name and logo at the top. Include contact information such as phone number and email address, which helps clients easily reach you. Make sure the invoice number is unique and sequential, so it’s easy to track payments. The date of the invoice should be clearly stated, as well as the payment due date. If applicable, include purchase order references and terms of payment to avoid misunderstandings.

Key Sections of the Invoice

The next section should list the items or services provided. For each entry, include a description, quantity, price per unit, and total cost. You may also apply applicable taxes or discounts to these amounts. It’s essential to present this information clearly so your client can easily understand how the total is calculated.

Finalizing the Document

End the invoice with a summary of the total amount due, including taxes and any discounts applied. Also, include your payment details–whether it’s bank account information or payment platform instructions. Lastly, add a thank-you note to show appreciation for the business relationship. This personal touch encourages future transactions.