To create a solid foundation for your real estate transactions, use a clear and straightforward receipt template. A well-structured receipt ensures transparency and maintains professional standards. It outlines the payment details, buyer and seller information, and property specifics, making it easy to track the transaction.

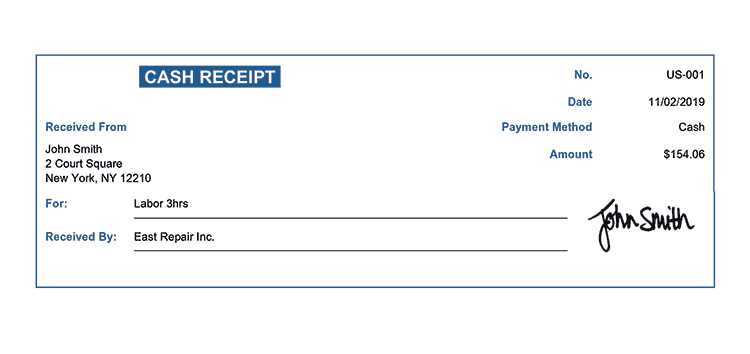

Include key details such as the transaction date, property address, amount paid, payment method, and the names of both parties. These elements help avoid misunderstandings and provide clear documentation for future reference.

For added clarity, consider breaking down payments if multiple amounts are involved, such as deposits, closing fees, or other charges. This approach helps buyers and sellers see exactly what each payment covers.

Ensure the template is easy to customize for each transaction. The more detailed the information, the less room there is for confusion. This makes your real estate dealings smoother and ensures all parties involved are on the same page.

Here is the corrected text where each word is repeated no more than two or three times:

When drafting a real estate receipt, use clear and concise language. Ensure the transaction date, amount, and parties involved are accurately recorded. Include the property details, such as address, type, and any specific conditions related to the sale or lease. Specify payment methods, including cash, check, or bank transfer, to avoid confusion. Additionally, ensure both parties’ signatures are provided to authenticate the transaction.

Avoid unnecessary jargon or redundant phrases. Keep the document easy to understand and straightforward, focusing on the key details of the exchange. This approach not only improves clarity but also protects both parties in the event of any dispute.

Real Estate Receipt Template

How to Create a Basic Property Receipt

Key Elements to Include in a Receipt

Customizing a Receipt for Specific Transactions

Formatting Tips for Professional Receipts

Ensuring Legal Compliance in Property Receipts

Common Errors to Avoid When Issuing Receipts

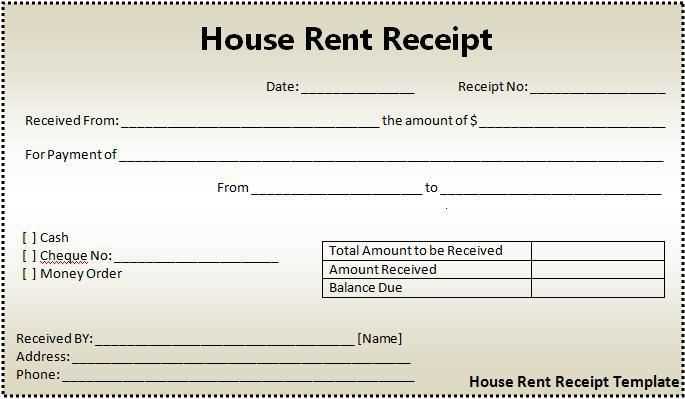

To create a reliable real estate receipt, start with the key details: the full names of both the buyer and seller, property address, and transaction amount. Ensure the payment method is clearly stated, along with the date the payment was made.

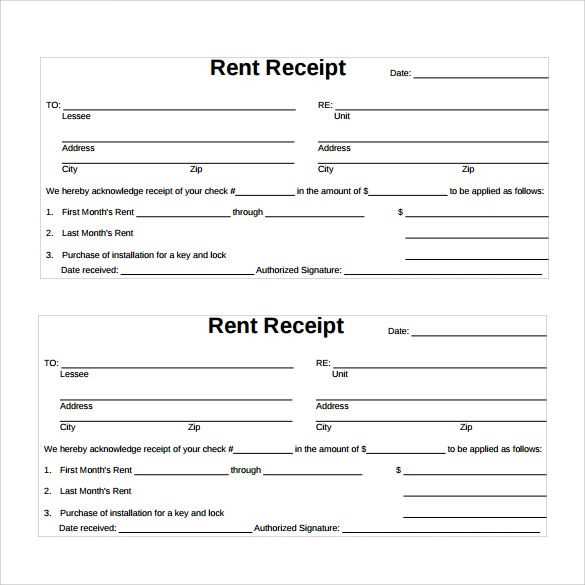

Key Elements to Include in a Receipt: Include transaction specifics such as the agreed sale price, payment terms, and a description of the property. Always note any additional terms like deposit amounts or installment payments. These details help clarify the scope of the transaction.

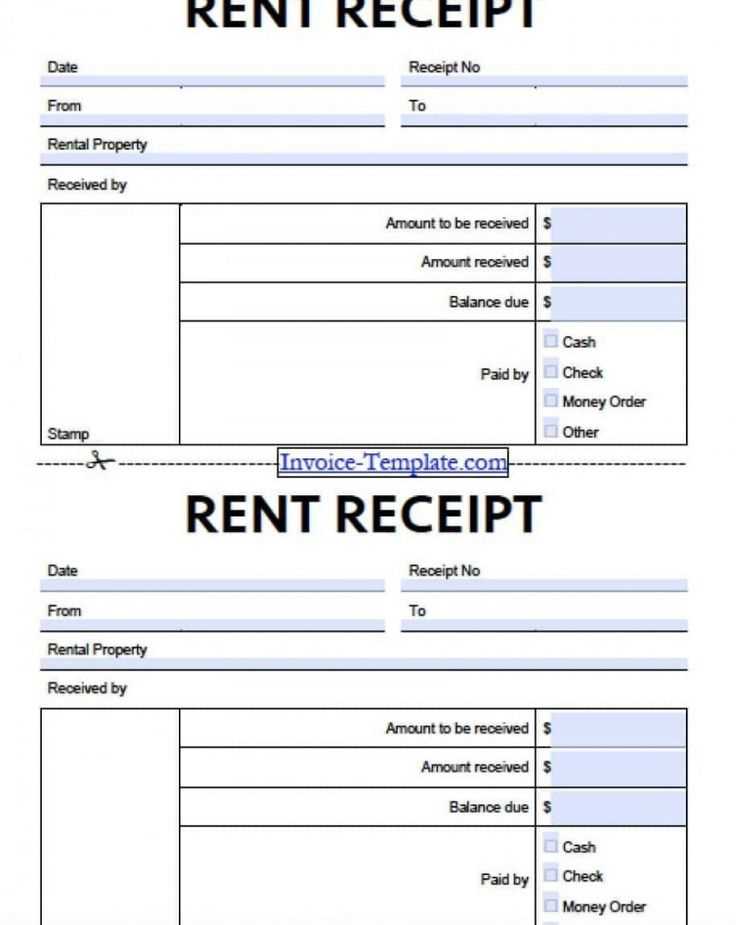

Customizing a Receipt for Specific Transactions: Tailor the receipt for the type of property deal. For example, if it’s a rental agreement, specify the rental period, payment frequency, and late fees if applicable. For a property sale, ensure you list the agreed-upon sale price and confirm any adjustments made during the transaction process.

Formatting Tips for Professional Receipts: Use a clear, readable font and ensure all sections are well-organized. Divide the receipt into sections like property details, payment terms, and signatures. Include space for both parties to sign, confirming the transaction details.

Ensuring Legal Compliance in Property Receipts: Make sure the receipt meets local regulations. Some jurisdictions may require certain details, such as tax information or notarization. Always check the requirements for your area to avoid any legal issues.

Common Errors to Avoid When Issuing Receipts: Avoid vague descriptions, missing payment information, and incorrect dates. Ensure all amounts match the agreed terms, and check for any typos or errors that might cause confusion. Always double-check the names and addresses of both parties.